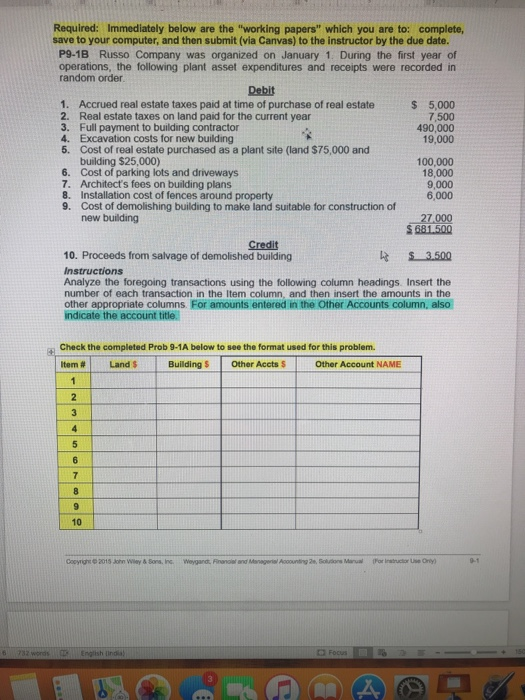

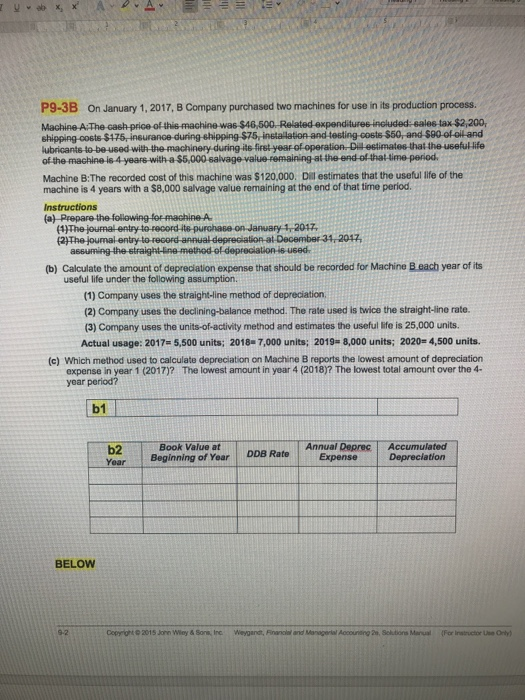

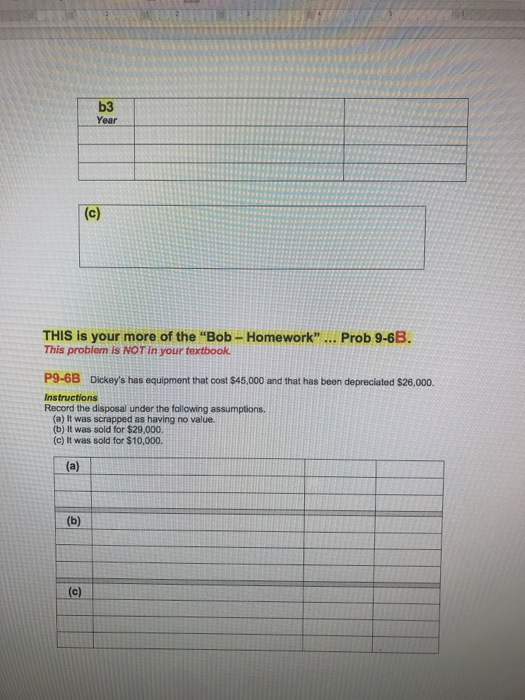

Required: Immediately below are the "working papers" which you are to: complete, save to your computer, and then submit (via Canvas) to the instructor by the due date. P9.1B Russo Company was organized on January 1 Dunng the first year of operations, the following plant asset expenditures and receipts were recorded in random order Debit 1. Accrued real estate taxes paid at time of purchase of real estate5,000 2. Real estate taxes on land paid for the current year 3. Full payment to building contractor 4. Excavation costs for new building 5. Cost of real estate purchased as a plant site (land $75,000 and 7,500 490,000 19,000 6. 7. 8. 9. building $25,000) Cost of parking lots and driveways Architect's fees on building plans Installation cost of fences around property Cost of demolishing building to make land suitable for construction of new building 100,000 18,000 9,000 6,000 27 000 S 681.500 Credit 10. Proceeds from salvage of demolished building Instructions S 3.500 Analyze the foregoing transactions using the following column headings. Insert the number of each transaction in the Item column, and then insert the amounts in the other appropriate columns. For amounts entered in the Other Accounts column, also indicate the account title Check the completed Prob 9-1A below to see the format used for this problem. Item # | Land $ | Building S | Other Accts S | Other Account NAME 10 9-1 6 732 wondsEnglish indal P9-3B On January 1, 2017, B Company purchased two machines for use in its production proces. of estimates-thai the useful life with the-machinery during-is a$5,000 at Machine B:The recorded cost of this machine was $120,000. Dill estimates that the useful life of the machine is 4 years with a S8,000 salvage value remaining at the end of that time period. Instructions assuming the straight-ine method-of depreciation is-used (b) Calculate the amount of depreciation expense that should be recorded for Machine B each year of its useful life under the following assumption. (1) Company uses the straight-line method of depreciation (2) Company uses the declining-balance method. The rate used is twice the straight-ine rate (3) Company uses the units-of-activity method and estimates the useful life is 25,000 units. Actual usage: 2017 5,500 units; 2018- 7,000 units; 2019- 8,000 units; 2020- 4,500 units. (c) Which method used to calculate depreciation on Machine B reports the lowest amount of depreciation The lowest amount in year 4 (2018)? The lowest total amount over the 4- expense in year 1 (2017)? year period? b1 Book Value at b2 Year Beginning of Year DDB Rate A Annual Deprec Accumulated Depreciation DDB RateExpense BELOW 9-2 Copypright o 2015 Jonn Wiey&Son Inc Weygandt, Financlal and Managerlal Accounieing 2n, Solutions Manual For Instructor Use Orlty) b3 Year THIS is your more of the "Bob-Homework" . Prob 9-6B. This problem is NOT in your textbook P9-6B Dickey's has equipment that cost $45,000 and that has been depreciated $26,000. Instructions Record the disposal under the fallowing assumptions. (a) It was scrapped as having no value. (b) It was sold for $29,000. (c) It was sold for $10,000