Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required Information E10-14 (Algo) (Supplement 10A) Recording the Effects of a Discount Bond Issue and First Interest Payment and Preparing a Discount Amortization Schedule (Stralght-Line

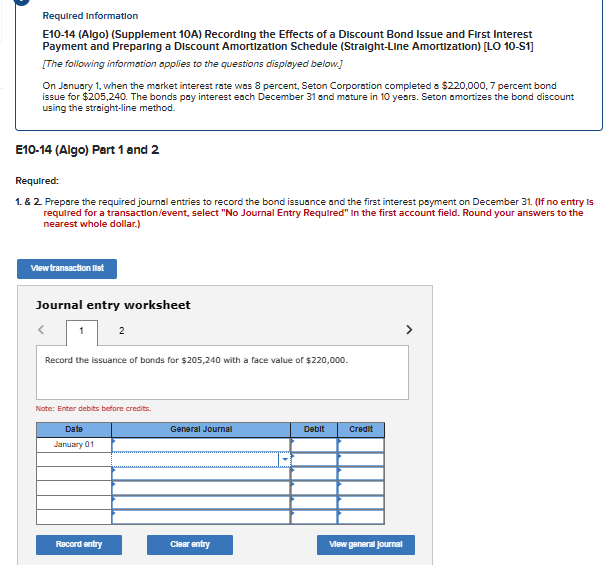

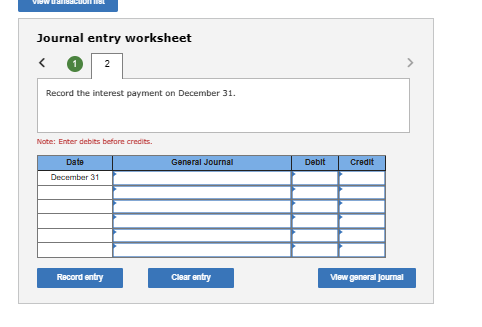

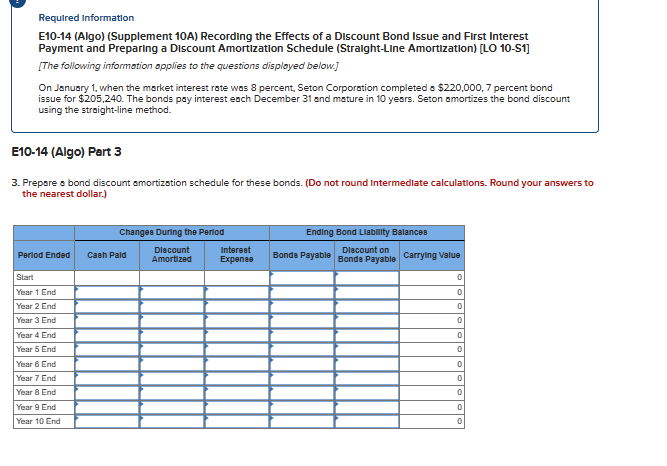

Required Information E10-14 (Algo) (Supplement 10A) Recording the Effects of a Discount Bond Issue and First Interest Payment and Preparing a Discount Amortization Schedule (Stralght-Line Amortization) [LO 10-S1] [The following informotion opplies to the questions disployed below] On January 1 , when the morket interest rate was 8 percent, Seton Corporation completed a $220,000,7 percent bond issue for $205,240. The bonds pay interest each December 31 and moture in 10 yesrs. Seton amortizes the bond discount using the stroight-line method. 0-14 (Algo) Part 1 and 2 quilred: \& 2 Prepore the required journal entries to record the bond issuance and the first interest poyment on December 31 . (If no entry Is required for a transaction/event, select "No Journal Entry Requlred" In the first account field. Round your answers to the nearest whole dollar.) Journal entry worksheet Record the issuance of bonds for $205,240 with a face value of $220,000. Note: Enter debits before credits. Journal entry worksheet Record the interest payment on December 31. Note: Enter debits before credits. Required Information E10-14 (Algo) (Supplement 10A) Recording the Effects of a Discount Bond Issue and First Interest Payment and Preparing a Discount Amortization Schedule (Straight-Line Amortization) [LO 10-S1] [The following informotion opplies to the questions clisployed below.] On Jonuary 1, when the morket interest rate was 8 percent, Seton Corporation completed a $220,000,7 percent bond issue for $205,240. The bonds pay interest eoch December 31 and mature in 10 years. Seton amortizes the bond discount using the stroight-line method. E10-14 (Algo) Part 3 3. Prepare a bond discount amortization schedule for these bonds. (Do not round Intermedlate calculations. Round your answers to the nearest dollar.)

Required Information E10-14 (Algo) (Supplement 10A) Recording the Effects of a Discount Bond Issue and First Interest Payment and Preparing a Discount Amortization Schedule (Stralght-Line Amortization) [LO 10-S1] [The following informotion opplies to the questions disployed below] On January 1 , when the morket interest rate was 8 percent, Seton Corporation completed a $220,000,7 percent bond issue for $205,240. The bonds pay interest each December 31 and moture in 10 yesrs. Seton amortizes the bond discount using the stroight-line method. 0-14 (Algo) Part 1 and 2 quilred: \& 2 Prepore the required journal entries to record the bond issuance and the first interest poyment on December 31 . (If no entry Is required for a transaction/event, select "No Journal Entry Requlred" In the first account field. Round your answers to the nearest whole dollar.) Journal entry worksheet Record the issuance of bonds for $205,240 with a face value of $220,000. Note: Enter debits before credits. Journal entry worksheet Record the interest payment on December 31. Note: Enter debits before credits. Required Information E10-14 (Algo) (Supplement 10A) Recording the Effects of a Discount Bond Issue and First Interest Payment and Preparing a Discount Amortization Schedule (Straight-Line Amortization) [LO 10-S1] [The following informotion opplies to the questions clisployed below.] On Jonuary 1, when the morket interest rate was 8 percent, Seton Corporation completed a $220,000,7 percent bond issue for $205,240. The bonds pay interest eoch December 31 and mature in 10 years. Seton amortizes the bond discount using the stroight-line method. E10-14 (Algo) Part 3 3. Prepare a bond discount amortization schedule for these bonds. (Do not round Intermedlate calculations. Round your answers to the nearest dollar.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started