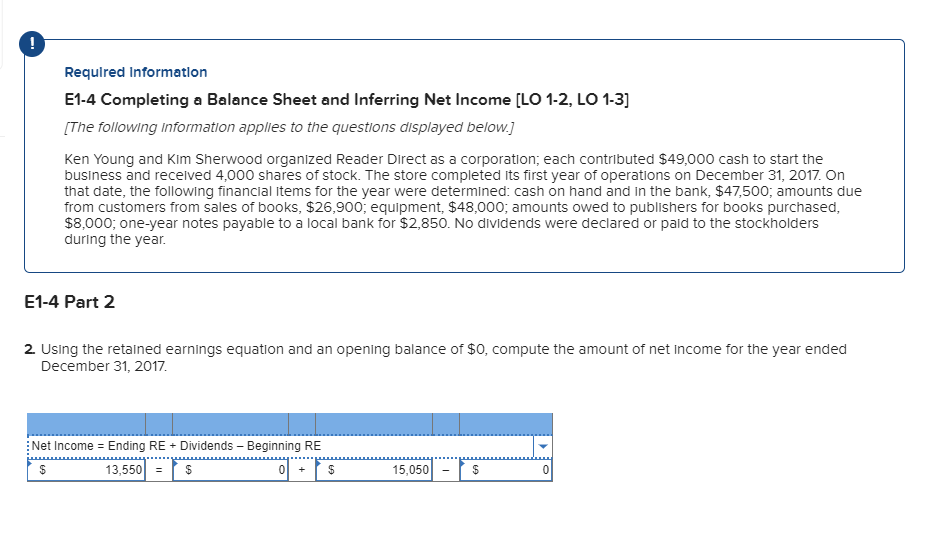

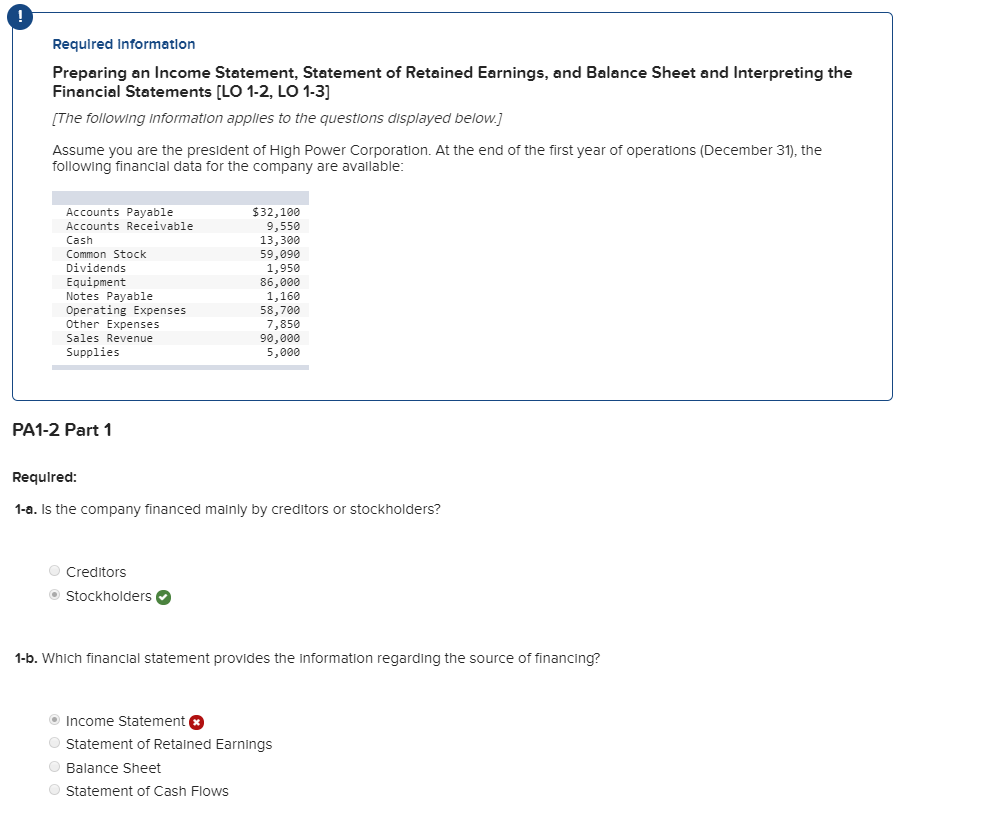

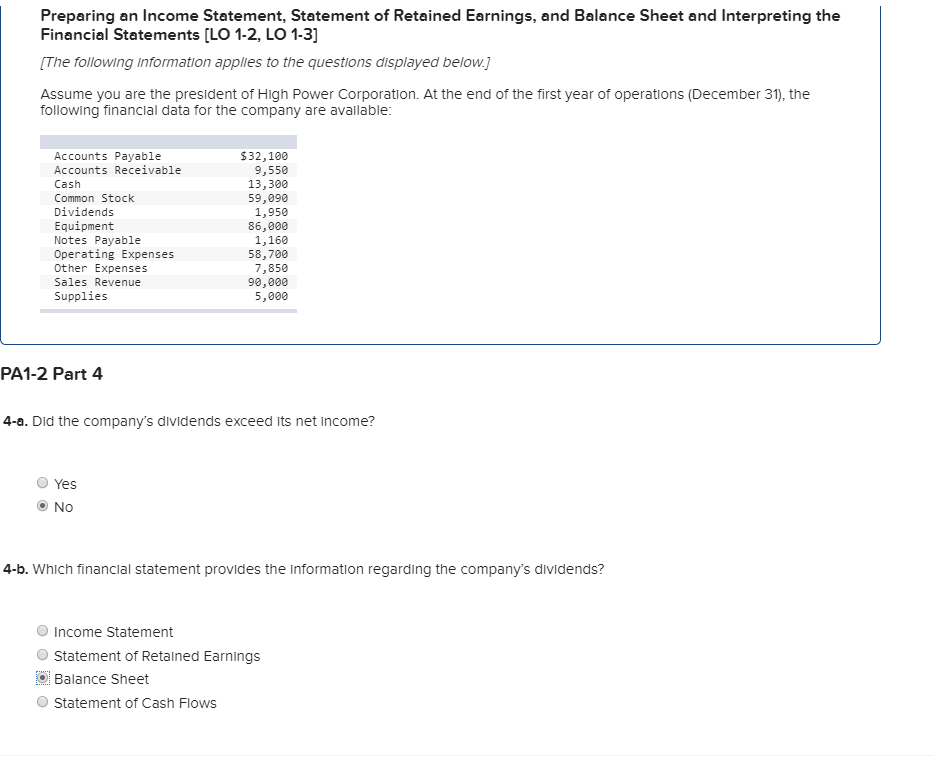

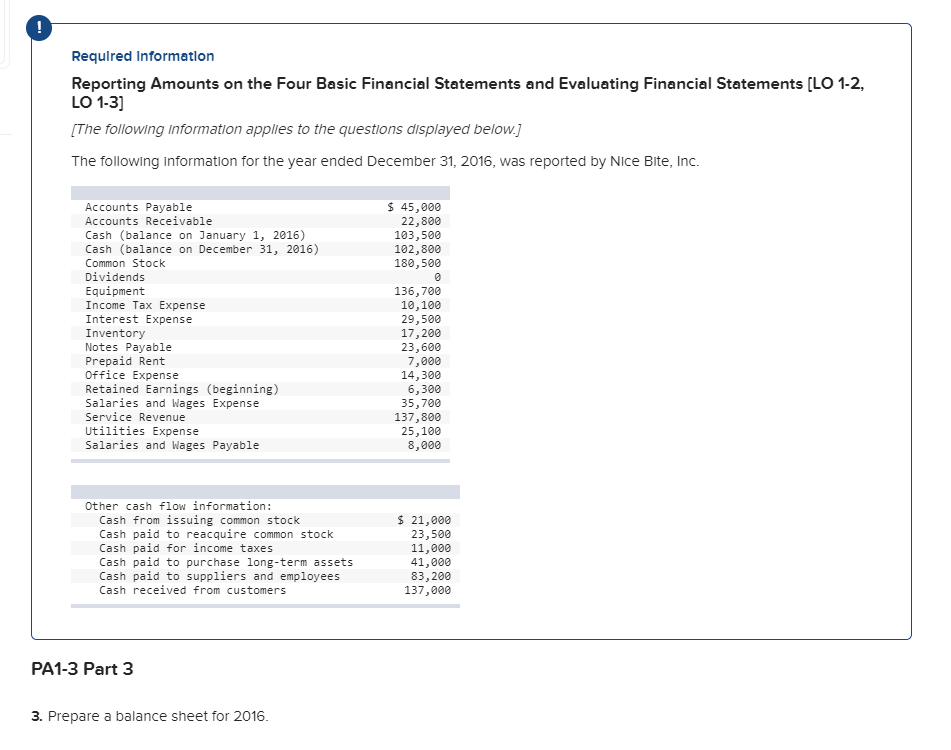

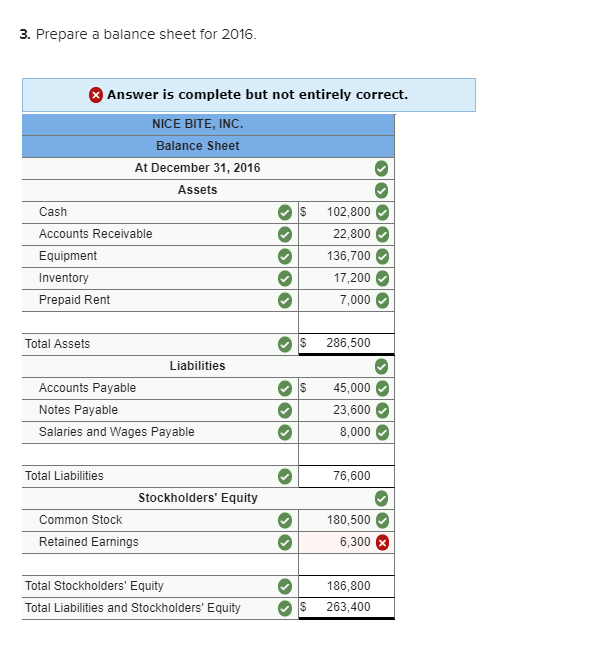

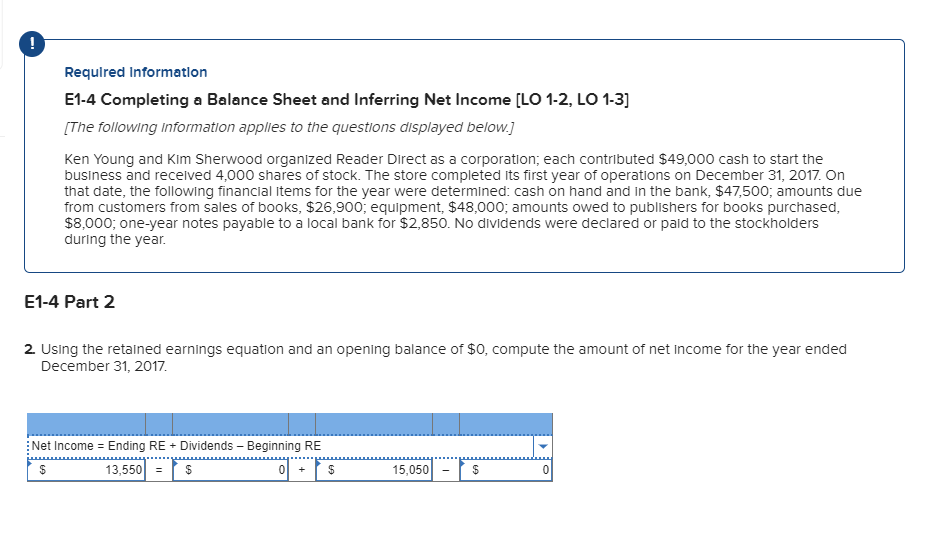

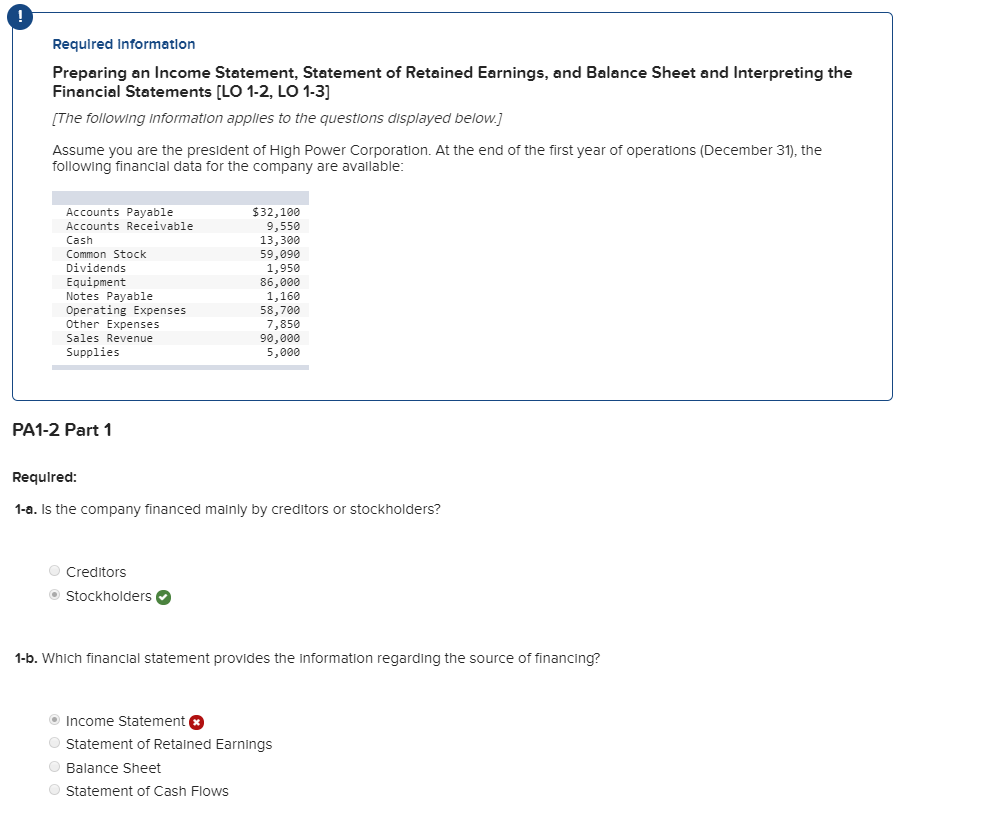

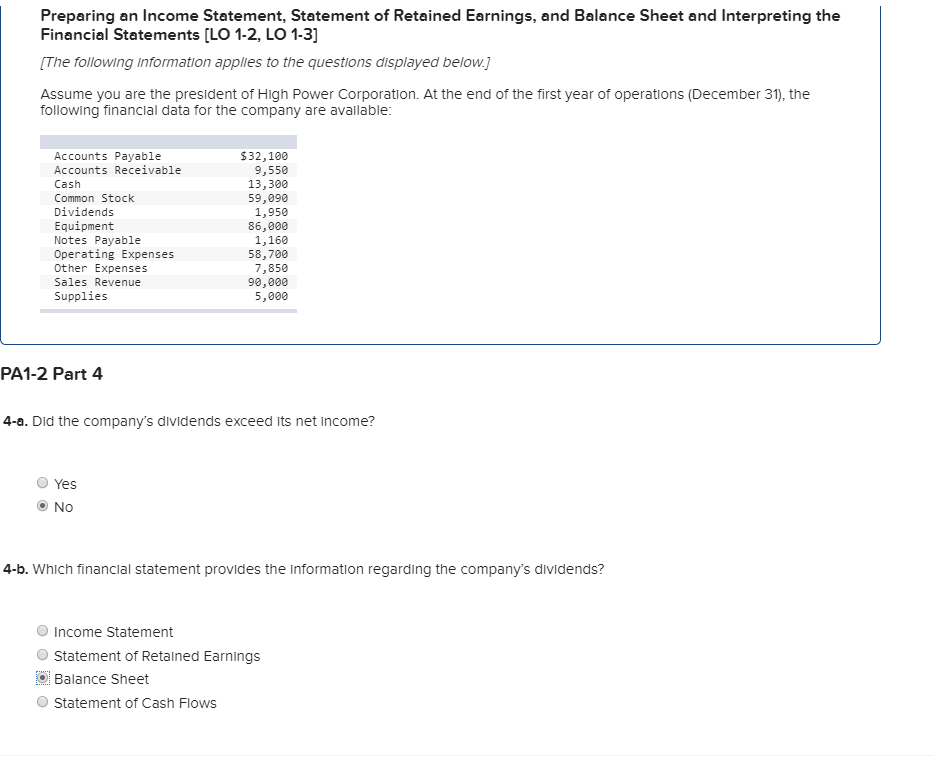

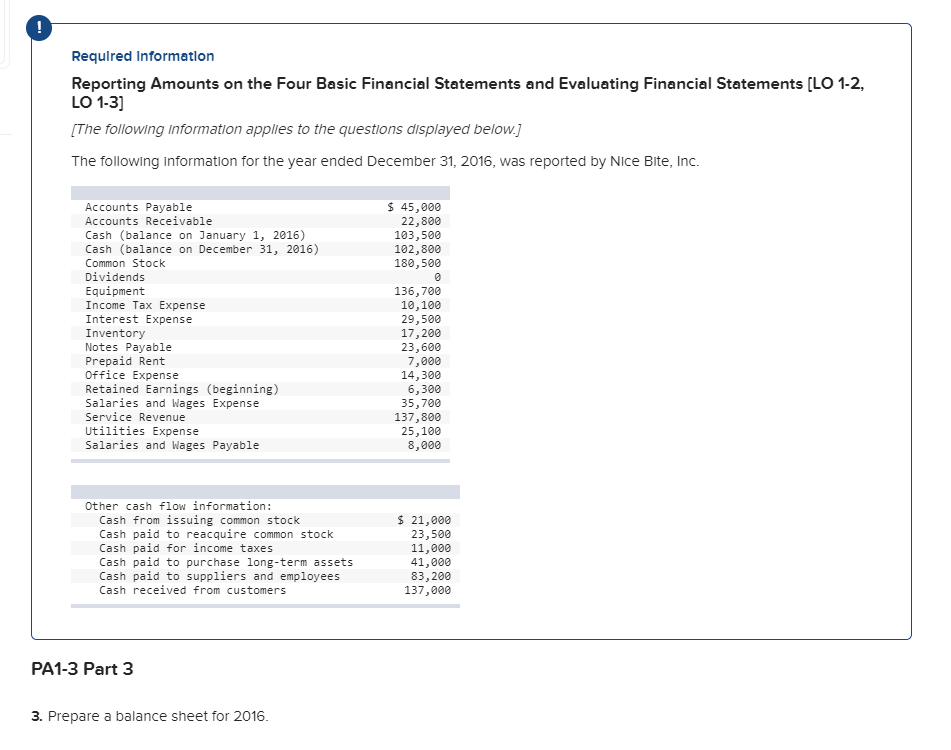

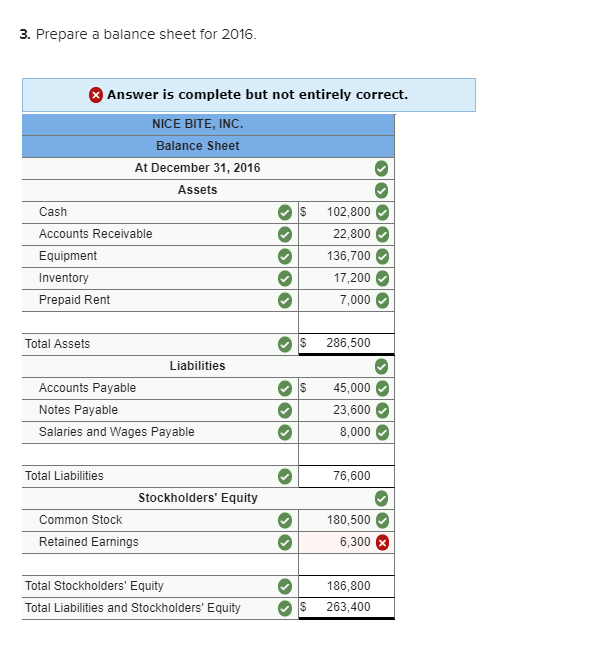

Required Information E1-4 Completing a Balance Sheet and Inferring Net Income (LO 1-2, LO 1-3] [The following information applies to the questions displayed below.] Ken Young and Kim Sherwood organized Reader Direct as a corporation; each contributed $49,000 cash to start the business and received 4,000 shares of stock. The store completed its first year of operations on December 