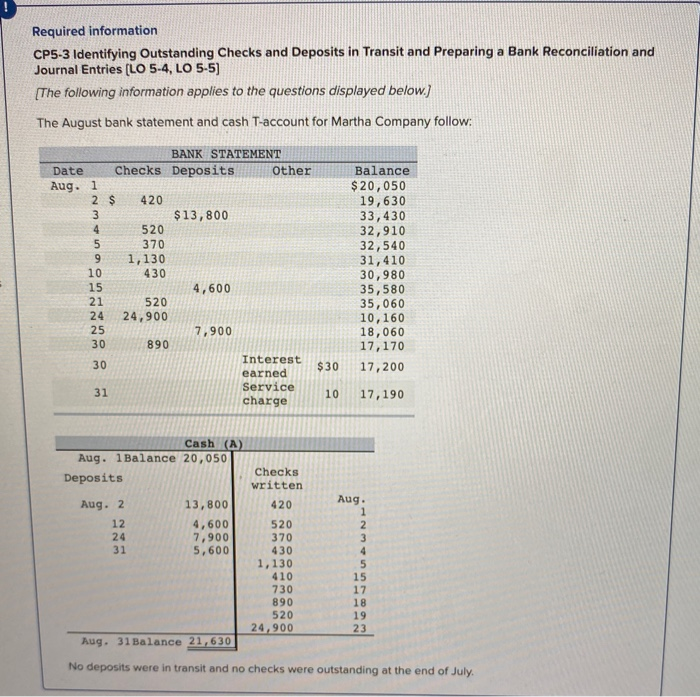

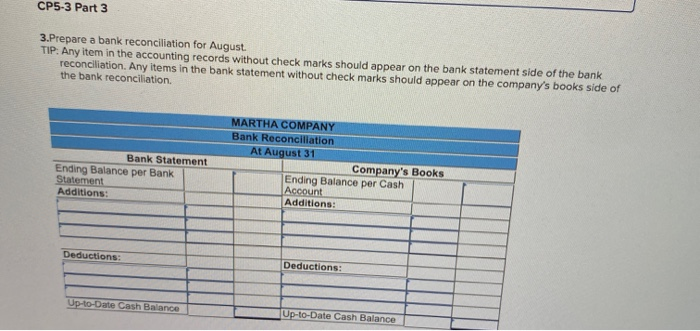

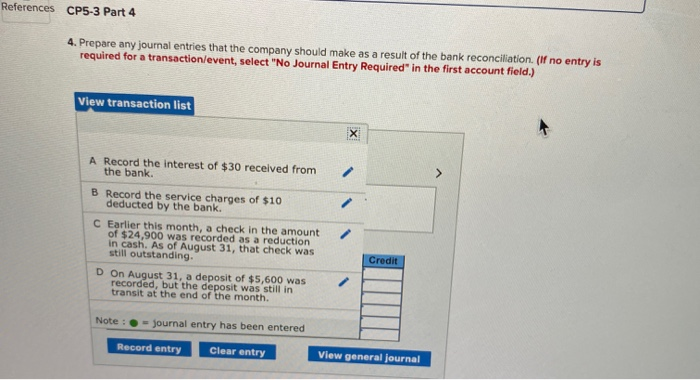

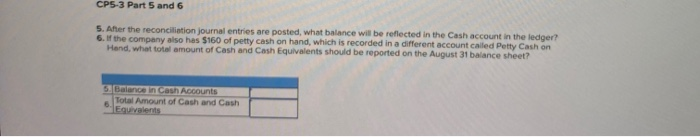

Required information CP5-3 Identifying Outstanding Checks and Deposits in Transit and preparing a Bank Reconciliation and Journal Entries (LO 5-4, LO 5-5) [The following information applies to the questions displayed below.) The August bank statement and cash T-account for Martha Company follow: BANK STATEMENT Date Checks Deposits Other Aug. 1 2 $ 420 $13,800 520 370 1,130 430 4,600 21 520 24 24,900 7,900 10 Balance $ 20,050 19,630 33,430 32,910 32,540 31,410 30,980 35,580 35,060 10,160 18,060 17,170 17,200 15 890 Interest $30 earned Service 10 charge 17,190 Cash (A) Aug. 1 Balance 20,050 Deposits Checks written Aug. 2 13,800 420 4,600 520 7,900 370 5,600 430 1,130 410 1 730 890 520 24,900 Aug. 31 Balance 21,630 No deposits were in transit and no checks were outstanding at the end of July. CP5-3 Part 3 3.Prepare a bank reconciliation for August TIP: Any item in the accounting records without check marks should appear on the bank statement side of the bank reconciliation. Any items in the bank statement without check marks should appear on the company's books side of the bank reconciliation Bank Statement Ending Balance per Bank Statement Additions: MARTHA COMPANY Bank Reconciliation At August 31 Company's Books Ending Balance per Cash Account Additions: Deductions: Deductions: Up-to-date Cash Balance Up-to-Date Cash Balance eferences CP5-3 Part 4 4. Prepare any journal entries that the company should make as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list A Record the interest of $30 received from the bank. B Record the service charges of $10 deducted by the bank. C Earlier this month, a check in the amount of $24,900 was recorded as a reduction in cash. As of August 31, that check was still outstanding. Credit DOn August 31, a deposit of $5,600 was recorded, but the deposit was still in transit at the end of the month. Note : journal entry has been entered Record entry Clear entry View general Journal CPS-3 Part 5 and 6 5. After the reconciliation journal entries are posted, what balance will be reflected in the Cash account in the ledger? 6.1 the company also has $160 of petty cash on hand, which is recorded in a different account called Petty Cash on Hand, what total amount of Cash and Cash Equivalents should be reported on the August 31 balance sheet? 5. Balance in Can Accounts Total Amount of Cash and Cash Equivalents