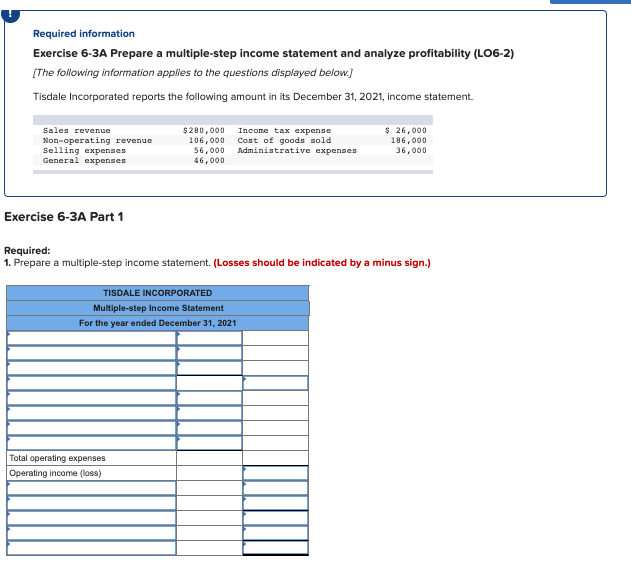

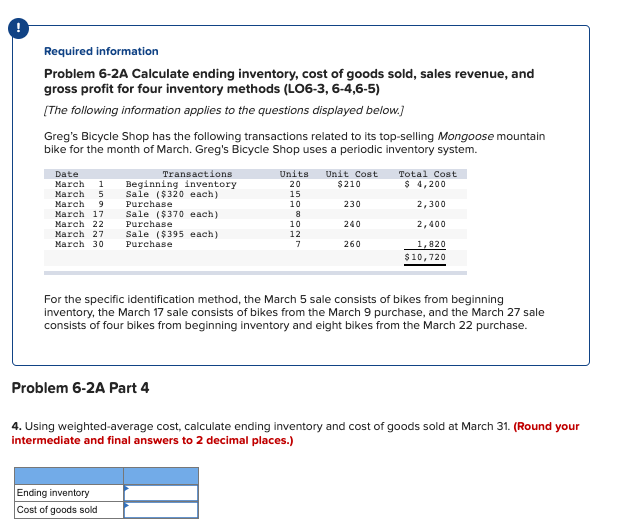

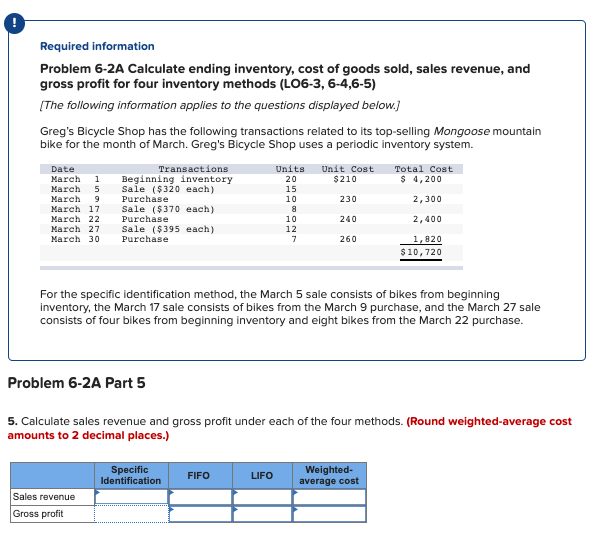

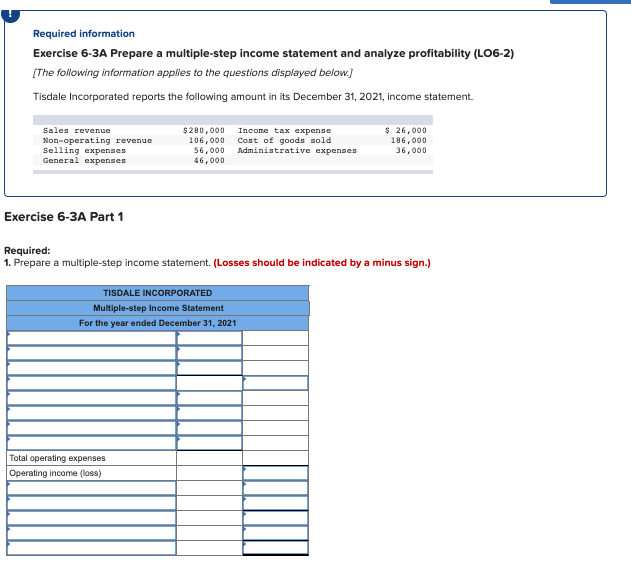

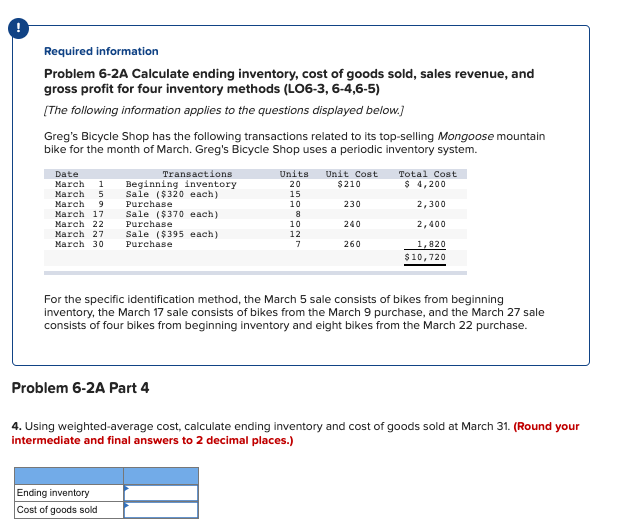

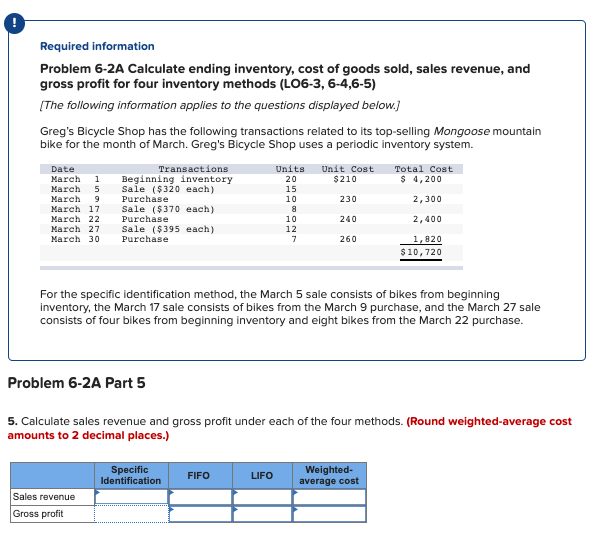

Required information Exercise 6-3A Prepare a multiple-step income statement and analyze profitability (L06-2) [The following information applies to the questions displayed below.) Tisdale Incorporated reports the following amount in its December 31, 2021, income statement. Sales revenue Non-operating revenue Selling expenses General expenses $280,000 106,000 56,000 46,000 Income tax expense Cost of goods sold Administrative expenses $ 26,000 186,000 36,000 Exercise 6-3A Part 1 Required: 1. Prepare a multiple-step income statement. (Losses should be indicated by a minus sign.) TISDALE INCORPORATED Multiple-step Income Statement For the year ended December 31, 2021 Total operating expenses Operating income (loss) Required information Problem 6-2A Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four inventory methods (L06-3, 6-4,6-5) [The following information applies to the questions displayed below.] Greg's Bicycle Shop has the following transactions related to its top-selling Mongoose mountain bike for the month of March. Greg's Bicycle Shop uses a periodic inventory system. Date Transactions Units Unit Cost Total cost March 1 Beginning inventory 20 $210 $ 4,200 March 5 Sale ($320 each) 15 March 9 Purchase 10 230 2,300 March 17 Sale ($370 each) 8 March 22 Purchase 10 240 2,400 March 27 Sale ($395 each) 12 March 30 Purchase 7 260 1,820 $10,720 For the specific