31, 2017. On that date, the following financial items for the year were determined: cash on hand and in the bank, $47,500, amounts due from customers from sales of books, $26,900; equipment, $48,000, amounts owed to publishers for books purchased, $8,000; one-year notes payable to a local bank for $2,850. No dividends were declared or paid to the stockholders during the year. E1-4 Part 2 2. Using the retained earnings equation and an opening balance of $0, compute the amount of net income for the year ended December 31, 2017 Net Income = Ending RE + Dividends - Beginning RE 5 13,550 = 5 5 15,050 - | $ al Required Information Preparing an Income Statement, Statement of Retained Earnings, and Balance Sheet and Interpreting the Financial Statements (LO 1-2, LO 1-3] [The following Information applies to the questions displayed below. Assume you are the president of High Power Corporation. At the end of the first year of operations (December 31), the following financial data for the company are available: Accounts Payable Accounts Receivable Cash Common Stock Dividends Equipment Notes Payable Operating Expenses Other Expenses Sales Revenue Supplies $32,100 9,550 13,300 59,090 1,950 86,000 1,160 58,700 7,850 90,000 5,000 PA1-2 Part 1 Required: 1-a. Is the company financed mainly by creditors or stockholders? Creditors Stockholders 1-b. Which financial statement provides the information regarding the source of financing? Income Statement Statement of Retained Earnings Balance Sheet Statement of Cash Flows Preparing an Income Statement, Statement of Retained Earnings, and Balance