Question

You are the CFO for KW, LLC, a seller of low price point affordable apparel which operates a series of retail stores on the west

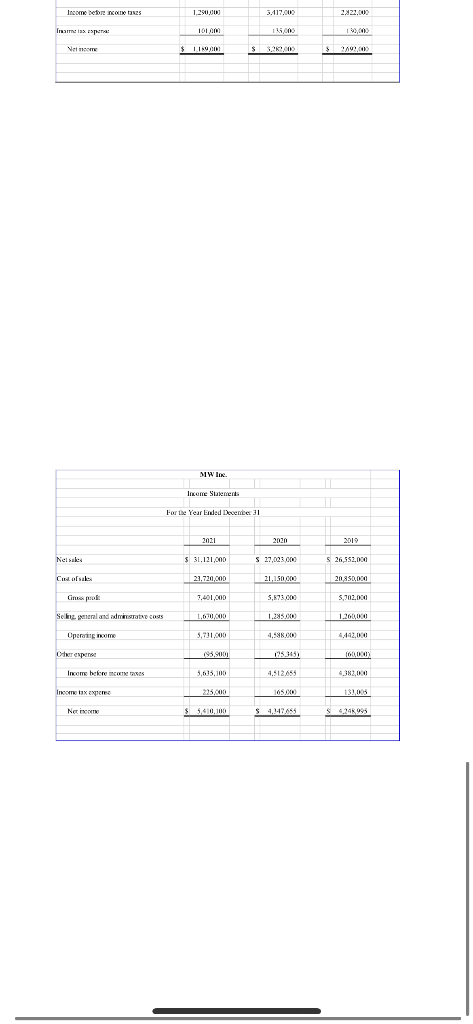

You are the CFO for KW, LLC, a seller of low price point affordable apparel which operates a series of retail stores on the west coast along with a wholesale business in which they sell to retailers. The owner and founder of the Company has asked you to perform some analysis on the last three years of the financial statements as a special project. Her request has come about because the Company's bank is concerned with the financial stability of the Company and the trend of the most recent financial reporting. In particular, the bank has concerns when comparing the operating results of the Company and MW, Inc., one of the Companys largest competitors. The financial statements are included on the following pages. Since MW, Inc. is a publicly traded company, the financial statements for that company is also available to be able to compare and contrast. To summarize, the owner has requested you do the following: 1. Vertical and horizontal analysis on both balance sheets and income statements. 2. Calculate the following ratios for all three years for both KW, LLC and MW, Inc.: a. Current ratio b. Receivable turnover and Average days sales uncollected (assume 75% of sales are credit sales for both the Company and competitor) c. Inventory turnover and Average days of inventory d. Payable turnover and Average days to pay e. Gross margin percentage f. Net income percentage Beyond performing the calculations, prepare a memo that you will provide to the owner commenting on the factors as to why you think the bank is warranted (or not) in their concerns. Include data from the calculations and an overall review of the trends of the financial statements to support your position. Round decimals to two places. 12/31/18 Accounts receivable 1,700,000 12/31/18 Inventory 850,000 12/31/18 Accounts Payable 975,000 12/31/18 Accounts receivable 950,000 12/31/18 Inventory 975,000 12/31/18 Accounts Payable 1,175,000

You are the CFO for KW, LLC, a seller of low price point affordable apparel which operates a series of retail stores on the west coast along with a wholesale business in which they sell to retailers. The owner and founder of the Company has asked you to perform some analysis on the last three years of the financial statements as a special project. Her request has come about because the Company's bank is concerned with the financial stability of the Company and the trend of the most recent financial reporting. In particular, the bank has concerns when comparing the operating results of the Company and MW, Inc., one of the Companys largest competitors. The financial statements are included on the following pages. Since MW, Inc. is a publicly traded company, the financial statements for that company is also available to be able to compare and contrast. To summarize, the owner has requested you do the following: 1. Vertical and horizontal analysis on both balance sheets and income statements. 2. Calculate the following ratios for all three years for both KW, LLC and MW, Inc.: a. Current ratio b. Receivable turnover and Average days sales uncollected (assume 75% of sales are credit sales for both the Company and competitor) c. Inventory turnover and Average days of inventory d. Payable turnover and Average days to pay e. Gross margin percentage f. Net income percentage Beyond performing the calculations, prepare a memo that you will provide to the owner commenting on the factors as to why you think the bank is warranted (or not) in their concerns. Include data from the calculations and an overall review of the trends of the financial statements to support your position. Round decimals to two places. 12/31/18 Accounts receivable 1,700,000 12/31/18 Inventory 850,000 12/31/18 Accounts Payable 975,000 12/31/18 Accounts receivable 950,000 12/31/18 Inventory 975,000 12/31/18 Accounts Payable 1,175,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started