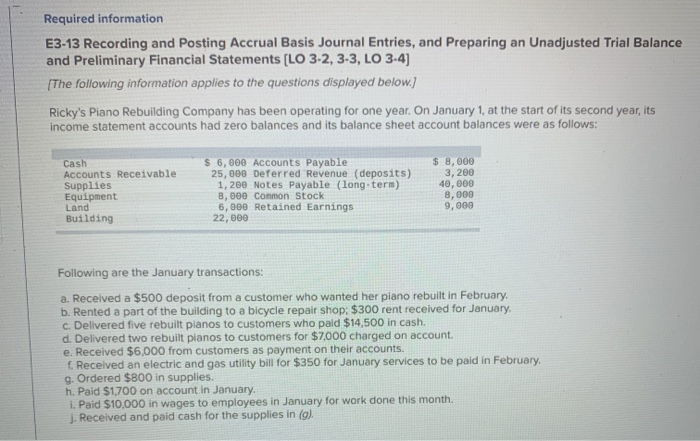

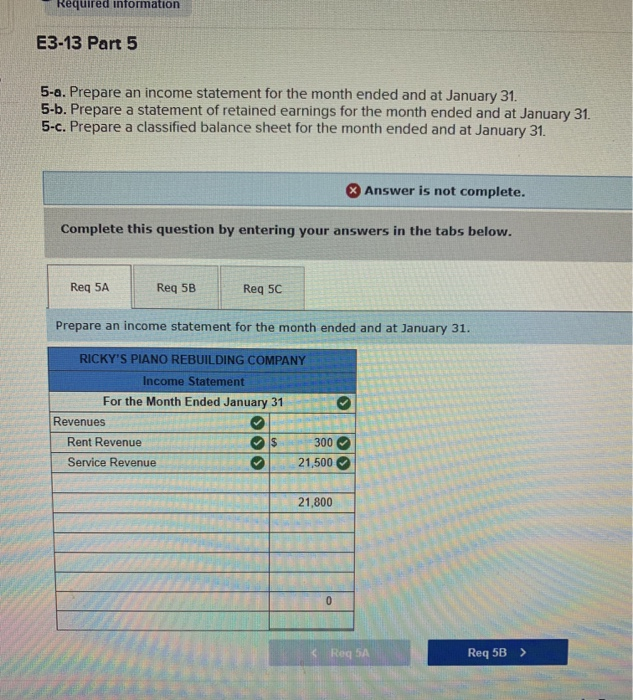

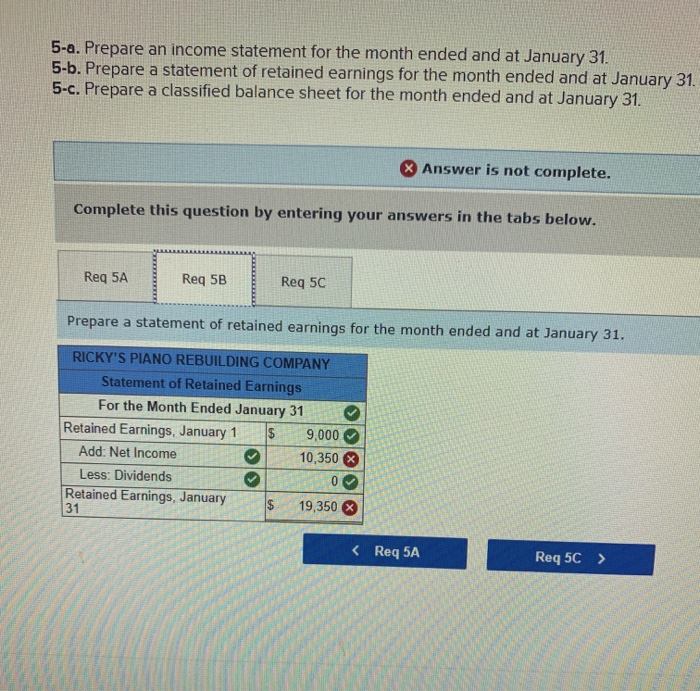

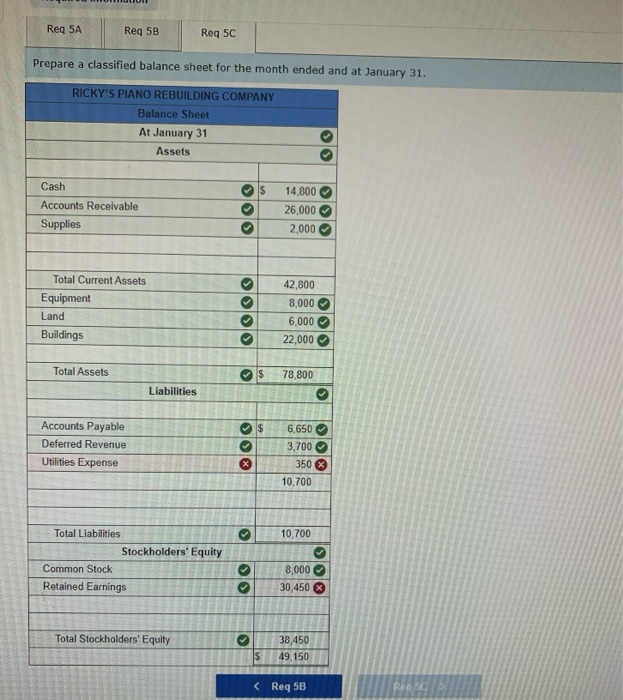

Required information E3-13 Recording and Posting Accrual Basis Journal Entries, and Preparing an Unadjusted Trial Balance and Preliminary Financial Statements [LO 3-2, 3-3, LO 3.4) [The following information applies to the questions displayed below.) Ricky's Piano Rebuilding Company has been operating for one year. On January 1, at the start of its second year, its income statement accounts had zero balances and its balance sheet account balances were as follows: Cash Accounts Receivable Supplies Equipment Land Building $ 6,000 Accounts Payable 25,000 Deferred Revenue (deposits) 1,200 Notes Payable (long-term) 8,000 Common Stock 6,900 Retained Earnings 22,000 $ 8,000 3, 200 40,000 8,000 9,000 Following are the January transactions: a. Received a $500 deposit from a customer who wanted her piano rebuilt in February b. Rented a part of the building to a bicycle repair shop: $300 rent received for January c. Delivered five rebuilt planos to customers who paid $14,500 in cash. d. Delivered two rebuilt pianos to customers for $7,000 charged on account. e. Received $6,000 from customers as payment on their accounts. Received an electric and gas utility bill for $350 for January services to be paid in February 9. Ordered $800 in supplies. h. Paid $1,700 on account in January. 1. Paid $10,000 in wages to employees in January for work done this month. J. Received and paid cash for the supplies in (g). Required information E3-13 Part 5 5-a. Prepare an income statement for the month ended and at January 31. 