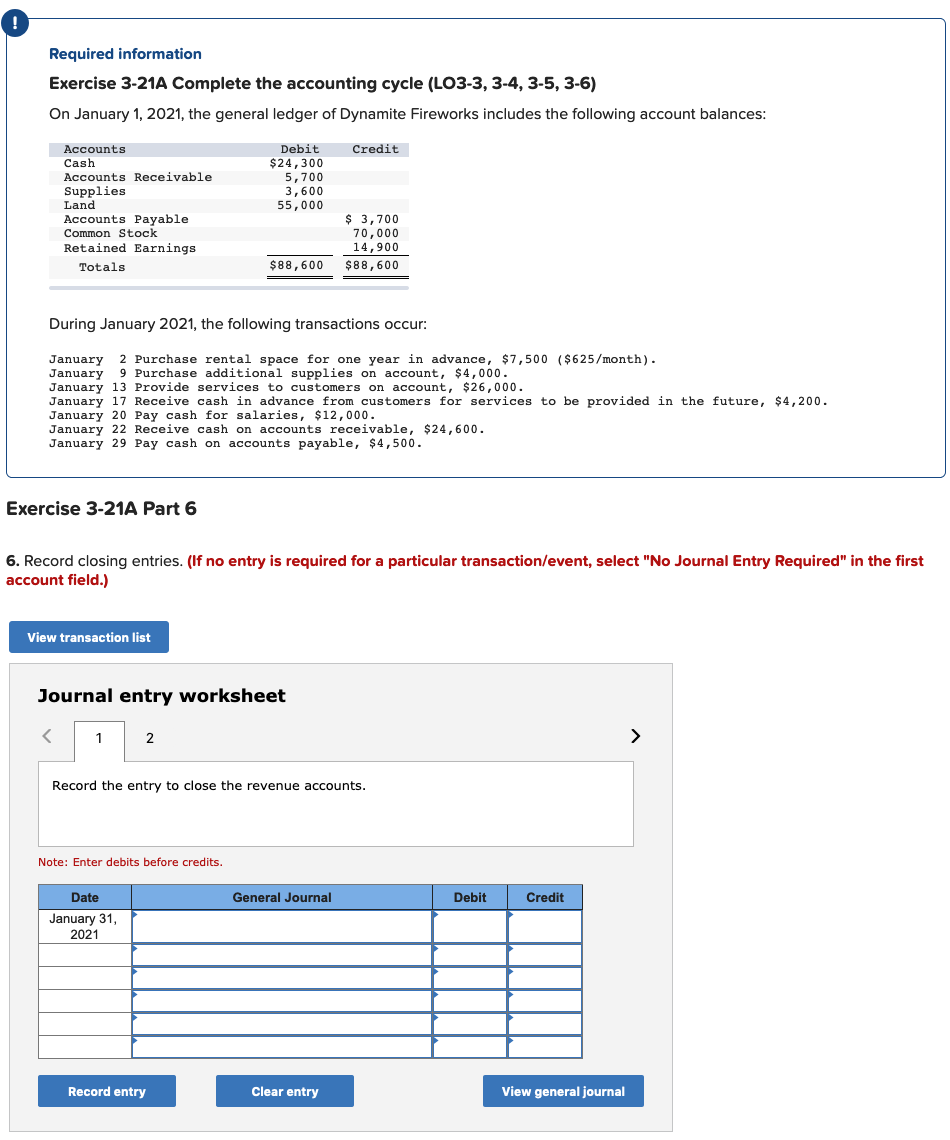

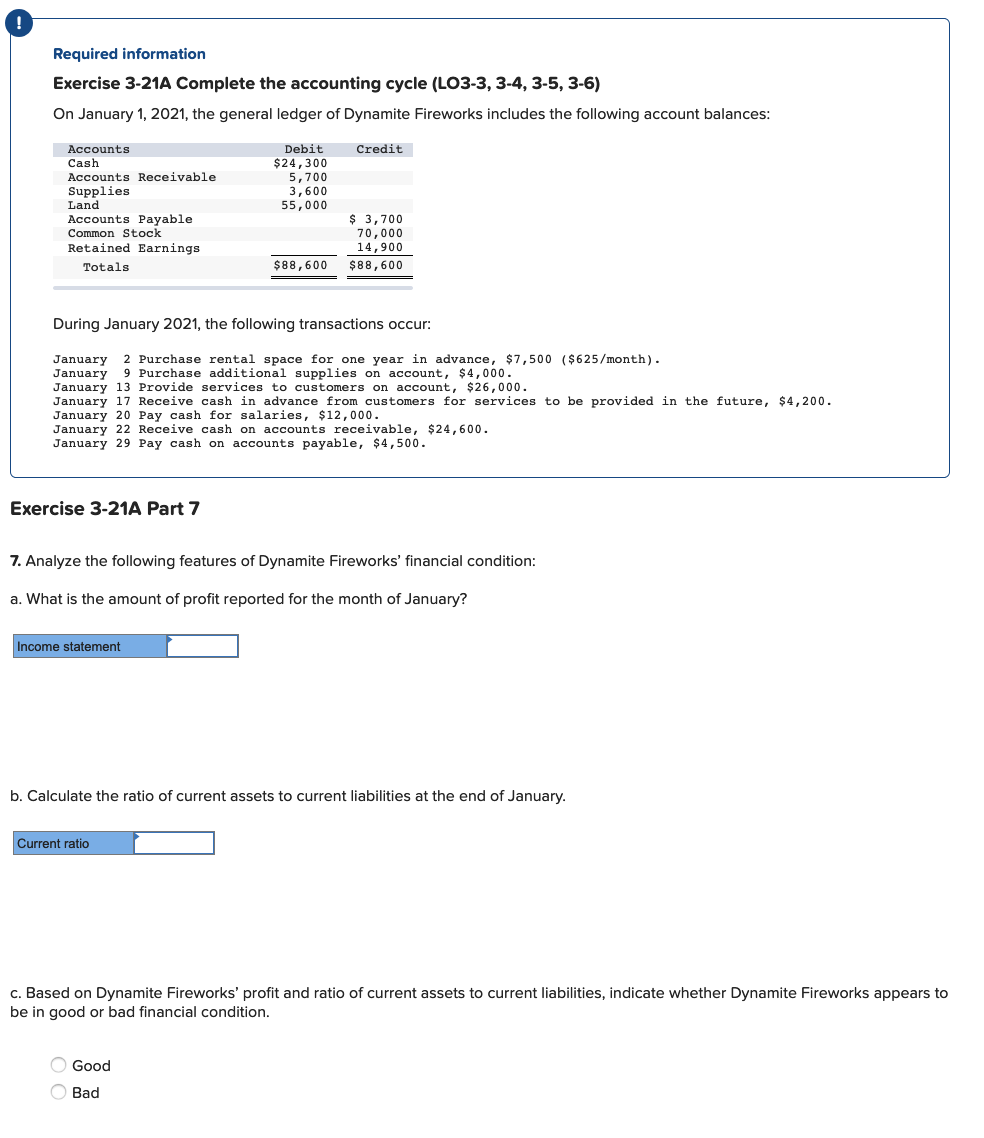

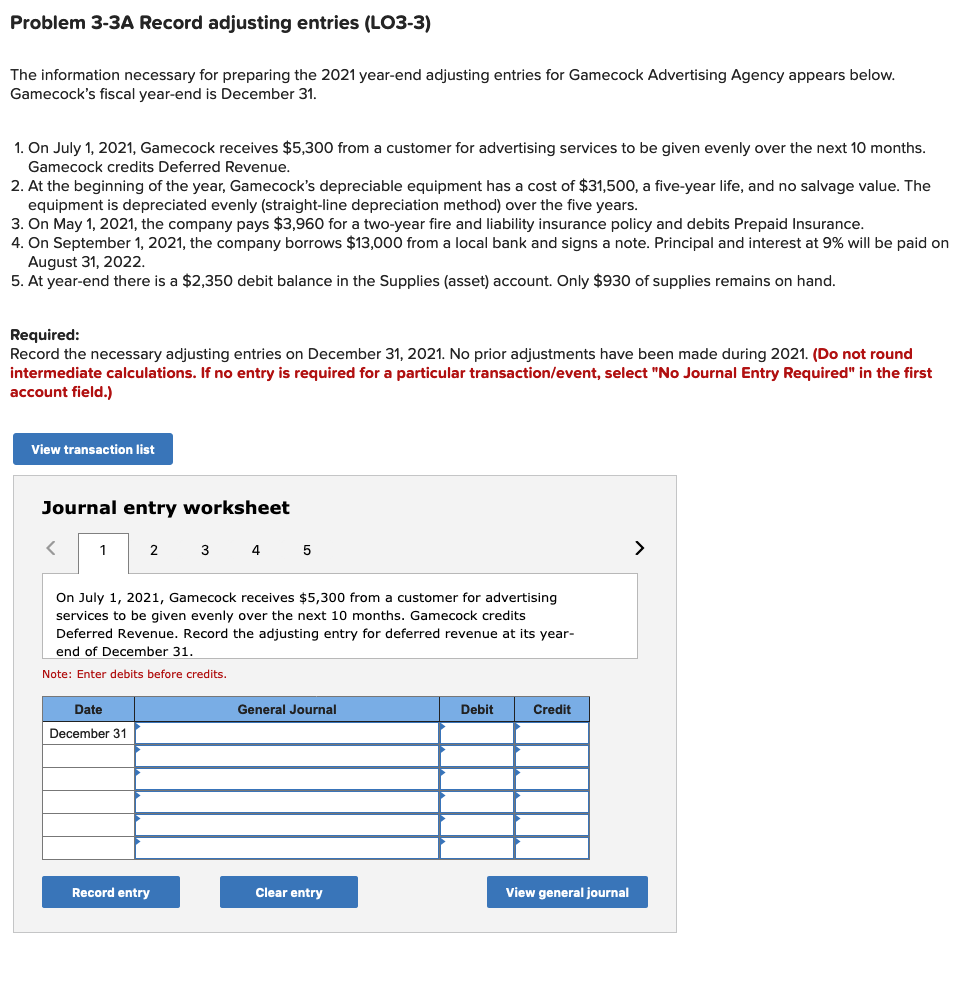

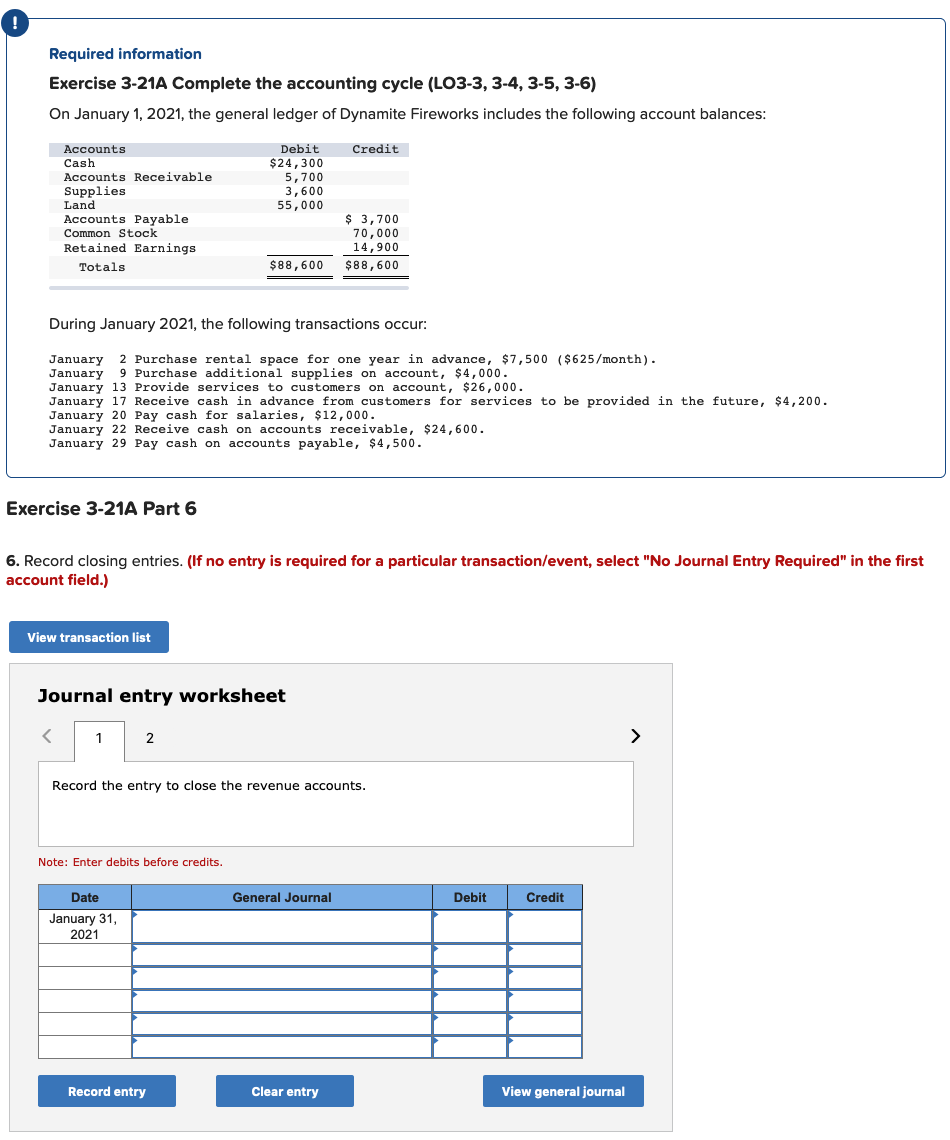

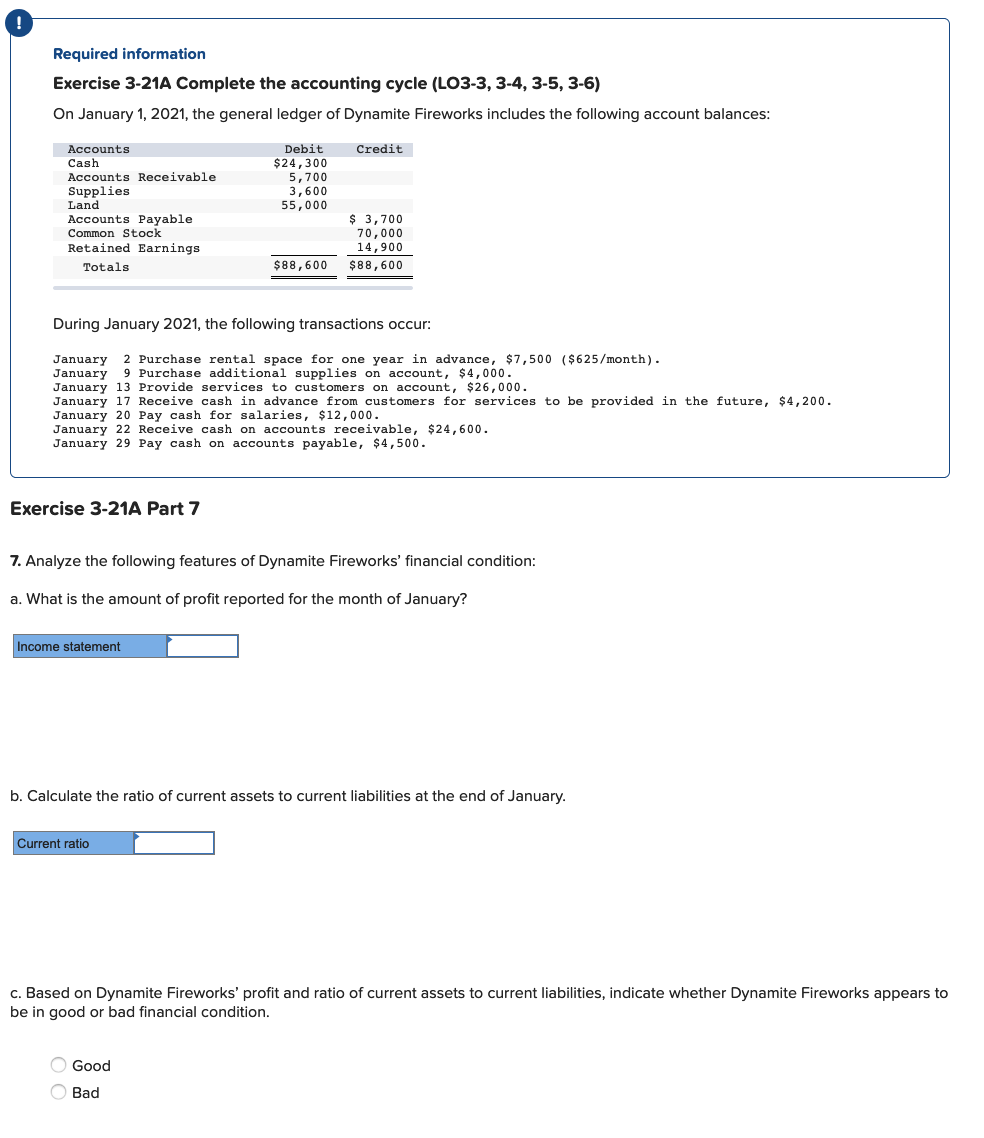

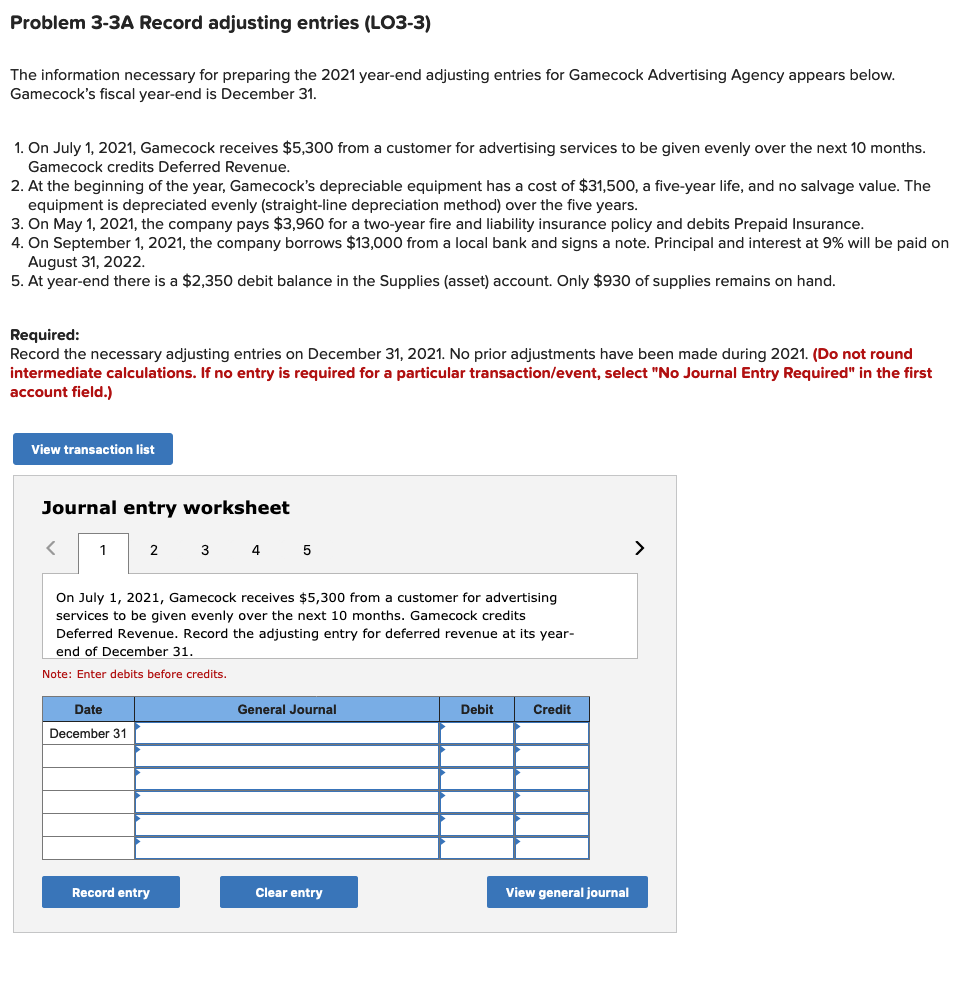

Required information Exercise 3-21A Complete the accounting cycle (LO3-3, 3-4, 3-5, 3-6) On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances: Credit Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Totals Debit $ 24,300 5,700 3,600 55,000 $ 3,700 70,000 14,900 $88,600 $88,600 During January 2021, the following transactions occur: January 2 Purchase rental space for one year in advance, $7,500 ($625/month). January 