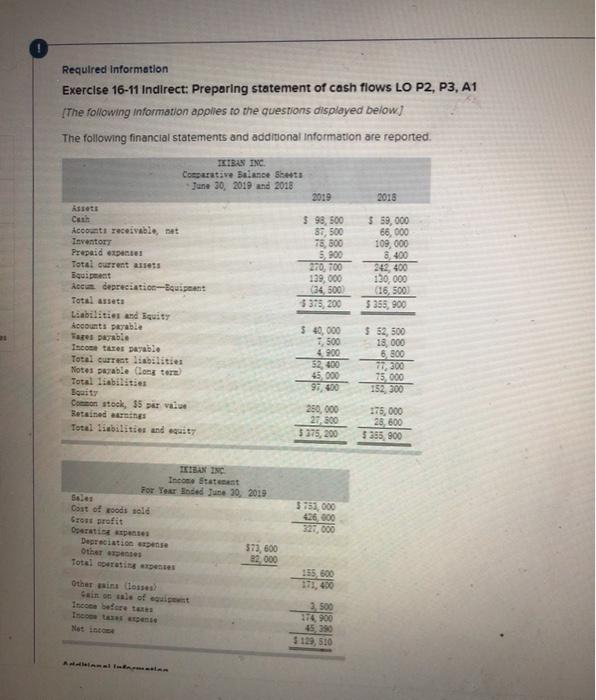

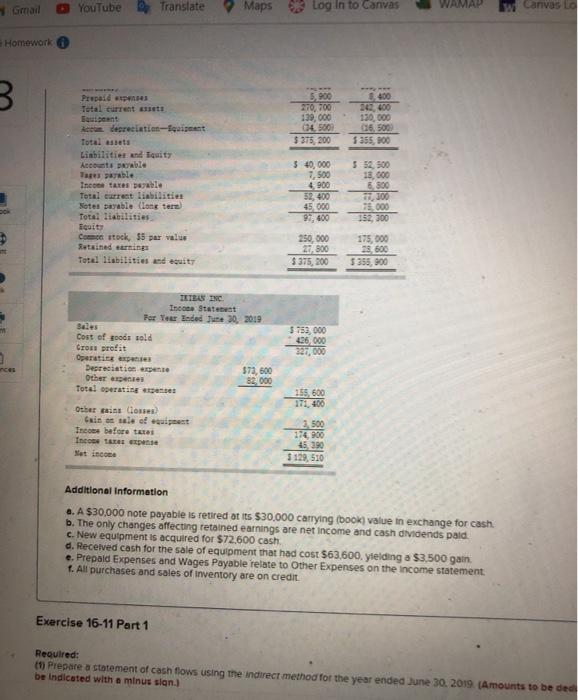

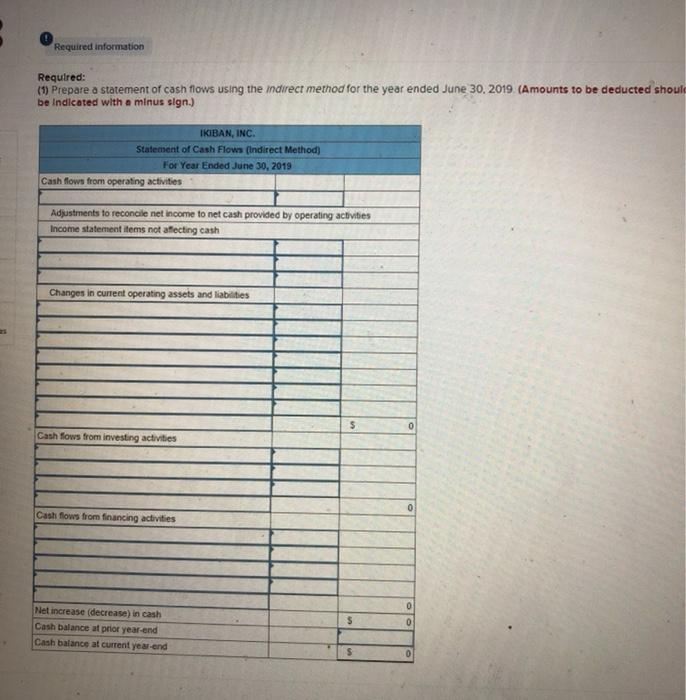

Required Information Exercise 16-11 Indirect: Preparing statement of cash flows LO P2, P3, A1 The following information applies to the questions displayed below) The following financial statements and additional Information are reported KIBAN INC Comparative Balance Shes June 30, 2019 and 2018 2019 2018 assets Canh Accounts receivable Inventory Prepaid expenses Total current stets Equipe Aus depreciatio-quint Total assets Liabilities and Equity accounts payable Tags payable Income taxes payable Total current liabilities Notes peable Cong to Total liabilities Equity Common stock, 35 per value $ 98,500 87,500 78, 800 5.900 270, 700 139,000 (34,500 $375, 200 $ 59,000 66,000 109,000 8,400 242, 400 130,000 16.500 $ 355, 900 $ 40,000 1,500 4900 $2,400 45,000 $ 52,500 18,000 6.800 17,300 75,000 152, 300 Total liabilities and wait 250,000 27.500 5375,200 375,000 28.800 5 355, 900 IKEAN INC For Your Boded June 30, 2019 Cost of goods sold Cross profit 5751,000 426 000 327,000 Depreciation expense 373, 800 22 000 Total sering mentes 155,600 Other in losses) Cain one of it 2.500 11 900 45.390 $ 129, 5:0 Gmail YouTube Translate Maps Log in to Canvas WAMA Canvas o Homework 3 Prepaid expenses Total current 5.900 270, 700 139,000 034. SOO $375,200 e depreciation-ipment Total assets Liabilities and Equity Accounts puble 130,000 16,500 $ 355, 900 Inco taxes peable Total current liabilities Notes Dayable clone ter Total liabilities Equity Costock, 55 par value Retained ning Total abilities and equity $ 40,000 7,500 4 000 52,400 45 000 97,400 250,000 27,500 $375,200 $ 52,500 18.000 8.800 77,300 75,000 352, 300 175,000 23.500 5355, 900 IKTES INC Inco Statet For Teer Ended June 20, 2019 32 Cost of soods sold Cross profit Operaties en | Desreciation $73,600 Other species 82 000 Total operating 5 753,000 425,000 155 600 Obertains contes) Cain a sale of equipment Income before tres Incore te 3.500 174.900 45 290 $ 129, 510 Additional Information ..A $30,000 note payable is retired at its $30.000 carrying (book) value in exchange for cash b. The only changes affecting retained earnings are net income and cash dividends pald c. New equipment is acquired for $72.600 cash d. Received cash for the sale of equipment that had cost $63.600. yielding a $3.500 gain e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement 1. All purchases and sales of inventory are on credit Exercise 16-11 Part 1 Required: (1) Prepare a statement of cash flows using the indirect method for the year ended June 30, 2019. (Amounts to be de be indicated with a minus sign) Required information Required: (1) Prepare a statement of cash flows using the Indirect method for the year ended June 30, 2019 (Amounts to be deducted shoul be Indicated with a minus slgn.) IKIBAN, INC. Statement of Cash Flows (Indirect Method) For Year Ended June 30, 2019 Cash flows from operating activities Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities $ 0 Cash flows from investing activities 0 Cash flows from financing activities 0 $ Net increase (decrease) in cash Cash balance at prior year-end Cash balance at current year-end 0 S 0