Question

REQUIRED: i. For the benefit of Adam, determine which securities are mispriced and the actions he should take in response. ii. The average beta of

REQUIRED:

i. For the benefit of Adam, determine which securities are mispriced and the actions he

should take in response.

ii. The average beta of Adams portfolio is 1. Adams friend has suggested he should disinvest from the securities above and instead invest in the market portfolio. Assuming that Adam takes his friends recommendation, but later decides he would like to (1) take up a risk-averse position and reduce his average beta to less than 1, and (2) increase his risk level to an average beta greater than 1, what investment advice would you offer him?

c. You are given the following information about English Land plc. The companys equity is currently valued at 25 million. It has an equity beta of 1.33. The company also has debt on its capital structure. The debt is valued to be 20 million and assumed to be risk-free. Yields on similar safe debt are 5%. The expected return on the market portfolio is 12%.

REQUIRED:

i. Find English Lands cost of capital and cost of equity.

ii. The company decides to retire half of its debt at current prices. Find the companys cost of capital and cost of equity. Explain your results.

d. Identify an empirical challenge (i.e. a market anomaly) to the Efficient Market Hypothesis and describe the strategy to earn abnormal returns by exploiting the anomaly you identify.

Your answer should also attempt to define the concept of market efficiency and explain which form of market efficiency your anomaly violates.

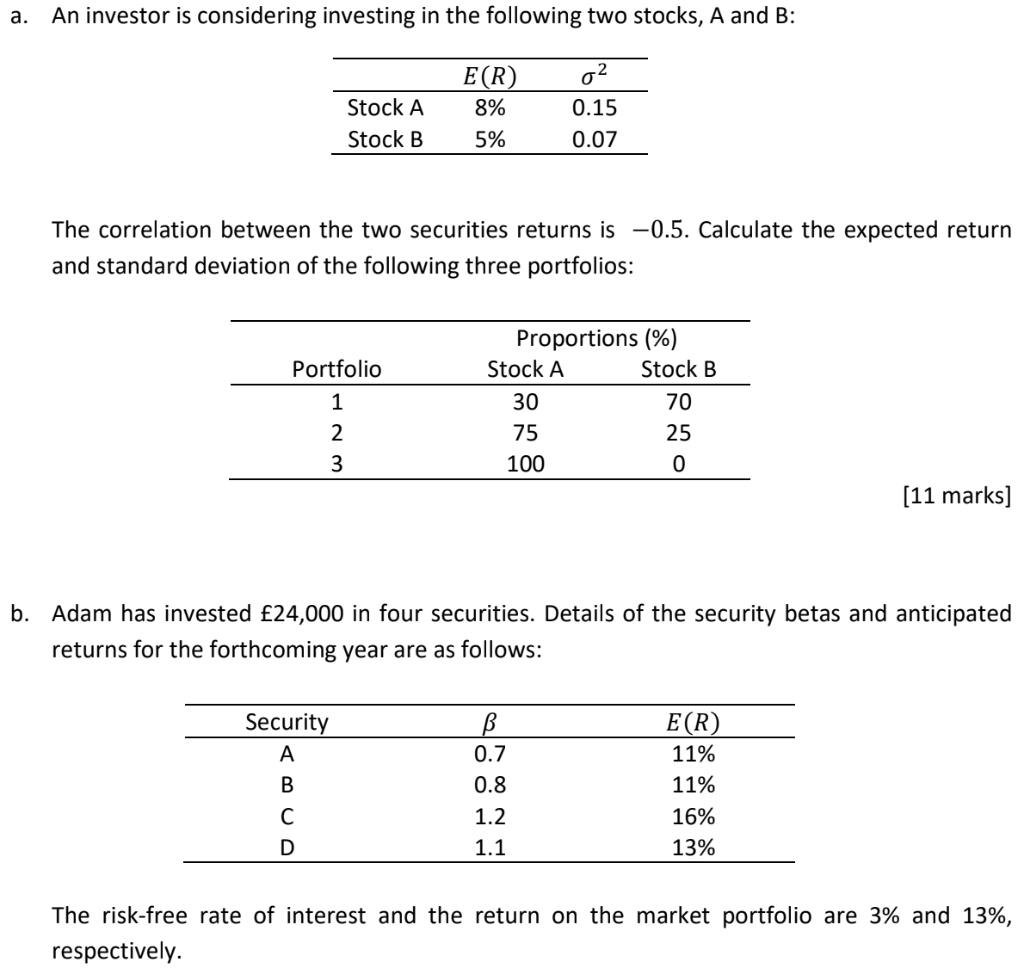

a. An investor is considering investing in the following two stocks, A and B: Stock A Stock B E(R) 8% 5% 02 0.15 0.07 The correlation between the two securities returns is -0.5. Calculate the expected return and standard deviation of the following three portfolios: Portfolio 1 2 3 W NA Proportions (%) Stock A Stock B 30 70 75 25 100 0 [11 marks] b. Adam has invested 24,000 in four securities. Details of the security betas and anticipated returns for the forthcoming year are as follows: Security A B 0.7 0.8 1.2 1.1 E(R) 11% 11% 16% 13% C D The risk-free rate of interest and the return on the market portfolio are 3% and 13%, respectivelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started