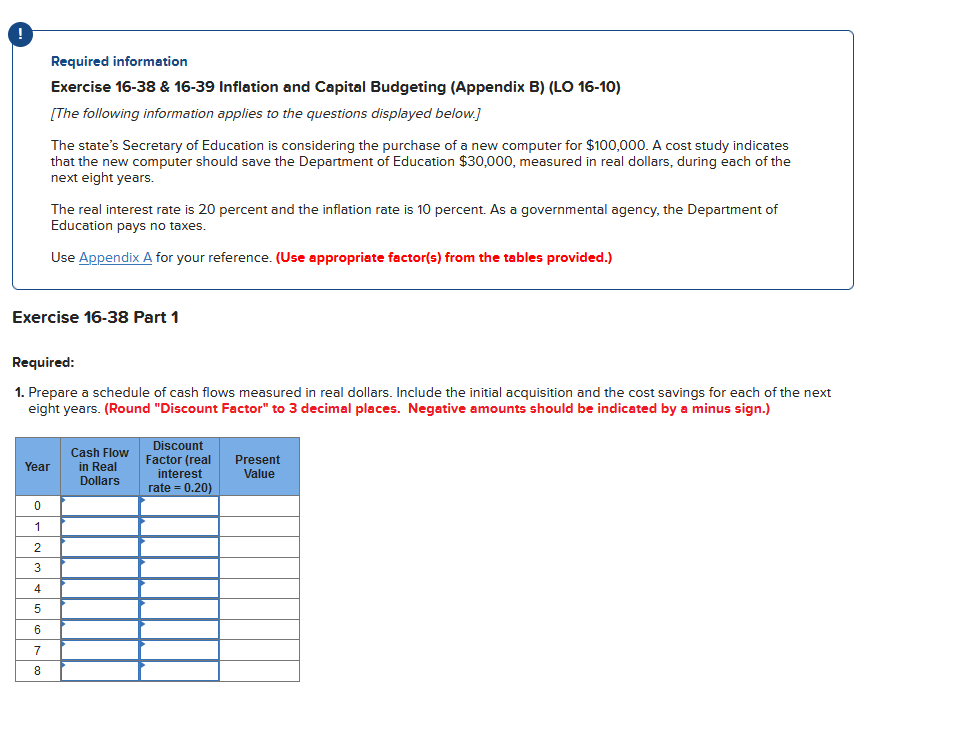

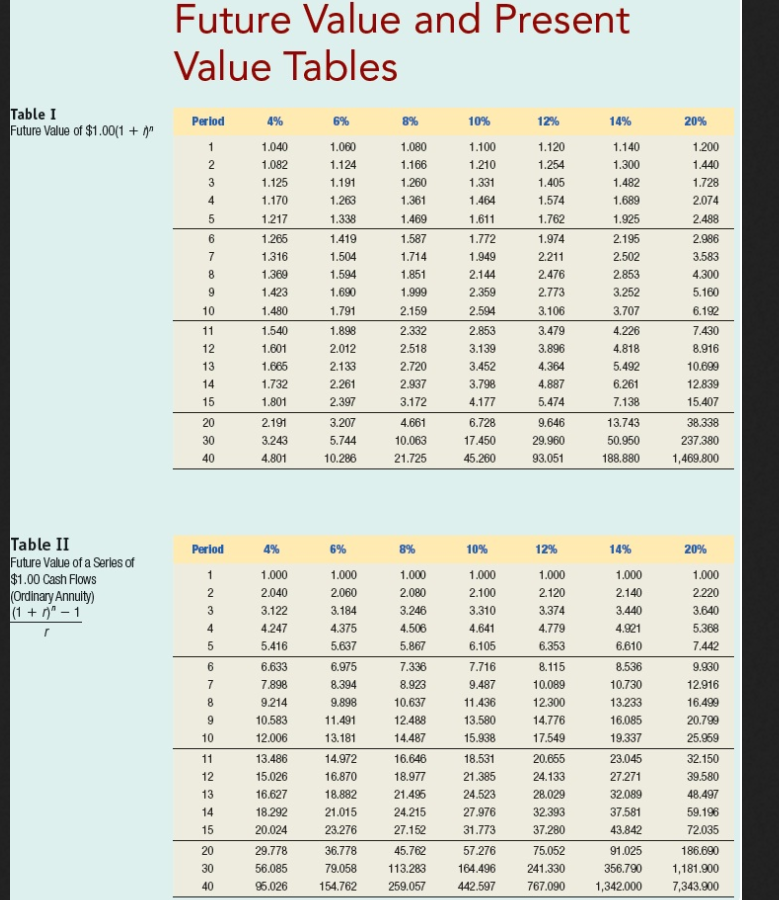

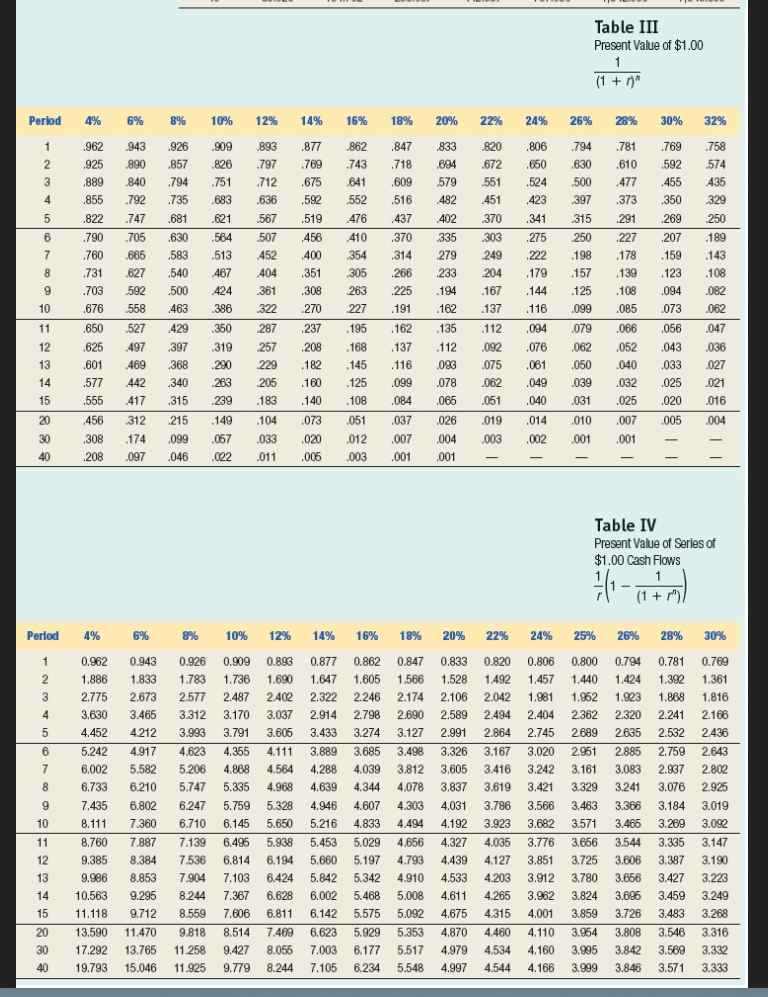

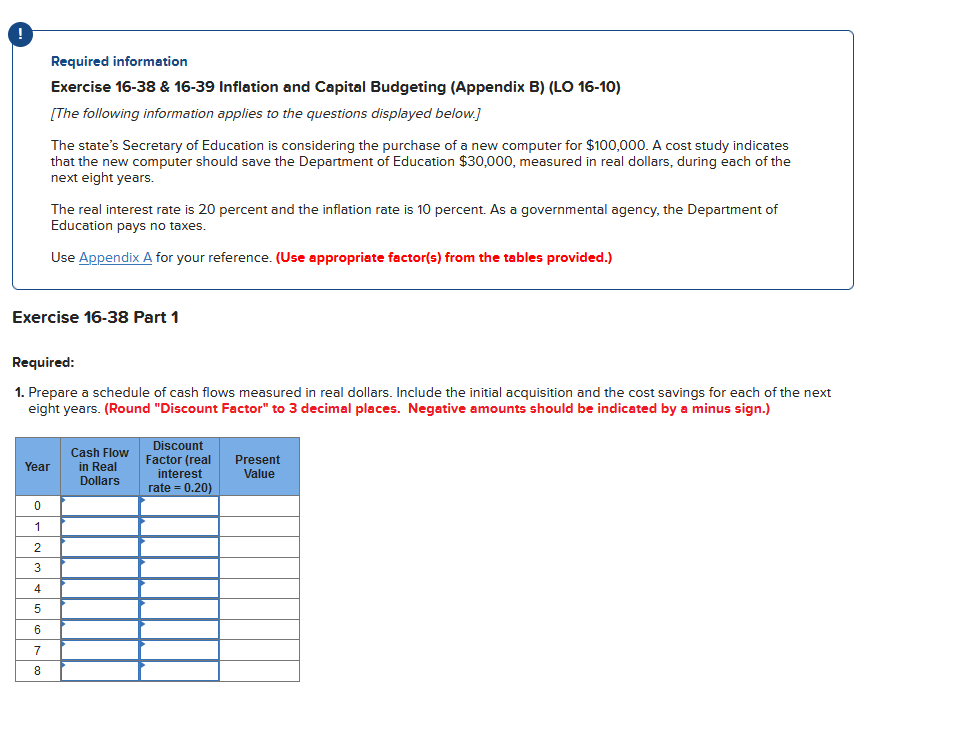

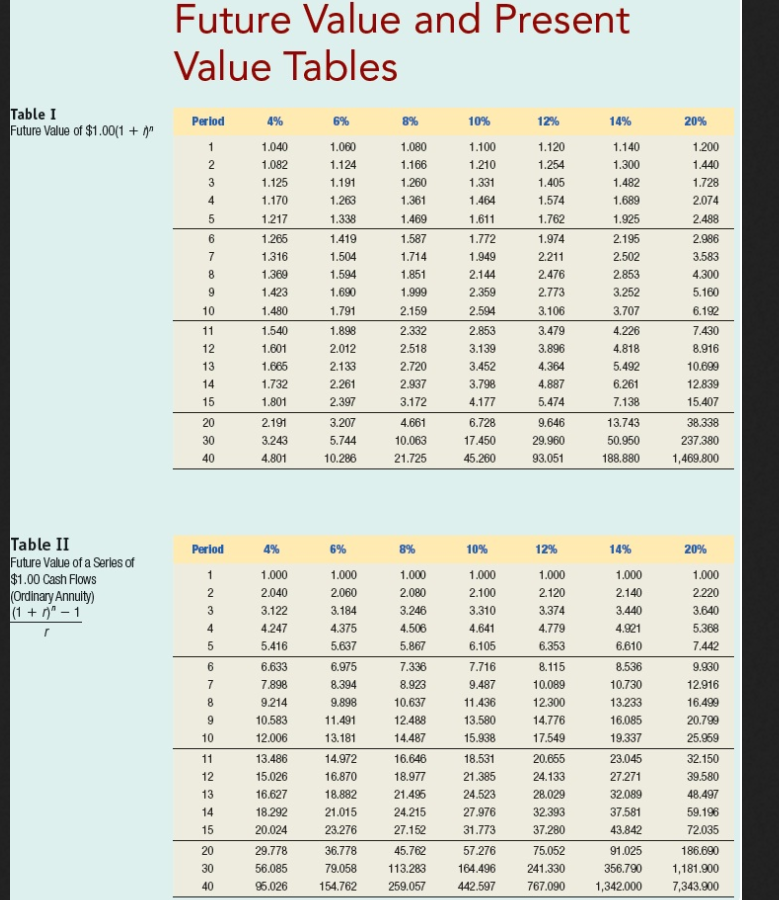

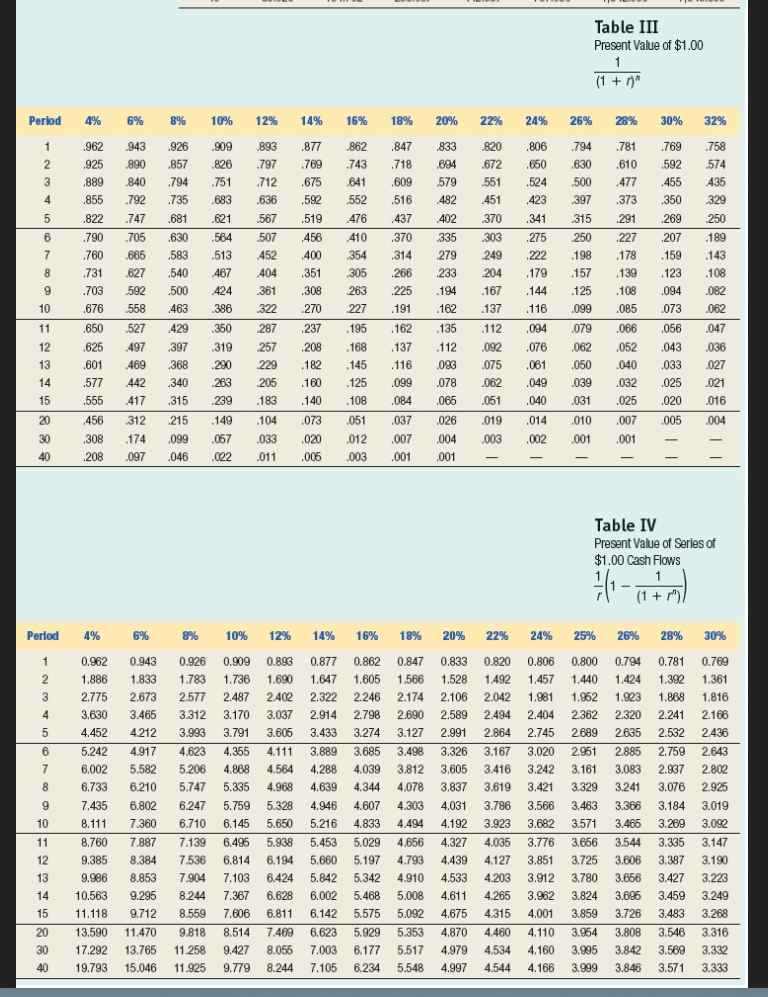

! Required information Exercise 16-38 & 16-39 Inflation and Capital Budgeting (Appendix B) (LO 16-10) [The following information applies to the questions displayed below.] The state's Secretary of Education is considering the purchase of a new computer for $100,000. A cost study indicates that the new computer should save the Department of Education $30,000, measured in real dollars, during each of the next eight years. The real interest rate is 20 percent and the inflation rate is 10 percent. As a governmental agency, the Department of Education pays no taxes. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Exercise 16-38 Part 1 Required: 1. Prepare a schedule of cash flows measured in real dollars. Include the initial acquisition and the cost savings for each of the next eight years. (Round "Discount