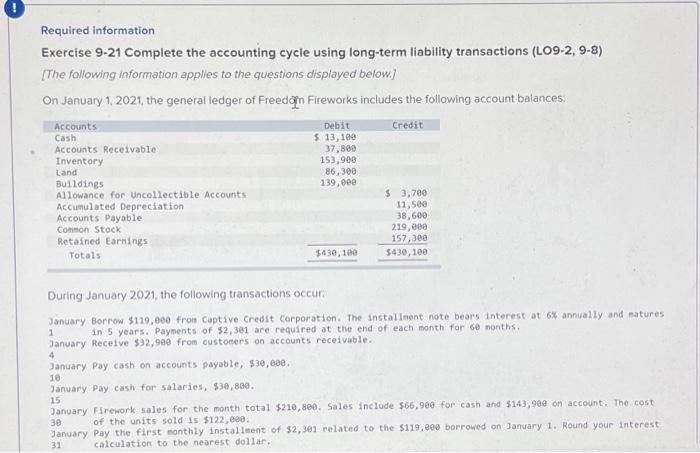

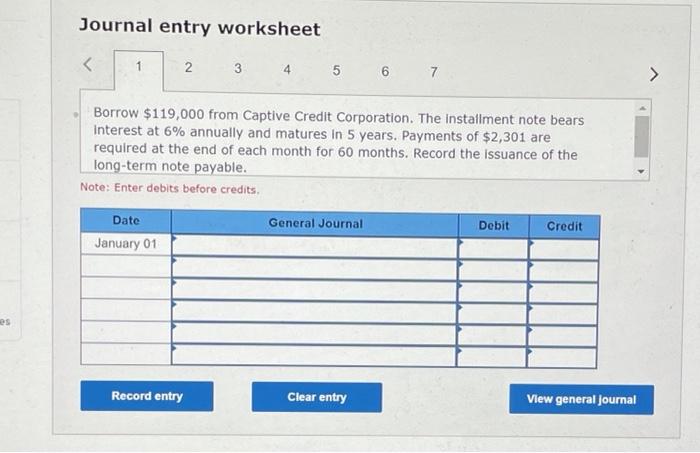

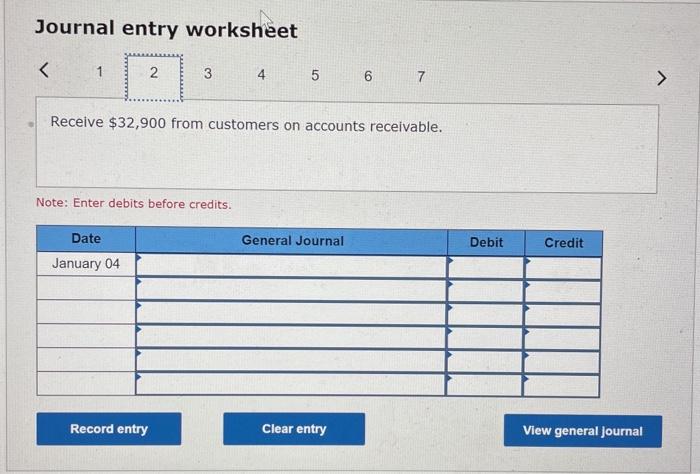

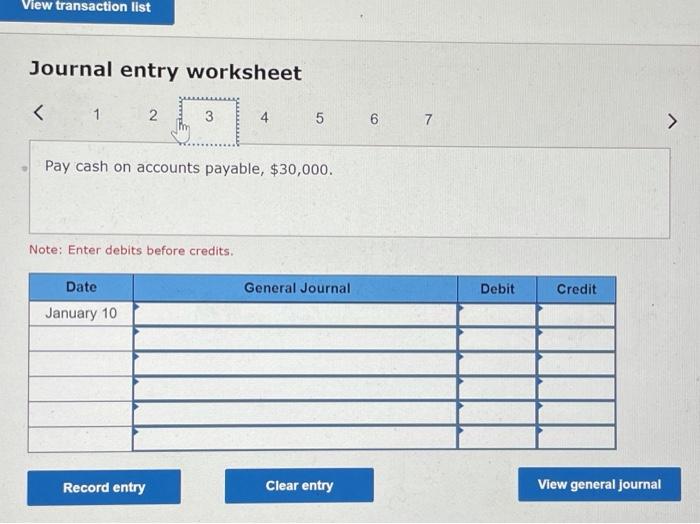

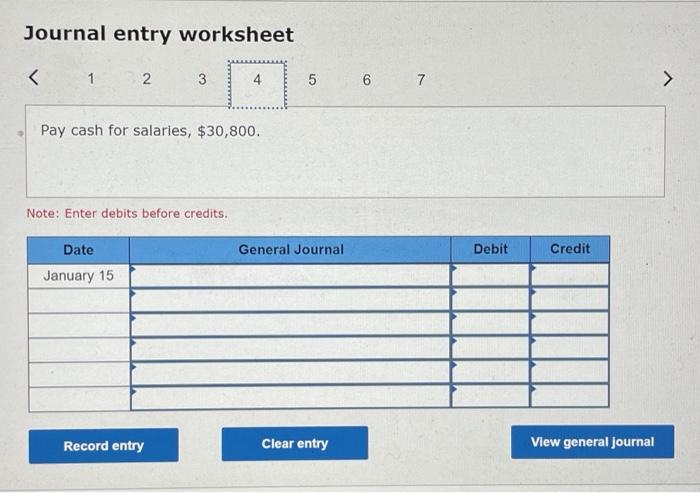

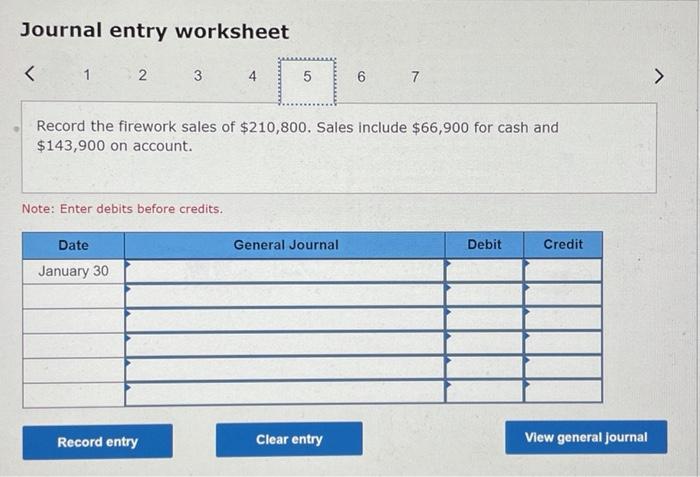

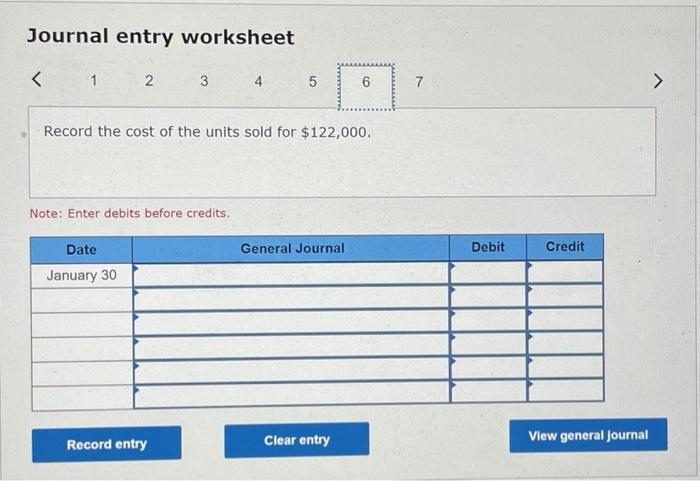

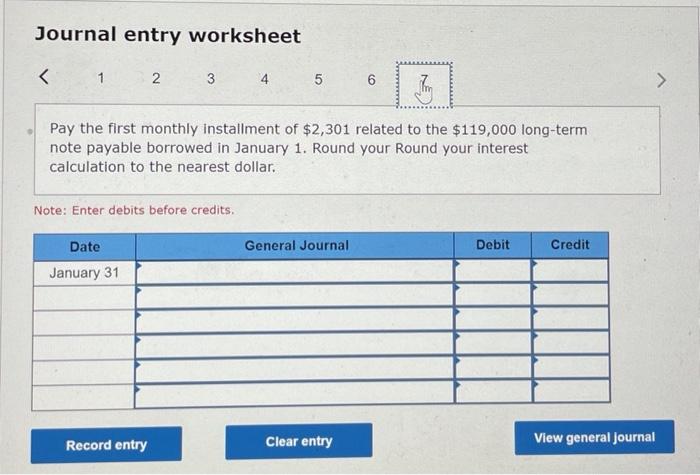

Required information Exercise 9-21 Complete the accounting cycle using long-term liability transactions (L09-2, 9-8) [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: Credit Debit $ 13,160 37,800 153,900 86,300 139,000 Accounts Cash Accounts Receivable Inventory Land Buildings Allowance for Uncollectible Accounts Accumulated Depreciation Accounts Payable Connon Stock Retained Earnings Totals $ 3,700 11,500 38,600 219,000 157,300 $430,100 $430,100 During January 2021, the following transactions occur January Borrow $119,000 from Captive Credit Corporation. The installment note bear's interest at 6% annually and matures 1 in 5 years. Payments of $2,301 are required at the end of each month for 60 months. January Receive $92,900 from customers on accounts receivable. 4 January Pay cash on accounts payable, $30,000 10 January Pay cash for salaries, $30,880. 15 January Firework sales for the month total $210,800 Sales include $66,988 for cash and $143,900 on account. The cost 3e of the units sold is $122,000 January Pay the first monthly installment of $2,901 related to the $119,000 borrowed on January 1. Round your interest 31 calculation