Question

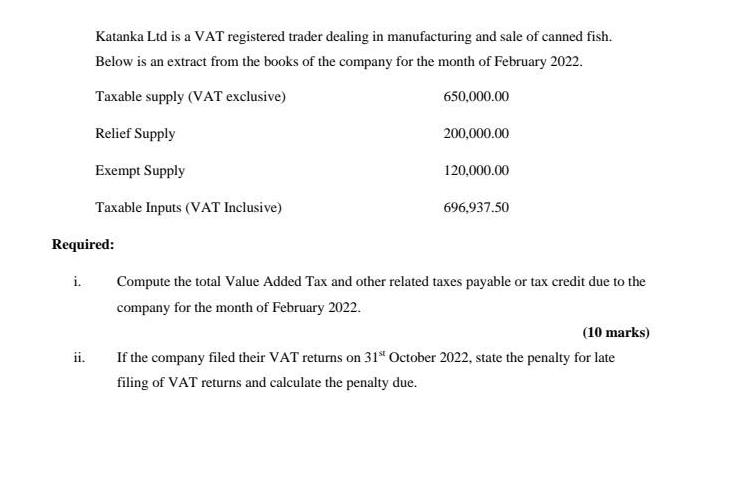

Required: i. Katanka Ltd is a VAT registered trader dealing in manufacturing and sale of canned fish. Below is an extract from the books

Required: i. Katanka Ltd is a VAT registered trader dealing in manufacturing and sale of canned fish. Below is an extract from the books of the company for the month of February 2022. Taxable supply (VAT exclusive) Relief Supply Exempt Supply Taxable Inputs (VAT Inclusive) ii. 650,000.00 200,000.00 120,000.00 696,937.50 Compute the total Value Added Tax and other related taxes payable or tax credit due to the company for the month of February 2022. (10 marks) If the company filed their VAT returns on 31st October 2022, state the penalty for late filing of VAT returns and calculate the penalty due.

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer i Total Value Added Tax Payable Taxable suppl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting

Authors: Barry Elliott, Jamie Elliott

14th Edition

978-0273744535, 273744445, 273744534, 978-0273744443

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App