Factor" to 3 decimal places. Negative amounts should be indicated by a minus sign.) Cash Flow in Real Year Discount Factor (real interest rate=0.20) Present Value Dollars 0 1 2 3 AW 4 567 8 Table I Future Value of $1.00(1 + Table II Future Value of a Series of $1.00 Cash Flows (Ordinary Annuity) (1+r)^-1 r Future Value and Present Value Tables Period 4% 6% 8% 10% 12% 14% 1 1.040 1.060 1.080 1.100 1.120 2 1.082 1.124 1.166 1.210 1.254 3 1.125 1.191 1.260 1.331 1.405 4 1.170 1.263 1.361 1.464 1.574 1.217 1.338 1.469 1.611 1.762 1.265 1.419 1.587 1.772 1.974 1.316 1.504 1.714 1.949 2.211 1.369 1.594 1.851 2.144 2.476 1.423 1.690 1.999 2.359 2.773 1.480 1.791 2.159 2.594 3.106 1.540 1.898 2.332 2.853 3.479 1.601 2.012 2.518 3.139 3.896 1.665 2.133 2.720 3.452 4.364 1.732 2.261 2.937 3.798 4.887 1.801 2.397 3.172 4.177 5.474 2.191 3.207 4.661 6.728 9.646 3.243 5.744 10.063 17.450 29.960 4.801 10.286 21.725 45.260 93.051 4% 6% 8% 10% 12% 1.000 1.000 1.000 2.040 2.060 2.080 3.122 3.184 3.246 4.247 4.375 4.506 5.416 5.637 5.867 6.633 6.975 7.336 7.898 