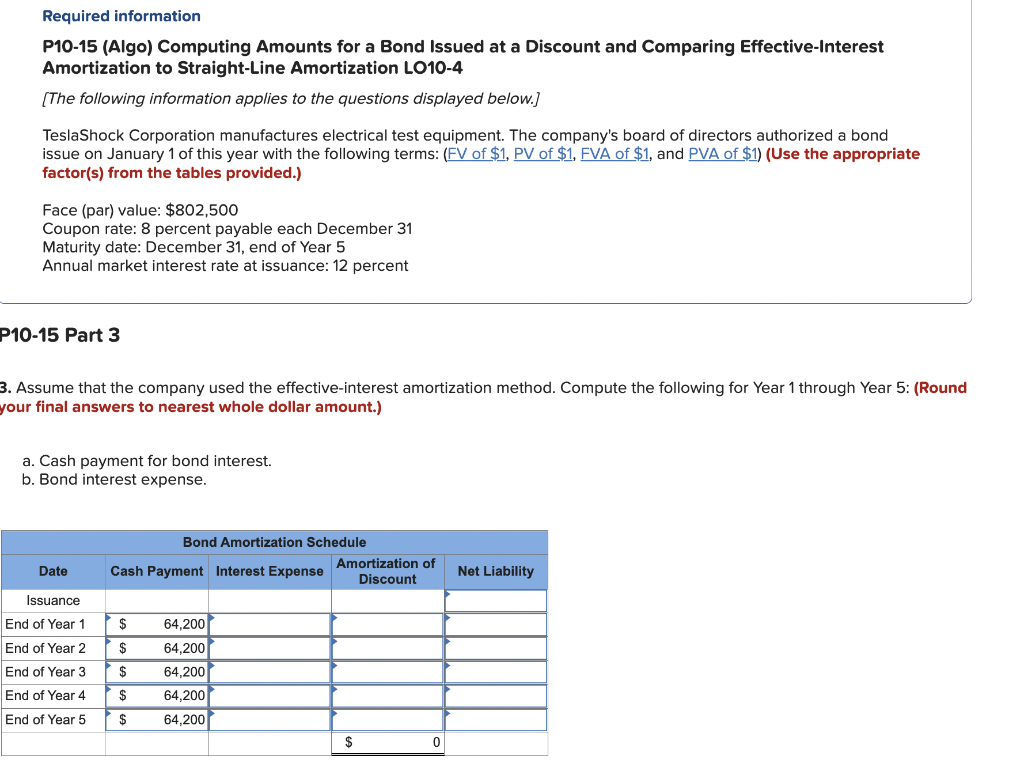

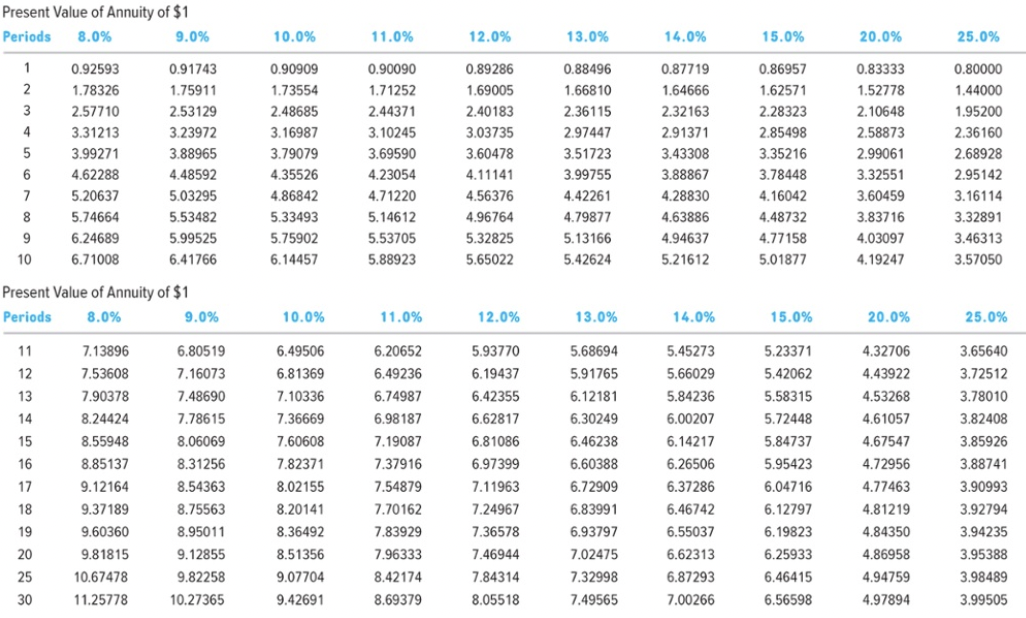

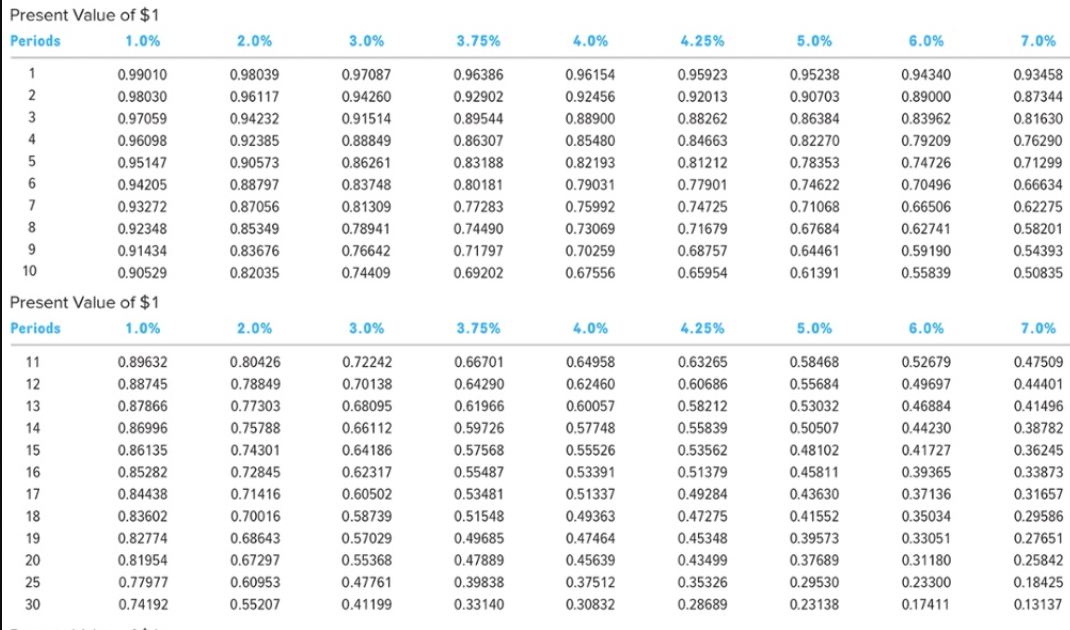

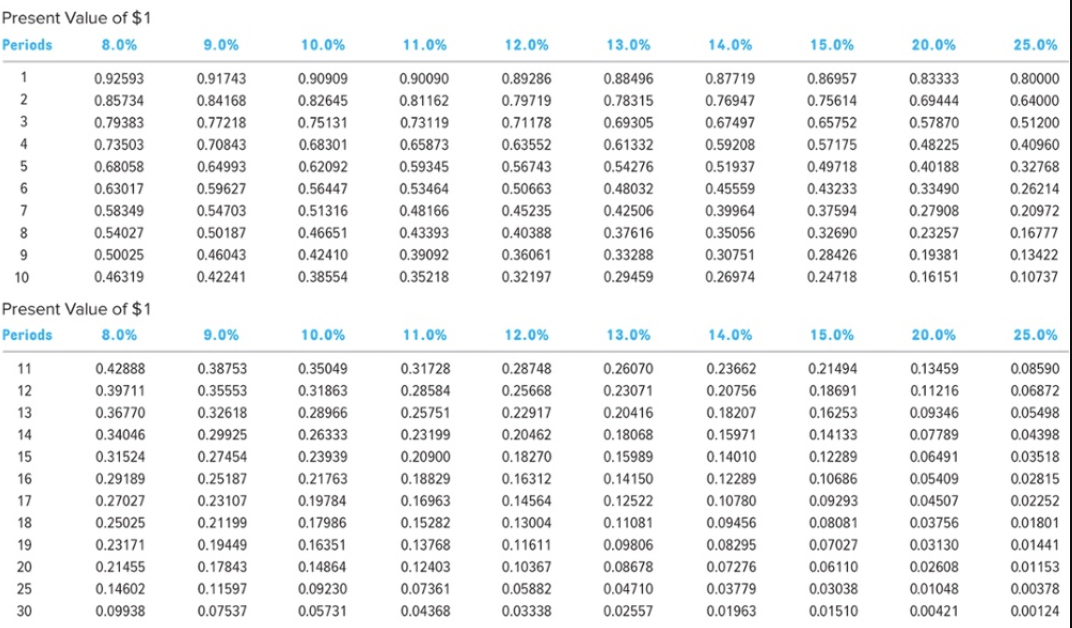

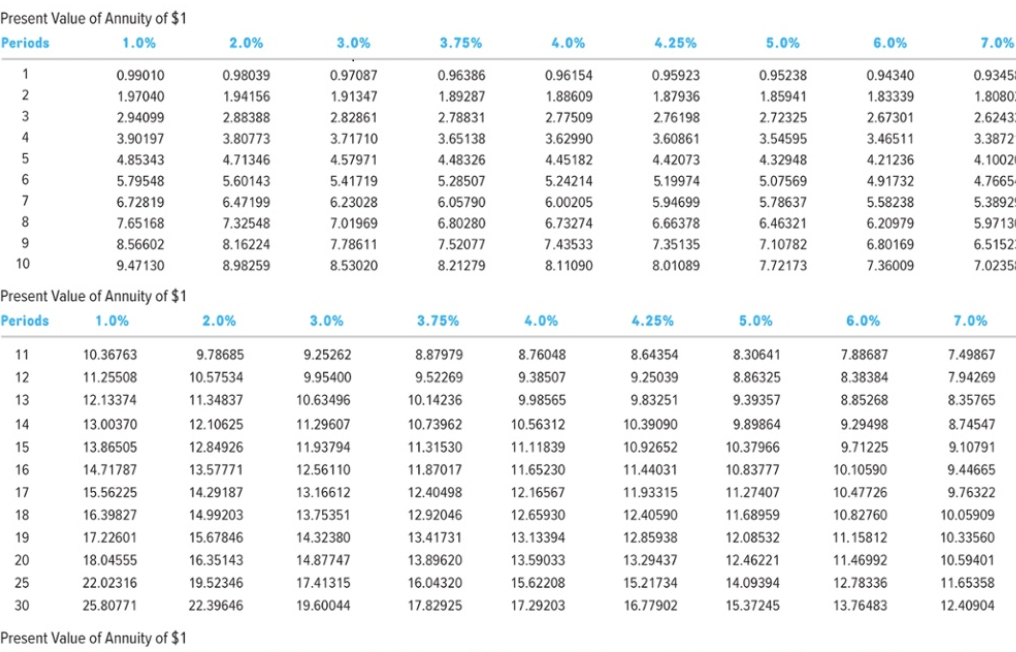

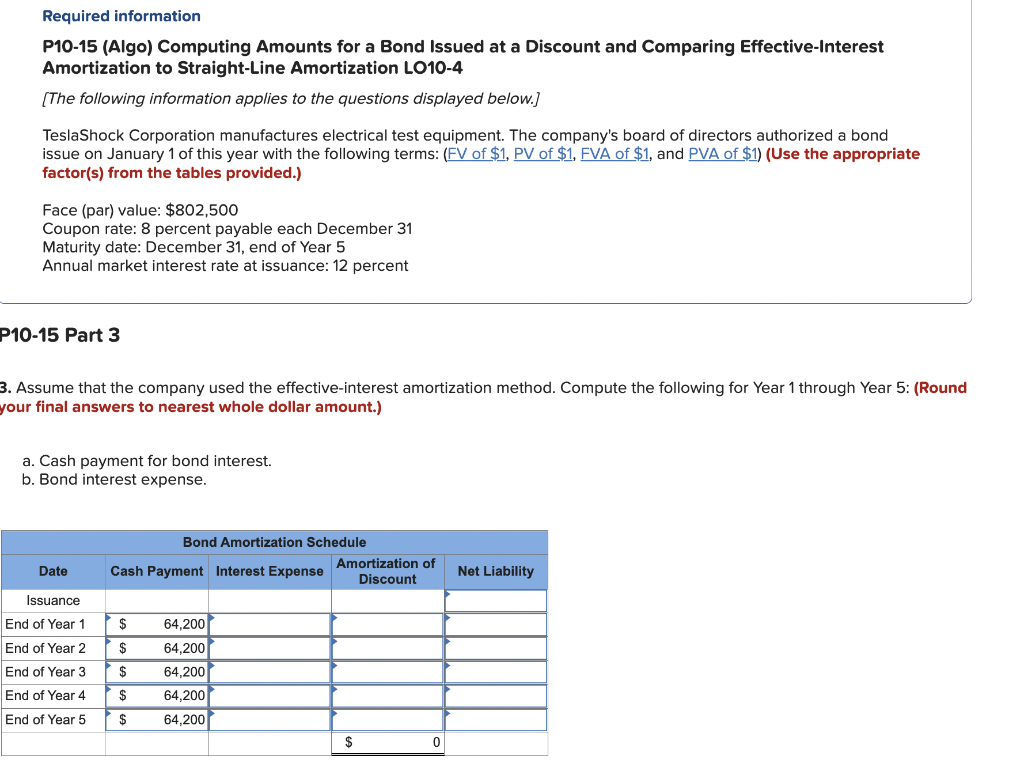

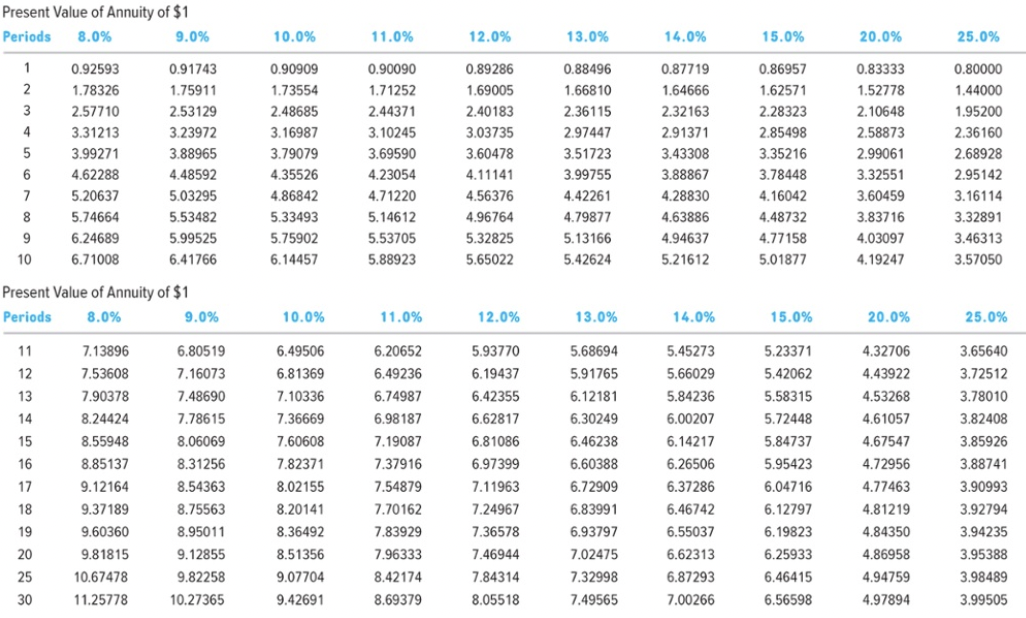

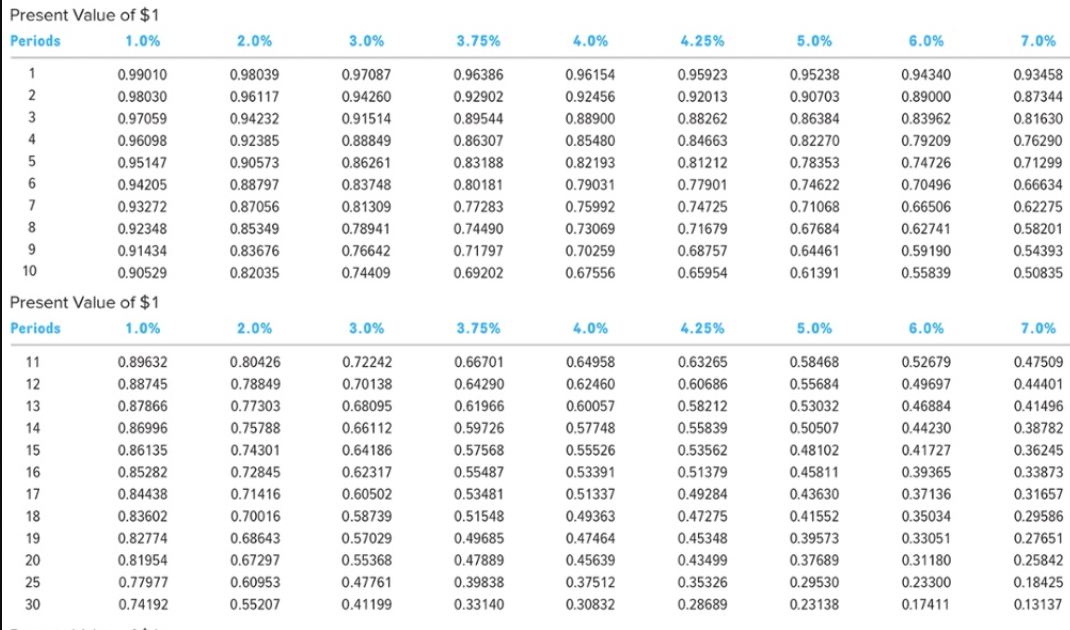

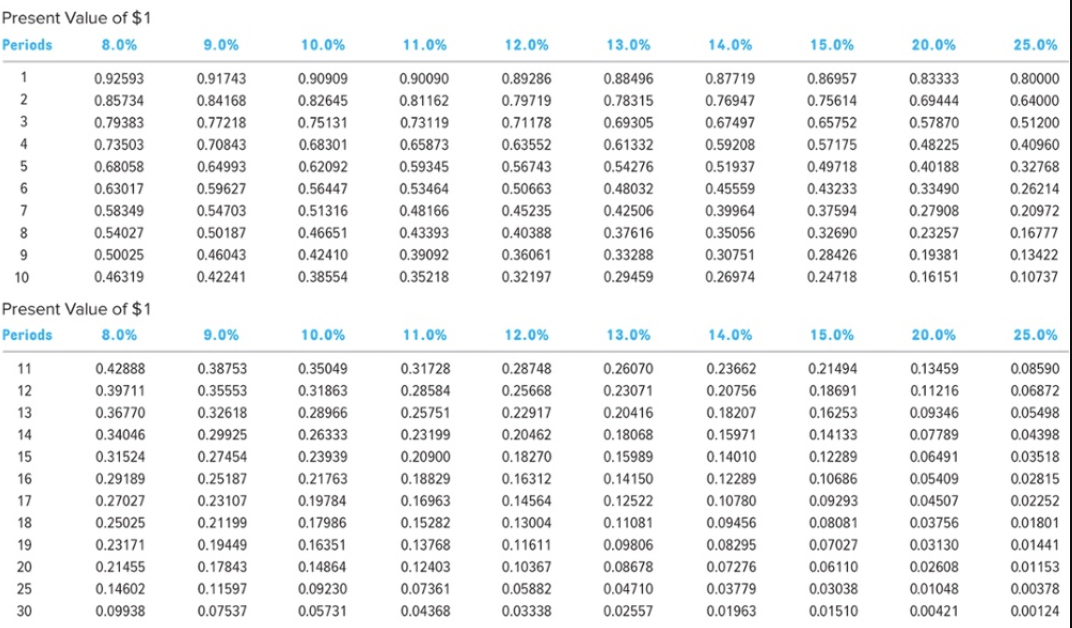

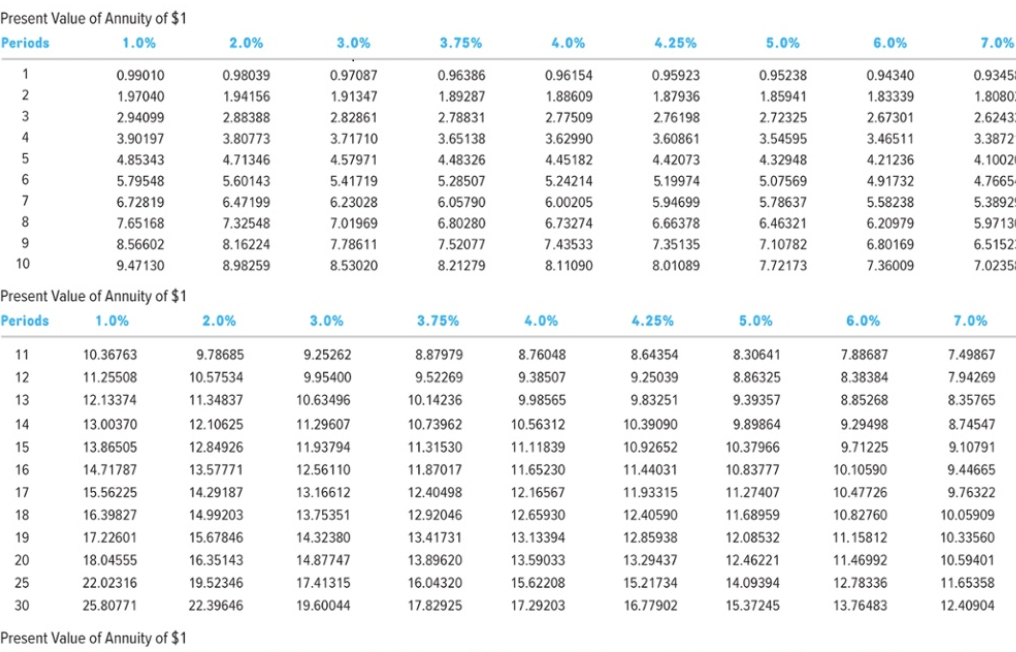

Required information P10-15 (Algo) Computing Amounts for a Bond Issued at a Discount and Comparing Effective-Interest Amortization to Straight-Line