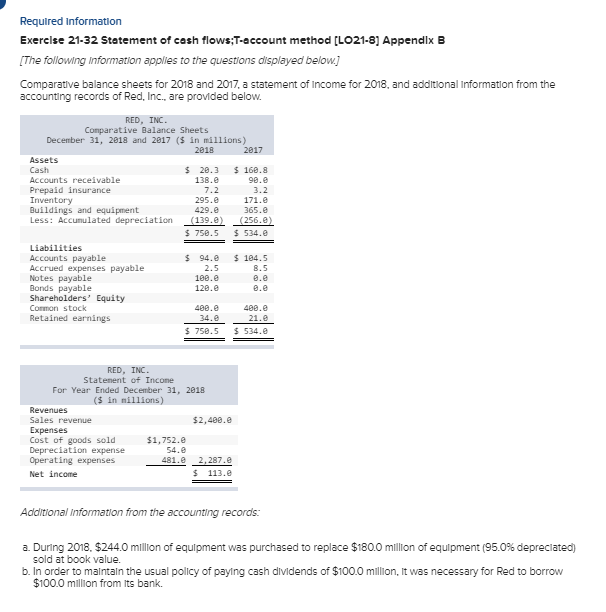

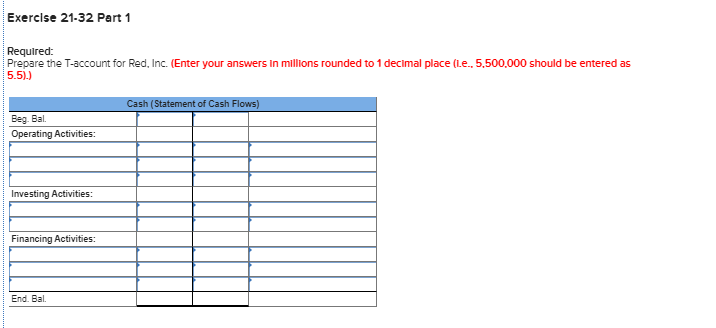

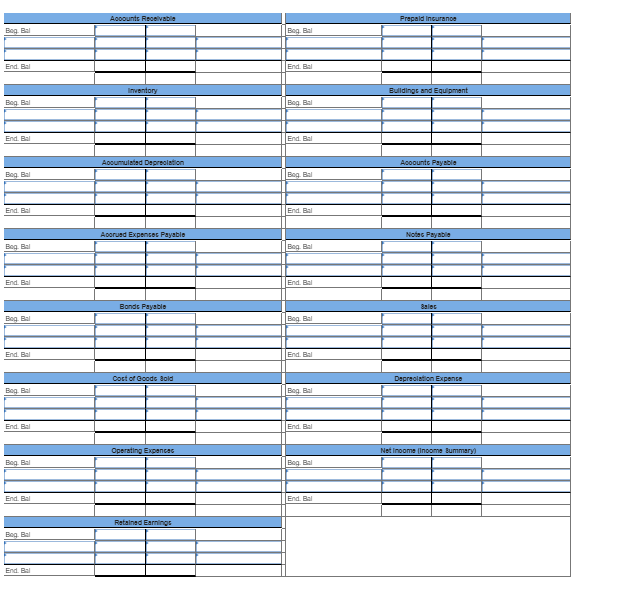

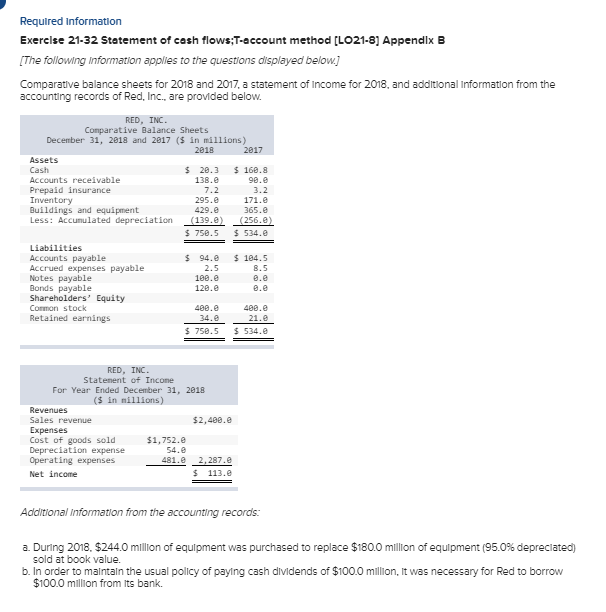

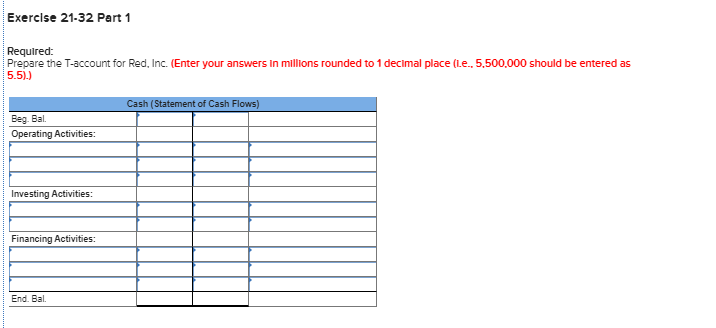

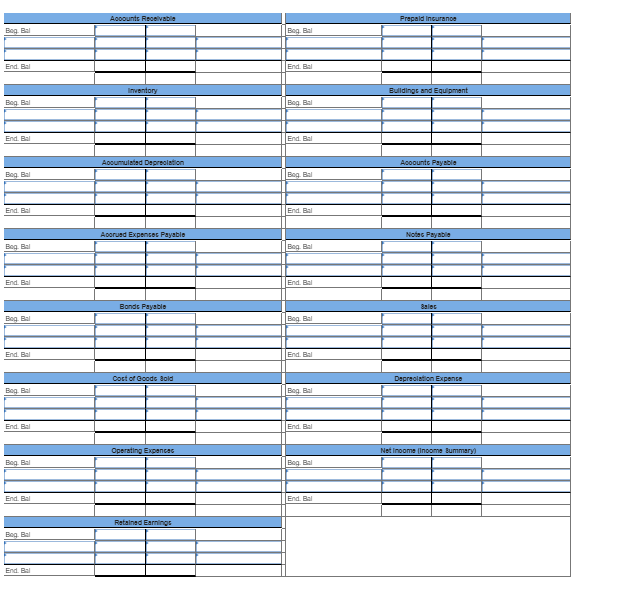

Required information Exercise 21-32 Statement of cash flows;T-account method [LO21-8] Appendix B [The following information applies to the questions displayed below] Comparative balance sheets for 2018 and 2017. a statement of Income for 2018, and additional Information from the accounting records of Red, Inc., are provided below. RED, INC. Comparative Balance Sheets December 31, 2018 and 2017 ($ in millions) 2018 2017 Cash Accounts receivable Prepaid insurance Inventory Buildings and equipment Less: Accumulated depreciation $ 20,3 138.0 7.2 295.0 429. 0 (139.0) $ 750.5 $160.8 90.0 3.2 171.e 365.e (256.0) $534. $ $ 104.5 Liabilities Accounts payable Accrued expenses payable Notes payable Bonds payable Shareholders' Equity Common stock Retained earnings 94.0 2.5 100. 120.2 480.0 34.0 $ 750.5 400.e 21.0 5 534.0 RED, INC. Statement of Income For Year Ended December 31, 2018 ($ in millions) Revenues Sales revenue $2,480. Expenses Cost of goods sold $1,752.0 Depreciation expense 54.0 Operating expenses 481.2 2,287.e Net income $ 113. Additional Information from the accounting records: a. During 2018. $244.0 million of equipment was purchased to replace $180.0 million of equipment (95.0% depreciated) sold at book value. b. In order to maintain