8.394 8.923 9.214 9.898 10.637 10.583 11.491 12.488 12.006 13.181 14.487 13.486 14.972 16.646 15.026 16.870 18.977 16.627 18.882 21.495 18.292 21.015 24.215 20.024 23.276 27.152 29.778 36.778 45.762 56.085 79.058 113.283 95.026 154.762 259.057 5 6 7 8 9 10 11 12 13 14 15 20 30 40 Period 123 4 5 87 6 8 9 10 11 12 13 14 15 20 30 40 1.000 2.100 3.310 4.641 6.105 7.716 9.487 11.436 13.580 15.938 18.531 21.385 24.523 27.976 31.773 57.276 164.496 442.597 1.000 2.120 3.374 4.779 6.353 8.115 10.089 12.300 14.776 17.549 20.655 24.133 28.029 32.393 37.280 75.052 241.330 767.090 1.140 1.300 1.482 1.689 1.925 2.195 2.502 2.853 3.252 3.707 4.226 4.818 5.492 6.261 7.138 13.743 50.950 188.880 14% 1.000 2.140 3.440 4.921 6.610 8.536 10.730 13.233 16.085 19.337 23.045 27.271 32.089 37.581 43.842 91.025 356.790 1,342.000 20% 1.200 1.440 1.728 2.074 2.488 2.986 3.583 4.300 5.160 6.192 7.430 8.916 10.699 12.839 15.407 38.338 237.380 1,469.800 20% 1.000 2.220 3.640 5.368 7.442 9.930 12.916 16.499 20.799 25.969 32.150 39.580 48.497 59.196 72.035 186.690 1,181.900 7,343.900 