identification method, the March 5 sale consists of bikes from beginning inventory, the March 17 sale consists of bikes from the March 9 purchase, and the March 27 sale consists of four bikes from beginning inventory and eight bikes from the March 22 purchase. Problem 6-2A Part 4 4. Using weighted-average cost, calculate ending inventory and cost of goods sold at March 31. (Round your intermediate and final answers to 2 decimal places.) Ending inventory Cost of goods sold Required information Problem 6-2A Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four inventory methods (LO6-3, 6-4,6-5) [The following information applies to the questions displayed below.] Greg's Bicycle Shop has the following transactions related to its top-selling Mongoose mountain bike for the month of March. Greg's Bicycle Shop uses a periodic inventory system. Date Transactions Units Unit Cost Total Cost March Beginning inventory $ 210 $ 4,200 March 5 Sale ($320 each) Purchase 2,300 Sale ($370 each) Purchase 2,400 Sale ($395 each) Purchase 1,820 $10,720 1 230 March 9 March 17 March 22 March 27 March 30 20 15 10 8 10 12 7 240 260 For the specific identification method, the March 5 sale consists of bikes from beginning inventory, the March 17 sale consists of bikes from the March 9 purchase, and the March 27 sale consists of four bikes from beginning inventory and eight bikes from the March 22 purchase. Problem 6-2A Part 5 5. Calculate sales revenue and gross profit under each of the four methods. (Round weighted-average cost amounts to 2 decimal places.) Specific Identification FIFO LIFO Weighted- average cost Sales revenue Gross profit