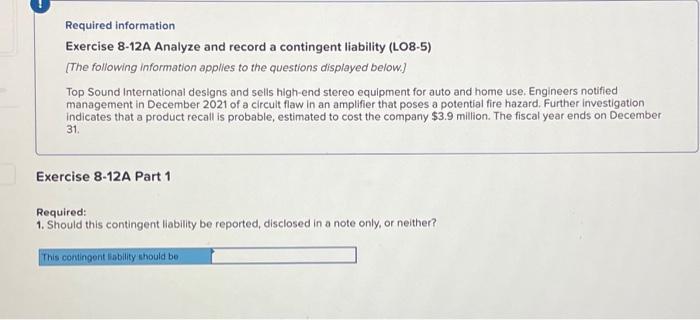

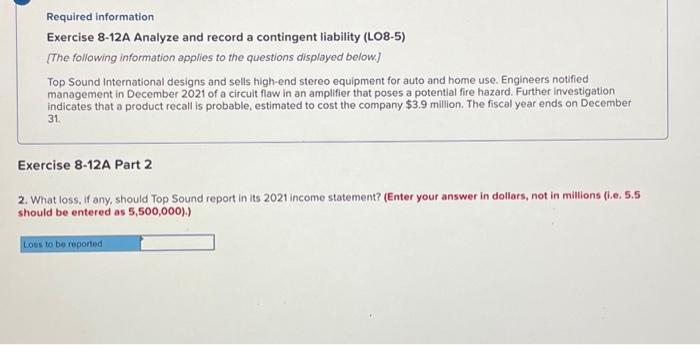

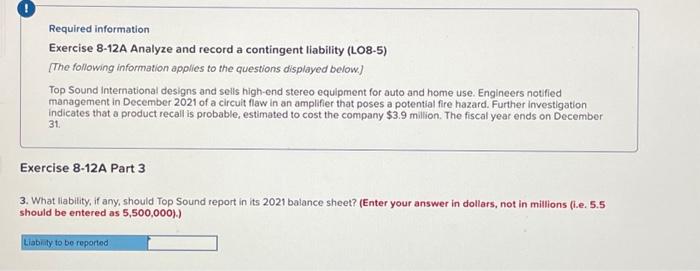

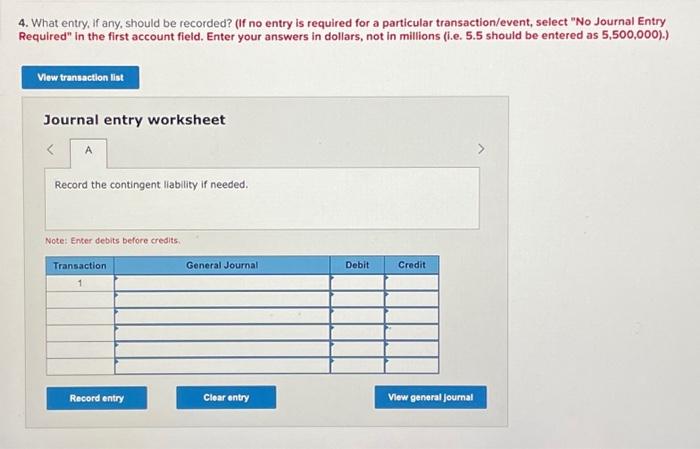

Required information Exercise 8-12A Analyze and record a contingent liability (LO8-5) [The following information applies to the questions displayed below] Top Sound International designs and selis high-end stereo equipment for auto and home use. Engineers notified management in December 2021 of a circult flaw in an amplifier that poses a potential fire hazard. Further investigation indicates that a product recall is probable, estimated to cost the company $3.9 million. The fiscal year ends on December 31. Exercise 8-12A Part 1 Required: 1. Should this contingent liability be reported, disclosed in a note only, or neither? Required information Exercise 8-12A Analyze and record a contingent liability (LO8-5) [The following information applies to the questions displayed below] Top Sound International designs and sells high-end stereo equipment for auto and home use. Engineers notified management in December 2021 of a circuit fiaw in an amplifier that poses a potential fire hazard. Further investigation indicates that a product recall is probable, estimated to cost the company $3.9 million. The fiscal year ends on December 31. xercise 812 A Part 2 What loss. If any, should Top Sound report in its 2021 income statement? (Enter your answer in dollars, not in millions (i.e. 5.5 hould be entered as 5,500,000).) Required information Exercise 8-12A Analyze and record a contingent liability (LO8-5) [The following information applies to the questions displayed bolow.] Top Sound international designs and sells high-end stereo equipment for auto and home use. Engineers notified management in December 2021 of a circuit flaw in an amplifier that poses a potential fire hazard. Further investigation indicates that a product recall is probable, estimated to cost the company $3.9 million. The fiscal year ends on December 31. Exercise 812 A Part 3 What llability, if any, should Top Sound report in its 2021 balance sheet? (Enter your answer in dollars, not in millions (i.e. 5.5 hould be entered as 5,500,000).) 4. What entry, if any, should be recorded? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field. Enter your answers in dollars, not in millions (i.e. 5.5 should be entered as 5,500,000).) Journal entry worksheet Note: Enter debits before cregits. Required information Exercise 8-12A Analyze and record a contingent liability (LO8-5) [The following information applies to the questions displayed below] Top Sound International designs and selis high-end stereo equipment for auto and home use. Engineers notified management in December 2021 of a circult flaw in an amplifier that poses a potential fire hazard. Further investigation indicates that a product recall is probable, estimated to cost the company $3.9 million. The fiscal year ends on December 31. Exercise 8-12A Part 1 Required: 1. Should this contingent liability be reported, disclosed in a note only, or neither? Required information Exercise 8-12A Analyze and record a contingent liability (LO8-5) [The following information applies to the questions displayed below] Top Sound International designs and sells high-end stereo equipment for auto and home use. Engineers notified management in December 2021 of a circuit fiaw in an amplifier that poses a potential fire hazard. Further investigation indicates that a product recall is probable, estimated to cost the company $3.9 million. The fiscal year ends on December 31. xercise 812 A Part 2 What loss. If any, should Top Sound report in its 2021 income statement? (Enter your answer in dollars, not in millions (i.e. 5.5 hould be entered as 5,500,000).) Required information Exercise 8-12A Analyze and record a contingent liability (LO8-5) [The following information applies to the questions displayed bolow.] Top Sound international designs and sells high-end stereo equipment for auto and home use. Engineers notified management in December 2021 of a circuit flaw in an amplifier that poses a potential fire hazard. Further investigation indicates that a product recall is probable, estimated to cost the company $3.9 million. The fiscal year ends on December 31. Exercise 812 A Part 3 What llability, if any, should Top Sound report in its 2021 balance sheet? (Enter your answer in dollars, not in millions (i.e. 5.5 hould be entered as 5,500,000).) 4. What entry, if any, should be recorded? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field. Enter your answers in dollars, not in millions (i.e. 5.5 should be entered as 5,500,000).) Journal entry worksheet Note: Enter debits before cregits