Answered step by step

Verified Expert Solution

Question

1 Approved Answer

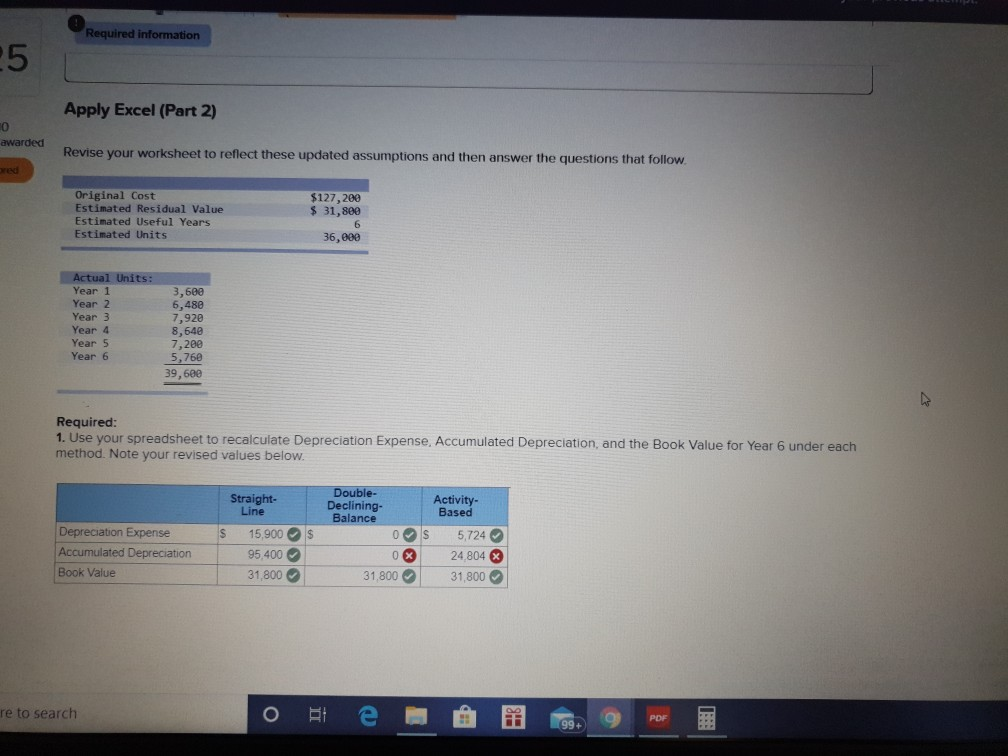

Required information o Apply Excel (Part 2) awarded Revise your worksheet to reflect these updated assumptions and then answer the questions that follow. $127,200 $