the usual policy of paying cash dividends of $100.0 million. It was necessary for Red to borrow $100.0 million from its bank. Required information Exercise 21-32 Statement of cash flows;T-account method [LO21-8] Appendix B [The following information applies to the questions displayed below] Comparative balance sheets for 2018 and 2017. a statement of Income for 2018, and additional Information from the accounting records of Red, Inc., are provided below. RED, INC. Comparative Balance Sheets December 31, 2018 and 2017 ($ in millions) 2018 2017 Cash Accounts receivable Prepaid insurance Inventory Buildings and equipment Less: Accumulated depreciation $ 20,3 138.0 7.2 295.0 429. 0 (139.0) $ 750.5 $160.8 90.0 3.2 171.e 365.e (256.0) $534. $ $ 104.5 Liabilities Accounts payable Accrued expenses payable Notes payable Bonds payable Shareholders' Equity Common stock Retained earnings 94.0 2.5 100. 120.2 480.0 34.0 $ 750.5 400.e 21.0 5 534.0 RED, INC. Statement of Income For Year Ended December 31, 2018 ($ in millions) Revenues Sales revenue $2,480. Expenses Cost of goods sold $1,752.0 Depreciation expense 54.0 Operating expenses 481.2 2,287.e Net income $ 113. Additional Information from the accounting records: a. During 2018. $244.0 million of equipment was purchased to replace $180.0 million of equipment (95.0% depreciated) sold at book value. b. In order to maintain the usual policy of paying cash dividends of $100.0 million. It was necessary for Red to borrow $100.0 million from its bank