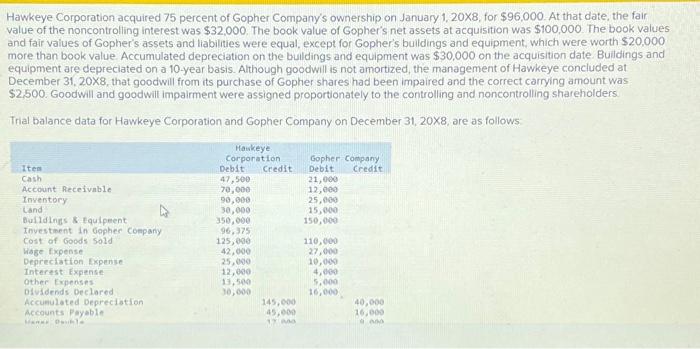

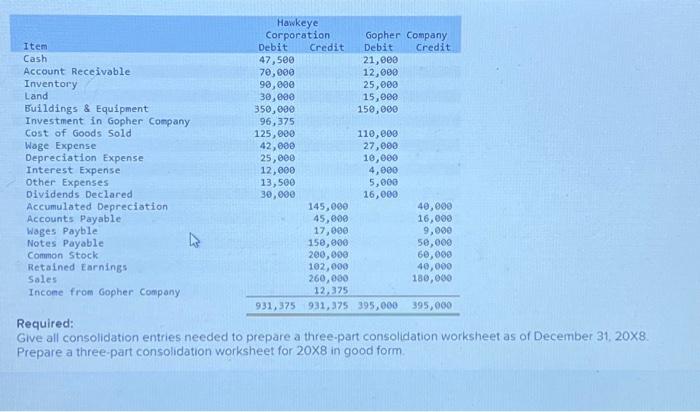

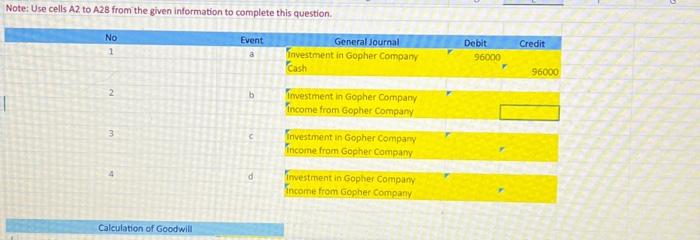

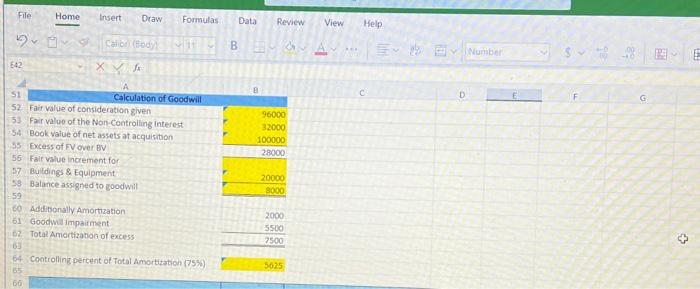

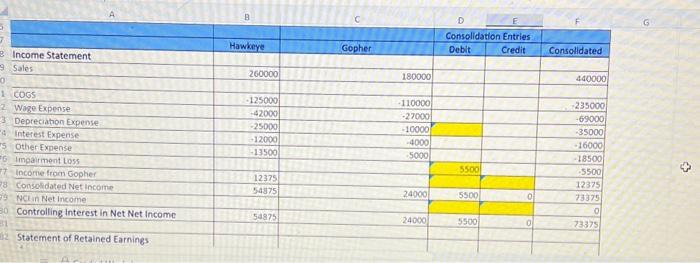

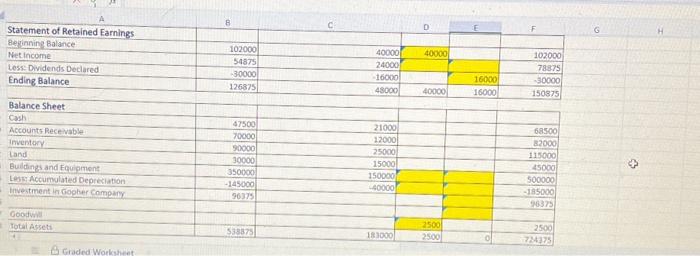

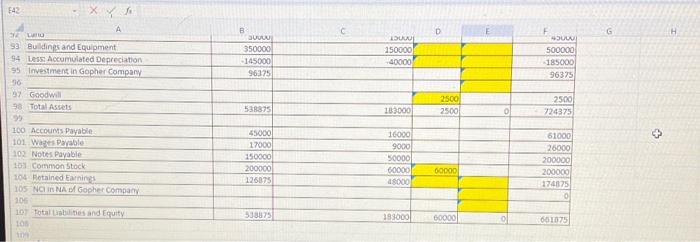

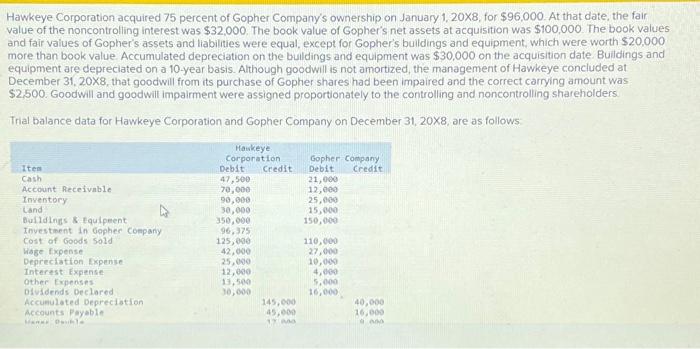

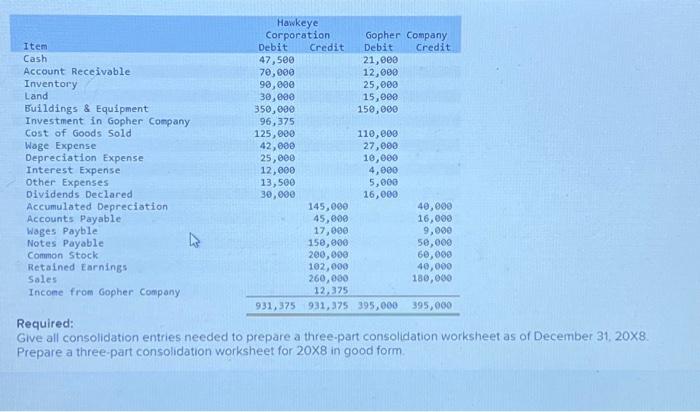

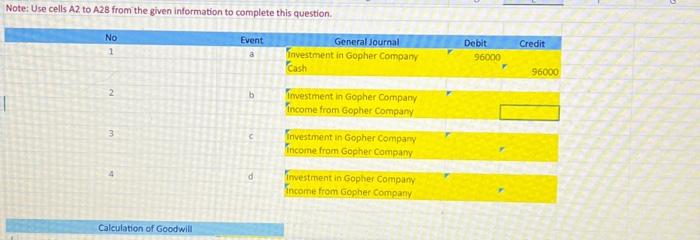

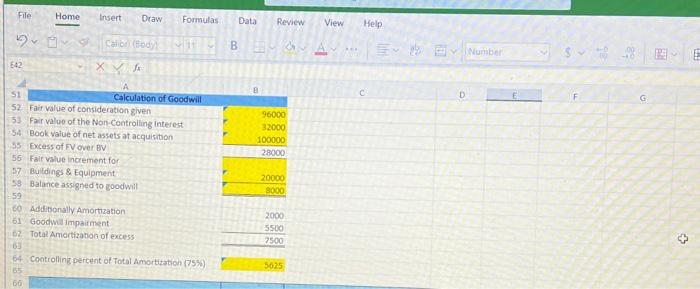

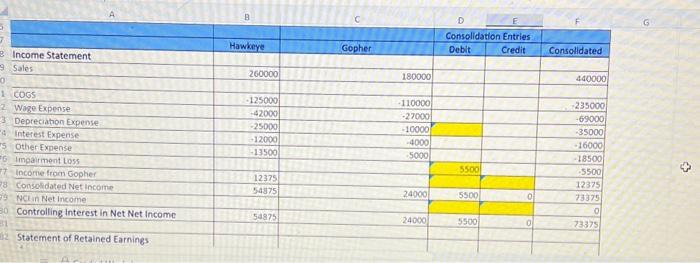

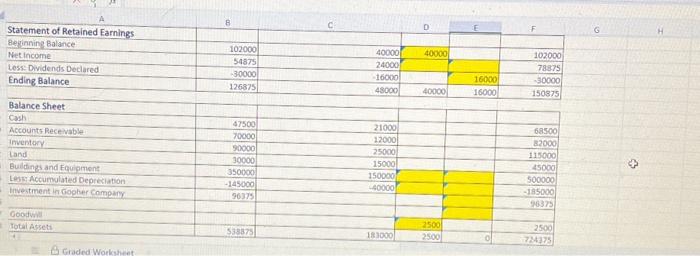

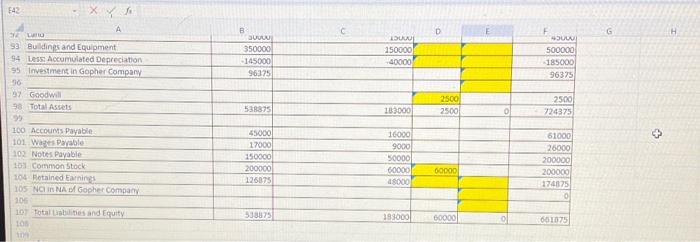

Required: Give all consolidation entries needed to prepare a three-part consolidation worksheet as of December 31,208. Prepare a three-part consolidation worksheet for 208 in good form. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline * & & & & & \multicolumn{2}{|c|}{ Consolidation Entries } & \\ \hline & Hawkeye & & Gopher & & Debit & Credit & Consolidated \\ \hline Income Statement & +2 & & & & & & \\ \hline Sales & 260000 & & & 180000 & & & 440000 \\ \hline & & & & & & & \\ \hline cos & -125000 & 10 & & -110000 & & & -235000 \\ \hline Wage Expense. & -42000 & & & -27000 & & & -69000 \\ \hline Depreciation Expense & -25000 & & & -10000 & & & .35000 \\ \hline Interest Expense & +12000 & x2 & & -4000 & & & -16000 \\ \hline Other Expense & 413500 & & & -5000 & & & -18500 \\ \hline Impairment toss & 20 & & & & 5500 & a & .5500 \\ \hline Income from Gopher & 12375 & & & & & & 12375 \\ \hline Consolidated Net income & 54375 & Ex & & 24000 & 5500 & 0 & 73375 \\ \hline NCI in Net income & & & & & & & 0 \\ \hline Controlling interest in Net Net Income & 54875 & & & 24000 & 5500 & 0 & 73375 \\ \hline Statement of Petained Faumines & & & & & & & \\ \hline Statement of Retained Earnings & & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline & 8 & c. & D & E & F \\ \hline & & & & & \\ \hline \begin{tabular}{l} 8efinning Balance \\ Net tacome \end{tabular} & 102000 & 40000 & 40000 & & 102000 \\ \hline Net income & 54875 & 24000 & & & 78375 \\ \hline Less: Dividends Declared & -30000 & -16000 & & 16000 & 30000 \\ \hline Ending Balance. & 126875 & 48000 & 40000 & 16000 & 150875 \\ \hline & & & & & \\ \hline Balance Sheet & & & & & \\ \hline Cosh & 47500 & 21000 & & & 68500 \\ \hline Accounts Receivable & 70000 & 22000 & & & 82000 \\ \hline inventary & 90000 & 25000 & & & 115000 \\ \hline land & 30000 & 15000 & & & 45000 \\ \hline Buildings and Equigment & 350000 & 1500001 & & & 500000 \\ \hline Lobs Accumulated Depreciation & -145000 & 40000 & & & -185000 \\ \hline investment in Gopher Company & 96375 & & & & 26375 \\ \hline & & & & & \\ \hline Goodyuli & & & 2500 & & 2500 \\ \hline Total Asseti & 533875 & 183000 & 2500 & of & 724375 \\ \hline \end{tabular} Hawkeye Corporation acquired 75 percent of Gopher Company's ownership on January 1, 20x8, for $96,000. At that date, the fair value of the noncontrolling interest was $32,000. The book value of Gopher's net assets at acquisition was $100,000 The book values and fair values of Gopher's assets and liabilities were equal, except for Gopher's buildings and equipment, which were worth $20,000 more than book value Accumulated depreciation on the buldings and equipment was $30,000 on the acquisition date. Buidings and equipment are depreciated on a 10-year basis. Although goodwill is not amortized, the management of Hawkeye concluded at December 31,208, that goodwill from its purchase of Gopher shares had been impaired and the correct carrying amount was $2,500. Goodwill and goodwill Impalrment were assigned proportionately to the controlling and noncontrolling shareholders. Trial balance data for Hawkeye Corporation and Gopher Company on December 31,208, are as follows Note: Use cells A2 to A28 from the given information to complete this question. \begin{tabular}{|c|c|c|c|c|c|c|} \hline & Lan & B suow & souwy. & o & E & F43000 \\ \hline 33 & Buldings and Equipment & 350000 & 150000 & & & 500000 \\ \hline 94. & Lers Accumulated Depreciaton & -145000 & 40000 & & & -185000 \\ \hline 95 & Investment