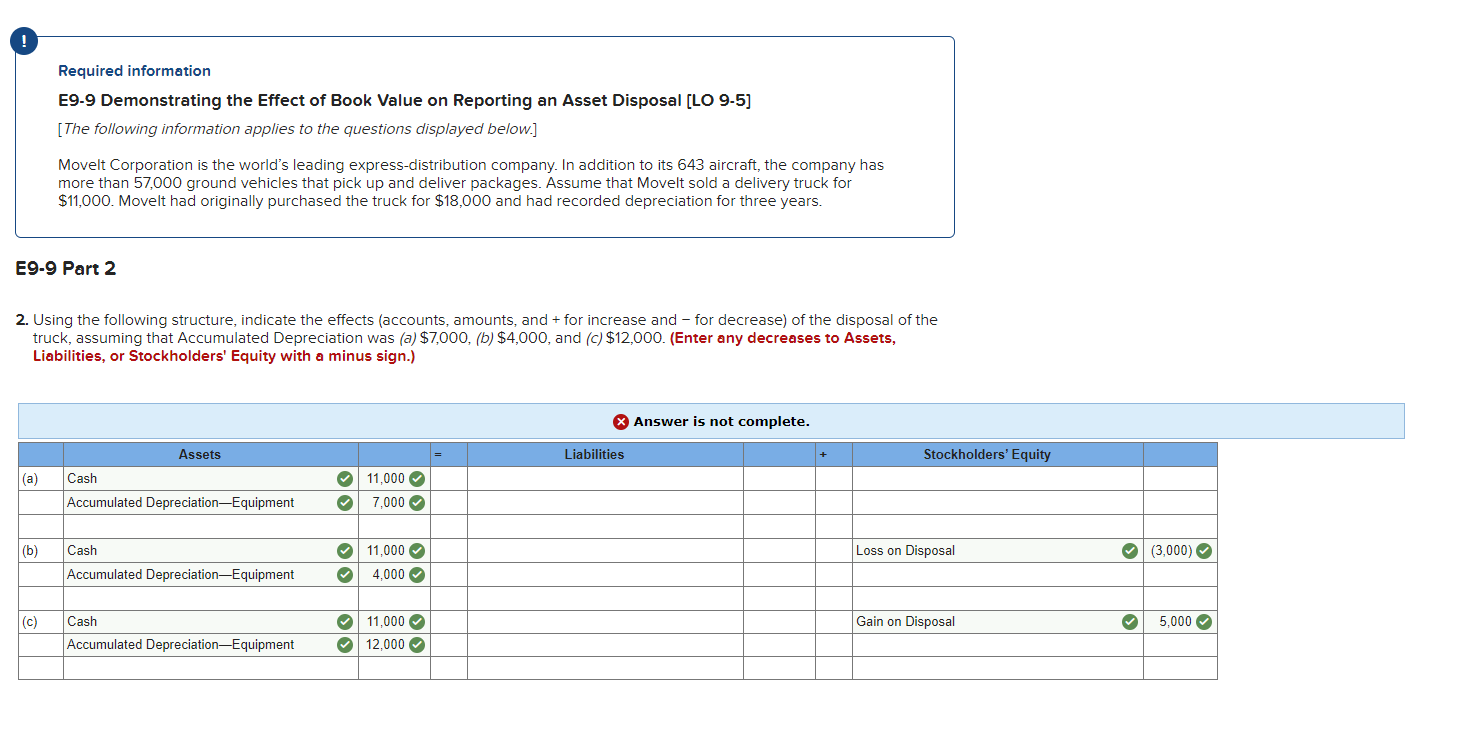

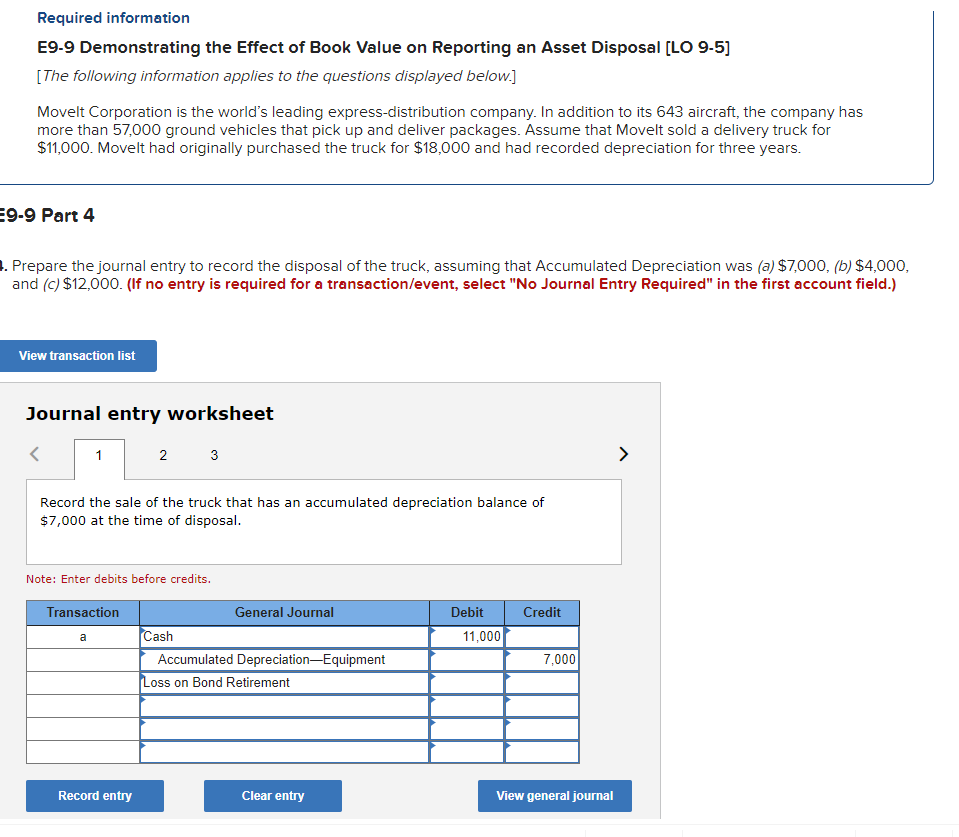

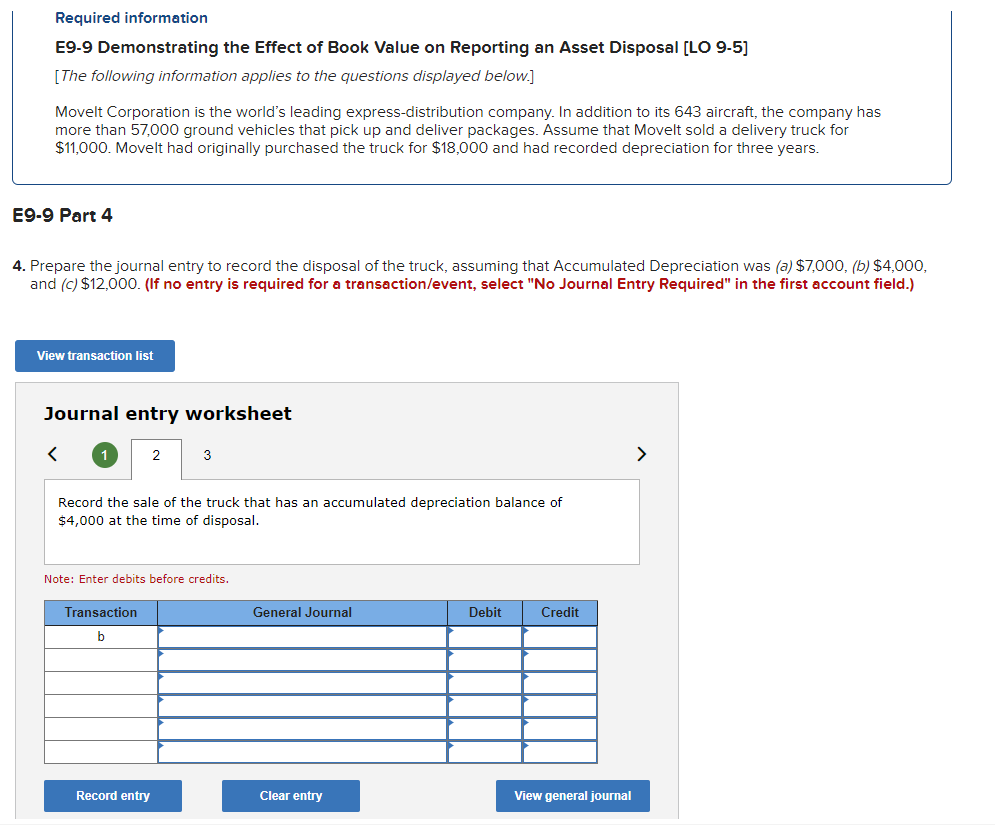

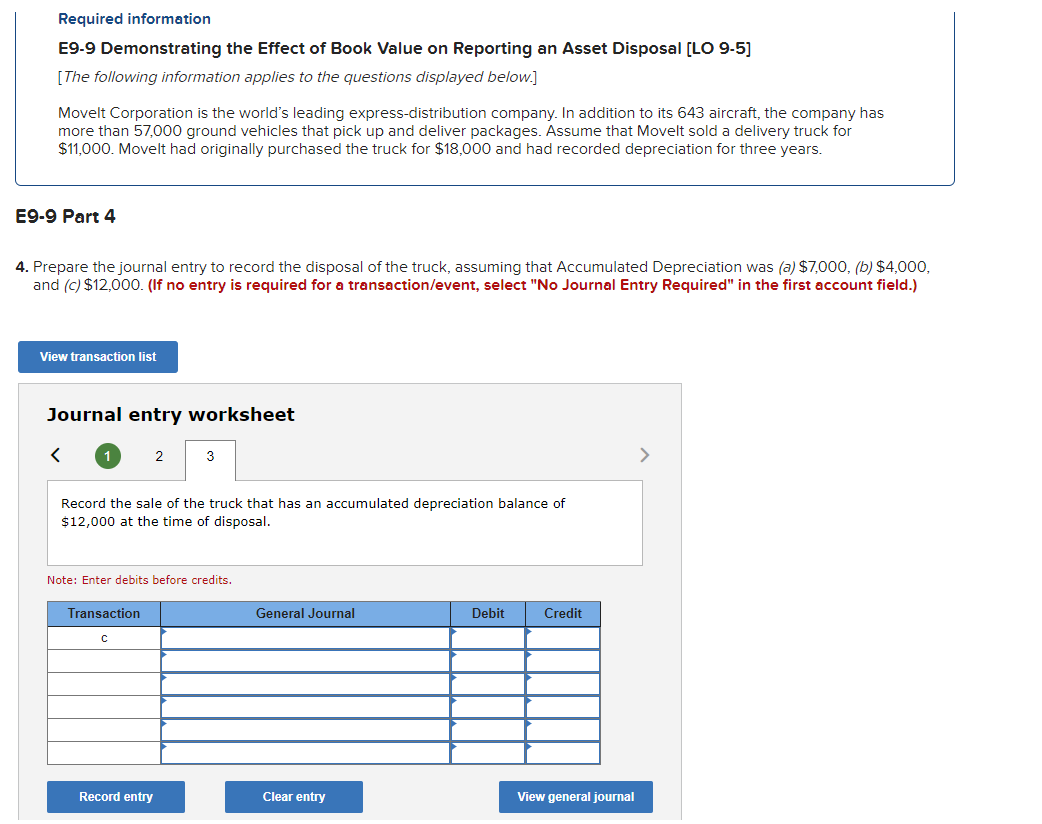

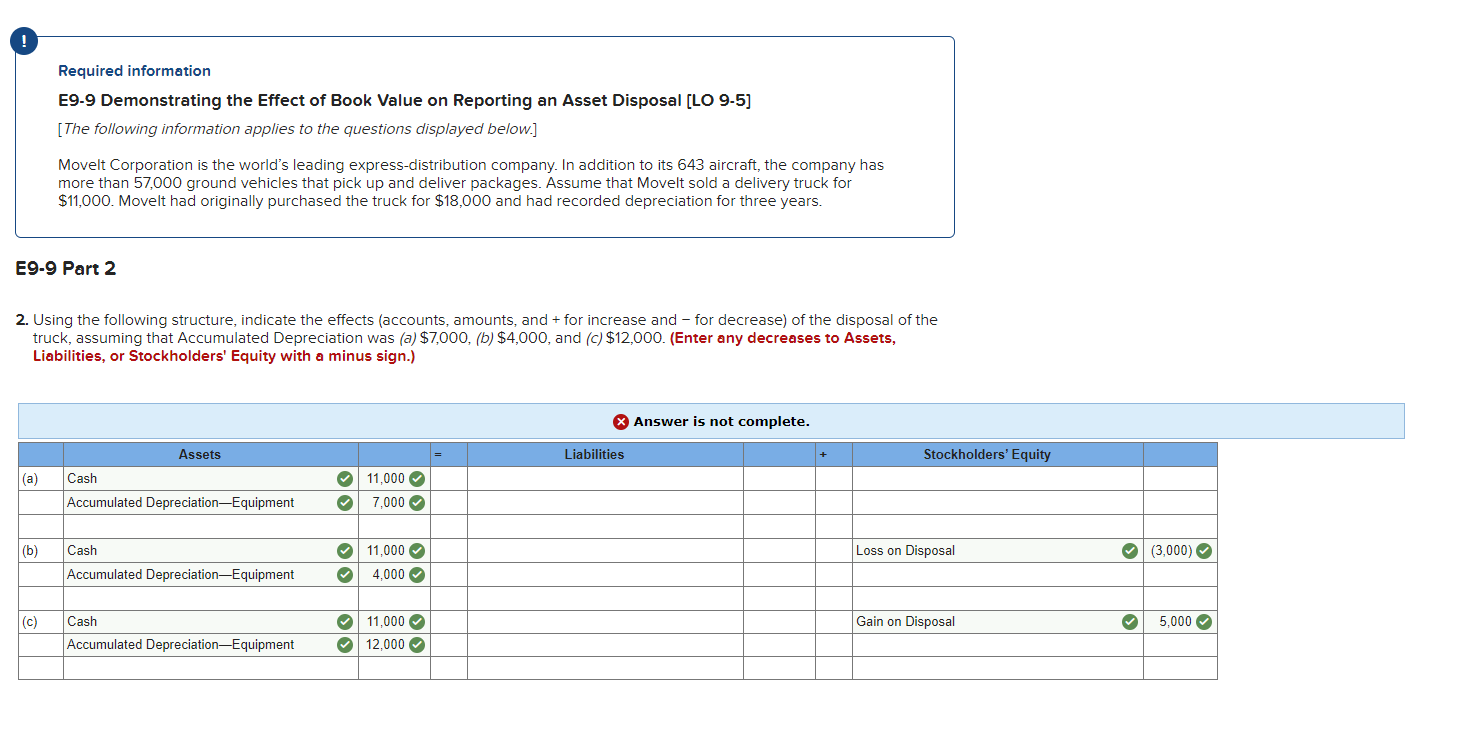

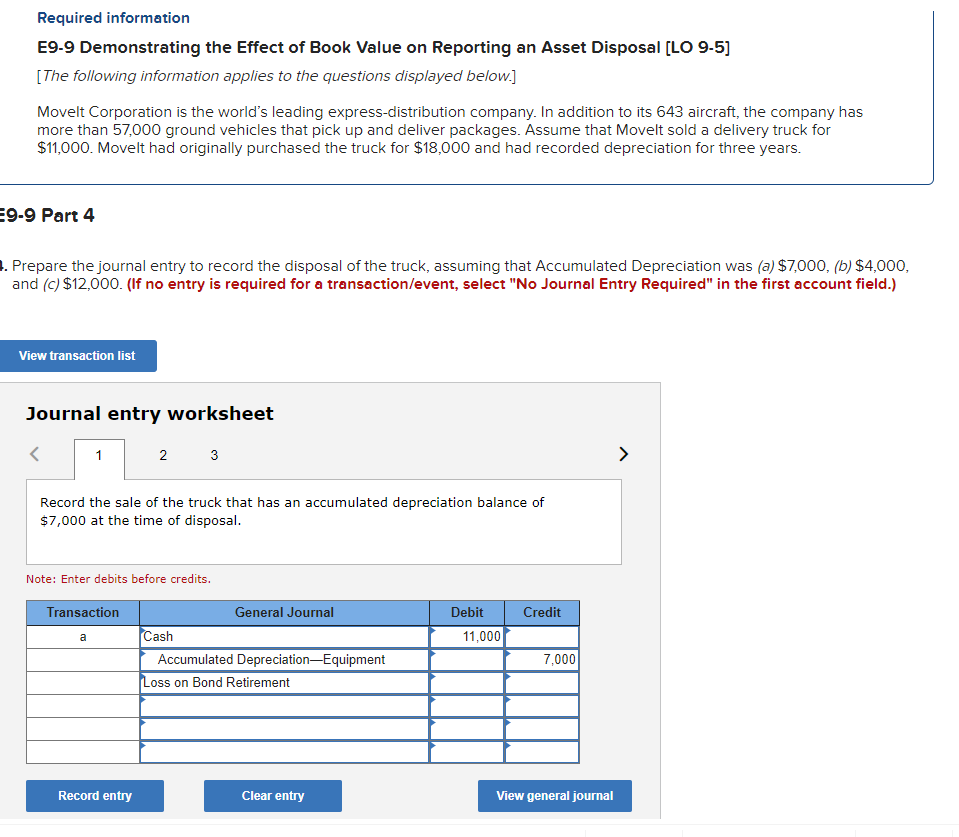

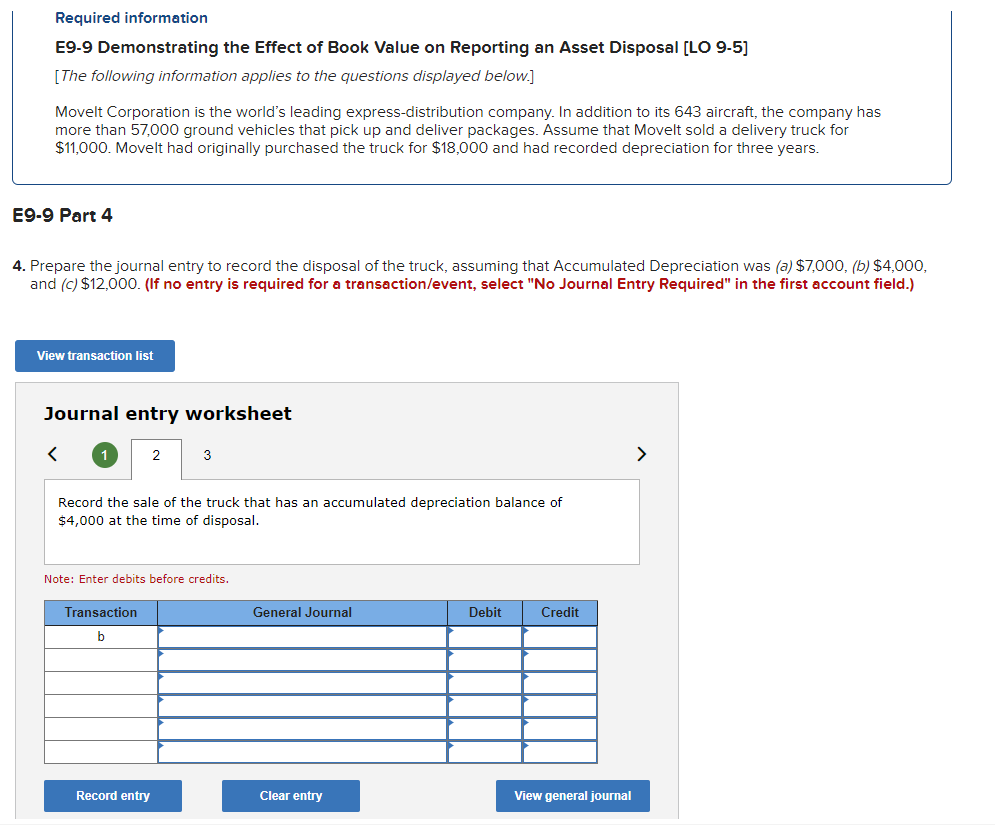

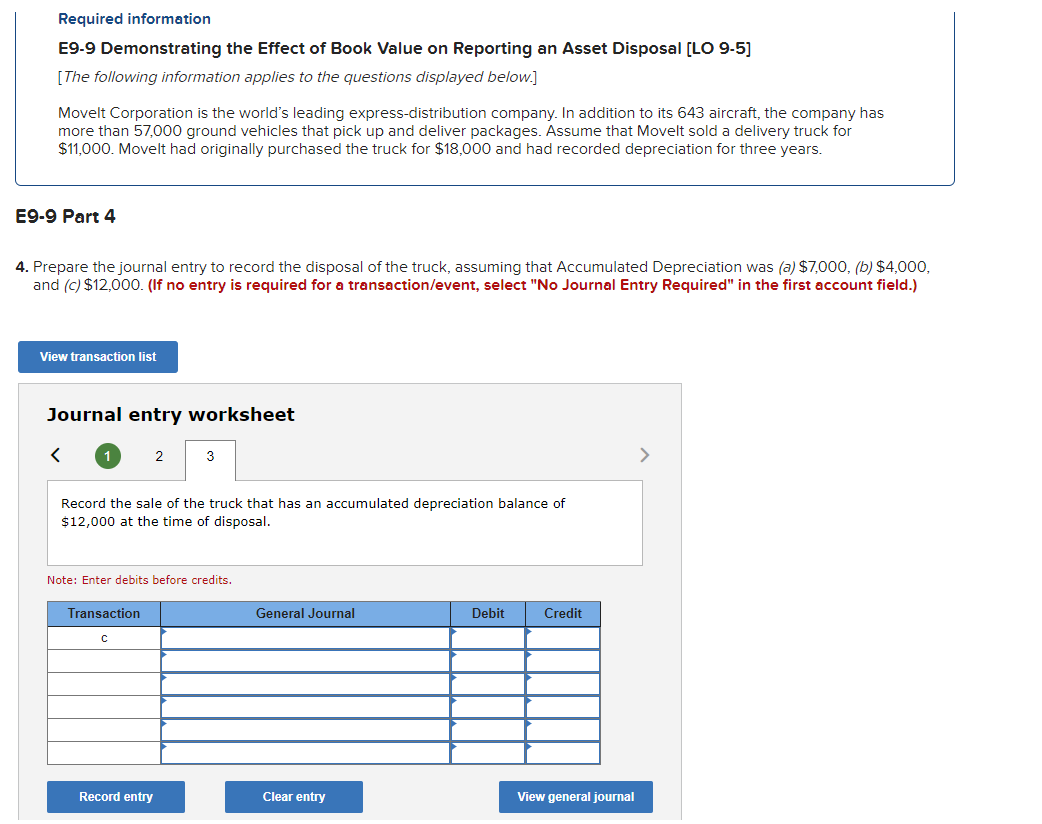

Required information E9-9 Demonstrating the Effect of Book Value on Reporting an Asset Disposal (LO 9-5] [The following information applies to the questions displayed below.] Movelt Corporation is the world's leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that Movelt sold a delivery truck for $11,000. Movelt had