Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Business Sim Corp. (BSC) issued 2,000 common shares to Kelly in exchange for $28.000. BSC borrowed $49.000 from the bank. promising to repay

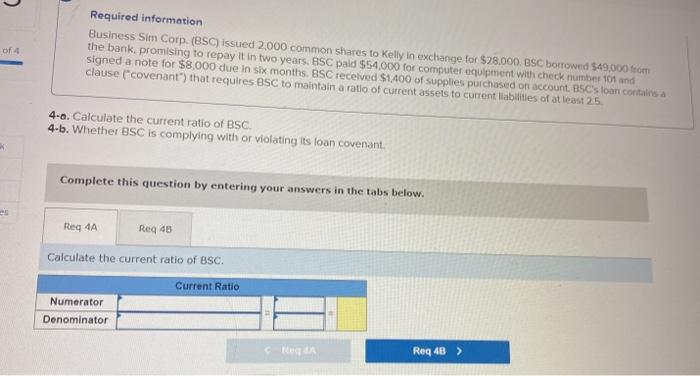

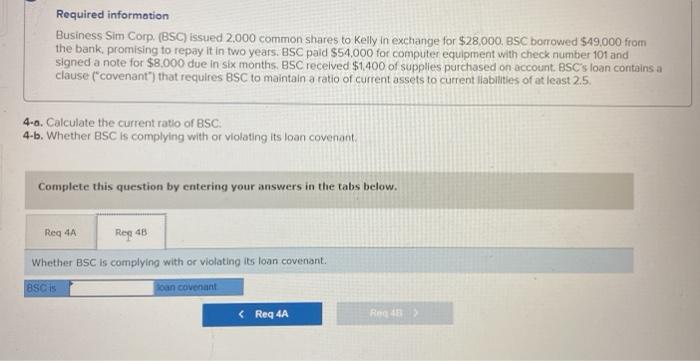

Required information Business Sim Corp. (BSC) issued 2,000 common shares to Kelly in exchange for $28.000. BSC borrowed $49.000 from the bank. promising to repay it in two years. BSC paid $54,000 for computer equipment with check number 101 and signed a note for $8,000 due in six months. BSC received $1,400 of supplies purchased on account. BSC's loan contains a clause ( covenant') that requires BSC to maintain a ratio of current assets to current liabilities of at least 25 of a 4-6. Calculate the current ratio of BSC. 4-5. Whether BSC is complying with or violating its loan covenant Complete this question by entering your answers in the tabs below. Req 4A Reg 4 Calculate the current ratio of BSC. Current Ratio Numerator Denominator Reg 43 > Required information Business Sim Corp. (BSC) issued 2,000 common shares to Kelly in exchange for $28,000. BSC borrowed $49,000 from the bank, promising to repay it in two years. BSC paid $54,000 for computer equipment with check number 101 and signed a note for $8,000 due in six months. BSC received $1.400 of supplies purchased on account. BSC's loan contains a clause ("covenant") that requires BSC to maintain a ratio of current assets to current liabilities of at least 2.5. 4-0. Calculate the current ratio of BSC 4-b. Whether BSC is complying with or violating its loan covenant Complete this question by entering your answers in the tabs below. Reg 4A Rog 48 Whether BSC is complying with or violating its loan covenant. BSCIS loan covenant

Required information Business Sim Corp. (BSC) issued 2,000 common shares to Kelly in exchange for $28.000. BSC borrowed $49.000 from the bank. promising to repay it in two years. BSC paid $54,000 for computer equipment with check number 101 and signed a note for $8,000 due in six months. BSC received $1,400 of supplies purchased on account. BSC's loan contains a clause ( covenant') that requires BSC to maintain a ratio of current assets to current liabilities of at least 25 of a 4-6. Calculate the current ratio of BSC. 4-5. Whether BSC is complying with or violating its loan covenant Complete this question by entering your answers in the tabs below. Req 4A Reg 4 Calculate the current ratio of BSC. Current Ratio Numerator Denominator Reg 43 > Required information Business Sim Corp. (BSC) issued 2,000 common shares to Kelly in exchange for $28,000. BSC borrowed $49,000 from the bank, promising to repay it in two years. BSC paid $54,000 for computer equipment with check number 101 and signed a note for $8,000 due in six months. BSC received $1.400 of supplies purchased on account. BSC's loan contains a clause ("covenant") that requires BSC to maintain a ratio of current assets to current liabilities of at least 2.5. 4-0. Calculate the current ratio of BSC 4-b. Whether BSC is complying with or violating its loan covenant Complete this question by entering your answers in the tabs below. Reg 4A Rog 48 Whether BSC is complying with or violating its loan covenant. BSCIS loan covenant

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started