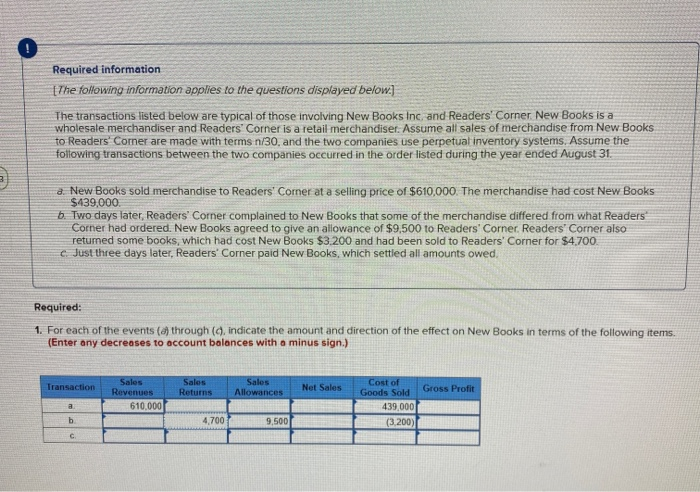

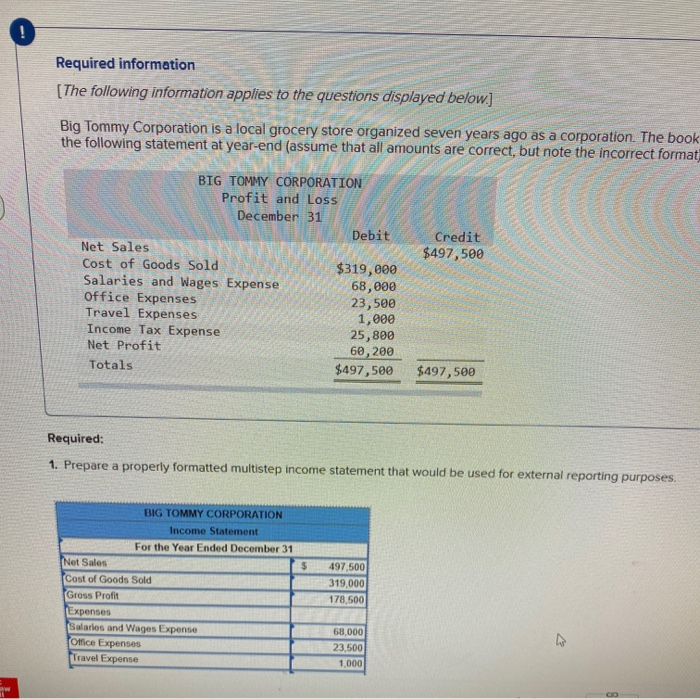

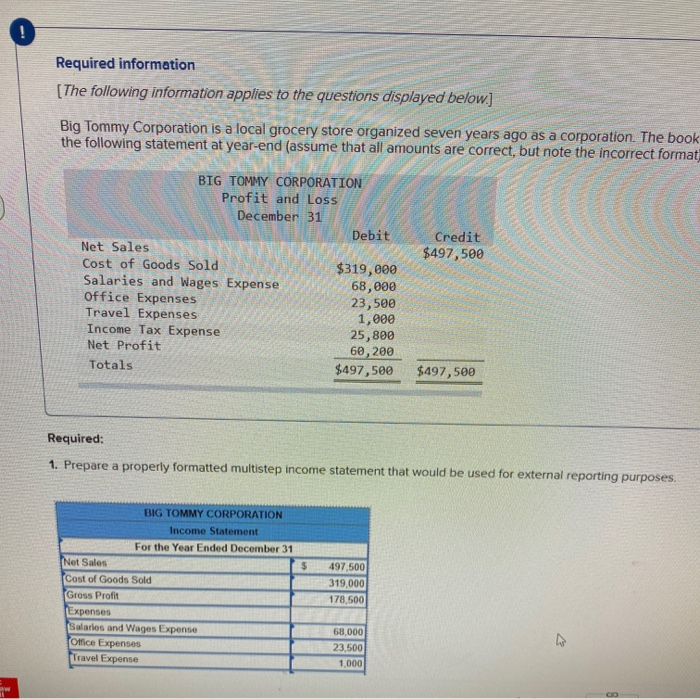

Required information 1The following information applies to the questions displayed below The transactions listed below are typical of those involving New Books Inc. and Readers' Corner New Books is a wholesale merchandiser and Readers Corner is a retail merchandiser. Assume all sales of merchandise from New Books to Readers Corner are made with terms n/30, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended August 31 New Books sold merchandise to Readers Corner at a selling price of $610,000 The merchandise had cost New Books $439,000 b. Two days later, Readers' Corner complained to New Books that some of the merchandise differed from what Readers Corner had ordered. New Books agreed to give an allowance of $9,500 to Readers' Corner. Readers Corner also returned some books, which had cost New Books $3.200 and had been sold to Readers' Corner for $4.700 C Just three days later, Readers' Corner paid New Books, which settled all amounts owed Required: 1. For each of the events (a) through (d, indicate the amount and direction of the effect on New Books in terms of the following items (Enter any decreases to account balances with a minus sign.) Sales Revenues Sales Sales Cost of Goods Sold Iransaction Net Sales Gross Profit Returns Allowances 610,000 439,000 9,500 b. 4,700 (3,200) C Required information [The following information applies to the questions displayed below] Big Tommy Corporation is a local grocery store organized seven years ago as a corporation. The book the following statement at year-end (assume that all amounts are correct, but note the incorrect format BIG TOMMY CORPORATION Profit and Loss December 31 Debit Credit $497,500 Net Sales Cost of Goods Sold $319,000 68,000 23,500 1,000 25,800 60,200 $497,500 Salaries and Wages Expense Office Expenses Travel Expenses Income Tax Expense Net Profit Totals $497,500 Required: 1. Prepare a properly formatted multistep income statement that would be used for external reporting purposes BIG TOMMY CORPORATION Income Statement For the Year Ended December 31 497,500 319,000 178,500 Net Sales Cost of Goods Sold Gross Profit Expenses Salaries and Wages Expense Office Expenses Travel Expense $ 68,000 23,500 1,000 aw