to the nearest dollar Journal entry worksheet 1 N 3 3 4 5 6 7 Borrow $119,000 from Captive Credit Corporation. The installment note bears Interest at 6% annually and matures in 5 years. Payments of $2,301 are required at the end of each month for 60 months. Record the issuance of the long-term note payable. Note: Enter debits before credits General Journal Debit Date January 01 Credit Record entry Clear entry View general Journal Journal entry worksheet Receive $32,900 from customers on accounts receivable. Note: Enter debits before credits. Date General Journal Debit Credit January 04 Record entry Clear entry View general Journal View transaction list Journal entry worksheet Pay cash on accounts payable, $30,000. Note: Enter debits before credits. General Journal Debit Credit Date January 10 Record entry Clear entry View general journal Journal entry worksheet Pay cash for salaries, $30,800. Note: Enter debits before credits. General Journal Debit Credit Date January 15 Record entry Clear entry View general journal Journal entry worksheet Record the firework sales of $210,800. Sales include $66,900 for cash and $143,900 on account. Note: Enter debits before credits. General Journal Debit Credit Date January 30 Record entry Clear entry View general Journal Journal entry worksheet Record the cost of the units sold for $122,000. Note: Enter debits before credits. General Journal Debit Credit Date January 30 Record entry Clear entry View general Journal Journal entry worksheet