9 Purchase additional supplies on account, $4,000. January 13 Provide services to customers on account, $ 26,000. January 17 Receive cash in advance from customers for services to be provided in the future, $4,200. January 20 Pay cash for salaries, $12,000. January 22 Receive cash on accounts receivable, $ 24,600. January 29 Pay cash on accounts payable, $4,500. Exercise 3-21A Part 6 6. Record closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the entry to close the revenue accounts. Note: Enter debits before credits. General Journal Debit Credit Date January 31, 2021 Record entry Clear entry View general journal Required information Exercise 3-21A Complete the accounting cycle (LO3-3, 3-4, 3-5, 3-6) On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances: Credit Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Totals Debit $24,300 5,700 3,600 55,000 $ 3,700 70,000 14,900 $88,600 $88,600 During January 2021, the following transactions occur: January 2 Purchase rental space for one year in advance, $7,500 ($625/month). January 9 Purchase additional supplies on account, $4,000. January 13 Provide services to customers on account, $ 26,000. January 17 Receive cash in advance from customers for services to be provided in the future, $4,200. January 20 Pay cash for salaries, $12,000. January 22 Receive cash on accounts receivable, $ 24,600. January 29 Pay cash on accounts payable, $4,500. Exercise 3-21A Part 7 7. Analyze the following features of Dynamite Fireworks' financial condition: a. What is the amount of profit reported for the month of January? Income statement b. Calculate the ratio of current assets to current liabilities at the end of January Current ratio c. Based on Dynamite Fireworks' profit and ratio of current assets to current liabilities, indicate whether Dynamite Fireworks appears to be in good or bad financial condition. Good O Bad Problem 3-3A Record adjusting entries (LO3-3) The information necessary for preparing the 2021 year-end adjusting entries for Gamecock Advertising Agency appears below. Gamecock's fiscal year-end is December 31. 1. On July 1, 2021, Gamecock receives $5,300 from a customer for advertising services to be given evenly over the next 10 months. Gamecock credits Deferred Revenue. 2. At the beginning of the year, Gamecock's depreciable equipment has a cost of $31,500, a five-year life, and no salvage value. The equipment is depreciated evenly (straight-line depreciation method) over the five years. 3. On May 1, 2021, the company pays $3,960 for a two-year fire and liability insurance policy and debits Prepaid Insurance. 4. On September 1, 2021, the company borrows $13,000 from a local bank and signs a note. Principal and interest at 9% will be paid on August 31, 2022. 5. At year-end there is a $2,350 debit balance in the Supplies (asset) account. Only $930 of supplies remains on hand. Required: Record the necessary adjusting entries on December 31, 2021. No prior adjustments have been made during 2021. (Do not round intermediate calculations. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 5 On July 1, 2021, Gamecock receives $5,300 from a customer for advertising services to be given evenly over the next 10 months. Gamecock credits Deferred Revenue. Record the adjusting entry for deferred revenue at its year- end of December 31. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general journal