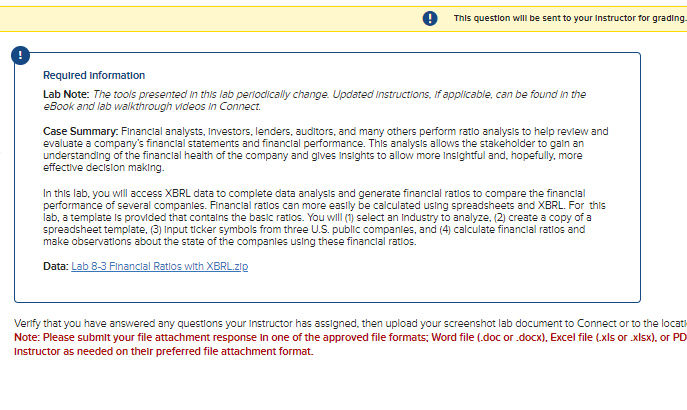

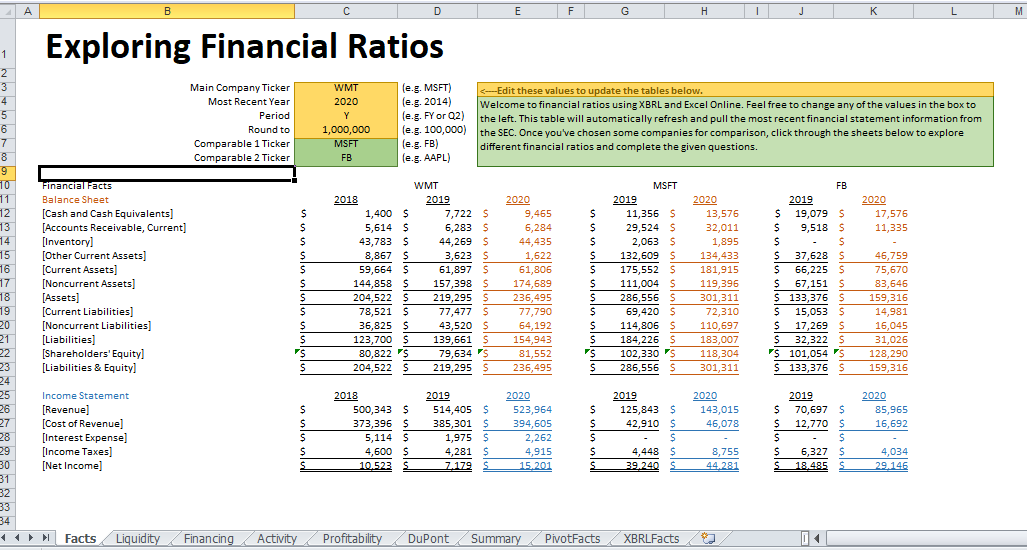

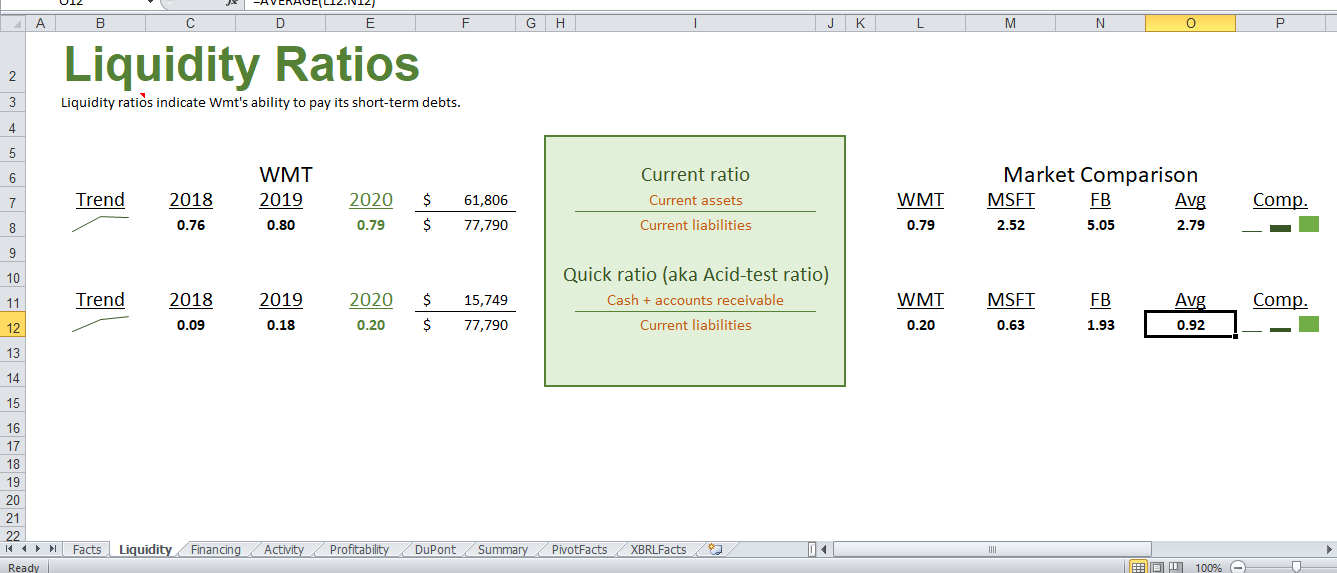

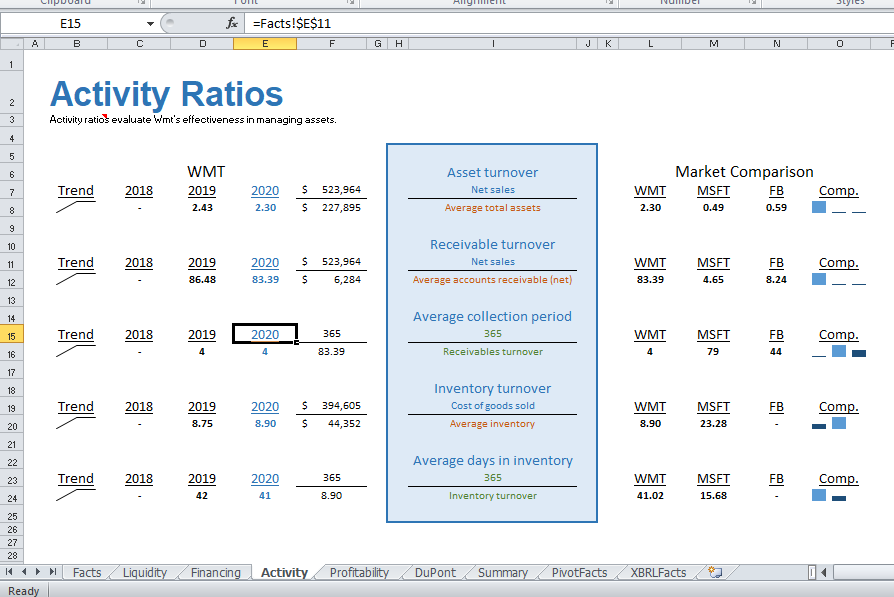

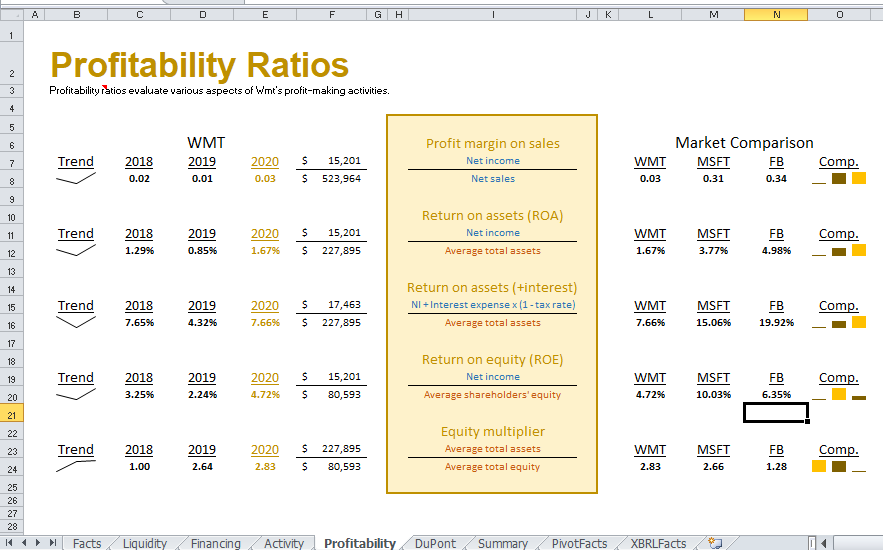

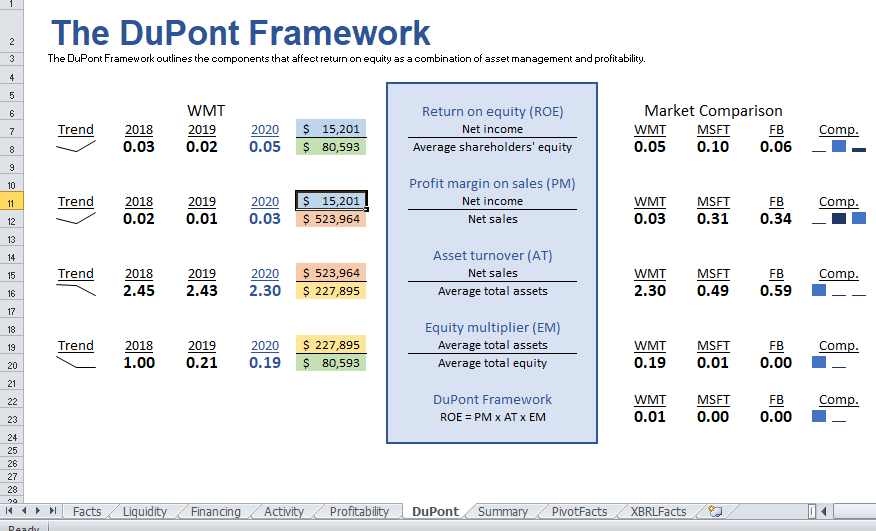

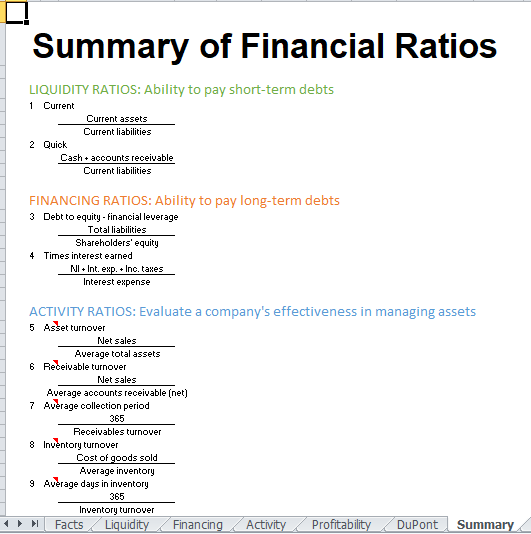

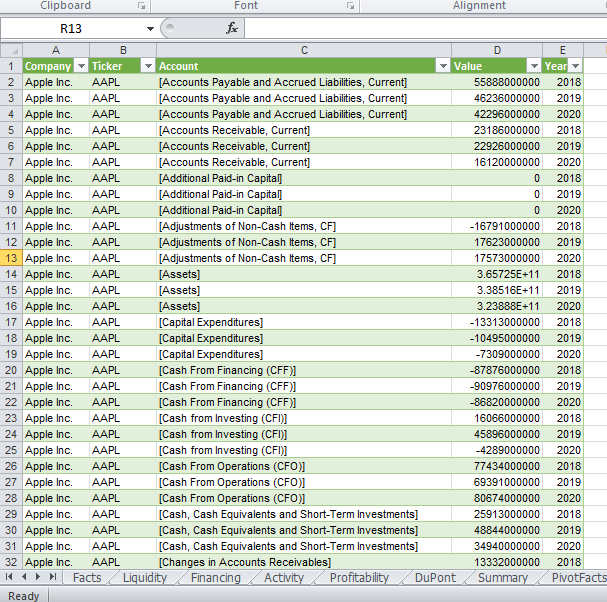

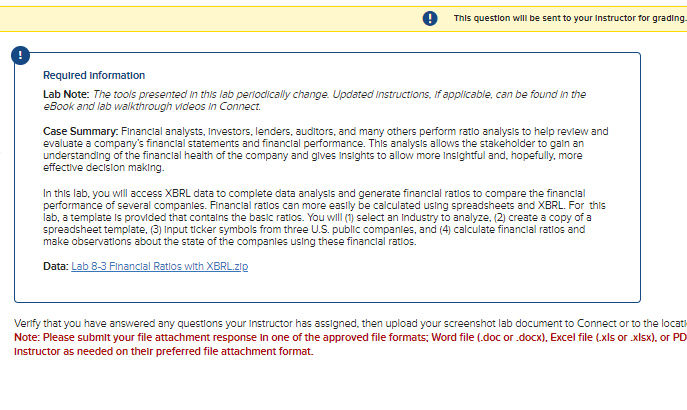

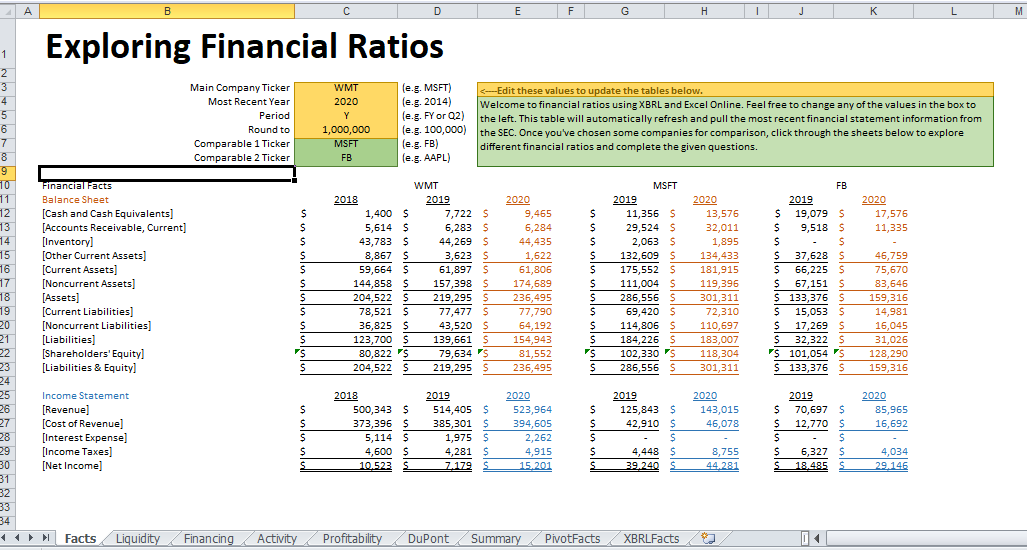

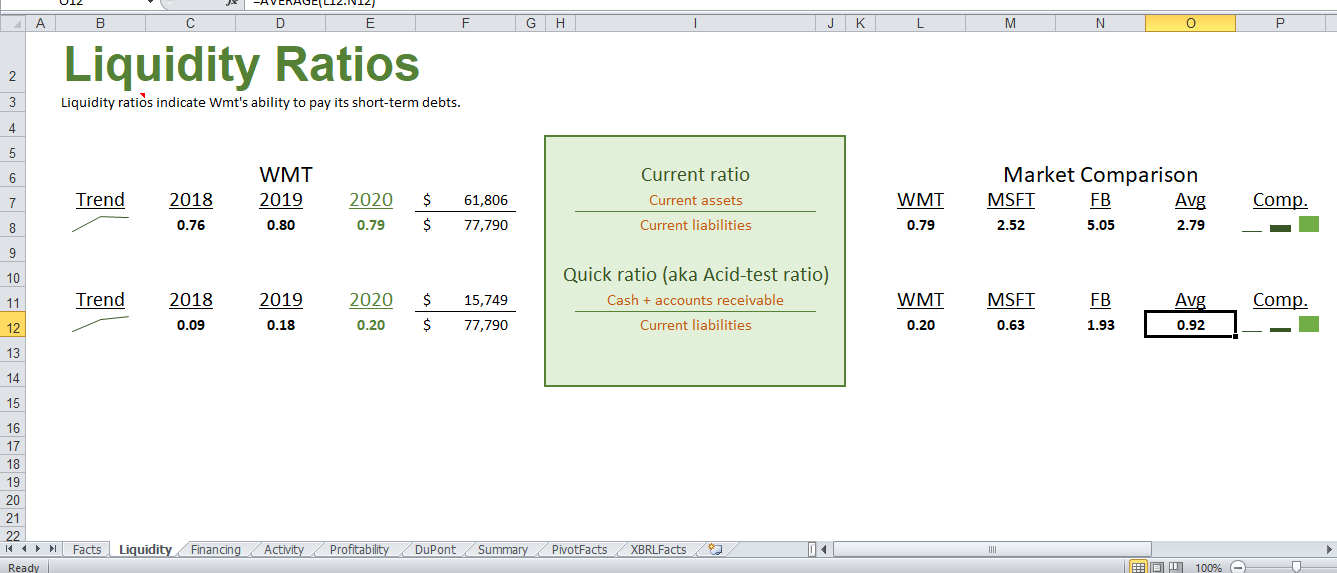

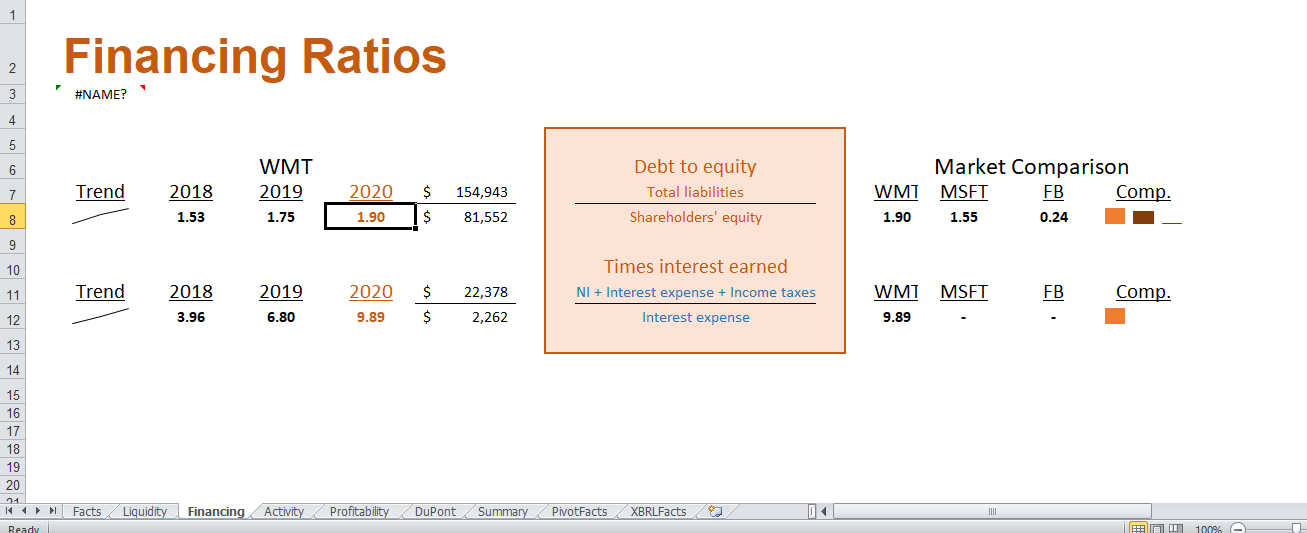

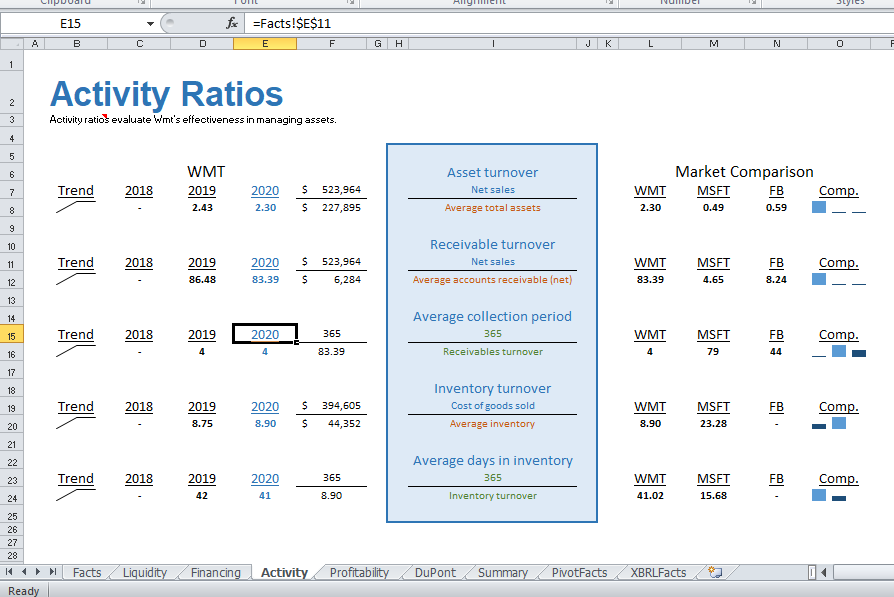

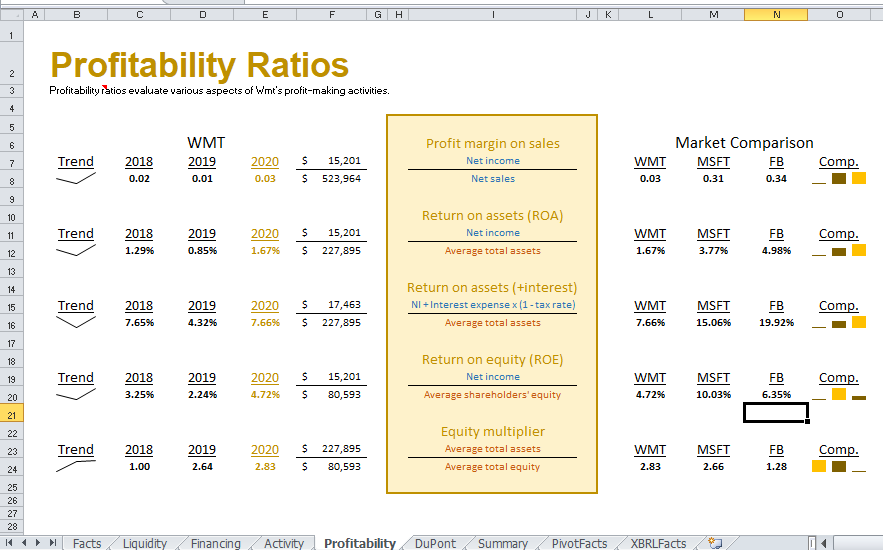

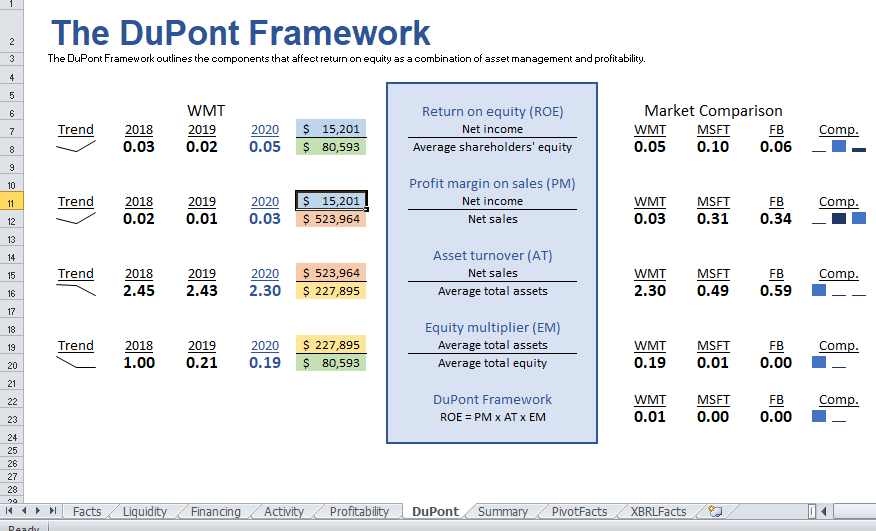