in Gopher Company & 96375 & & & & 96375 \\ \hline 96 & & & & 1 & & \\ \hline 97. & Goodwill & & & 2500 & & 2500 \\ \hline 98 & Total Assets & 538375 & 183000 & 2500 & of & -724375 \\ \hline 93 & & & & & & \\ \hline 100 & Accouns Payable. & 45000 & 16000 & & & 61000 \\ \hline 101. & 1. Wasti prable & 17000 & 9000 & & & 26000 \\ \hline 102 & Nots Payable & 150000 & 50000 & & & 200000 \\ \hline 103 & Commonstock & 200000 & 60000 & 60000 & & 200000 \\ \hline 204 & Betained Earnings & 126875 & 48000 & & & 174875 \\ \hline 105 & NG in MA of Gopher Company & & & & & 0 \\ \hline 206 & & & & & & \\ \hline 107. & Fotal tiabilines and Equity & & 193000 & 60000 & a) & 601075 \\ \hline \end{tabular} File Home Insert Draw Formulas Data Review View Help 542 si \$2. Fair value of consideration given 53. Fair valuo of the Non-Controlling interest i54. Book value of net assets at acquisition 35 Excess of FV over BV 56 Fal value increment for 57 Bullding \& Equipment 59 Batance assigned to goodwill 59 So Additonally Amortization 61 Goodwilimpairment b2. Total Amortization of excess 6] 64 Controlling percent of Total Amortization (75\%) a \begin{tabular}{|r} 96000 \\ \hliner \\ \hline 120000 \\ \hline 280000 \\ \hliner \\ \hline 70000 \\ \hline 8000 \\ \hline \end{tabular} \begin{tabular}{r} 2000 \\ 5500 \\ \hline 7500 \\ \hline \end{tabular} c D Number: G 66