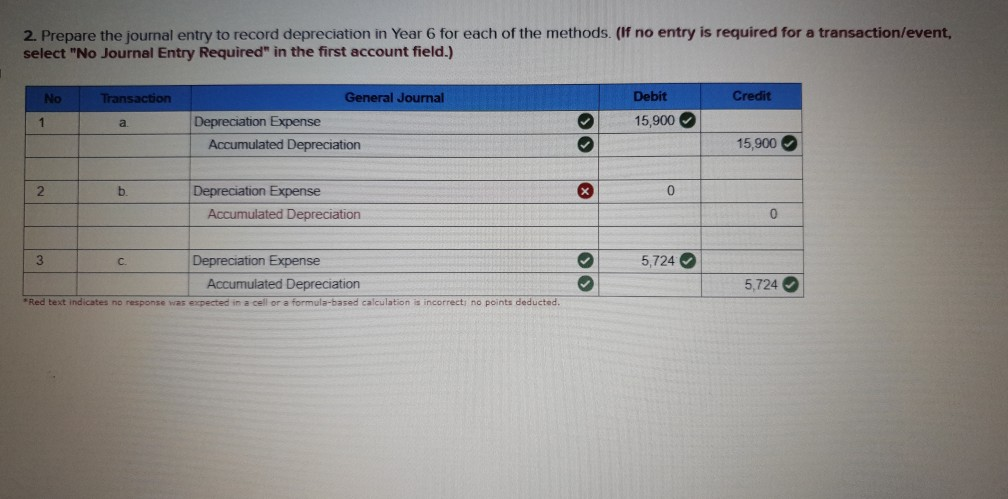

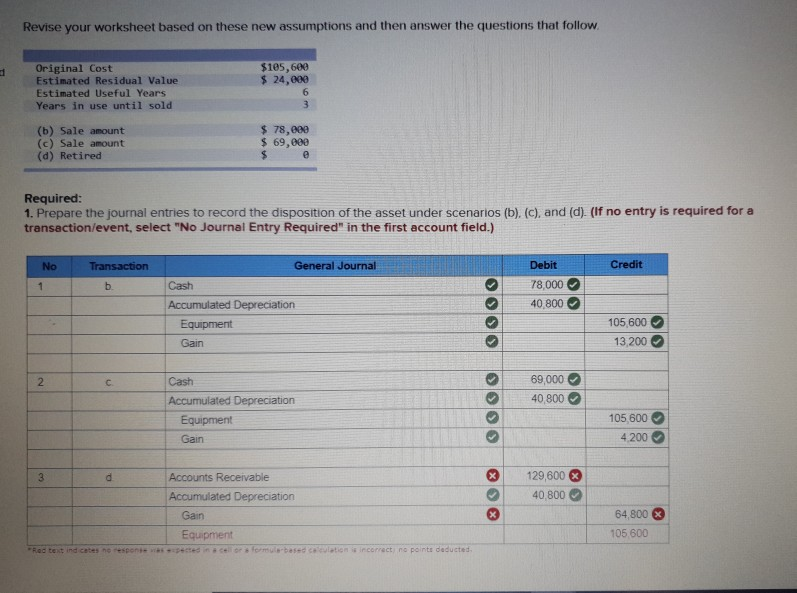

Required information o Apply Excel (Part 2) awarded Revise your worksheet to reflect these updated assumptions and then answer the questions that follow. $127,200 $ 31,800 Original Cost Estimated Residual Value Estimated Useful Years Estimated Units 36,000 Actual Units: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 3,600 6,480 7,920 8,640 7,200 5,760 39,680 Required: 1. Use your spreadsheet to recalculate Depreciation Expense. Accumulated Depreciation, and the Book Value for Year 6 under each method. Note your revised values below. Straight- Line $ $ Depreciation Expense Accumulated Depreciation Book Value 15,900 95.400 31,800 Double- Declining- Balance 0 S 0 % 31,800 Activity- Based 5,724 24804 X 31,800 e to search o te - @ Teg. 9 2. Prepare the journal entry to record depreciation in Year 6 for each of the methods. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Credit No 1 L Transaction a General Journal Depreciation Expense Accumulated Depreciation Debit 15,900 15,900 2 Depreciation Expense Accumulated Depreciation 3 c. 5,724 Depreciation Expense Accumulated Depreciation 5,724 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect no points deducted. Revise your worksheet based on these new assumptions and then answer the questions that follow Original Cost Estimated Residual Value Estimated Useful Years Years in use until sold $195,600 $ 24,000 (b) Sale amount (c) Sale amount (d) Retired $ 78,000 $ 69,000 Required: 1. Prepare the journal entries to record the disposition of the asset under scenarios (b), (c), and (d). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) No Transaction Debit Credit General Journal Cash Accumulated Depreciation Equipment Gain OOO 78,000 40,800 105,600 13,200 69,000 Cash Accumulated Depreciation Equipment 40,800 0000 105,600 4 200 Gain 3 Accounts Receivable Accumulated Depreciation Gain 129,600 40.800 0 64.800 105.600 Equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started