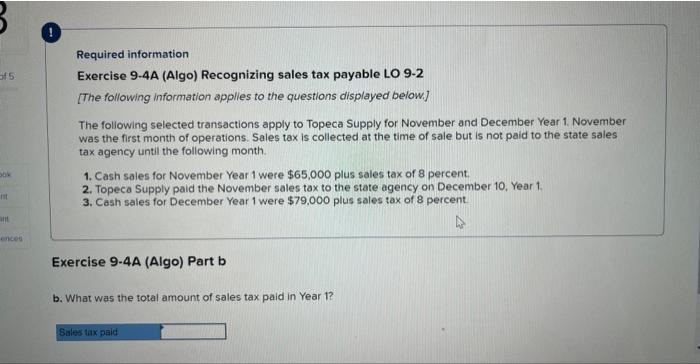

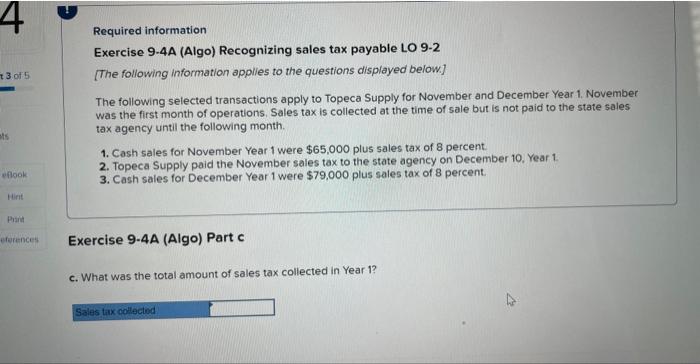

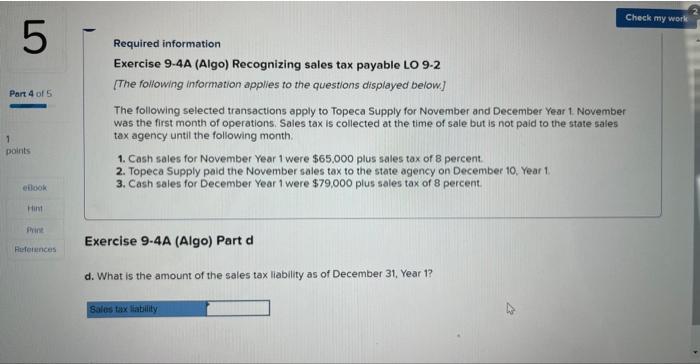

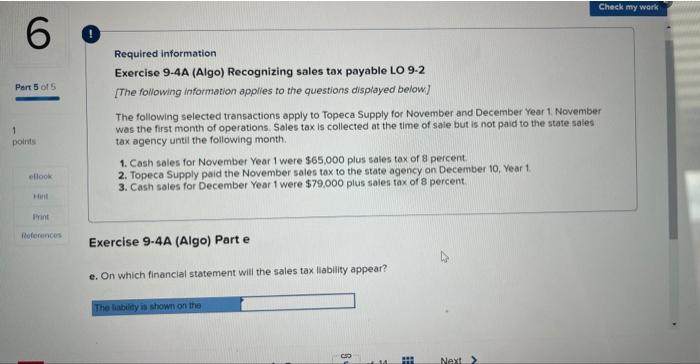

Required information Exercise 9-4A (Algo) Recognizing sales tax payable LO 9-2 [The following information applies to the questions displayed below.] The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $65,000 plus sales tax of 8 percent. 2. Topeca Supply paid the November sales tax to the state agency on December 10 , Year 1. 3. Cash sales for December Year 1 were $79.000 plus sales tax of 8 percent. Exercise 9-4A (Algo) Part b b. What was the total amount of sales tax paid in Year 1 ? Required information Exercise 9-4A (Algo) Recognizing sales tax payable LO 9-2 [The following information applies to the questions displayed below.] The following selected transactions apply to Topeca Supply for November and December Year 1, November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $65,000 plus sales tax of 8 percent: 2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1. 3. Cash sales for December Year 1 were $79,000 plus sales tax of 8 percent. Exercise 9-4A (Algo) Part c c. What was the total amount of sales tax collected in Year 1 ? Required information Exercise 9-4A (Algo) Recognizing sales tax payable LO 9-2 [The following information applies to the questions displayed below] The following selected transactions apply to Topeca Supply for November and December Year 1 November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the tate sales tax agency until the following month. 1. Cash sales for November Year 1 were $65.000 plus sales tax of 8 percent 2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1 3. Cash sales for December Year 1 were $79,000 plus sales tax of 8 percent. Exercise 9-4A (Algo) Part d d. What is the amount of the sales tax liability as of December 31, Year 1 ? Required information Exercise 9-4A (Algo) Recognizing sales tax payable LO 9-2 [The following information applies to the questions displayed below] The following selected transactions apply to Topeca Supply for November and December Year 1. November. was the first month of operations. Sales tax is collected at the time of saie but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $65,000 plus sales tax of 8 percent 2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1 3. Cash sales for December Year 1 were $79.000 plus sales tax of 8 percent Exercise 9-4A (Algo) Parte e. On which financial statement will the sales tax liability appear