Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: How much incremental revenue does the company earn per jar of polish by further processing Grit 3 3 7 rather than selling it as

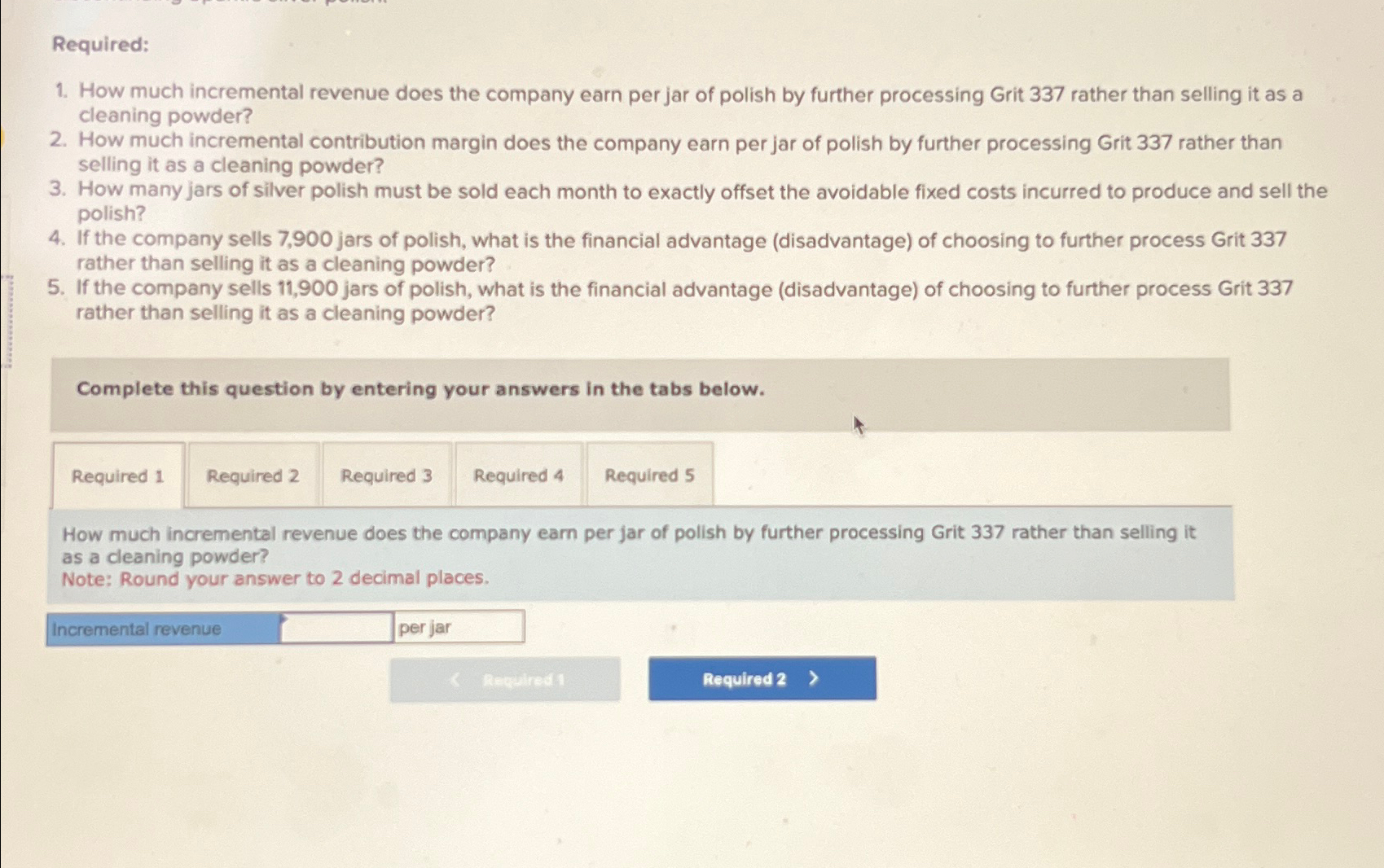

Required:

How much incremental revenue does the company earn per jar of polish by further processing Grit rather than selling it as a cleaning powder?

How much incremental contribution margin does the company earn per jar of polish by further processing Grit rather than selling it as a cleaning powder?

How many jars of silver polish must be sold each month to exactly offset the avoidable fixed costs incurred to produce and sell the polish?

If the company sells jars of polish, what is the financial advantage disadvantage of choosing to further process Grit rather than selling it as a cleaning powder?

If the company sells jars of polish, what is the financial advantage disadvantage of choosing to further process Grit rather than selling it as a cleaning powder?

Complete this question by entering your answers in the tabs below.

Required

Required

How much incremental revenue does the company earn per jar of polish by further processing Grit rather than selling it as a cleaning powder?

Note: Round your answer to decimal places.

Incremental revenue

per jar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started