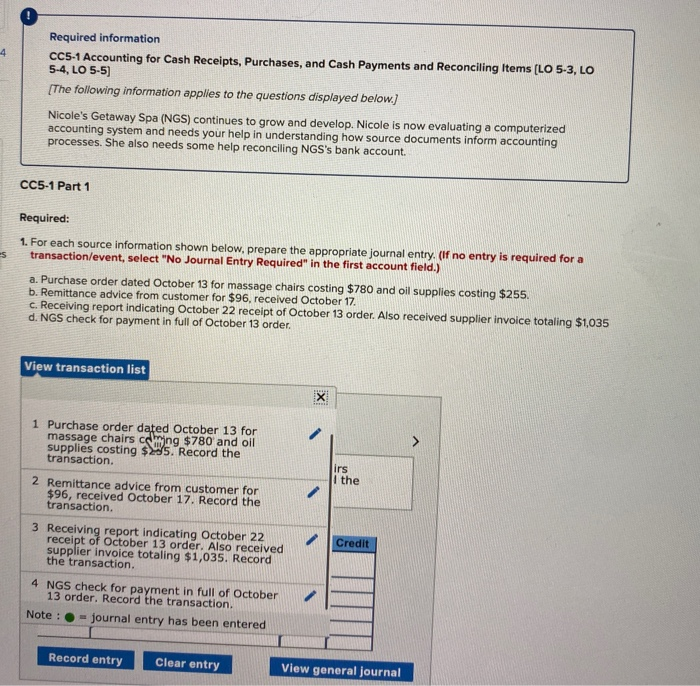

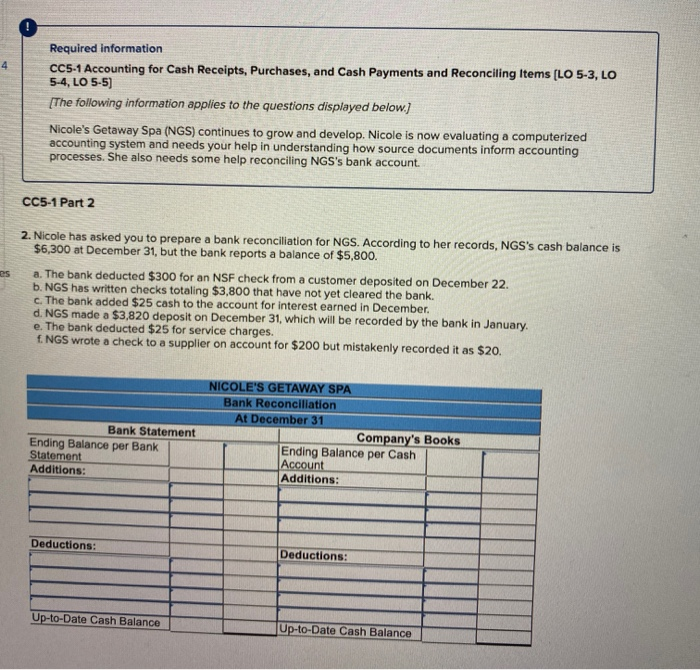

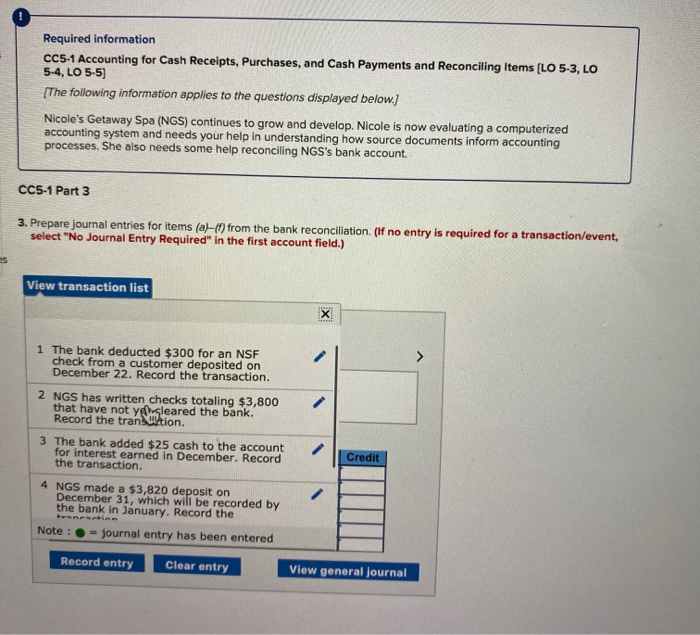

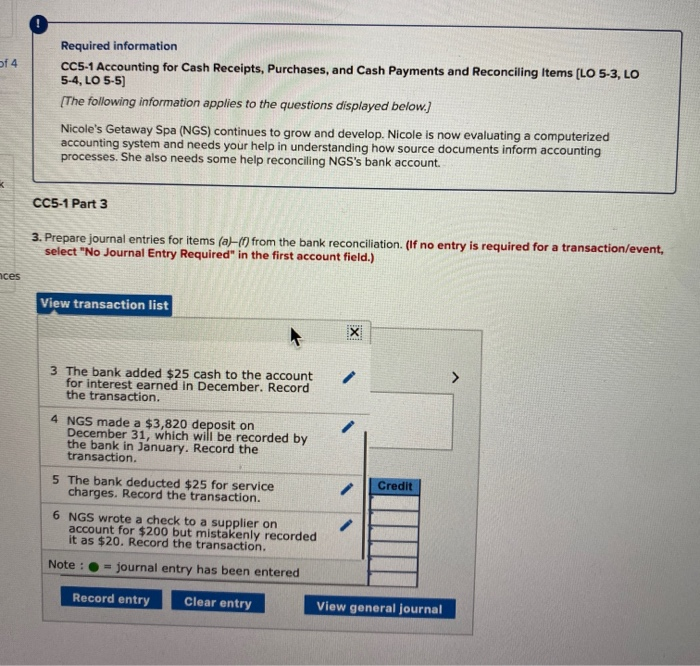

Required information CC5-1 Accounting for Cash Receipts, Purchases, and Cash Payments and Reconciling Items (LO 5-3, LO 5-4, LO 5-5) [The following information applies to the questions displayed below.) Nicole's Getaway Spa (NGS) continues to grow and develop. Nicole is now evaluating a computerized accounting system and needs your help in understanding how source documents inform accounting processes. She also needs some help reconciling NGS's bank account CC5-1 Part 1 Required: 1. For each source information shown below, prepare the appropriate journal entry. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) a. Purchase order dated October 13 for massage chairs costing $780 and oil supplies costing $255. b. Remittance advice from customer for $96, received October 17. c. Receiving report indicating October 22 receipt of October 13 order. Also received supplier invoice totaling $1,035 d. NGS check for payment in full of October 13 order. View transaction list 1 Purchase order dated October 13 for massage chairs csing $780 and oil supplies costing $95. Record the transaction. the 2 Remittance advice from customer for $96, received October 17. Record the transaction. Credit 3 Receiving report indicating October 22 receipt of October 13 order. Also received supplier invoice totaling $1,035. Record the transaction. 4 NGS check for payment in full of October 13 order. Record the transaction. Note : - Journal entry has been entered Record entry Clear entry View general journal Required information CC5-1 Accounting for Cash Receipts, Purchases, and Cash Payments and Reconciling Items [LO 5-3, LO 5-4, LO 5-5) (The following information applies to the questions displayed below.) Nicole's Getaway Spa (NGS) continues to grow and develop. Nicole is now evaluating a computerized accounting system and needs your help in understanding how source documents inform accounting processes. She also needs some help reconciling NGS's bank account. CC5-1 Part 2 2. Nicole has asked you to prepare a bank reconciliation for NGS. According to her records, NGS's cash balance is $6,300 at December 31, but the bank reports a balance of $5.800. a. The bank deducted $300 for an NSF check from a customer deposited on December 22 b. NGS has written checks totaling $3,800 that have not yet cleared the bank c. The bank added $25 cash to the account for interest earned in December d. NGS made a $3,820 deposit on December 31, which will be recorded by the bank in January e. The bank deducted $25 for service charges. ENGS wrote a check to a supplier on account for $200 but mistakenly recorded it as $20. Bank Statement Ending Balance per Bank Statement Additions: NICOLE'S GETAWAY SPA Bank Reconciliation At December 31 Company's Books Ending Balance per Cash Account Additions: Deductions: Deductions: Up-to-Date Cash Balance Up-to-Date Cash Balance Required information CC5.1 Accounting for Cash Receipts, Purchases, and Cash Payments and Reconciling Items (LO 5-3, LO 5-4, LO 5-5) (The following information applies to the questions displayed below.) Nicole's Getaway Spa (NGS) continues to grow and develop. Nicole is now evaluating a computerized accounting system and needs your help in understanding how source documents inform accounting processes. She also needs some help reconciling NGS's bank account. CC5-1 Part 3 3. Prepare journal entries for items (a)-(from the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list 1 The bank deducted $300 for an NSF check from a customer deposited on December 22. Record the transaction. 2 NGS has written checks totaling $3,800 that have not yg gleared the bank. Record the transition. 3 The bank added $25 cash to the account for interest earned in December. Record the transaction. Credit 4 NGS made a $3,820 deposit on December 31, which will be recorded by the bank in January. Record the Note : journal entry has been entered Record entry Clear entry View general Journal 14 Required information CC5-1 Accounting for Cash Receipts, Purchases, and Cash Payments and Reconciling Items (LO 5-3, LO 5-4, LO 5-5) (The following information applies to the questions displayed below.) Nicole's Getaway Spa (NGS) continues to grow and develop. Nicole is now evaluating a computerized accounting system and needs your help in understanding how source documents inform accounting processes. She also needs some help reconciling NGS's bank account. CC5-1 Part 3 3. Prepare journal entries for items (a)-(f) from the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) aces View transaction list 3 The bank added $25 cash to the account for interest earned in December. Record the transaction. 4 NGS made a $3,820 deposit on December 31, which will be recorded by the bank in January. Record the transaction. Credit 5 The bank deducted $25 for service charges. Record the transaction. 6 NGS wrote a check to a supplier on account for $200 but mistakenly recorded it as $20. Record the transaction. Note : = journal entry has been entered Record entry Clear entry View general journal Required information CC5-1 Accounting for Cash Receipts, Purchases, and Cash Payments and Reconciling Items (LO 5-3, LO 5-4, LO 5-5) [The following information applies to the questions displayed below.] Nicole's Getaway Spa (NGS) continues to grow and develop. Nicole is now evaluating a computerized accounting system and needs your help in understanding how source documents inform accounting processes. She also needs some help reconciling NGS's bank account. CC5-1 Part 4 4. If NGS also has $150 of petty cash and $1,500 invested in government Treasury bills purchased in August, what is the amount of Cash and Cash Equivalents on NGS's December 31 balance sheet? Cash and Cash Equivalents