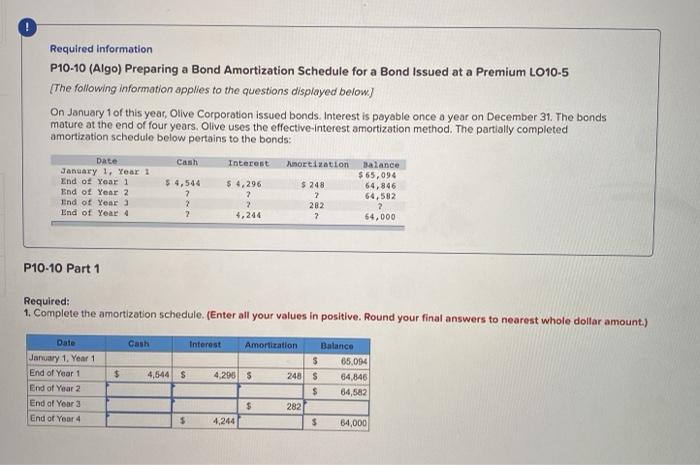

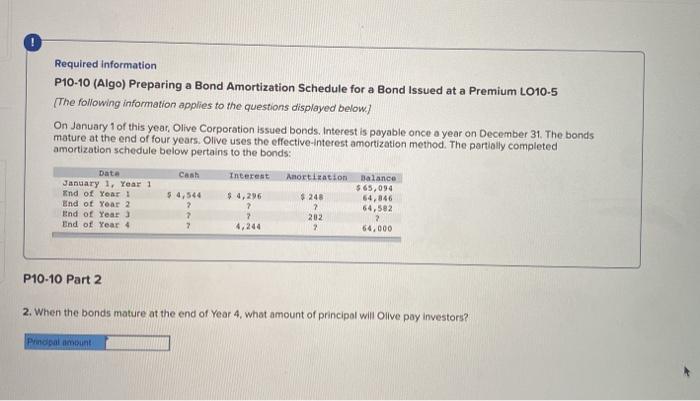

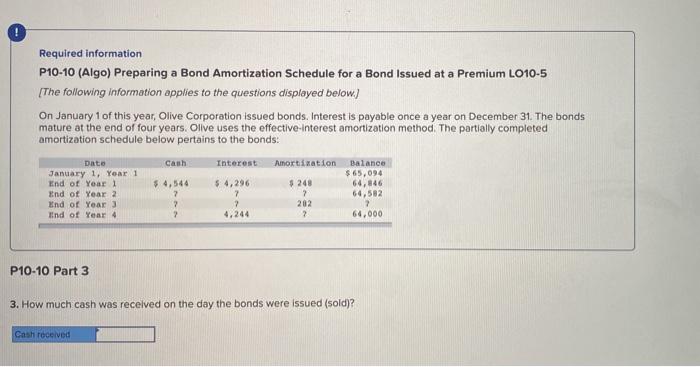

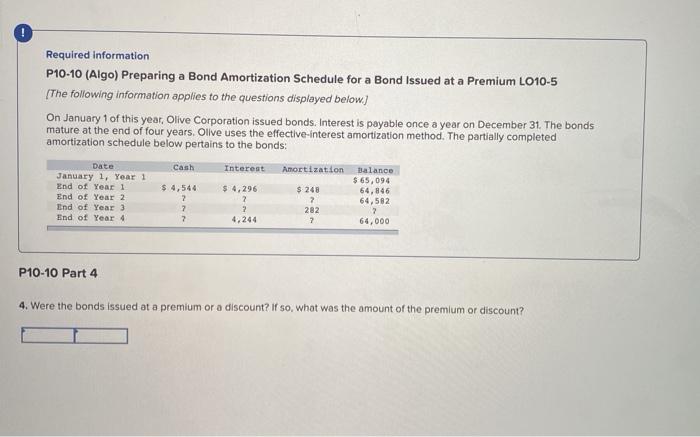

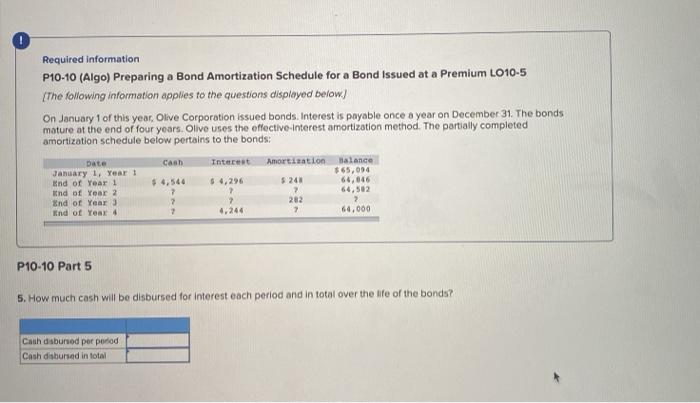

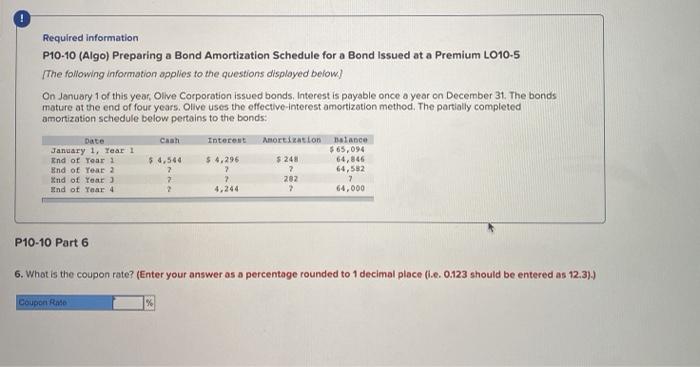

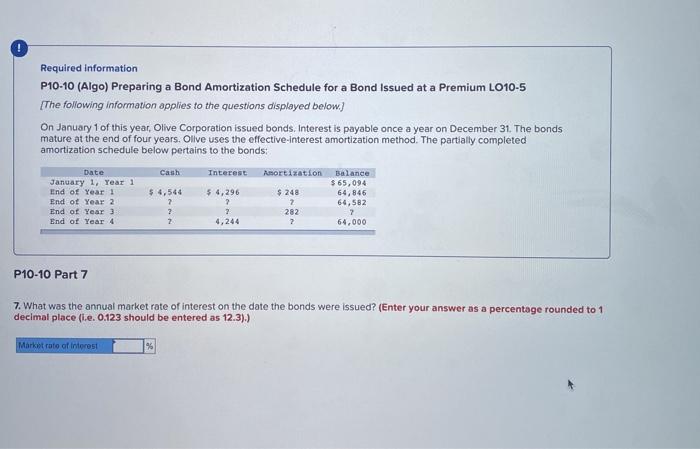

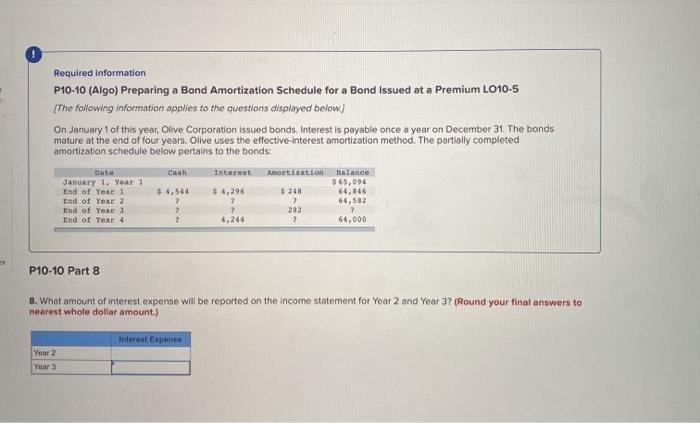

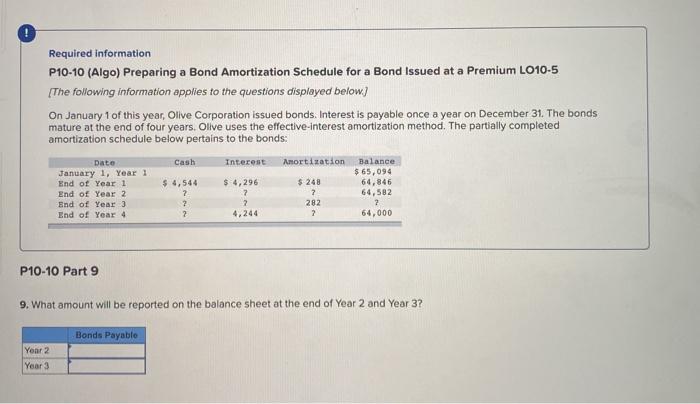

Required information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium LO10-5 {The following information applies to the questions displayed below.) On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective interest amortization method. The partially completed amortization schedule below pertains to the bonds: Date Cash Interest Amortization Balance January 1, Year i $ 65,094 End of Year 1 $4,544 $ 4,296 $ 248 64,846 End of Year 2 64,582 ind of Year 2 End of Year 4 4,244 64.000 2 2 2 2 2 282 2 2 P10-10 Part 1 Required: 1. Complete the amortization schedule. (Enter all your values in positive. Round your final answers to nearest whole dollar amount.) $ Date January 1. Year 1 End of Year 1 End of Year 2 End of Year 3 End of Year 4 Cash Interest Amortization Balance S 65,094 4,544 $ 4,295 $ 248s 64,846 $ 64,582 $ 282 $ 4,244 $ 64,000 Required Information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium L010-5 (The following information applies to the questions displayed below) On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds: Cash Interest Amortization Data January 1, Year 1 ind of Year 1 End of Year 2 End of Year) End of Year 4 2 ? ? 4,244 $240 2 202 2 Balance $ 65,094 54,346 64,582 2 64.000 7 P10.10 Part 2 2. When the bonds mature at the end of Year 4, what amount of principal will Olive pay Investors? Prindpal amount Required information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium LO10-5 [The following information applies to the questions displayed below) On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective interest amortization method. The partially completed amortization schedule below pertains to the bonds: Cash Interest Amortization $ 248 Date January 1, Year 1 End of Year 1 End of Year 2 End of Year 3 Ind of Year 4 $ 4,544 2 ? 