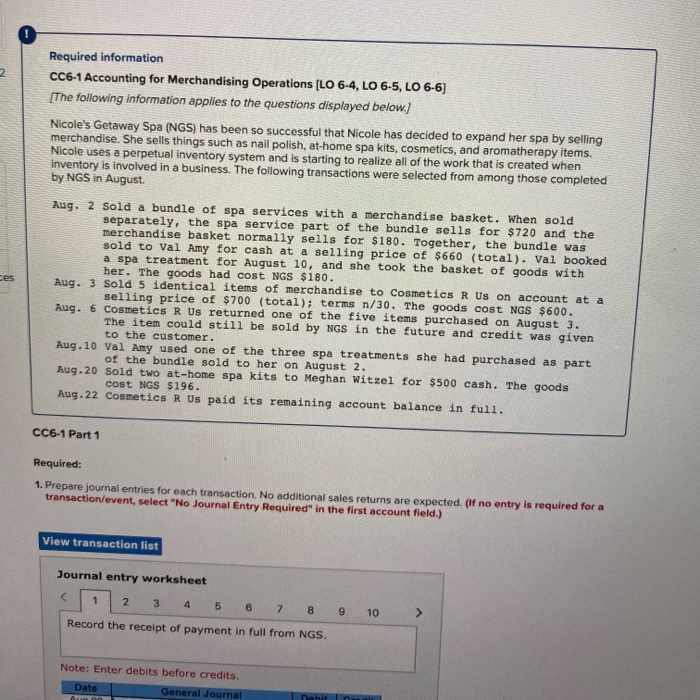

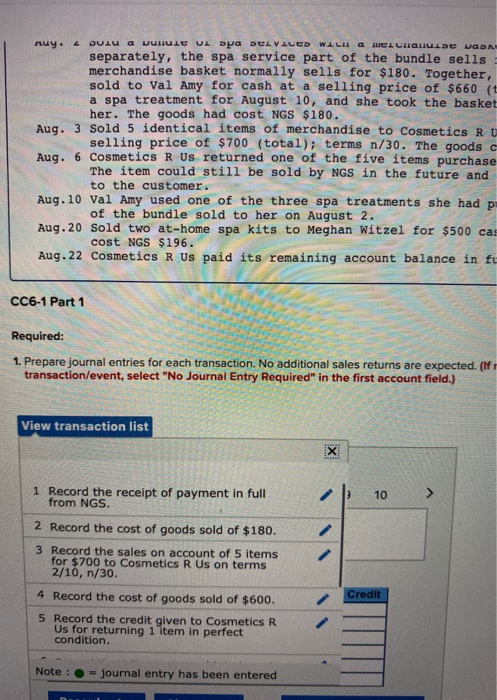

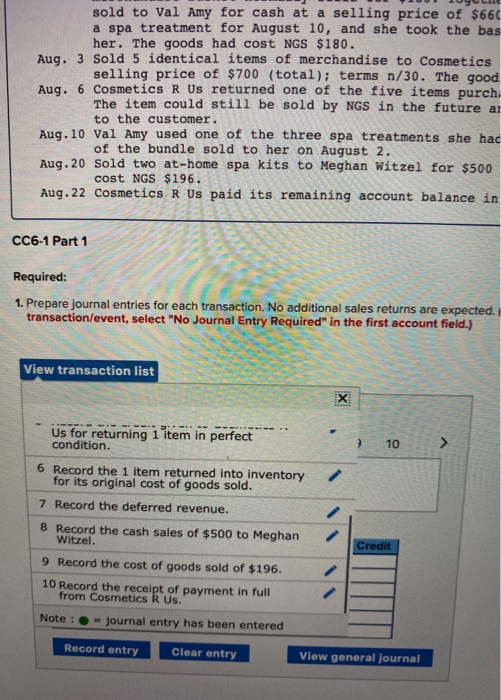

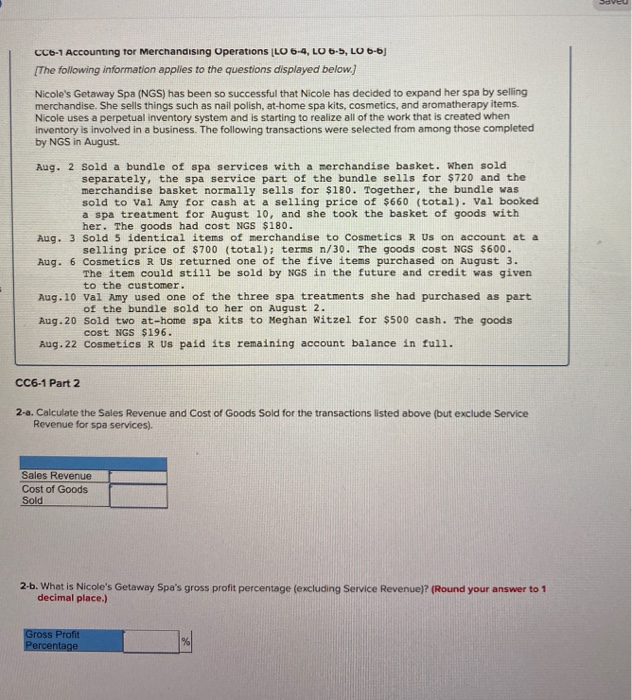

Required information CC6-1 Accounting for Merchandising Operations (LO 6-4, LO 6-5, LO 6-6) [The following information applies to the questions displayed below.) Nicole's Getaway Spa (NGS) has been so successful that Nicole has decided to expand her spa by selling merchandise. She sells things such as nail polish, at-home spa kits, cosmetics, and aromatherapy items. Nicole uses a perpetual inventory system and is starting to realize all of the work that is created when inventory is involved in a business. The following transactions were selected from among those completed by NGS in August basket normalt selling price the basket of Aug. 2 Sold a bundle of spa services with a merchandise basket. When sold separately, the spa service part of the bundle sells for $720 and the merchandise basket normally sells for $180. Together, the bundle was sold to Val Amy for cash at a selling price of $660 (total). Val booked a spa treatment for August 10, and she took the basket of goods with her. The goods had cost NGS $180. Aug. 3 Sold 5 identical items of merchandise to Cosmetics R Us on account at a selling price of $ 700 (total); terms n/30. The goods cost NGS $600. Aug. 6 Cosmetics R Us returned one of the five items purchased on August 3. The item could still be sold by NGS in the future and credit was given to the customer. Aug. 10 Val Amy used one of the three spa treatments she had purchased as part of the bundle sold to her on August 2. Aug.20 Sold two at-home spa kits to Meghan Witzel for $500 cash. The goods cost NGS $196. Aug.22 Cosmetics R Us paid its remaining account balance in full. CC6-1 Part 1 Required: 1. Prepare journal entries for each transaction. No additional sales returns are expected. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 5 6 7 8 Record the receipt of payment in full from NGS. 9 10 > Note: Enter debits before credits. Date Auy. 4 DULU a vuru LE UL pa SELV ALED WALL MELCHON DE VODN separately, the spa service part of the bundle sells merchandise basket normally sells for $180. Together, sold to Val Amy for cash at a selling price of $660 (t a spa treatment for August 10, and she took the basket her. The goods had cost NGS $180. Aug. 3 Sold 5 identical items of merchandise to Cosmetics RU selling price of $700 (total); terms n/30. The goods Aug. 6 Cosmetics R Us returned one of the five items purchase The item could still be sold by NGS in the future and to the customer. Aug. 10 Val Amy used one of the three spa treatments she had p of the bundle sold to her on August 2. Aug.20 Sold two at-home spa kits to Meghan Witzel for $500 ca: cost NGS $196. Aug.22 Cosmetics R Us paid its remaining account balance in ft CC6-1 Part 1 Required: 1. Prepare journal entries for each transaction. No additional sales returns are expected. (Ifr transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list b 1 Record the receipt of payment in full from NGS. 10 2 Record the cost of goods sold of $180. 3 Record the sales on account of 5 items for $700 to Cosmetics R Us on terms 2/10, n/30. Credit 4 Record the cost of goods sold of $600. 