Amortization LO10-4 [The following information applies to the questions displayed below.] TeslaShock Corporation manufactures electrical test equipment. The company's board of directors authorized a bond issue on January 1 of this year with the following terms: (FV of \$1, PV of \$1. FVA of $1, and PVA of $1 ) (Use the appropriate factor(s) from the tables provided.) Face (par) value: $802,500 Coupon rate: 8 percent payable each December 31 Maturity date: December 31 , end of Year 5 Annual market interest rate at issuance: 12 percent 10-15 Part 3 . Assume that the company used the effective-interest amortization method. Compute the following for Year 1 through Year 5 : (Round our final answers to nearest whole dollar amount.) a. Cash payment for bond interest. b. Bond interest expense. Present Value of Annuity of $1 Present Value of Annuity of $1 Present Value of $1 Present Value of $1 Present Value of $1 Present Value of $1 Present Value of Annuity of $1 \begin{tabular}{cccccccccc} Periods & 1.0% & 2.0% & 3.0% & 3.75% & 4.0% & 4.25% & 5.0% & 6.0% & 7.0% \\ \hline 1 & 0.99010 & 0.98039 & 0.97087 & 0.96386 & 0.96154 & 0.95923 & 0.95238 & 0.94340 & 0.9345 \\ 2 & 1.97040 & 1.94156 & 1.91347 & 1.89287 & 1.88609 & 1.87936 & 1.85941 & 1.83339 & 1.8080 \\ 3 & 2.94099 & 2.88388 & 2.82861 & 2.78831 & 2.77509 & 2.76198 & 2.72325 & 2.67301 & 2.6243 \\ 4 & 3.90197 & 3.80773 & 3.71710 & 3.65138 & 3.62990 & 3.60861 & 3.54595 & 3.46511 & 3.3872 \\ 5 & 4.85343 & 4.71346 & 4.57971 & 4.48326 & 4.45182 & 4.42073 & 4.32948 & 4.21236 & 4.1002 \\ 6 & 5.79548 & 5.60143 & 5.41719 & 5.28507 & 5.24214 & 5.19974 & 5.07569 & 4.91732 & 4.7665 \\ 7 & 6.72819 & 6.47199 & 6.23028 & 6.05790 & 6.00205 & 5.94699 & 5.78637 & 5.58238 & 5.3892 \\ 8 & 7.65168 & 7.32548 & 7.01969 & 6.80280 & 6.73274 & 6.66378 & 6.46321 & 6.20979 & 5.9713 \\ 9 & 8.56602 & 8.16224 & 7.78611 & 7.52077 & 7.43533 & 7.35135 & 7.10782 & 6.80169 & 6.5152 \\ 10 & 9.47130 & 8.98259 & 8.53020 & 8.21279 & 8.11090 & 8.01089 & 7.72173 & 7.36009 & 7.0235 \end{tabular} Present Value of Annuity of $1 \begin{tabular}{cccccccccc} Periods & 1.0% & 2.0% & 3.0% & 3.75% & 4.0% & 4.25% & 5.0% & 6.0% & 7.0% \\ \hline 11 & 10.36763 & 9.78685 & 9.25262 & 8.87979 & 8.76048 & 8.64354 & 8.30641 & 7.88687 & 7.49867 \\ 12 & 11.25508 & 10.57534 & 9.95400 & 9.52269 & 9.38507 & 9.25039 & 8.86325 & 8.38384 & 7.94269 \\ 13 & 12.13374 & 11.34837 & 10.63496 & 10.14236 & 9.98565 & 9.83251 & 9.39357 & 8.85268 & 8.35765 \\ 14 & 13.00370 & 12.10625 & 11.29607 & 10.73962 & 10.56312 & 10.39090 & 9.89864 & 9.29498 & 8.74547 \\ 15 & 13.86505 & 12.84926 & 11.93794 & 11.31530 & 11.11839 & 10.92652 & 10.37966 & 9.71225 & 9.10791 \\ 16 & 14.71787 & 13.57771 & 12.56110 & 11.87017 & 11.65230 & 11.44031 & 10.83777 & 10.10590 & 9.44665 \\ 17 & 15.56225 & 14.29187 & 13.16612 & 12.40498 & 12.16567 & 11.93315 & 11.27407 & 10.47726 & 9.76322 \\ 18 & 16.39827 & 14.99203 & 13.75351 & 12.92046 & 12.65930 & 12.40590 & 11.68959 & 10.82760 & 10.05909 \\ 19 & 17.22601 & 15.67846 & 14.32380 & 13.41731 & 13.13394 & 12.85938 & 12.08532 & 11.15812 & 10.33560 \\ 20 & 18.04555 & 16.35143 & 14.87747 & 13.89620 & 13.59033 & 13.29437 & 12.46221 & 11.46992 & 10.59401 \\ 25 & 22.02316 & 19.52346 & 17.41315 & 16.04320 & 15.62208 & 15.21734 & 14.09394 & 12.78336 & 11.65358 \\ 30 & 25.80771 & 22.39646 & 19.60044 & 17.82925 & 17.29203 & 16.77902 & 15.37245 & 13.76483 & 12.40904 \end{tabular} Present Value of Annuity of $1