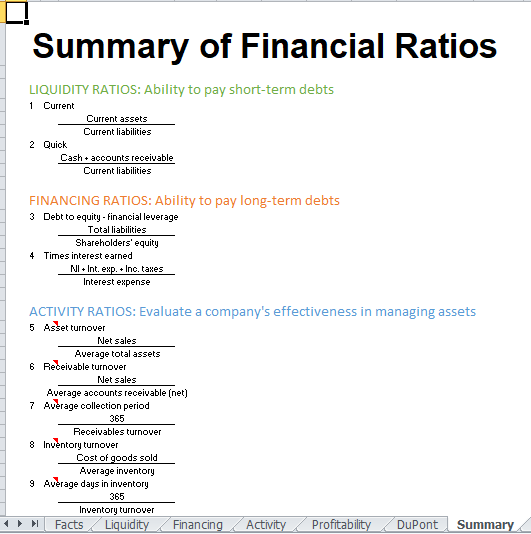

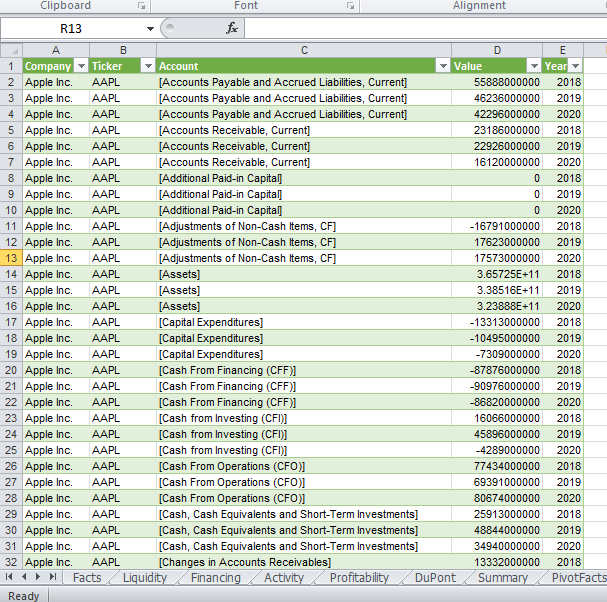

Required information Lab Note: The tools presented in this lab periodically change. Updated instructions, If applicable, can be found in the eBook and lab walkthrough videos in Connect. Case Summary. Financlal analysts, Investors, lenders, auditors, and many others perform ratio analysis to help revlew and evaluate a company's financial statements and financial performance. This analysis allows the stakeholder to gain an understanding of the financlal health of the company and gives insights to allow more insightful and, hopefully, more effective decision