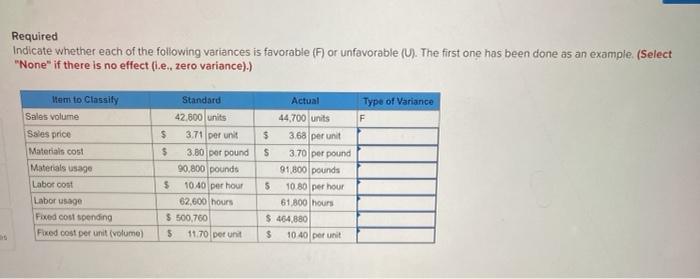

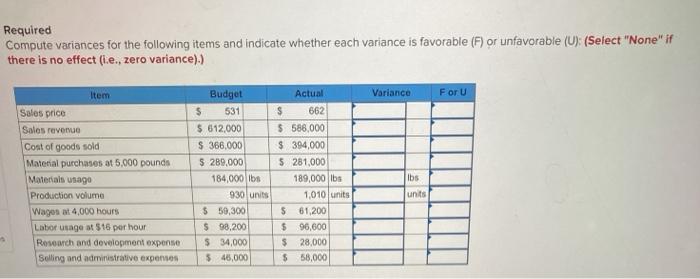

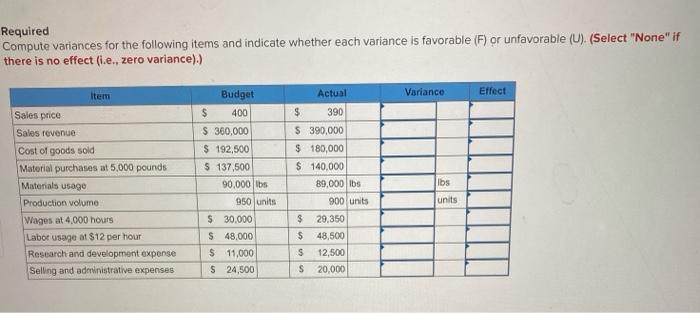

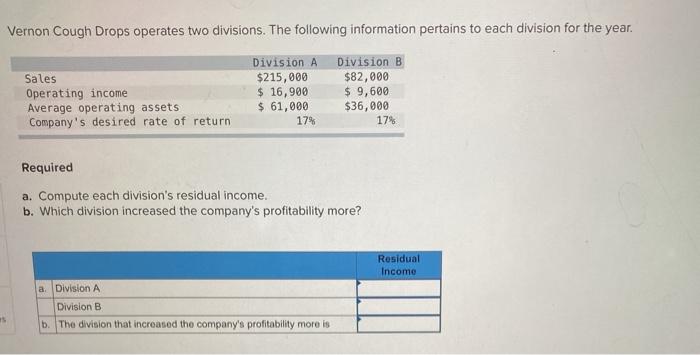

Required Indicate whether each of the following variances is favorable (F) or unfavorable (U). The first one has been done as an example (Select "None" if there is no effect (ie. zero variance).) Actual Type of Variance F Item to Classity Sales volume Sales price Materials cost Materials usage Labor cost Labor usage Foxed cost spending Fixed cost per unit (volume) Standard 42.600 units $ 3.71 per unit $ 3.80 por pound 90,800 pounds $ 10.40 per hour 62,600 hours $ 500,760 $ 11.70 per unit 44,700 units $ 3.68 per unit $ 3.70 per pound 91 800 pounds $ 10.80 per hour 61 800 hours $ 464.880 $ 10 40 per unit Required Compute variances for the following items and indicate whether each variance is favorable (F) or unfavorable (U): (Select "None" if there is no effect (ie, zero variance).) Item Variance For U Sales price Sales revenue Cost of goods sold Material purchases at 5,000 pounds Materials usago Production volume Wages at 4.000 hours Labor usage at $16 per hour Research and development expense Selling and administrative expenses Budget $ 531 $ 612,000 S 366,000 $ 289,000 184,000 lbs 930 units $ 50,300 $ 98,200 $ 34,000 $ 45,000 Actual $ 662 $588,000 $ 394,000 5 281,000 189,000 lbs 1,010 units $ 61,200 $ 96,000 $ 28,000 $ 58,000 lbs units Required Compute variances for the following items and indicate whether each variance is favorable (F) or unfavorable (U). (Select "None" if there is no effect (i.e., zero variance).) Item Variance Effect Sales price Sales revenue Cost of goods sold Material purchases at 5,000 pounds Materials usage Production volume Wages at 4.000 hours Labor usage of $12 per hour Research and development expense Selling and administrative expenses Budget $ 400 $ 360,000 $ 192,500 $ 137,500 90.000 lbs 950 units $ 30,000 $48.000 $ 11,000 $ 24,500 Actual $ 390 $ 390,000 $ 180,000 $ 140,000 89,000 lbs 900 units $ 29,350 $ 48,500 S 12,500 $ 20,000 lbs units Vernon Cough Drops operates two divisions. The following information pertains to each division for the year. Sales Operating income Average operating assets Company's desired rate of return Division A $215,000 $ 16,900 $ 61,000 17% Division B $82,000 $ 9,600 $36,000 174 Required a. Compute each division's residual income. b. Which division increased the company's profitability more? Residual Income a Division A Division B . The division that increased the company's profitability more is 5