Answered step by step

Verified Expert Solution

Question

1 Approved Answer

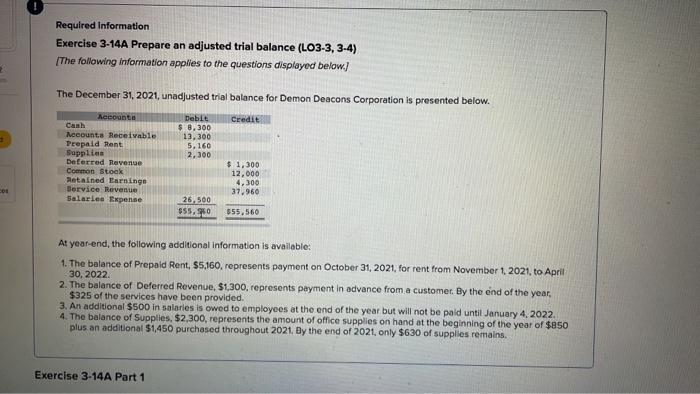

Required Information Exercise 3-14A Prepare an adjusted trial balance (LO3-3, 3-4) [The following Information applies to the questions displayed below.] 2 The December 31,

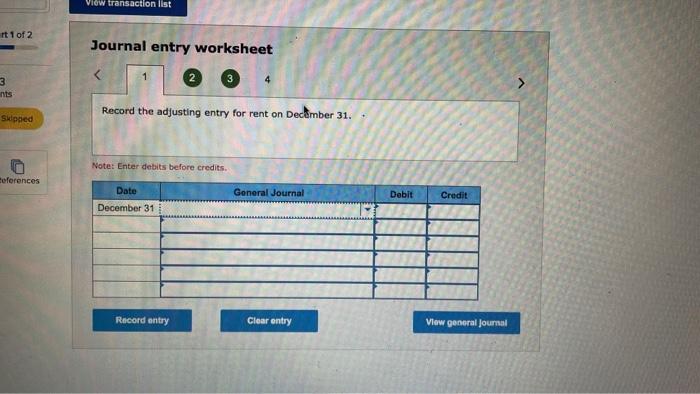

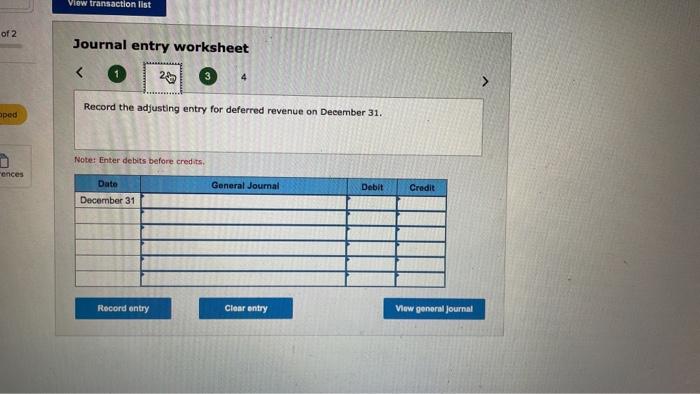

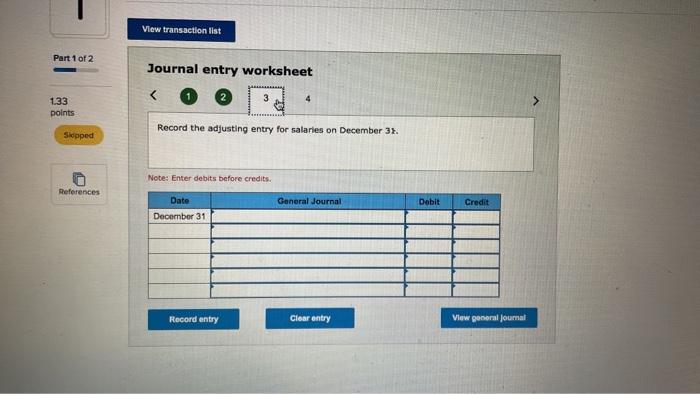

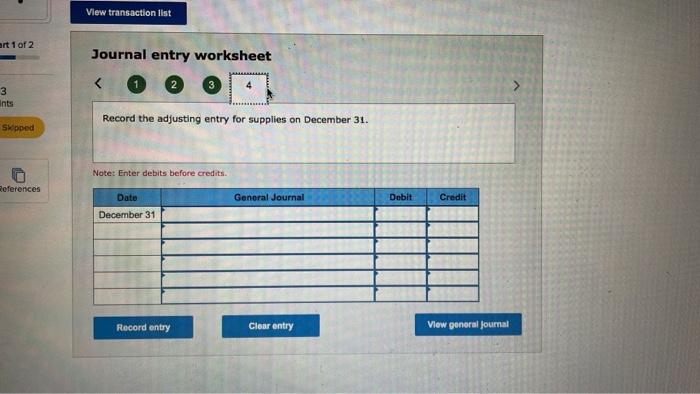

Required Information Exercise 3-14A Prepare an adjusted trial balance (LO3-3, 3-4) [The following Information applies to the questions displayed below.] 2 The December 31, 2021, unadjusted trial balance for Demon Deacons Corporation is presented below. Accounts Cash Accounts Receivable Prepaid Rent Debit $ 8,300 13,300 5,160 Credit Supplies Deferred Revenue Common Stock Retained Earnings Service Revenue Salaries Expense 2,300 $1,300 12,000 4,300 37,960 26,500 $55,260 $55,560 At year-end, the following additional information is available: 1. The balance of Prepaid Rent, $5,160, represents payment on October 31, 2021, for rent from November 1, 2021, to April 30, 2022. 2. The balance of Deferred Revenue, $1,300, represents payment in advance from a customer. By the end of the year, $325 of the services have been provided. 3. An additional $500 in salaries is owed to employees at the end of the year but will not be paid until January 4, 2022. 4. The balance of Supplies, $2,300, represents the amount of office supplies on hand at the beginning of the year of $850 plus an additional $1,450 purchased throughout 2021. By the end of 2021, only $630 of supplies remains. Exercise 3-14A Part 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started