Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: i. Using amortised cost, account for the bond on Star plcs statement of financial position and statement of comprehensive income for the financial year

Required:

i. Using amortised cost, account for the bond on Star plcs statement of financial position and statement of comprehensive income for the financial year ending 31 December 20X2. Show all workings.

ii. Explain how your answer to i. above would change if the bond was accounted using Fair Value Through Other Comprehensive Income (FVOCI).

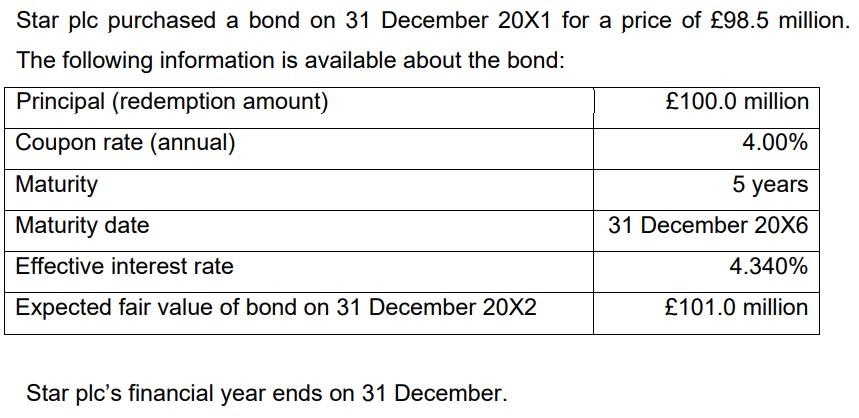

Star plc purchased a bond on 31 December 20X1 for a price of 98.5 million. The following information is available about the bond: Principal (redemption amount) 100.0 million Coupon rate (annual) 4.00% Maturity Maturity date 31 December 20X6 Effective interest rate 4.340% Expected fair value of bond on 31 December 20X2 101.0 million 5 years Star plc's financial year ends on 31 DecemberStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started