2 $ 4,296 7 2 4.244 Balance $ 65,094 64,846 64,582 ? 60.000 202 ? P10-10 Part 3 3. How much cash was recelved on the day the bonds were issued (sold)? Cash received Required Information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium LO10-5 [The following information applies to the questions displayed below) On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds: Date Interest Amortization Balance January 1, Year 1 $ 65,094 End of Year 1 $ 4,544 $ 4,296 $ 248 End of Year 2 2 64,582 7 64,000 Cash 64,846 End of Year 3 End of Year 4 2 ? 4.244 ? 282 7 2 ? P10-10 Part 4 4. Were the bonds issued at a premium or a discount? If so, what was the amount of the premium or discount? Required information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium L010-5 [The following information applies to the questions displayed below) On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-Interest amortization method. The partially completed amortization schedule below pertains to the bonds: Interest Date January 1, Year 1 and of Year 1 ind of Year 2 End of Year 3 ind of Year 4 Cash $ 4,544 7 2 Amortization Balance $65,094 $ 240 64,046 2 4.244 282 2 2 64,000 P10-10 Part 5 5. How much cash will be disbursed for interest each period and in total over the life of the bonds? Cash disbursed per period Cash disbursed in total Required information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium L010-5 The following information applies to the questions displayed below) On January 1 of this year, Olive Corporation issued bonds, Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds: Cash Interest Date January 1, Year 1 End of Year 1 End of Year 2 And of Year) End of Year 4 $ 4,544 2 7 $ 4,296 7 ? Amortization Balance 565,094 $ 243 64,846 7 64,552 282 64,000 P10-10 Part 6 