Question

Required information Exercise 10-9 Straight-Line: Bond computations, amortization, and bond retirement LO P2, P4 On January 1, 2017, Shay issues $380,000 of 9%, 15-year bonds

Required information

Exercise 10-9 Straight-Line: Bond computations, amortization, and bond retirement LO P2, P4

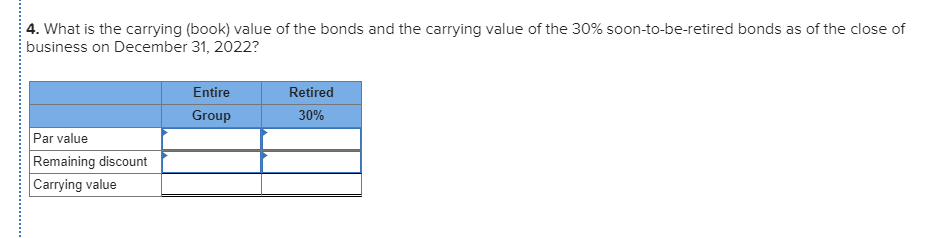

On January 1, 2017, Shay issues $380,000 of 9%, 15-year bonds at a price of 97.25. Six years later, on January 1, 2023, Shay retires 30% of these bonds by buying them on the open market at 105.25. All interest is accounted for and paid through December 31, 2022, the day before the purchase. The straight-line method is used to amortize any bond discount.

1. How much does the company receive when it issues the bonds on January 1, 2017?

|

2. What is the amount of the discount on the bonds at January 1, 2017? Amount of discount _____

3. How much amortization of the discount is recorded on the bonds for the entire period from January 1, 2017, through December 31, 2022?

Authorization of discount _____

5. How much did the company pay on January 1, 2023, to purchase the bonds that it retired?

Purchase Price ___

6. What is the amount of the recorded gain or loss from retiring the bonds?

Gain or Loss of Retirement? Amount _______

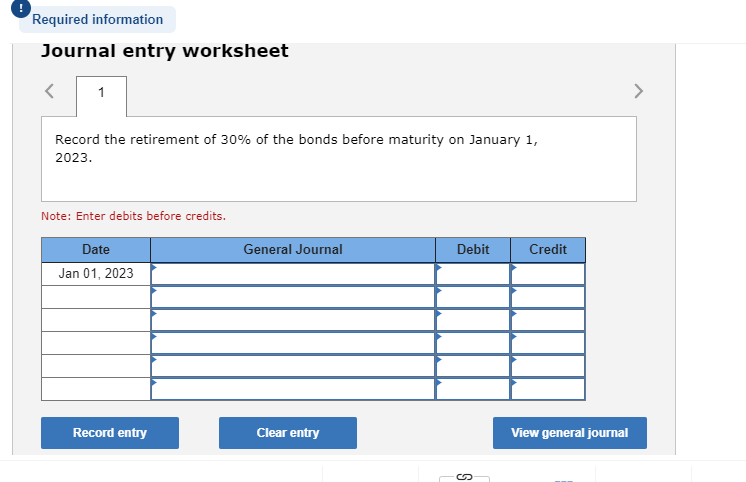

7. Prepare the journal entry to record the bond retirement at January 1, 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started