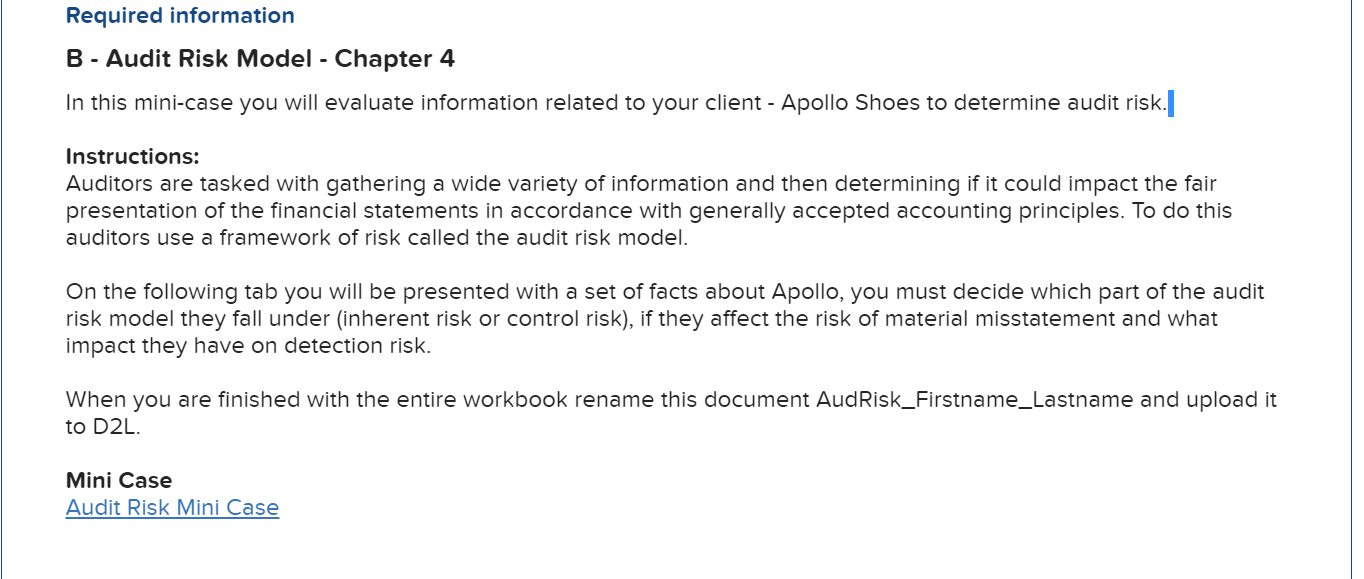

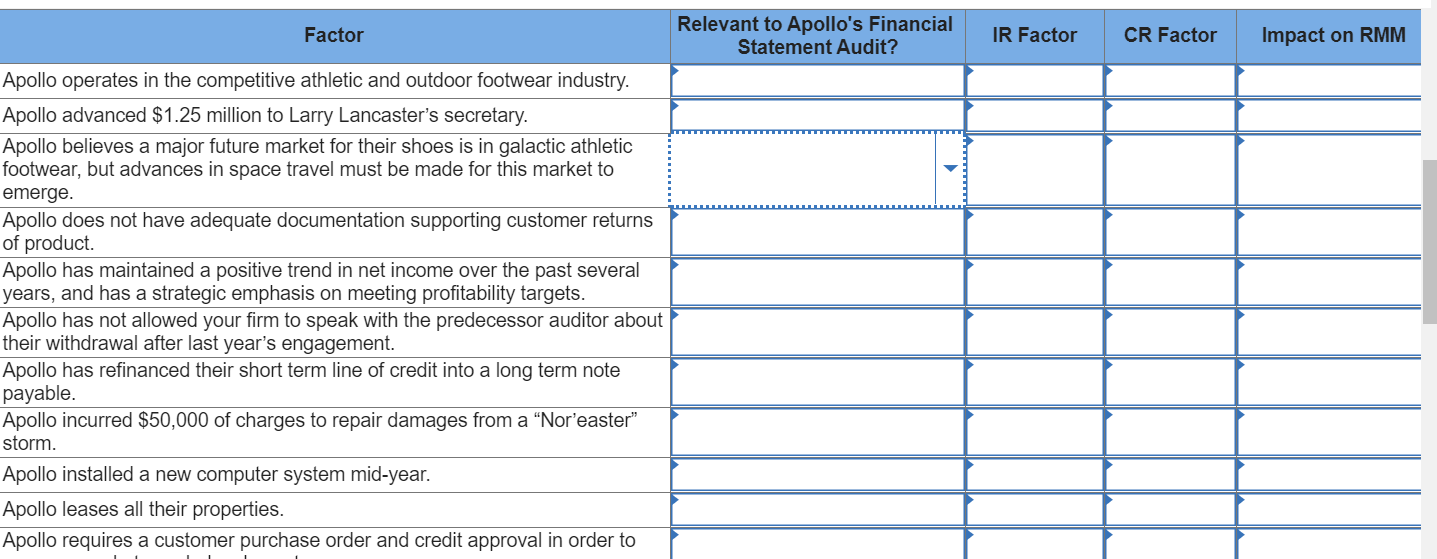

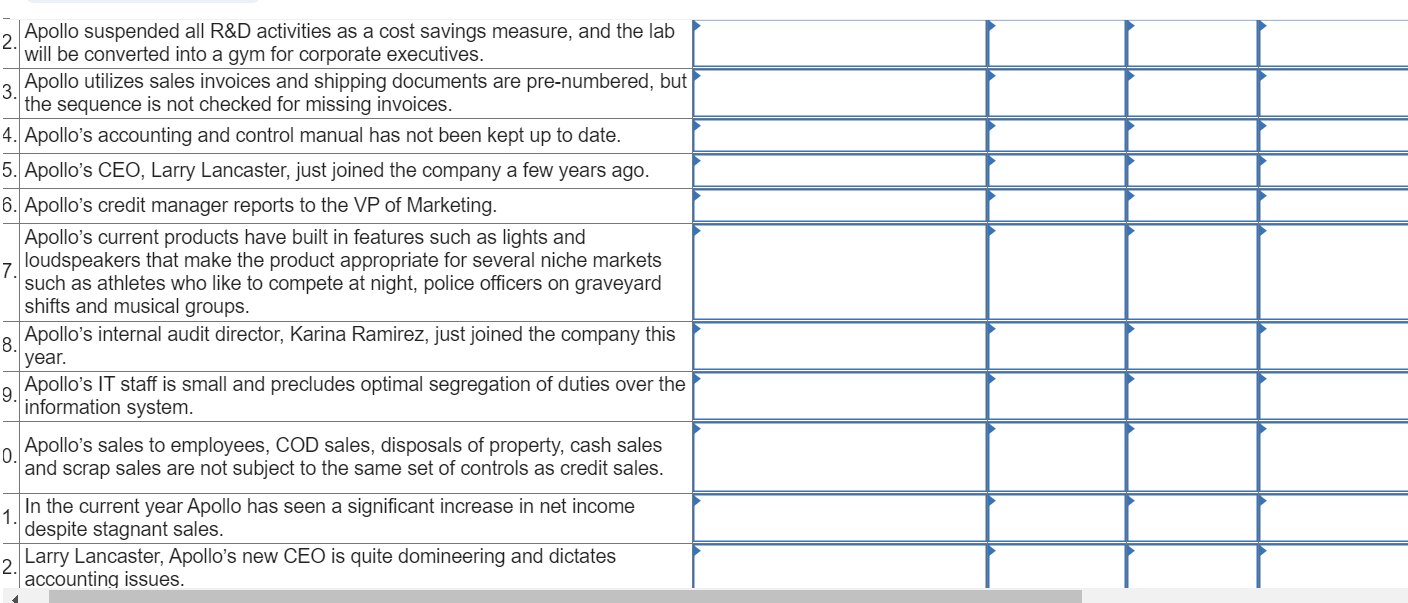

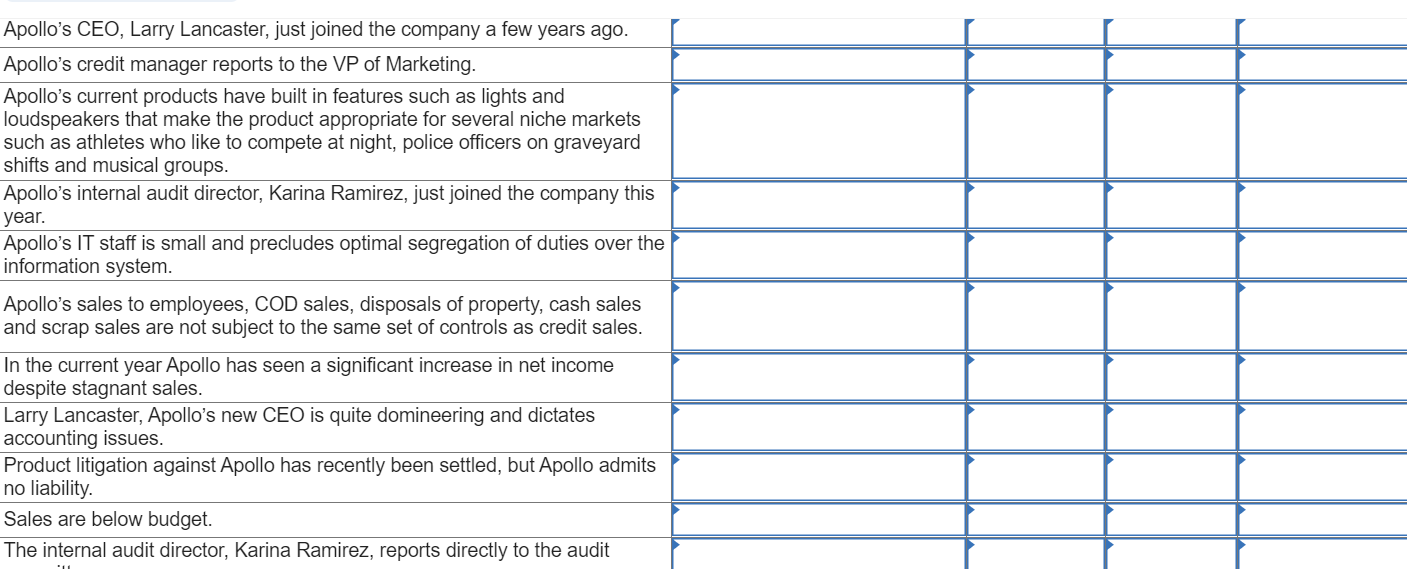

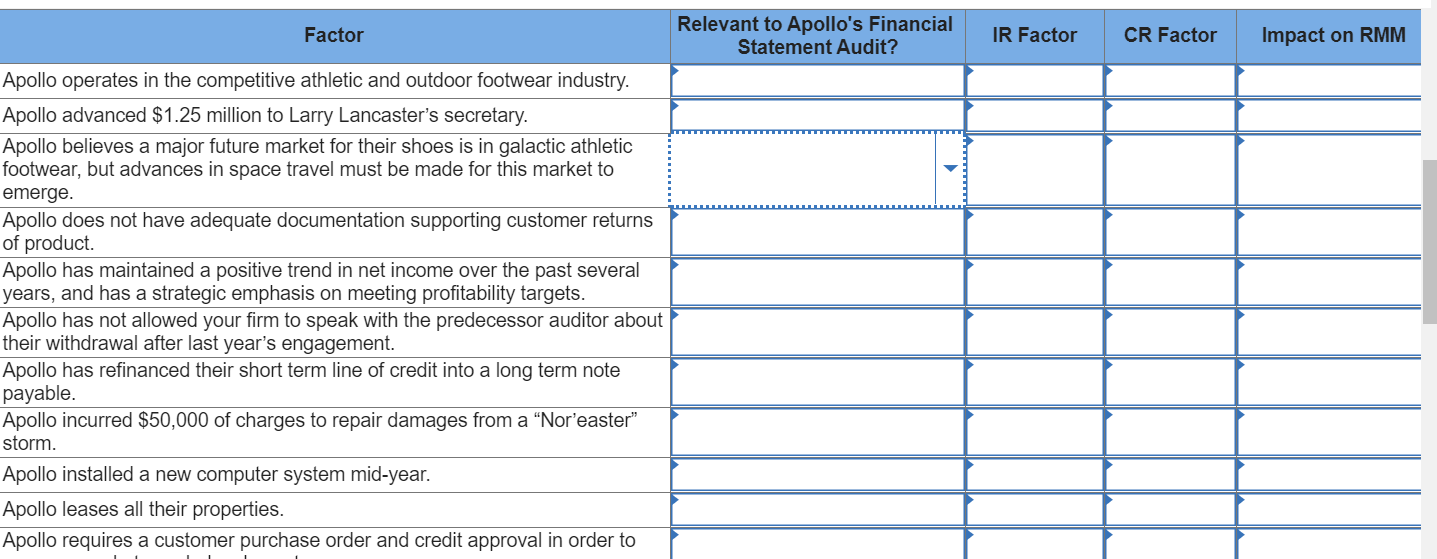

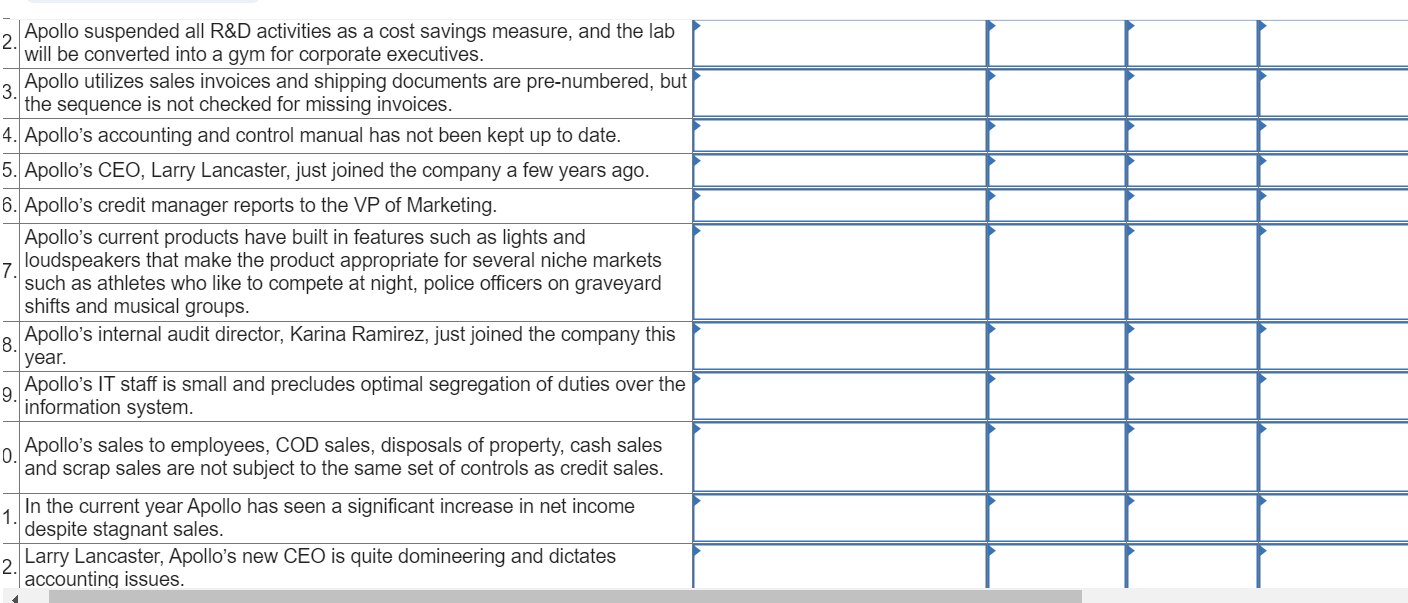

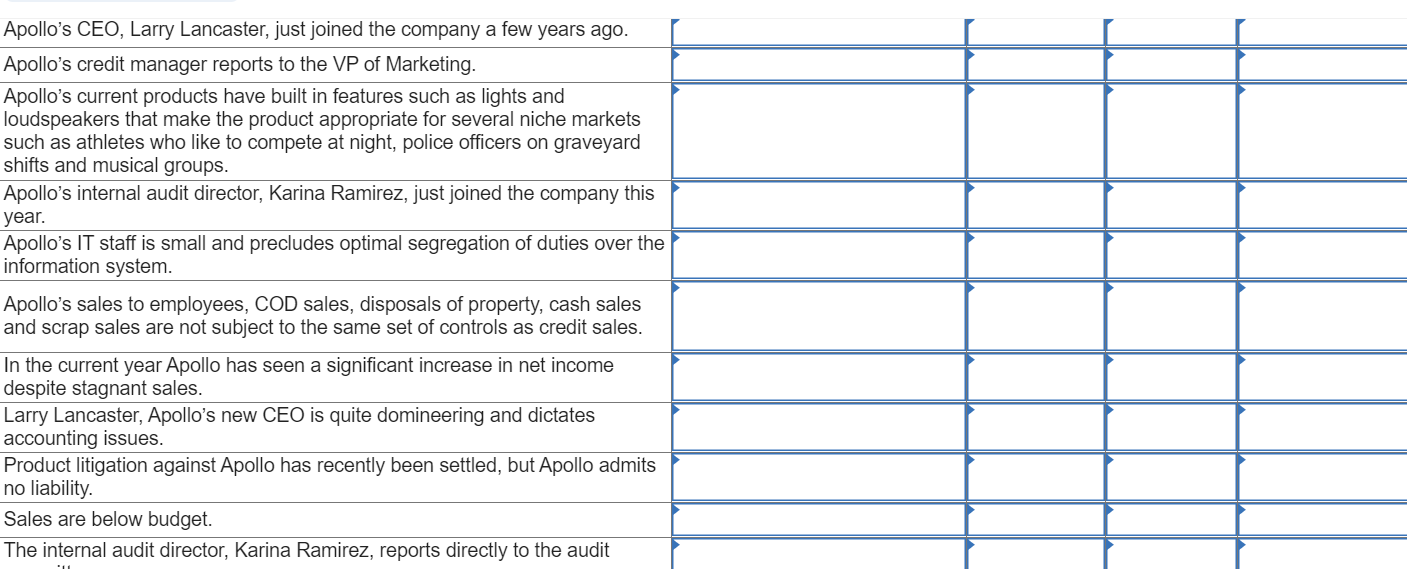

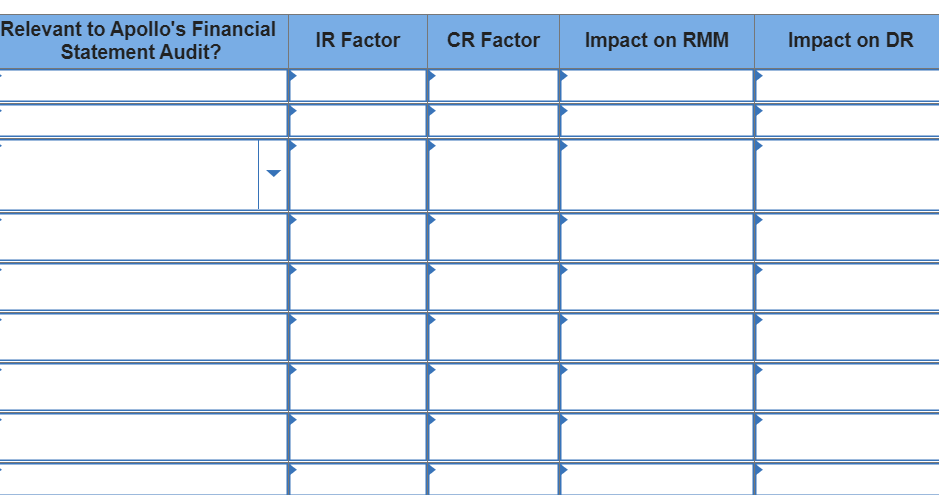

Required information B - Audit Risk Model - Chapter 4 In this mini-case you will evaluate information related to your client - Apollo Shoes to determine audit risk./ Instructions: Auditors are tasked with gathering a wide variety of information and then determining if it could impact the fair presentation of the financial statements in accordance with generally accepted accounting principles. To do this auditors use a framework of risk called the audit risk model. On the following tab you will be presented with a set of facts about Apollo, you must decide which part of the audit risk model they fall under (inherent risk or control risk), if they affect the risk of material misstatement and what impact they have on detection risk. When you are finished with the entire workbook rename this document AudRisk_Firstname_Lastname and upload it to D2L. Mini Case Audit Risk Mini Case Factor Relevant to Apollo's Financial Statement Audit? IR Factor CR Factor