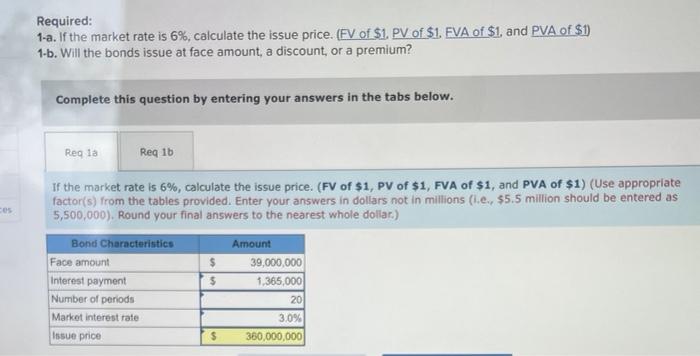

Required information Exercise 9-21 (Algo) Calculate the issue price of bonds (LO9-7) [The following information applies to the questions displayed below.] On January 1,2024 , Adventure World issues $39.0 million of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. The proceeds will be used to build a ride that combines a roller coaster, a water ride, a dark tunnel, and the great smell of outdoor barbeq all in one ride. Exercise 9-21 (Algo) Part 1 Required: 1-a. If the market rate is 6%, calculate the issue price. (FV of $1, PV of $1, FVA of $1, and PVA of $1 ) 1-b. Will the bonds issue at face amount, a discount, or a premium? Complete this question by entering your answers in the tabs below. If the market rate is 6%, calculate the issue price. (FV of $1,PV of $1,FVA of $1, and PVA of $1 ) (Use appro fartarle) from the tahlec nrovided Fnter vour answers in dollars not in millions (1.e.. $5.5 million should be enter Required: 1-a. If the market rate is 6%, calculate the issue price. (FV of \$1, PV of \$1. FVA of \$1, and PVA of \$1) 1-b. Will the bonds issue at face amount, a discount, or a premium? Complete this question by entering your answers in the tabs below. If the market rate is 6%, calculate the issue price. (FV of $1, PV of $1, FVA of $1, and PVA of $1 ) (Use appropriate factor(s) from the tables provided. Enter your answers in dollars not in millions (i.e., $5.5 million should be entered as 5,500,000). Round your final answers to the nearest whole dollar.) Required information Exercise 9-21 (Algo) Calculate the issue price of bonds (LO9-7) [The following information applies to the questions displayed below.] On January 1,2024 , Adventure World issues $39.0 million of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. The proceeds will be used to build a ride that combines a roller coaster, a water ride, a dark tunnel, and the great smell of outdoor barbeq all in one ride. Exercise 9-21 (Algo) Part 1 Required: 1-a. If the market rate is 6%, calculate the issue price. (FV of $1, PV of $1, FVA of $1, and PVA of $1 ) 1-b. Will the bonds issue at face amount, a discount, or a premium? Complete this question by entering your answers in the tabs below. If the market rate is 6%, calculate the issue price. (FV of $1,PV of $1,FVA of $1, and PVA of $1 ) (Use appro fartarle) from the tahlec nrovided Fnter vour answers in dollars not in millions (1.e.. $5.5 million should be enter Required: 1-a. If the market rate is 6%, calculate the issue price. (FV of \$1, PV of \$1. FVA of \$1, and PVA of \$1) 1-b. Will the bonds issue at face amount, a discount, or a premium? Complete this question by entering your answers in the tabs below. If the market rate is 6%, calculate the issue price. (FV of $1, PV of $1, FVA of $1, and PVA of $1 ) (Use appropriate factor(s) from the tables provided. Enter your answers in dollars not in millions (i.e., $5.5 million should be entered as 5,500,000). Round your final answers to the nearest whole dollar.)