Answered step by step

Verified Expert Solution

Question

1 Approved Answer

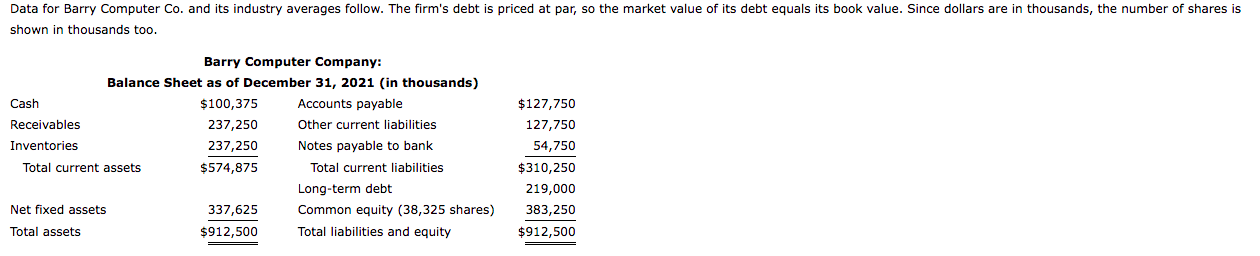

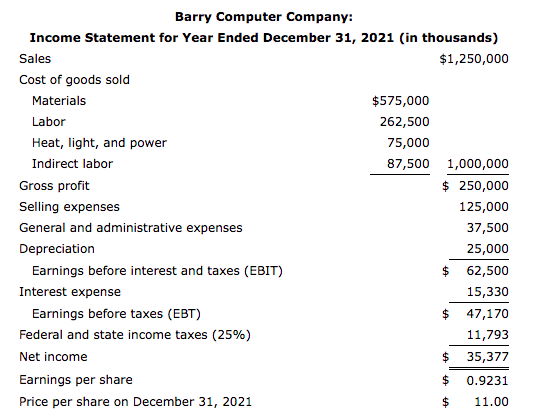

(Required information Above) (Problems Below) (Please Answer A through D) shown in thousands too. Barry Computer Company: Balance Sheet as of December 31, 2021 (in

(Required information Above)

(Problems Below) (Please Answer A through D)