Impact on RMM Apollo operates in the competitive athletic and outdoor footwear industry. Apollo advanced $1.25 million to Larry Lancaster's secretary. Apollo believes a major future market for their shoes is in galactic athletic footwear, but advances in space travel must be made for this market to emerge. Apollo does not have adequate documentation supporting customer returns of product. Apollo has maintained a positive trend in net income over the past several years, and has a strategic emphasis on meeting profitability targets. Apollo has not allowed your firm to speak with the predecessor auditor about their withdrawal after last year's engagement. Apollo has refinanced their short term line of credit into a long term note payable. Apollo incurred $50,000 of charges to repair damages from a Nor'easter" storm. Apollo installed a new computer system mid-year. Apollo leases all their properties. Apollo requires a customer purchase order and credit approval in order to Apollo suspended all R&D activities as a cost savings measure, and the lab 2. will be converted into a gym for corporate executives. 3. Apollo utilizes sales invoices and shipping documents are pre-numbered, but the sequence is not checked for missing invoices. 4. Apollo's accounting and control manual has not been kept up to date. 5. Apollo's CEO, Larry Lancaster, just joined the company a few years ago. 6. Apollo's credit manager reports to the VP of Marketing. Apollo's current products have built in features such as lights and 7 loudspeakers that make the product appropriate for several niche markets such as athletes who like to compete at night, police officers on graveyard shifts and musical groups. 8. Apollo's internal audit director, Karina Ramirez, just joined the company this year. 9. Apollo's IT staff is small and precludes optimal segregation of duties over the information system. Apollo's sales to employees, COD sales, disposals of property, cash sales 0. and scrap sales are not subject to the same set of controls as credit sales. 1. In the current year Apollo has seen a significant increase in net income despite stagnant sales. 2. Larry Lancaster, Apollo's new CEO is quite domineering and dictates accounting issues. Apollo's CEO, Larry Lancaster, just joined the company a few years ago. Apollo's credit manager reports to the VP of Marketing. Apollo's current products have built in features such as lights and loudspeakers that make the product appropriate for several niche markets such as athletes who like to compete at night, police officers on graveyard shifts and musical