5-b. Prepare a statement of retained earnings for the month ended and at January 31. 5-c. Prepare a classified balance sheet for the month ended and at January 31. X Answer is not complete. Complete this question by entering your answers in the tabs below. Req 5A Req 5B Req 5C Prepare an income statement for the month ended and at January 31. RICKY'S PIANO REBUILDING COMPANY Income Statement For the Month Ended January 31 Revenues Rent Revenue Is 300 Service Revenue 21,500 21,800 0 Req 5A Req 5B > 5-a. Prepare an income statement for the month ended and at January 31. 5-b. Prepare a statement of retained earnings for the month ended and at January 31. 5-c. Prepare a classified balance sheet for the month ended and at January 31. Answer is not complete. Complete this question by entering your answers in the tabs below. Req 5A Req 5B Req 5C Prepare a statement of retained earnings for the month ended and at January 31. RICKY'S PIANO REBUILDING COMPANY Statement of Retained Earnings For the Month Ended January 31 Retained Earnings, January 1 $ 9,000 Add: Net Income 10,350 Less: Dividends 0 Retained Earnings, January 19,350 31 $ Req 5A Req 5B Req 5C Prepare a classified balance sheet for the month ended and at January 31. RICKY'S PIANO REBUILDING COMPANY Balance Sheet At January 31 Assets > $ Cash Accounts Receivable Supplies 14,800 26,000 2,000 OO >$ Total Current Assets Equipment Land Buildings 42,800 8,000 6,000 22,000 > Total Assets $ 78,800 Liabilities $ Accounts Payable Deferred Revenue Utilities Expense 0 6,650 3,700 350 10,700 > 10,700 Total Liabilities Stockholders' Equity Common Stock Retained Earnings 00 8,000 30,450 Total Stockholders' Equity > 38,450 49 150 IS