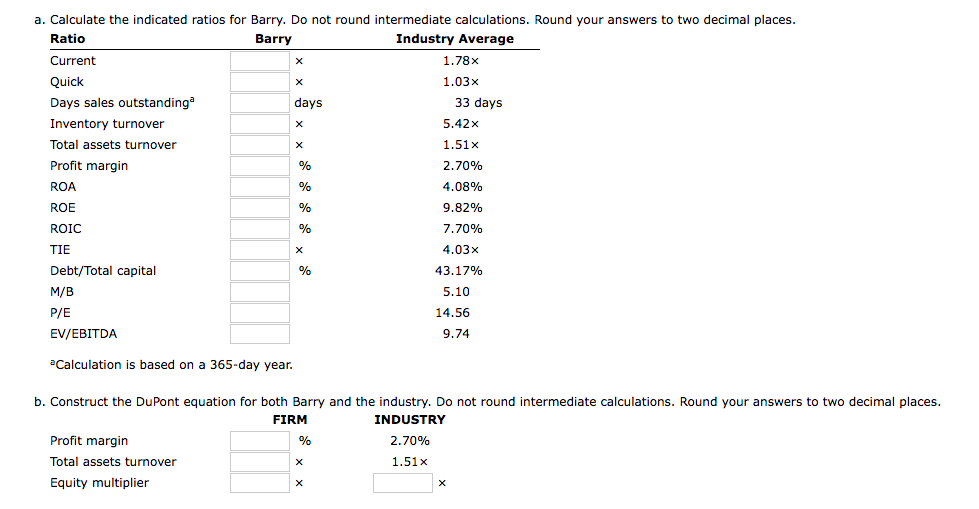

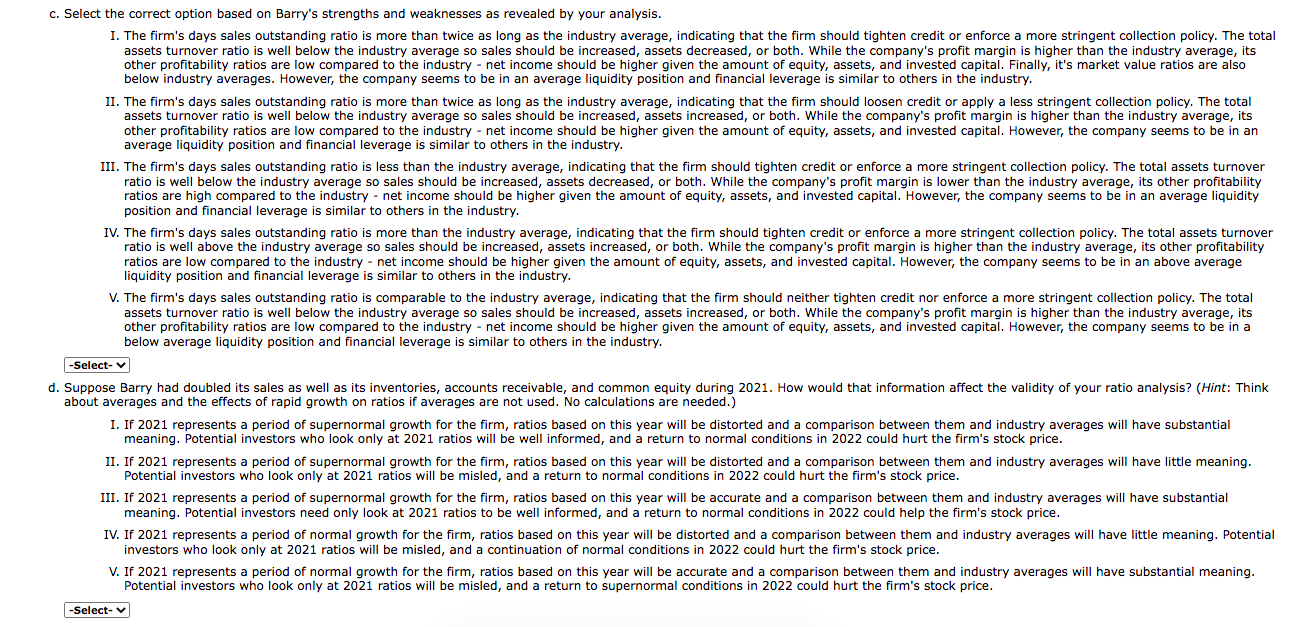

shown in thousands too. Barry Computer Company: Balance Sheet as of December 31, 2021 (in thousands) Barry Computer Company: aCalculation is based on a 365-day year. b. Construct the DuPont equation for both Barry and the industry. Do not round intermediate calculations. Round your answers to two decimal places. c. Select the correct option based on Barry's strengths and weaknesses as revealed by your analysis. below industry averages. However, the company seems to be in an average liquidity position and financial leverage is similar to others in the industry. average liquidity position and financial leverage is similar to others in the industry. position and financial leverage is similar to others in the industry. liquidity position and financial leverage is similar to others in the industry. below average liquidity position and financial leverage is similar to others in the industry. about averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.) meaning. Potential investors who look only at 2021 ratios will be well informed, and a return to normal conditions in 2022 could hurt the firm's stock price. Potential investors who look only at 2021 ratios will be misled, and a return to normal conditions in 2022 could hurt the firm's stock price. meaning. Potential investors need only look at 2021 ratios to be well informed, and a return to normal conditions in 2022 could help the firm's stock price. investors who look only at 2021 ratios will be misled, and a continuation of normal conditions in 2022 could hurt the firm's stock price. Potential investors who look only at 2021 ratios will be misled, and a return to supernormal conditions in 2022 could hurt the firm's stock price

shown in thousands too. Barry Computer Company: Balance Sheet as of December 31, 2021 (in thousands) Barry Computer Company: aCalculation is based on a 365-day year. b. Construct the DuPont equation for both Barry and the industry. Do not round intermediate calculations. Round your answers to two decimal places. c. Select the correct option based on Barry's strengths and weaknesses as revealed by your analysis. below industry averages. However, the company seems to be in an average liquidity position and financial leverage is similar to others in the industry. average liquidity position and financial leverage is similar to others in the industry. position and financial leverage is similar to others in the industry. liquidity position and financial leverage is similar to others in the industry. below average liquidity position and financial leverage is similar to others in the industry. about averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.) meaning. Potential investors who look only at 2021 ratios will be well informed, and a return to normal conditions in 2022 could hurt the firm's stock price. Potential investors who look only at 2021 ratios will be misled, and a return to normal conditions in 2022 could hurt the firm's stock price. meaning. Potential investors need only look at 2021 ratios to be well informed, and a return to normal conditions in 2022 could help the firm's stock price. investors who look only at 2021 ratios will be misled, and a continuation of normal conditions in 2022 could hurt the firm's stock price. Potential investors who look only at 2021 ratios will be misled, and a return to supernormal conditions in 2022 could hurt the firm's stock price Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started