originally purchased the truck for $18,000 and had recorded depreciation for three years. E9-9 Part 2 2. Using the following structure, indicate the effects (accounts, amounts, and + for increase and - for decrease) of the disposal of the truck, assuming that Accumulated Depreciation was (a) $7,000, (6) $4,000, and (c) $12,000. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign.) Answer is not complete. Liabilities Stockholders' Equity (a) Assets Cash Accumulated Depreciation Equipment 11,000 7.000 (b) 11.000 Loss on Disposal (3,000) Cash Accumulated Depreciation Equipment 4,000 (c) 11,000 Gain on Disposal > 5,000 Cash Accumulated Depreciation-Equipment 12,000 Required information E9-9 Demonstrating the Effect of Book Value on Reporting an Asset Disposal (LO 9-5] [The following information applies to the questions displayed below.] Movelt Corporation is the world's leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that Movelt sold a delivery truck for $11,000. Movelt had originally purchased the truck for $18,000 and had recorded depreciation for three years. E9-9 Part 4 . Prepare the journal entry to record the disposal of the truck, assuming that Accumulated Depreciation was (a) $7,000, (b) $4,000, and (c) $12,000. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the sale of the truck that has an accumulated depreciation balance of $7,000 at the time of disposal. Note: Enter debits before credits. Transaction Credit Debit 11,000 a General Journal Cash Accumulated Depreciation Equipment Loss on Bond Retirement 7,000 Record entry Clear entry View general journal Required information E9-9 Demonstrating the Effect of Book Value on Reporting an Asset Disposal (LO 9-5) [The following information applies to the questions displayed below.] Movelt Corporation is the world's leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that Movelt sold a delivery truck for $11,000. Movelt had originally purchased the truck for $18,000 and had recorded depreciation for three years. E9-9 Part 4 4. Prepare the journal entry to record the disposal of the truck, assuming that Accumulated Depreciation was (a) $7,000, (b) $4,000, and (c) $12,000. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the sale of the truck that has an accumulated depreciation balance of $4,000 at the time of disposal. Note: Enter debits before credits. Transaction General Journal Debit Credit b Record entry Clear entry View general journal Required information E9-9 Demonstrating the Effect of Book Value on Reporting an Asset Disposal (LO 9-5) [The following information applies to the questions displayed below.] Movelt Corporation is the world's leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that Movelt sold a delivery truck for $11,000. Movelt had originally purchased the truck for $18,000 and had recorded depreciation for three years. E9-9 Part 4 4. Prepare the journal entry to record the disposal of the truck, assuming that Accumulated Depreciation was (a) $7,000, (b) $4,000, and (c) $12,000. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 > Record the sale of the truck that has an accumulated depreciation balance of $12,000 at the time of disposal. Note: Enter debits before credits. Transaction General Journal Debit Credit C Record entry Clear entry View general journal