Answered step by step

Verified Expert Solution

Question

1 Approved Answer

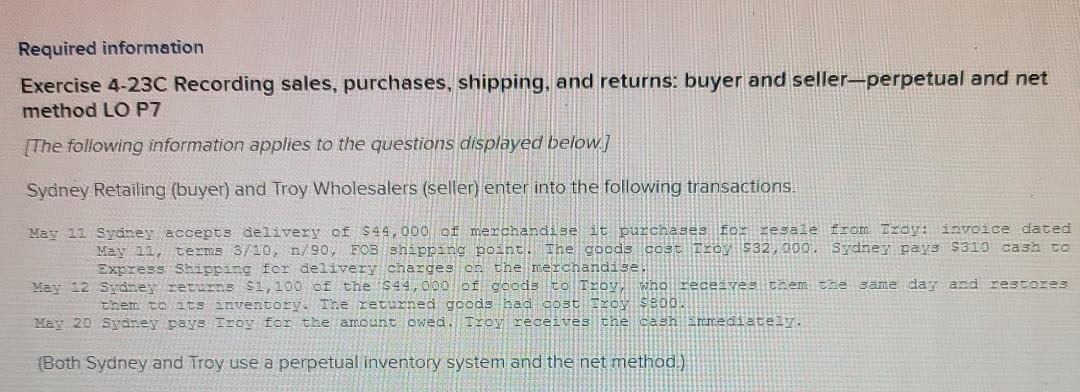

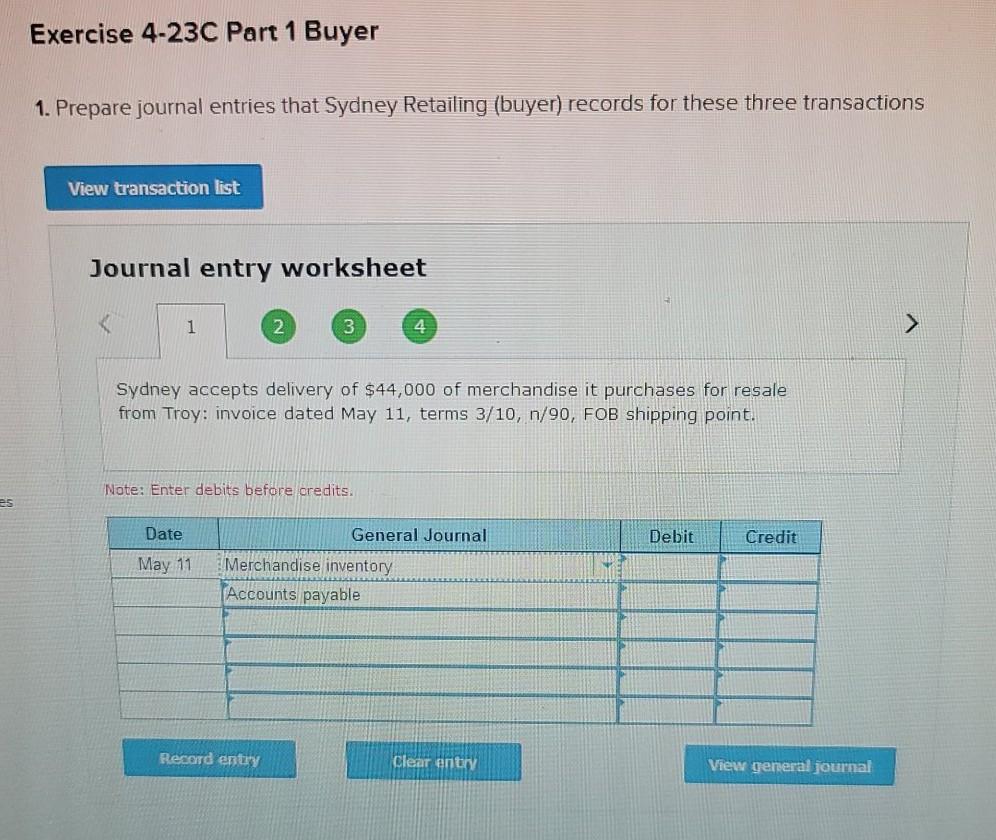

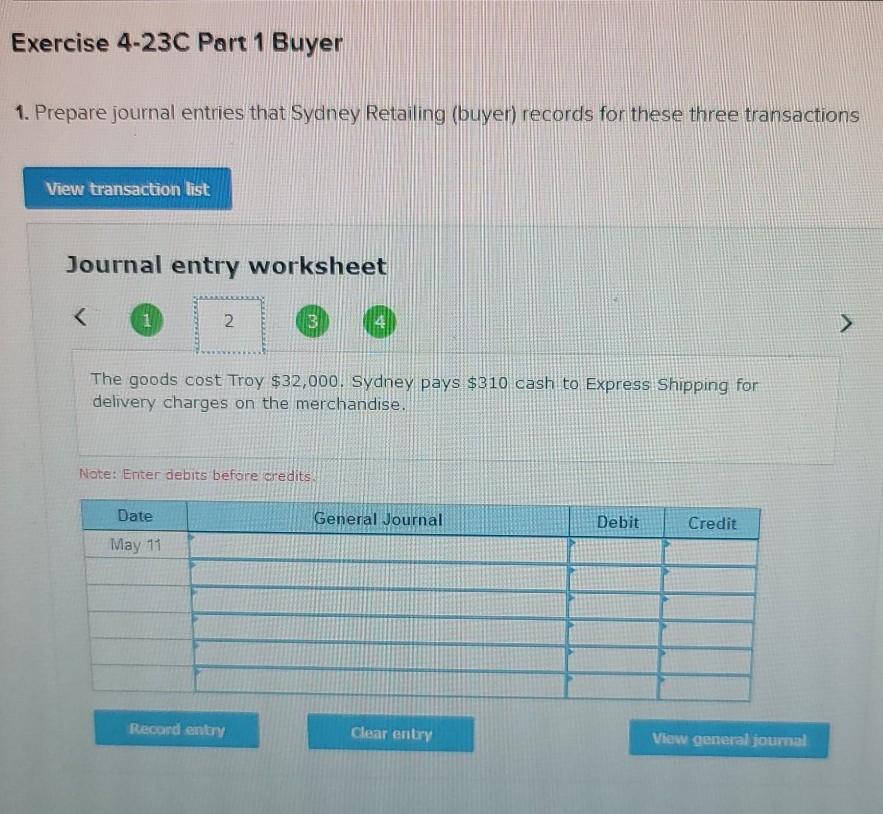

Required information Exercise 4-230 Recording sales, purchases, shipping, and returns: buyer and seller-perpetual and net method LO P7 [The following information applies to the questions

