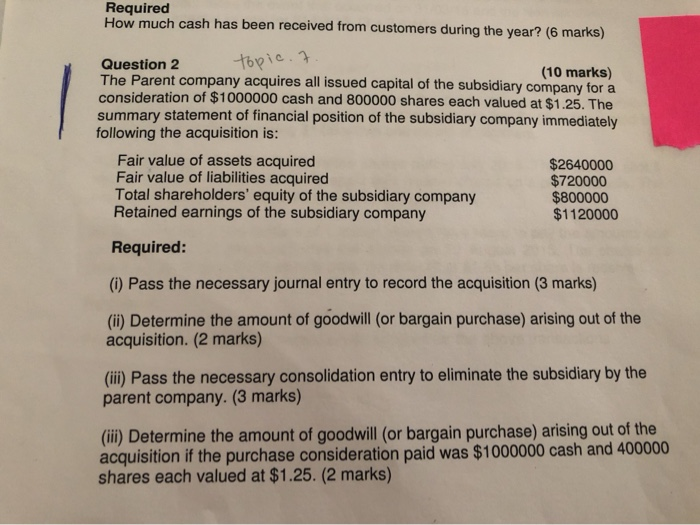

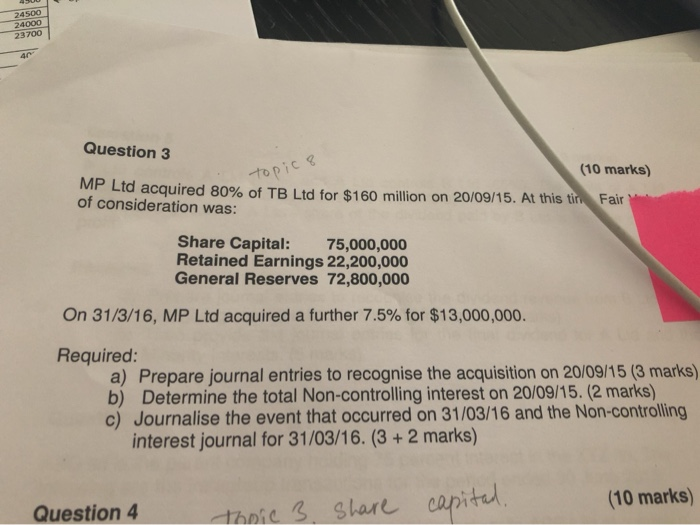

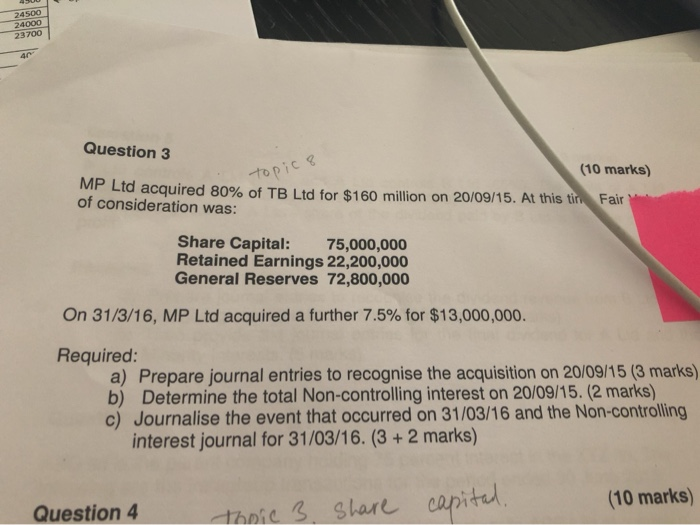

Required How much cash has been received from customers during the year? (6 marks) Question 2 topic.7 The Parent company acquires all issued capital of the subsidiary company for a (10 marks) consideration of $1000000 cash and 800000 shares each valued at $1.25. The summary statement of financial position of the subsidiary company immediately following the acquisition is: Fair value of assets acquired Fair value of liabilities acquired Total shareholders' equity of the subsidiary company Retained earnings of the subsidiary company $2640000 $720000 $800000 $1120000 Required: (1) Pass the necessary journal entry to record the acquisition (3 marks) (ii) Determine the amount of goodwill (or bargain purchase) arising out of the acquisition. (2 marks) (iii) Pass the necessary consolidation entry to eliminate the subsidiary by the parent company. (3 marks) (iii) Determine the amount of goodwill (or bargain purchase) arising out of the acquisition if the purchase consideration paid was $1000000 cash and 400000 shares each valued at $1.25. (2 marks) 24500 24000 23700 topic 8 Question 3 (10 marks) MP Ltd acquired 80% of TB Ltd for $160 million on 20/09/15. At this tini Fair of consideration was: Share Capital: 75,000,000 Retained Earnings 22,200,000 General Reserves 72,800,000 On 31/3/16, MP Ltd acquired a further 7.5% for $13,000,000. Required: a) Prepare journal entries to recognise the acquisition on 20/09/15 (3 marks) b) Determine the total Non-controlling interest on 20/09/15. (2 marks) c) Journalise the event that occurred on 31/03/16 and the Non-controlling interest journal for 31/03/16. (3 + 2 marks) (10 marks) Question 4 Thoic 3. share capital, Required How much cash has been received from customers during the year? (6 marks) Question 2 topic.7 The Parent company acquires all issued capital of the subsidiary company for a (10 marks) consideration of $1000000 cash and 800000 shares each valued at $1.25. The summary statement of financial position of the subsidiary company immediately following the acquisition is: Fair value of assets acquired Fair value of liabilities acquired Total shareholders' equity of the subsidiary company Retained earnings of the subsidiary company $2640000 $720000 $800000 $1120000 Required: (1) Pass the necessary journal entry to record the acquisition (3 marks) (ii) Determine the amount of goodwill (or bargain purchase) arising out of the acquisition. (2 marks) (iii) Pass the necessary consolidation entry to eliminate the subsidiary by the parent company. (3 marks) (iii) Determine the amount of goodwill (or bargain purchase) arising out of the acquisition if the purchase consideration paid was $1000000 cash and 400000 shares each valued at $1.25. (2 marks) 24500 24000 23700 topic 8 Question 3 (10 marks) MP Ltd acquired 80% of TB Ltd for $160 million on 20/09/15. At this tini Fair of consideration was: Share Capital: 75,000,000 Retained Earnings 22,200,000 General Reserves 72,800,000 On 31/3/16, MP Ltd acquired a further 7.5% for $13,000,000. Required: a) Prepare journal entries to recognise the acquisition on 20/09/15 (3 marks) b) Determine the total Non-controlling interest on 20/09/15. (2 marks) c) Journalise the event that occurred on 31/03/16 and the Non-controlling interest journal for 31/03/16. (3 + 2 marks) (10 marks) Question 4 Thoic 3. share capital