making. In this lab, you will access XBRL data to complete data analysis and generate financial ratios to compare the financial performance of several companles. Financlal ratlos can more easily be calculated using spreadsheets and XBRL. For this lab, a template is provided that contains the basic ratios. You will (i) select an Industry to analyze, (2) create a copy of a spreadsheet template, (3) Input ticker symbols from three U.S. public companles, and (4) calculate financial ratios and make observations about the state of the companles using these financlal ratios. Di Jerify that you have answered any questions your instructor has assigned, then upload your screenshot lab document to Connect or to the locat: Note: Please submit your file attachment response in one of the approved file formats; Word file (.doc or .docx), Excel file (.x|s or .xlsx), or PD nstructor as needed on their preferred file attachment format. Exploring Financial Ratios Liquidity Ratios Financing Ratios Activity Ratios Profitability Ratios The DuPont Framework Summary of Financial Ratios LIQUIDITY RATIOS: Ability to pay short-term debts 1 Current 2 Quick Cash+accountsreceivable FINANCING RATIOS: Ability to pay long-term debts 3 Debr to equity - financial leverage Total liabilities 4 Times interest earned \( \frac{\mathrm{Nl}+\text { Int. exp. }+\text { Inc. takes }}{\hline \text { Interest expense }} \) ACTIVITY RATIOS: Evaluate a company's effectiveness in managing assets 5 Asset turnover Net sales Average total assets 6 Rebeivable turnover Net sales Average accounts receivable (net) 7 Average collection period 365 8 Inventory turnover Required information Lab Note: The tools presented in this lab periodically change. Updated instructions, If applicable, can be found in the eBook and lab walkthrough videos in Connect. Case Summary. Financlal analysts, Investors, lenders, auditors, and many others perform ratio