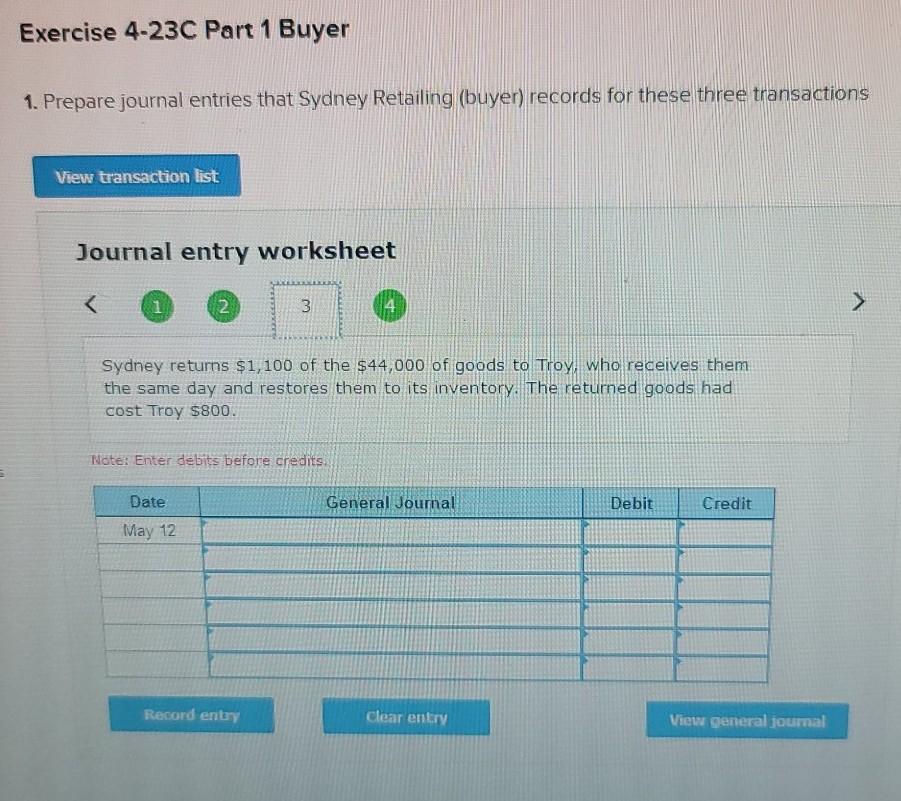

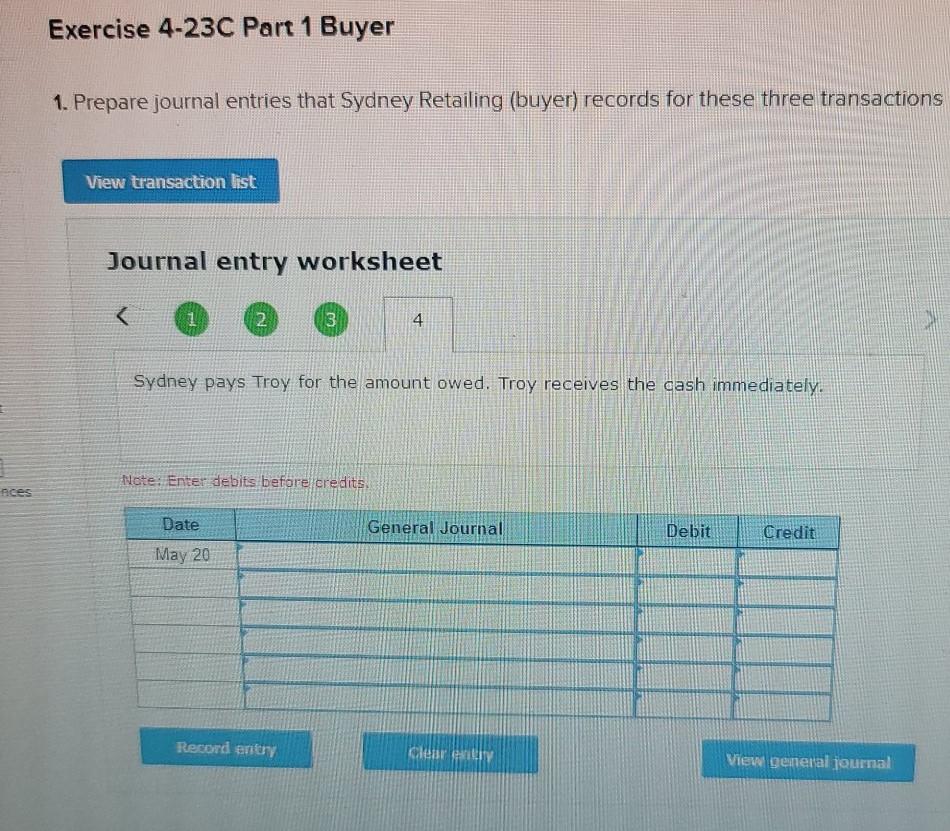

Required information Exercise 4-230 Recording sales, purchases, shipping, and returns: buyer and seller-perpetual and net method LO P7 [The following information applies to the questions displayed below] Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions, May 11 Sydney accepts delivery of $44,000 of merchandise it purchases for resale from Tzay: invoice dated May 11, terms 3/10, n/90, FOB shipping point. The goods cost Troy 532, 000. Sydney pays $310 cash to Express Shipping for delivery charges on the merchandise May 32 Sydney returns $1,100 of the $44,000 of goods to Troy, who receives them se same day and restores them to ats inventory. The returned goods had cost Troy $200. May 20 Sydney pays Troy for the amount owed. Troy receives the cash mediately. (Both Sydney and Troy use a perpetual inventory system and the net method.) Exercise 4-23C Part 1 Buyer 1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions View transaction list Journal entry worksheet 1 2 3 4 Sydney accepts delivery of $44,000 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/10, n/90, FOB shipping point. Note: Enter debits before credits es General Journal Debit Credit Date May 11 Merchandise inventory TAccounts payable Record entry Clear entry View general journal Exercise 4-23C Part 1 Buyer 1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions View transaction list Journal entry worksheet The goods cost Troy $32,000. Sydney pays $310 cash to Express Shipping for delivery charges on the merchandise. Note: Enter debits before credits Date General Journal Debit Credit May 11 Record entry Clear entry View general journal Exercise 4-23C Part 1 Buyer 1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions View transaction list Journal entry worksheet 2 3 > Sydney returns $1,100 of the $44,000 of goods to Troy, who receives them the same day and restores them to its inventory. The returned goods had cost Troy $800. Note: Enter debits before credits. Date General Journal Debit Credit May 12 Record entry Clear entry View general journal Exercise 4-23C Part 1 Buyer 1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started