Required: In the following pages, you will find excerpts from the Press Release, Annual Consolidated Financial Statements and Management's Discussion and Analysis of Financial

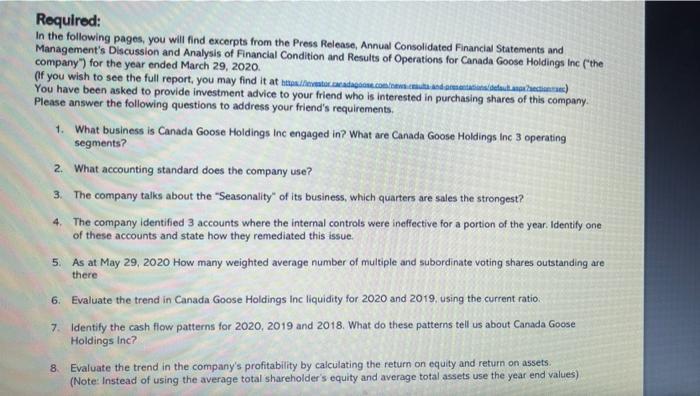

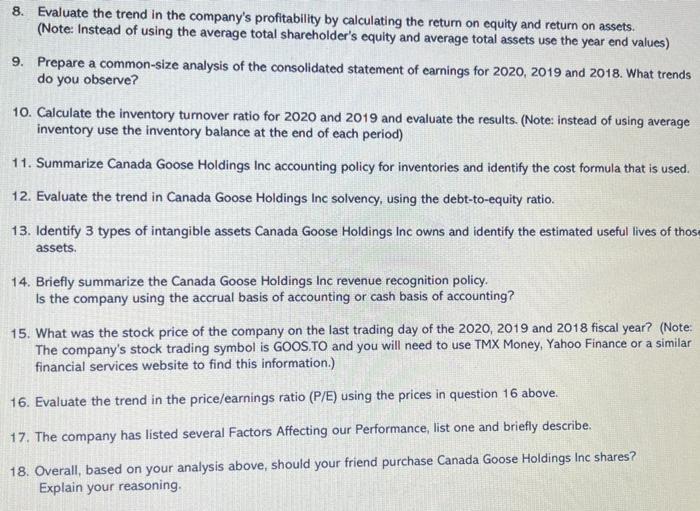

Required: In the following pages, you will find excerpts from the Press Release, Annual Consolidated Financial Statements and Management's Discussion and Analysis of Financial Condition and Results of Operations for Canada Goose Holdings Inc ("the company") for the year ended March 29, 2020. (If you wish to see the full report, you may find it at https://vestor.canadagoose.com/news.auts and prontations/default haectiates) You have been asked to provide investment advice to your friend who is interested in purchasing shares of this company. Please answer the following questions to address your friend's requirements. 1. What business is Canada Goose Holdings Inc engaged in? What are Canada Goose Holdings Inc 3 operating segments? 2. What accounting standard does the company use? 3. The company talks about the "Seasonality of its business, which quarters are sales the strongest? 4. The company identified 3 accounts where the internal controls were ineffective for a portion of the year. Identify one of these accounts and state how they remediated this issue. 5. As at May 29, 2020 How many weighted average number of multiple and subordinate voting shares outstanding are there 6. Evaluate the trend in Canada Goose Holdings Inc liquidity for 2020 and 2019, using the current ratio. 7. Identify the cash flow patterns for 2020, 2019 and 2018. What do these patterns tell us about Canada Goose Holdings Inc? 8. Evaluate the trend in the company's profitability by calculating the return on equity and return on assets. (Note: Instead of using the average total shareholder's equity and average total assets use the year end values) 8. Evaluate the trend in the company's profitability by calculating the return on equity and return on assets. (Note: Instead of using the average total shareholder's equity and average total assets use the year end values) 9. Prepare a common-size analysis of the consolidated statement of earnings for 2020, 2019 and 2018. What trends do you observe? 10. Calculate the inventory turnover ratio for 2020 and 2019 and evaluate the results. (Note: instead of using average inventory use the inventory balance at the end of each period) 11. Summarize Canada Goose Holdings Inc accounting policy for inventories and identify the cost formula that is used. 12. Evaluate the trend in Canada Goose Holdings Inc solvency, using the debt-to-equity ratio. 13. Identify 3 types of intangible asse Canada Goose Holdings Inc owns and identify the estimated useful lives of those assets. 14. Briefly summarize the Canada Goose Holdings Inc revenue recognition policy. Is the company using the accrual basis of accounting or cash basis of accounting? 15. What was the stock price of the company on the last trading day of the 2020, 2019 and 2018 fiscal year? (Note: The company's stock trading symbol is GOOS.TO and you will need to use TMX Money, Yahoo Finance or a similar financial services website to find this information.) 16. Evaluate the trend in the price/earnings ratio (P/E) using the prices in question 16 above. 17. The company has listed several Factors Affecting our Performance, list one and briefly describe. 18. Overall, based on your analysis above, should your friend purchase Canada Goose Holdings Inc shares? Explain your reasoning.

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 Canada Goose Holdings Inc is engaged in the design manufacture marketing and sale of premium outerwear for men women and children The company ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started