Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information CC 9 - 1 ( Static ) Accounting for the Use and Disposal of Long - Lived Assets [ LO 9 - 3

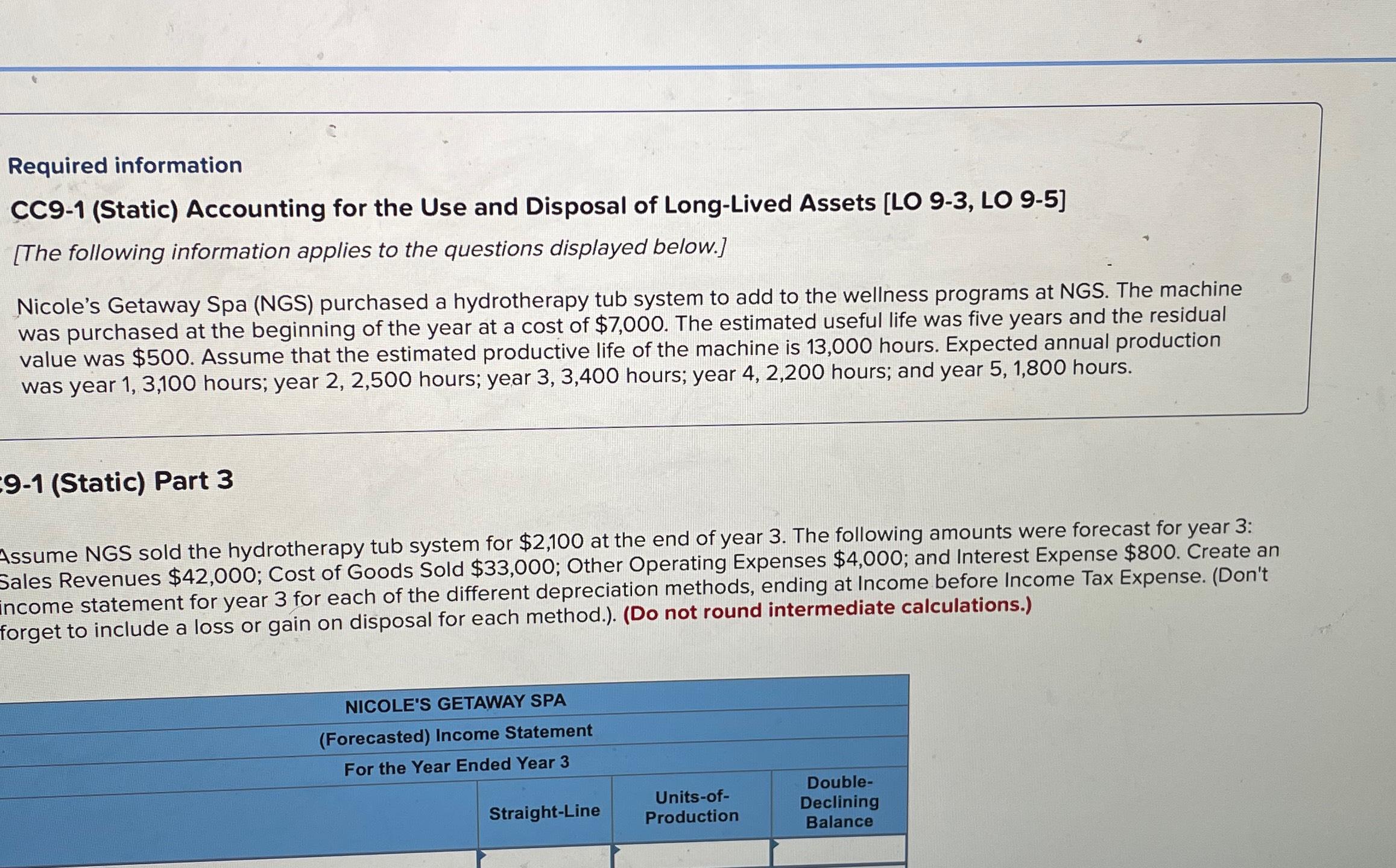

Required information

CCStatic Accounting for the Use and Disposal of LongLived Assets LO LO

The following information applies to the questions displayed below.

Nicole's Getaway Spa NGS purchased a hydrotherapy tub system to add to the wellness programs at NGS The machine was purchased at the beginning of the year at a cost of $ The estimated useful life was five years and the residual value was $ Assume that the estimated productive life of the machine is hours. Expected annual production was year hours; year hours; year hours; year hours; and year hours.

Static Part

Assume NGS sold the hydrotherapy tub system for $ at the end of year The following amounts were forecast for year : Sales Revenues $; Cost of Goods Sold $; Other Operating Expenses $; and Interest Expense $ Create an income statement for year for each of the different depreciation methods, ending at Income before Income Tax Expense. Dont forget to include a loss or gain on disposal for each method.Do not round intermediate calculations.

NICOLE'S GETAWAY SPA

Forecasted Income Statement

For the Year Ended Year

StraightLine begintabularccc

hline &

tableUnitsofProduction &

tableDoubleDecliningBalance

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started