groups. Apollo's internal audit director, Karina Ramirez, just joined the company this year. Apollo's IT staff is small and precludes optimal segregation of duties over the information system. Apollo's sales to employees, COD sales, disposals of property, cash sales and scrap sales are not subject to the same set of controls as credit sales. In the current year Apollo has seen a significant increase in net income despite stagnant sales. Larry Lancaster, Apollo's new CEO is quite domineering and dictates accounting issues. Product litigation against Apollo has recently been settled, but Apollo admits no liability. Sales are below budget. The internal audit director, Karina Ramirez, reports directly to the audit Relevant to Apollo's Financial Statement Audit? IR Factor CR Factor Impact on RMM Impact on DR Required information B - Audit Risk Model - Chapter 4 In this mini-case you will evaluate information related to your client - Apollo Shoes to determine audit risk./ Instructions: Auditors are tasked with gathering a wide variety of information and then determining if it could impact the fair presentation of the financial statements in accordance with generally accepted accounting principles. To do this auditors use a framework of risk called the audit risk model. On the following tab you will be presented with a set of facts about Apollo, you must decide which part of the audit risk model they fall under (inherent risk or control risk), if they affect the risk of material misstatement and what impact they have on detection risk. When you are finished with the entire workbook rename this document AudRisk_Firstname_Lastname and upload it to D2L. Mini Case Audit Risk Mini Case Factor Relevant to Apollo's Financial Statement Audit? IR Factor CR Factor Impact on RMM Apollo operates in the competitive athletic and outdoor footwear industry. Apollo advanced $1.25 million to Larry Lancaster's secretary. Apollo believes a major future market for their shoes is in galactic athletic footwear, but advances in space travel must be made for this market to emerge. Apollo does not have adequate documentation supporting customer returns of product. Apollo has maintained a positive trend in net income over the past several years, and has a strategic emphasis on meeting profitability targets. Apollo has not allowed your firm to speak with the predecessor auditor about their withdrawal after last year's engagement. Apollo has refinanced their short term line of credit into a long term note payable. Apollo incurred $50,000 of charges to repair damages from a