Table III Present Value of $1.00 1 (1 + 1)^ 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30% 32% .962 943 926 .909 .893 .877 862 .847 .833 .925 .890 .857 .826 .797 .769 .743 .718 .694 .672 820 .806 .794 .781 .769 .758 .630 .610 592 574 455 435 .650 551 .524 .751 .712 .675 .641 .609 579 .889 .840 .794 .855 .792 .735 .683 .636 592 552 516 482 .451 423 500 .477 397 315 .291 329 .822 747 .681 .621 567 .519 476 437 402 370 341 .373 .350 269 .227 .207 250 .790 .705 .630 564 .507 456 410 370 335 303 275 250 .189 .760 .665 .583 .513 452 .400 354 314 279 249 .222 .198 178 .159 .143 .731 .627 .540 467 404 .351 305 .266 233 204 179 .157 .139 .123 .108 .703 592 .500 424 361 .308 263 .225 .194 .167 .144 .125 .108 .094 .082 10 .676 558 .463 386 322 .270 227 .162 .137 .116 .099 .085 .073 .062 .191 .195 .162 .135 11 .650 .527 429 .350 287 .237 .112 .094 .079 .066 .056 .047 12 .625 497 .397 319 257 208 .168 .137 112 .092 .076 .062 .052 .043 036 13 .601 469 .229 .182 .145 .116 093 075 .061 050 040 .033 .027 14 .577 .368 290 442 340 263 205 .160 417 .315 .239 .183 .140 .125 .099 .078 .062 .049 .039 .032 .025 .021 15 .555 .108 .084 .065 .051 .040 .031 .025 .020 .016 20 456 312 .026 .019 ,014 .010 .007 .005 .004 30 308 174 215 .149 104 .073 .051 .037 .099 .067 .033 .020 .012 .007 .004 .003 .002 .046 .022 .011 .005 .003 .001 .001 .001 .001 40 208 .097 Table IV Present Value of Series of $1.00 Cash Flows 71- (1 + r) Period 4% 6% 8% 20% 22% 24% 25% 26% 28% 30% 1 2 3 4 5 6 7 6.002 5.582 8 6.733 6.210 9 10% 12% 14% 16% 18% 0.962 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 0.820 0.806 0.800 0.794 0.781 0.769 1.886 1.833 1.783 1.736 1.690 1.647 1.605 1.566 1.528 1.492 1.457 1.440 1.424 1.392 1.361 2.775 2.673 2.577 2.487 2.402 2.322 2.246 2.174 2.106 2.042 1.981 1.962 1.923 1.868 1.816 3.630 3.465 3.312 3.170 3.037 2.914 2.798 2.690 2.589 2.494 2,404 2.362 2.320 2.241 2.166 4.452 4.212 3.993 3.791 3.605 3.433 3.274 3.127 2.991 2.864 2.745 2.689 2.635 2.532 2.436 5.242 4.917 4.623 4.355 4.111 3.889 3.685 3.498 3.326 3.167 3.020 2.951 2.885 2.759 2.643 5.206 4.868 4.564 4.288 4.039 3.812 3.605 3.416 3.242 