Sheet and Interpreting the Financial Statements (LO 1-2, LO 1-3] [The following information applies to the questions displayed below. Assume you are the president of High Power Corporation. At the end of the first year of operations (December 31), the following financial data for the company are available: Accounts Payable Accounts Receivable Cash Common Stock Dividends Equipment Notes Payable Operating Expenses Other Expenses Sales Revenue Supplies $32,100 9,550 13,300 59,090 1,950 86,000 1,160 58,700 7,850 90,000 5,000 PA1-2 Part 4 4-a. Did the company's dividends exceed its net income? Yes No 4-b. Which financial statement provides the information regarding the company's dividends? Income Statement Statement of Retained Earnings O Balance Sheet Statement of Cash Flows Required Information Reporting Amounts on the Four Basic Financial Statements and Evaluating Financial Statements [LO 1-2, LO 1-3] [The following information applies to the questions displayed below.) The following information for the year ended December 31, 2016, was reported by Nice Bite, Inc. $ 45,000 22,800 103,500 102,800 180,500 Accounts Payable Accounts Receivable Cash (balance on January 1, 2016) Cash (balance on December 31, 2016) Common Stock Dividends Equipment Income Tax Expense Interest Expense Inventory Notes Payable Prepaid Rent Office Expense Retained Earnings (beginning) Salaries and Wages Expense Service Revenue Utilities Expense Salaries and Wages Payable 136,700 10,100 29,500 17,200 23,600 7,000 14,300 6,300 35,700 137,800 25,100 8,000 Other cash flow information: Cash from issuing common stock Cash paid to reacquire common stock Cash paid for income taxes Cash paid to purchase long-term assets Cash paid to suppliers and employees Cash received from customers $ 21,000 23,500 11,000 41,000 83,200 137,000 PA1-3 Part 3 3. Prepare a balance sheet for 2016. 3. Prepare a balance sheet for 2016. & Answer is complete but not entirely correct. NICE BITE, INC Balance Sheet At December 31, 2016 Assets Cash $ 102,800 Accounts Receivable 22,800 Equipment 136,700 Inventory 17,200 Prepaid Rent 7,000 Total Assets $ 286,500 Liabilities $ Accounts Payable Notes Payable Salaries and Wages Payable 45,000 23,600 8,000 76,600 Total Liabilities Stockholders' Equity Common Stock Retained Earnings 180.500 6,300 % Total Stockholders' Equity Total Liabilities and Stockholders' Equity 186,800 263,400 S