6. What is the coupon rate? (Enter your answer as a percentage rounded to 1 decimal place (.e. 0.123 should be entered as 12.3).) Coupon Rate Required information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium L010-5 [The following information applies to the questions displayed below) On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds: Cash Interest Date January 1, Year 1 End of Year 1 End of Year 2 End of Year 3 End of Year 4 $ 4,544 2 ? 2 $ 4,296 ? 2 4,244 Amortization Balance $ 65,094 $ 248 64,846 2 64,582 282 ? 2 64,000 P10-10 Part 7 7. What was the annual market rate of interest on the date the bonds were issued? (Enter your answer as a percentage rounded to 1 decimal place (i..0123 should be entered as 12.3).) Market rate of interest Required information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium L010-5 [The following information applies to the questions displayed below) On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds Date Interest Motion Balance January 1, Year 1 565,094 End of Year 1 $ 4,544 $ 4,296 524 64.46 tad of Year 2 64,582 End of Year 3 7 Ind of Year 4 64.000 2 2 2 2 2 4.244 7 202 ? P10-10 Part 8 8. What amount of interest expense will be reported on the income statement for Year 2 and Year 3? (Round your final answers to nearest whole dollar amount.) Interest Expense Year 2 Year 3 Required information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium L010-5 (The following information applies to the questions displayed below) On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective interest amortization method. The partially completed amortization schedule below pertains to the bonds: Date Cash Interest Amortization Balance January 1, Year 1 $ 65,094 End of Year 1 $ 4,544 $ 4,296 $ 248 64,846 End of Year 2 2 64,582 End of Year 3 282 End of Year 4 4.244 64,000 2 ? 2 2 2 ? 2 P10-10 Part 9 9. What amount will be reported on the balance sheet at the end of Year 2 and Year 3? Bonds Payable Year 2 Year 3