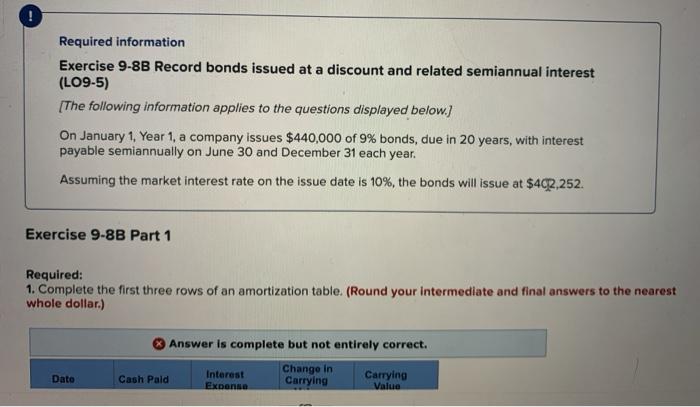

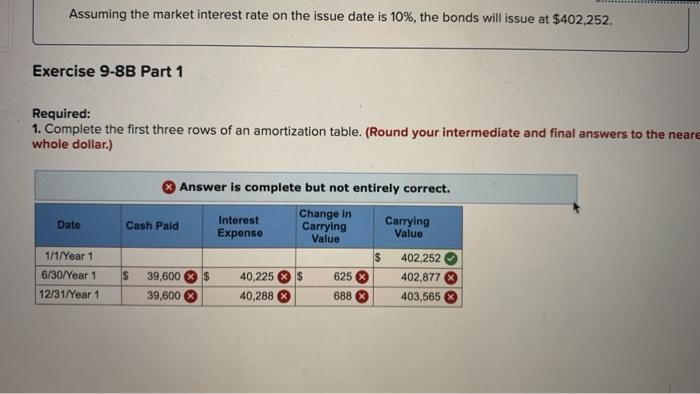

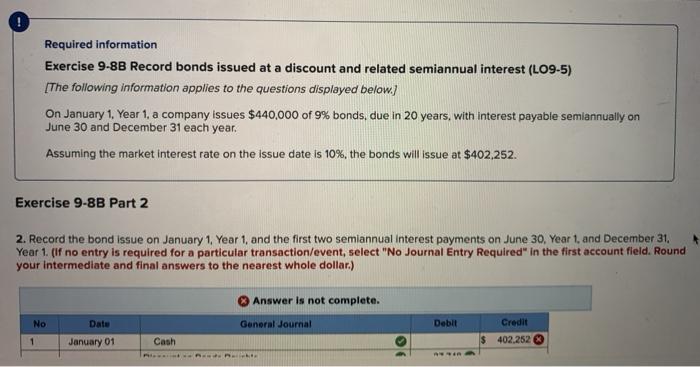

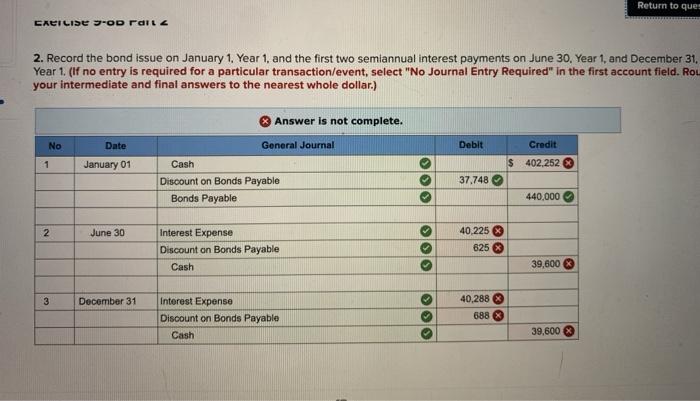

Required information Exercise 9-8B Record bonds issued at a discount and related semiannual interest (LO9-5) [The following information applies to the questions displayed below.] On January 1, Year 1, a company issues $440,000 of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. Assuming the market interest rate on the issue date is 10%, the bonds will issue at $402,252. Exercise 9-8B Part 1 Required: 1. Complete the first three rows of an amortization table. (Round your intermediate and final answers to the nearest whole dollar.) Answer is complete but not entirely correct. Chango in Interest Cash Paid Carrying Expono Carrying Value Dato Assuming the market interest rate on the issue date is 10%, the bonds will issue at $402,252. Exercise 9-8B Part 1 Required: 1. Complete the first three rows of an amortization table. (Round your intermediate and final answers to the neare whole dollar.) Date Answer is complete but not entirely correct. Interest Change in Cash Paid Carrying Carrying Expense Value Value 402,252 IS 39,600 $ 40,225 $ 625 % 402,877 39,600 40,288 688 403,565 1/1/Year 1 6/30/Year 1 12/31/Year 1 ! Required information Exercise 9-8B Record bonds issued at a discount and related semiannual interest (L09-5) [The following information applies to the questions displayed below.) On January 1, Year 1, a company issues $440,000 of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. Assuming the market interest rate on the issue date is 10%, the bonds will issue at $402,252. Exercise 9-8B Part 2 2. Record the bond issue on January 1, Yeart, and the first two semiannual Interest payments on June 30, Year 1, and December 31. Year 1. (if no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your intermediate and final answers to the nearest whole dollar.) Answer is not complete. No General Journal Debit Data January 01 Credit 402.252 1 Cash $ Return to ques CRECISE OD rait 2. Record the bond issue on January 1. Year 1, and the first two semiannual interest payments on June 30. Year 1 and December 31, Year 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Rou your intermediate and final answers to the nearest whole dollar.) Answer is not complete. No Date General Journal Debit Credit 1 January 01 $ 402.252 Cash Discount on Bonds Payable Bonds Payable 37.748 440,000 2 June 30 Interest Expense Discount on Bonds Payable Cash 40.225 625 39,600 3 December 31 Interest Expense Discount on Bonds Payable Cash 40.288 688 39,600