Nor'easter" storm. Apollo installed a new computer system mid-year. Apollo leases all their properties. Apollo requires a customer purchase order and credit approval in order to Apollo suspended all R&D activities as a cost savings measure, and the lab 2. will be converted into a gym for corporate executives. 3. Apollo utilizes sales invoices and shipping documents are pre-numbered, but the sequence is not checked for missing invoices. 4. Apollo's accounting and control manual has not been kept up to date. 5. Apollo's CEO, Larry Lancaster, just joined the company a few years ago. 6. Apollo's credit manager reports to the VP of Marketing. Apollo's current products have built in features such as lights and 7 loudspeakers that make the product appropriate for several niche markets such as athletes who like to compete at night, police officers on graveyard shifts and musical groups. 8. Apollo's internal audit director, Karina Ramirez, just joined the company this year. 9. Apollo's IT staff is small and precludes optimal segregation of duties over the information system. Apollo's sales to employees, COD sales, disposals of property, cash sales 0. and scrap sales are not subject to the same set of controls as credit sales. 1. In the current year Apollo has seen a significant increase in net income despite stagnant sales. 2. Larry Lancaster, Apollo's new CEO is quite domineering and dictates accounting issues. Apollo's CEO, Larry Lancaster, just joined the company a few years ago. Apollo's credit manager reports to the VP of Marketing. Apollo's current products have built in features such as lights and loudspeakers that make the product appropriate for several niche markets such as athletes who like to compete at night, police officers on graveyard shifts and musical groups. Apollo's internal audit director, Karina Ramirez, just joined the company this year. Apollo's IT staff is small and precludes optimal segregation of duties over the information system. Apollo's sales to employees, COD sales, disposals of property, cash sales and scrap sales are not subject to the same set of controls as credit sales. In the current year Apollo has seen a significant increase in net income despite stagnant sales. Larry Lancaster, Apollo's new CEO is quite domineering and dictates accounting issues. Product litigation against Apollo has recently been settled, but Apollo admits no liability. Sales are below budget. The internal audit director, Karina Ramirez, reports directly to the audit Relevant to Apollo's Financial Statement Audit? IR Factor CR Factor Impact on RMM Impact on DR