5 Record the credit given to Cosmetics R Us for returning 1 item in perfect condition. Note : journal entry has been entered sold to Val Amy for cash at a selling price of $660 a spa treatment for August 10, and she took the bas her. The goods had cost NGS $180. Aug. 3 Sold 5 identical items of merchandise to Cosmetics selling price of $700 (total); terms n/30. The good Aug. 6 Cosmetics R Us returned one of the five items purchi The item could still be sold by NGS in the future an to the customer. Aug. 10 Val Amy used one of the three spa treatments she had of the bundle sold to her on August 2. Aug.20 Sold two at-home spa kits to Meghan Witzel for $500 cost NGS $196. Aug. 22 Cosmetics R Us paid its remaining account balance in CC6-1 Part 1 Required: 1. Prepare journal entries for each transaction. No additional sales returns are expected. transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list 7 10 Us for returning 1 item in perfect condition. 6 Record the 1 item returned into inventory for its original cost of goods sold. 7 Record the deferred revenue. 8 Record the cash sales of $500 to Meghan Witzel. Credit 9 Record the cost of goods sold of $196. 10 Record the receipt of payment in full from Cosmetics R Us. Note : journal entry has been entered Record entry Clear entry View general journal Saveu CC6-1 Accounting for Merchandising Operations LO 6-4, LO 6-5, LO 0-6 [The following information applies to the questions displayed below.) Nicole's Getaway Spa (NGS) has been so successful that Nicole has decided to expand her spa by selling merchandise. She sells things such as nail polish, at-home spa kits, Cosmetics, and aromatherapy items. Nicole uses a perpetual inventory system and is starting to realize all of the work that is created when Inventory is involved in a business. The following transactions were selected from among those completed by NGS in August. Aug. 2 Sold a bundle of spa services with a merchandise basket. When sold separately, the spa service part of the bundle sells for $720 and the merchandise basket normally sells for $180. Together, the bundle was sold to Val Amy for cash at a selling price of $660 (total). Val booked a spa treatment for August 10, and she took the basket of goods with her. The goods had cost NGS $180. Aug. 3 Sold 5 identical items of merchandise to Cosmetics R Us on account at a selling price of $700 (total); terms n/30. The goods cost NGS $600. Aug. 6 Cosmetics R Us returned one of the five items purchased on August 3. The item could still be sold by NGS in the future and credit was given to the customer. Aug. 10 Val Amy used one of the three spa treatments she had purchased as part of the bundle sold to her on August 2. Aug.20 Sold two at-home spa kits to Meghan Witzel for $500 cash. The goods cost NGS $196. Aug. 22 Cosmetics R Us paid its remaining account balance in full. CC6-1 Part 2 2.a. Calculate the Sales Revenue and Cost of Goods Sold for the transactions listed above (but exclude Service Revenue for spa services). Sales Revenue Cost of Goods Sold 2.b. What is Nicole's Getaway Spa's gross profit percentage (excluding Service Revenue)? (Round your answer to 1 decimal place.) Gross Profit Percentage