Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required For the Danson-Knowles Partnership, prepare page 1 of Form 1065 (2020 tax year). The following information is available from the general ledger of the

Required

Required

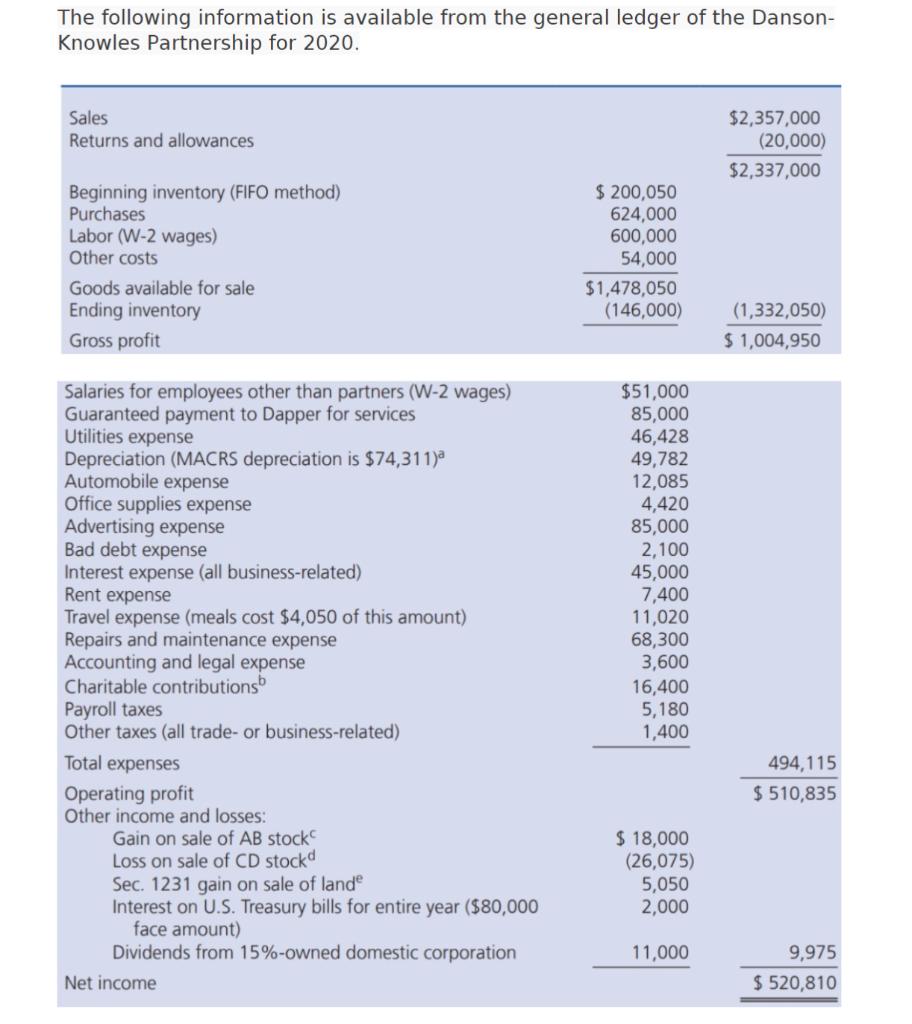

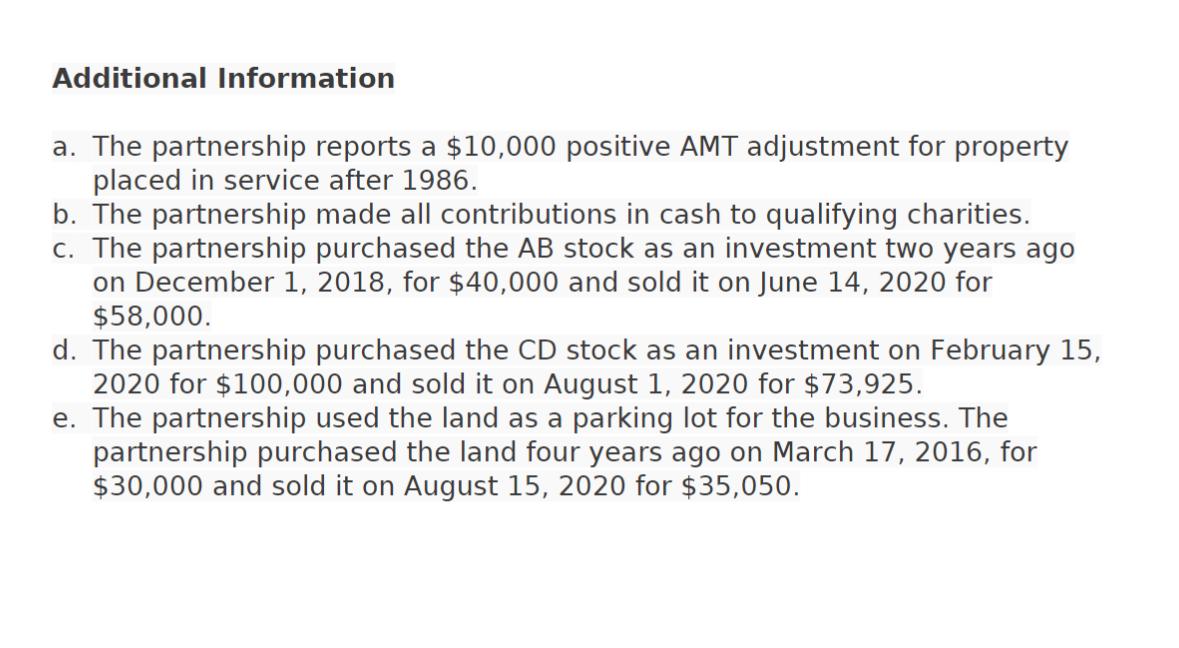

For the Danson-Knowles Partnership, prepare page 1 of Form 1065 (2020 tax year).

The following information is available from the general ledger of the Danson- Knowles Partnership for 2020. Sales Returns and allowances Beginning inventory (FIFO method) Purchases Labor (W-2 wages) Other costs Goods available for sale Ending inventory Gross profit Salaries for employees other than partners (W-2 wages) Guaranteed payment to Dapper for services Utilities expense Depreciation (MACRS depreciation is $74,311)a Automobile expense Office supplies expense Advertising expense Bad debt expense Interest expense (all business-related) Rent expense Travel expense (meals cost $4,050 of this amount) Repairs and maintenance expense Accounting and legal expense Charitable contributions Payroll taxes Other taxes (all trade- or business-related) Total expenses Operating profit Other income and losses: Gain on sale of AB stock Loss on sale of CD stockd Sec. 1231 gain on sale of lande Interest on U.S. Treasury bills for entire year ($80,000 face amount) Dividends from 15%-owned domestic corporation Net income $ 200,050 624,000 600,000 54,000 $1,478,050 (146,000) $51,000 85,000 46,428 49,782 12,085 4,420 85,000 2,100 45,000 7,400 11,020 68,300 3,600 16,400 5,180 1,400 $ 18,000 (26,075) 5,050 2,000 11,000 $2,357,000 (20,000) $2,337,000 (1,332,050) $ 1,004,950 494,115 $ 510,835 9,975 $ 520,810

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for the relevant sections of Form 1065 based on the information provided P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started