analysis to help revlew and evaluate a company's financial statements and financial performance. This analysis allows the stakeholder to gain an understanding of the financlal health of the company and gives insights to allow more insightful and, hopefully, more effective decision making. In this lab, you will access XBRL data to complete data analysis and generate financial ratios to compare the financial performance of several companles. Financlal ratlos can more easily be calculated using spreadsheets and XBRL. For this lab, a template is provided that contains the basic ratios. You will (i) select an Industry to analyze, (2) create a copy of a spreadsheet template, (3) Input ticker symbols from three U.S. public companles, and (4) calculate financial ratios and make observations about the state of the companles using these financlal ratios. Di Jerify that you have answered any questions your instructor has assigned, then upload your screenshot lab document to Connect or to the locat: Note: Please submit your file attachment response in one of the approved file formats; Word file (.doc or .docx), Excel file (.x|s or .xlsx), or PD nstructor as needed on their preferred file attachment format. Exploring Financial Ratios Liquidity Ratios Financing Ratios Activity Ratios Profitability Ratios The DuPont Framework Summary of Financial Ratios LIQUIDITY RATIOS: Ability to pay short-term debts 1 Current 2 Quick Cash+accountsreceivable FINANCING RATIOS: Ability to pay long-term debts 3 Debr to equity - financial leverage Total liabilities 4 Times interest earned \( \frac{\mathrm{Nl}+\text { Int. exp. }+\text { Inc. takes }}{\hline \text { Interest expense }} \) ACTIVITY RATIOS: Evaluate a company's effectiveness in managing assets 5 Asset turnover Net sales Average total assets 6 Rebeivable turnover Net sales Average accounts receivable (net) 7 Average collection period 365 8 Inventory turnover