Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: In each situation, indicate the cash distribution to be made to partners at the end of the liquidation process. Unless otherwise stated, assume that

Required:

In each situation, indicate the cash distribution to be made to partners at the end of the liquidation process. Unless otherwise stated, assume that all solvent partners will reimburse the partnership for their deficit capital balances.

Part A

The Buarque, Monte, and Vinicius partnership reports the following accounts. Vinicius is personally insolvent and can contribute only an additional $ to the partnership.

tableCashLiabilities$ Monte loan,Buarque capital of profits and lossesMonte capital Vinicius capital table

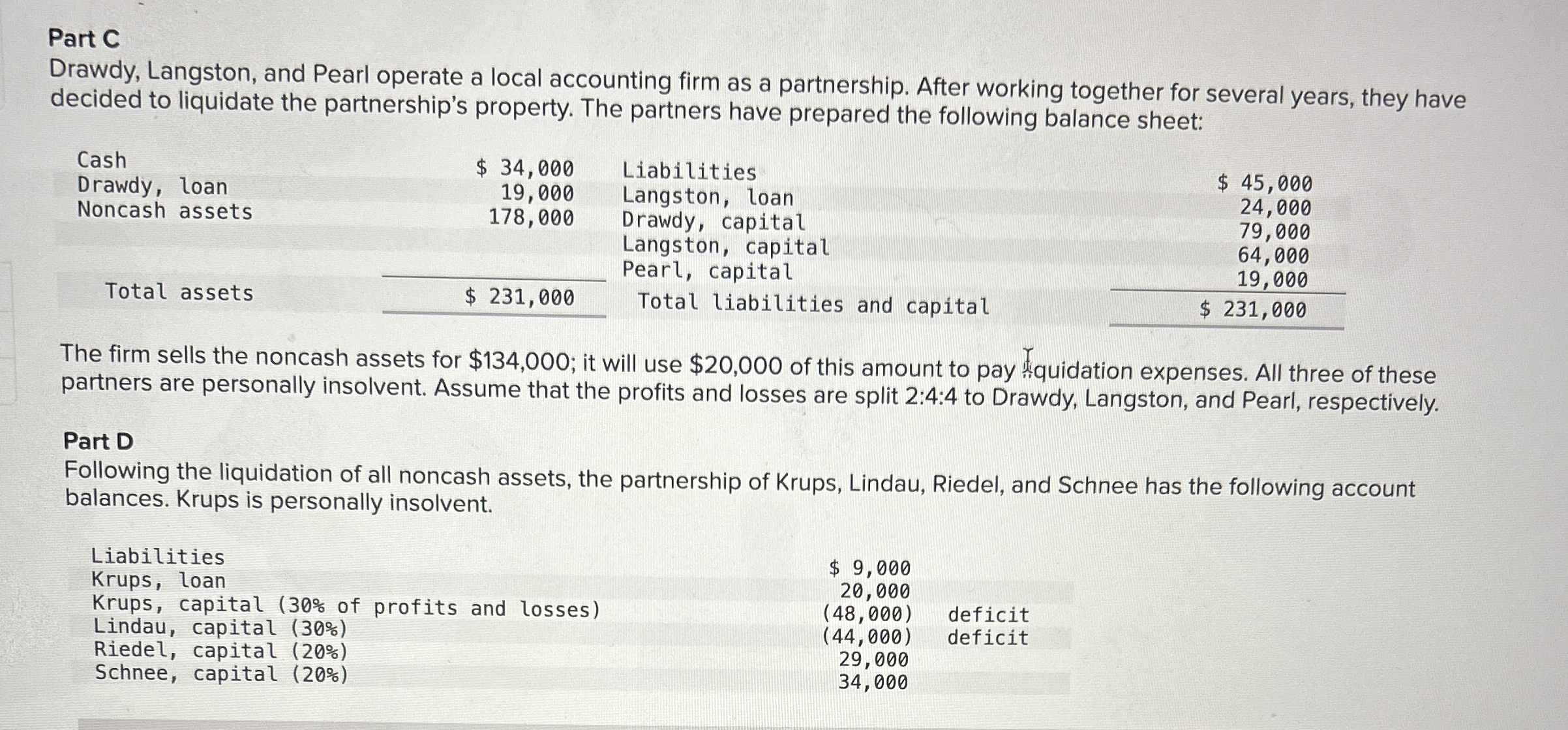

Part C

Drawdy, Langston, and Pearl operate a local accounting firm as a partnership. After working together for several years, they have decided to liquidate the partnership's property. The partners have prepared the following balance sheet:

tableCash$ Liabilities,Drawdy loan,Langston, loan,$ Noncash assets,Drawdy, capital,Langston, capital,Langston, capital,Total assets,$ capital,Total liabilities and capital,$

The firm sells the noncash assets for $; it will use $ of this amount to pay suidation expenses. All three of these partners are personally insolvent. Assume that the profits and losses are split :: to Drawdy, Langston, and Pearl, respectively.

Part D

Following the liquidation of all noncash assets, the partnership of Krups, Lindau, Riedel, and Schnee has the following account balances. Krups is personally insolvent.

tableLiabilitiesKrups loan,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started