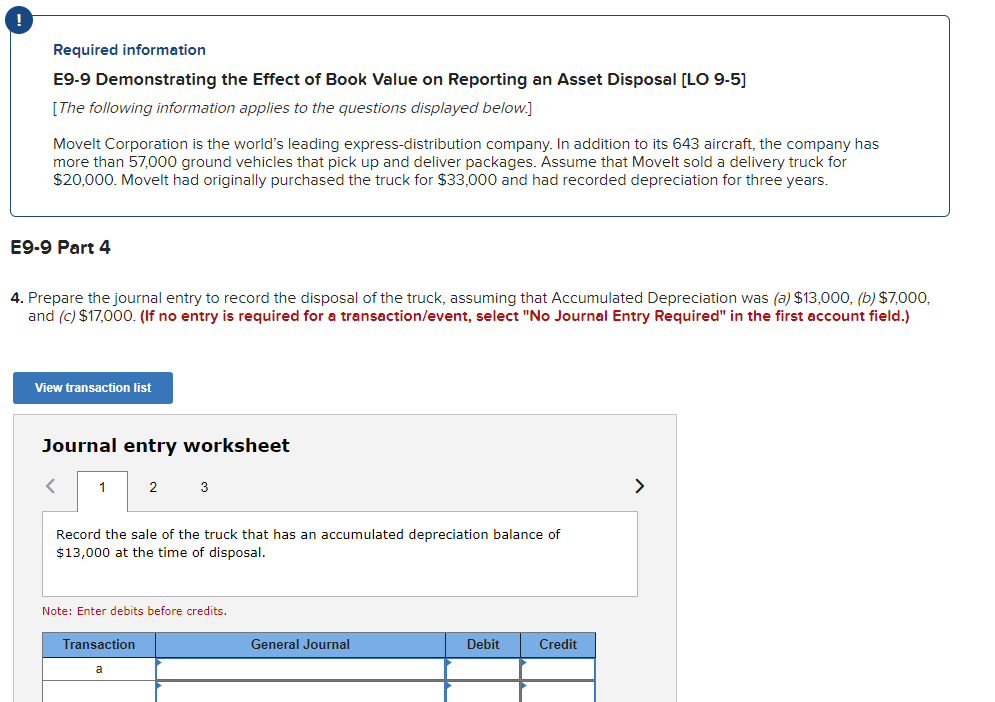

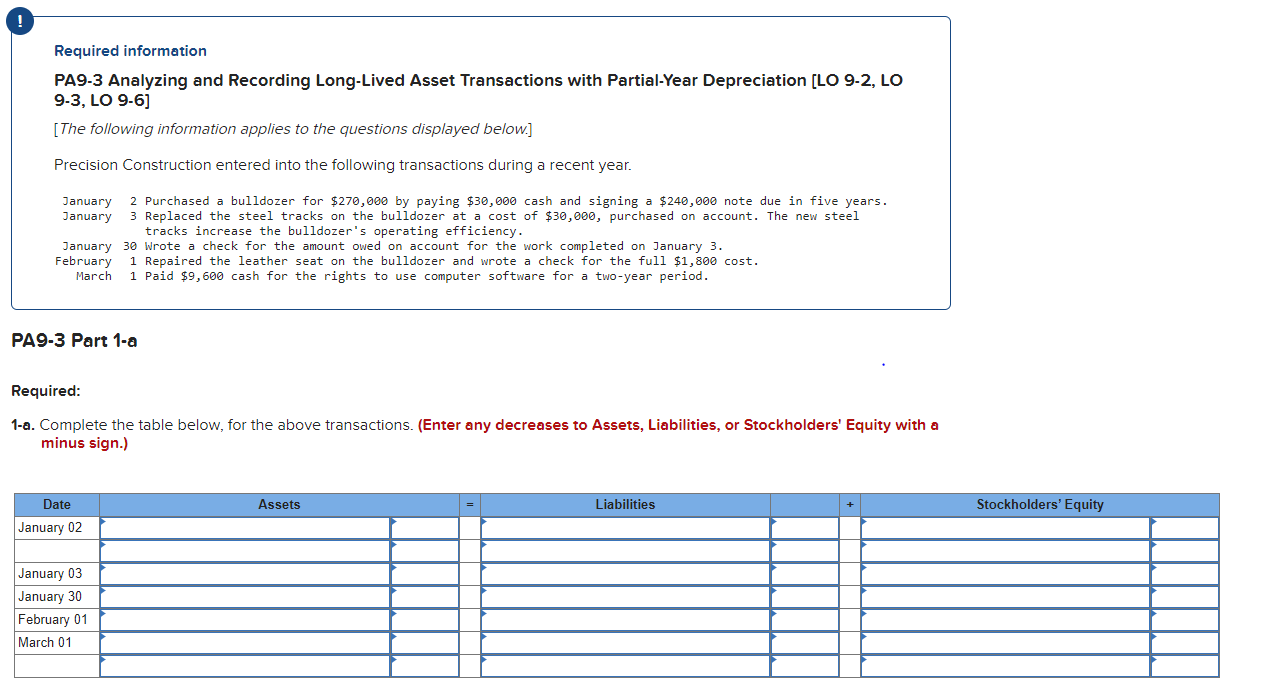

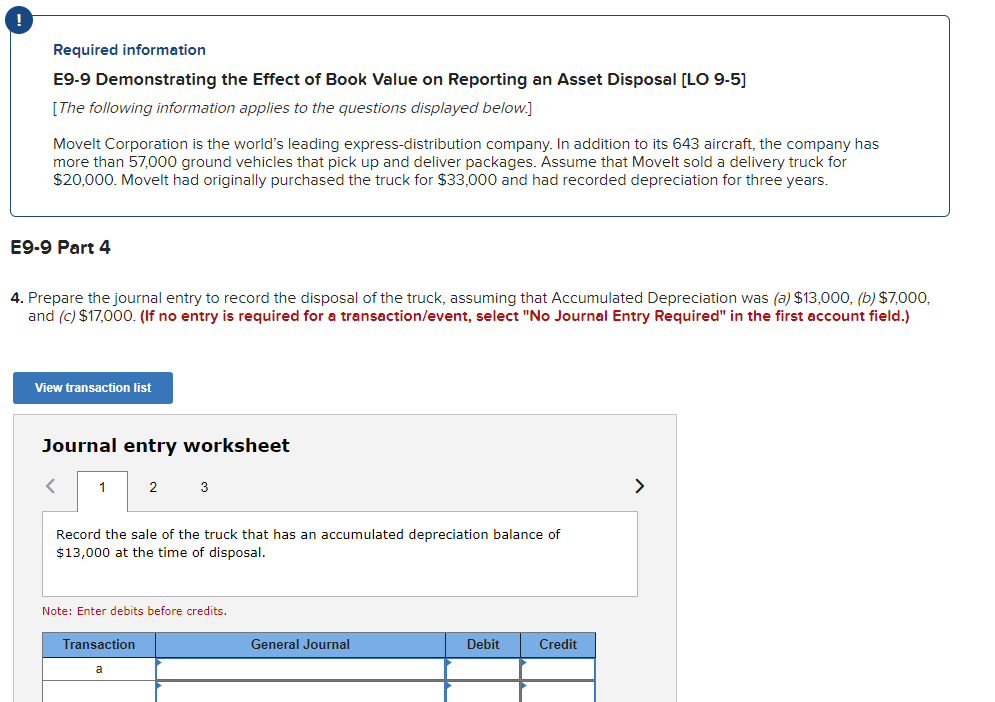

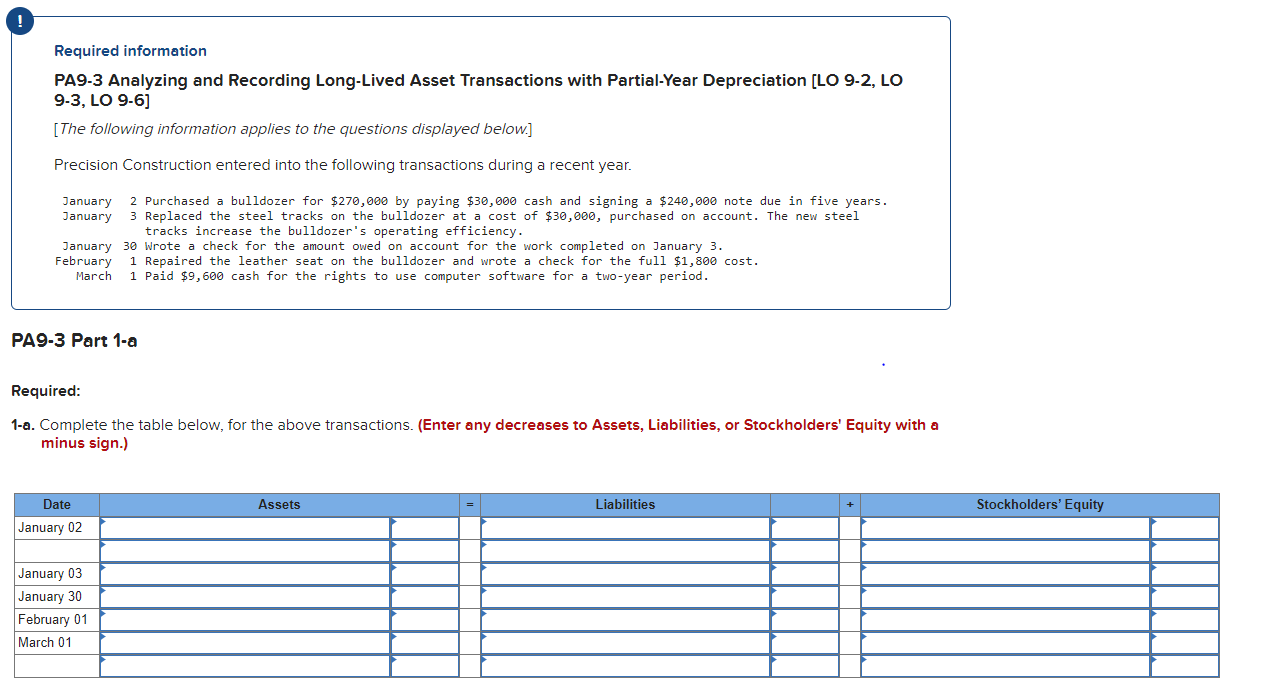

Required information E9-9 Demonstrating the Effect of Book Value on Reporting an Asset Disposal (LO 9-5] [The following information applies to the questions displayed below.] Movelt Corporation is the world's leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that Movelt sold a delivery truck for $20,000. Movelt had originally purchased the truck for $33,000 and had recorded depreciation for three years. E9-9 Part 4 4. Prepare the journal entry to record the disposal of the truck, assuming that Accumulated Depreciation was (a) $13,000, (b) $7,000, and (c) $17,000. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the sale of the truck that has an accumulated depreciation balance of $13,000 at the time of disposal. Note: Enter debits before credits. Transaction General Journal Debit Credit a ! Required information PA9-3 Analyzing and Recording Long-Lived Asset Transactions with Partial-Year Depreciation (LO 9-2, LO 9-3, LO 9-6] [The following information applies to the questions displayed below.] Precision Construction entered into the following transactions during a recent year. January 2 Purchased a bulldozer for $270,000 by paying $30,000 cash and signing a $240,000 note due in five years. January 3 Replaced the steel tracks on the bulldozer at a cost of $30,000, purchased on account. The new steel tracks increase the bulldozer's operating efficiency. January 30 Wrote a check for the amount owed on account for the work completed on January 3. February 1 Repaired the leather seat on the bulldozer and wrote a check for the full $1,800 cost. March 1 Paid $9,600 cash for the rights to use computer software for a two-year period. PA9-3 Part 1-a Required: 1-a. Complete the table below, for the above transactions. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign.) Date Assets Liabilities Stockholders' Equity January 02 January 03 January 30 February 01 March 01