Start the QuickBooks Online test-drive. Using Craig's Design and Landscaping Services, complete all the hands-on work, step-by-step activities presented on pages 1 to 46,

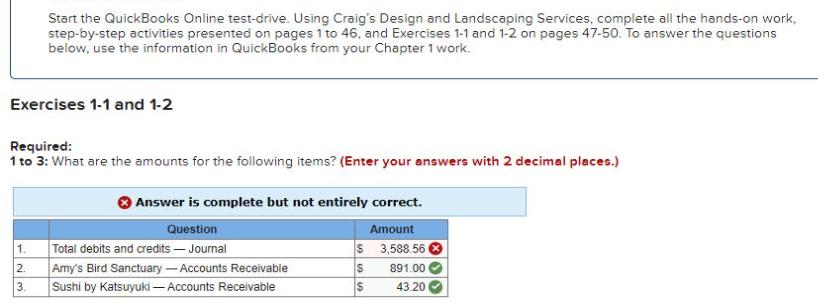

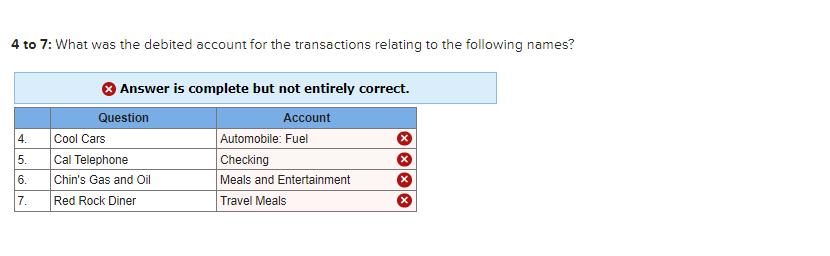

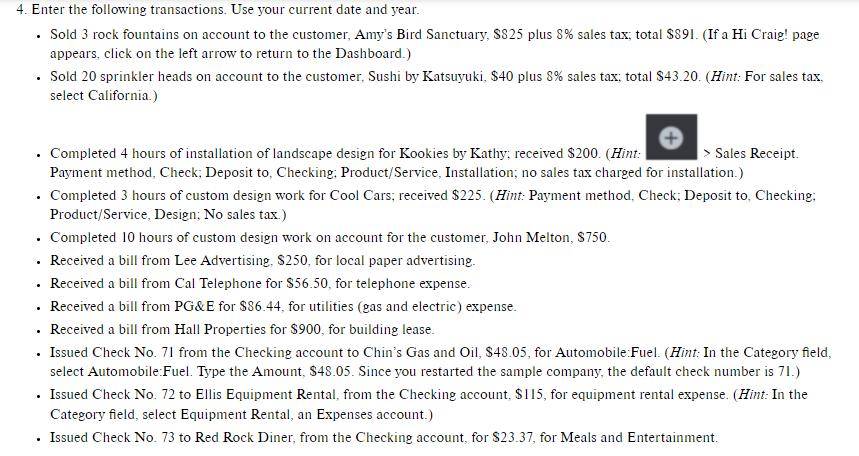

Start the QuickBooks Online test-drive. Using Craig's Design and Landscaping Services, complete all the hands-on work, step-by-step activities presented on pages 1 to 46, and Exercises 1-1 and 1-2 on pages 47-50. To answer the questions below, use the information in QuickBooks from your Chapter 1 work. Exercises 1-1 and 1-2 Required: 1 to 3: What are the amounts for the following items? (Enter your answers with 2 decimal places.) Answer is complete but not entirely correct. Question 1. Total debits and credits - Journal 23 Amy's Bird Sanctuary - Accounts Receivable 3. Sushi by Katsuyuki-Accounts Receivable Amount $ 3,588.56 $ 891.00 43.20 $ 4 to 7: What was the debited account for the transactions relating to the following names? 4. Cool Cars Cal Telephone 6. Chin's Gas and Oil 45 5. Answer is complete but not entirely correct. 67 Question 7. Red Rock Diner Account Automobile: Fuel Checking Meals and Entertainment Travel Meals X 4. Enter the following transactions. Use your current date and year. Sold 3 rock fountains on account to the customer, Amy's Bird Sanctuary, $825 plus 8% sales tax, total $891. (If a Hi Craig! page appears, click on the left arrow to return to the Dashboard.) . Sold 20 sprinkler heads on account to the customer, Sushi by Katsuyuki, $40 plus 8% sales tax; total $43.20. (Hint: For sales tax. select California.) . . Completed 3 hours of custom design work for Cool Cars; received $225. (Hint: Payment method, Check; Deposit to, Checking: Product/Service, Design: No sales tax.) Completed 10 hours of custom design work on account for the customer, John Melton, $750. . > Sales Receipt. Completed 4 hours of installation of landscape design for Kookies by Kathy; received $200. (Hint: Payment method, Check; Deposit to, Checking: Product/Service, Installation; no sales tax charged for installation.) Received a bill from Lee Advertising, $250, for local paper advertising. Received a bill from Cal Telephone for $56.50, for telephone expense. Received a bill from PG&E for $86.44, for utilities (gas and electric) expense. Received a bill from Hall Properties for $900, for building lease. . Issued Check No. 71 from the Checking account to Chin's Gas and Oil, $48.05, for Automobile:Fuel. (Hint: In the Category field, select Automobile:Fuel. Type the Amount, $48.05. Since you restarted the sample company, the default check number is 71.) . . . . Issued Check No. 72 to Ellis Equipment Rental, from the Checking account, $115, for equipment rental expense. (Hint: In the Category field, select Equipment Rental, an Expenses account.) Issued Check No. 73 to Red Rock Diner, from the Checking account, for $23.37, for Meals and Entertainment. . Check Your Figures: Checking Accounts Receivable Accounts Payable. Design Income Advertising 1,439.58 6,965.72 2,895.61 3,225.00 324.86

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine the total debits and credits lets record the provided transactions and calculate the amounts Question Amount 1 Total debits and Journal 339756 2 Amys Bird Sanctuary Accounts Receivable 89...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started