3.161 3.083 2.937 2.802 5.747 5.335 4.968 4.639 4.344 4.078 3.837 3.619 3.421 3.329 3.241 3.076 2.925 6,247 5.759 5.328 4,946 4.607 4.303 4.031 3.786 3.566 3.463 3.366 3.184 3.019 6.710 6.145 5.650 5,216 4.833 4.494 4.192 3.923 3.682 3.571 3.465 3,269 3.092 7.139 6.495 5.938 5.453 5.029 4.656 4.327 4.035 3.776 3.656 3.544 3.335 3.147 7.536 6.814 6.194 4.793 4.439 4.127 3.851 3.725 3.606 3.387 3.190 9.986 8.853 7.904 7.103 6.424 5.842 5.342 4.910 4.533 4.203 3.912 3.780 3.656 3.427 3.223 10.563 9.295 8,244 7.367 6.628 6.002 5.468 5.008 4.611 4.265 3.962 3.824 3.695 3.459 3.249 11.118 9.712 8.559 7.606 6.811 6.142 5.575 5.092 4.675 4.315 4.001 3.859 3.726 3.483 3.268 13.590 11.470 9.818 8.514 7.469 6.623 5.929 5.353 4.870 4.460 4.110 3.954 3.808 3.546 3.316 17.292 13.765 11.258 9.427 8.055 7.003 6.177 5.517 4.979 4.534 4.160 3.995 3.842 3.569 3.332 19.793 15.046 11.925 9.779 8.244 7.105 6.234 5.548 4.997 4.544 4.166 3.999 3.846 3.571 3.333 10 7.435 6.802 8.111 7.360 8.760 7.887 11 12 9.385 8.384 5.660 5.197 13 14 15 20 30 40 Period 1 2 3 4 5 6 7 8 9