Answered step by step

Verified Expert Solution

Question

1 Approved Answer

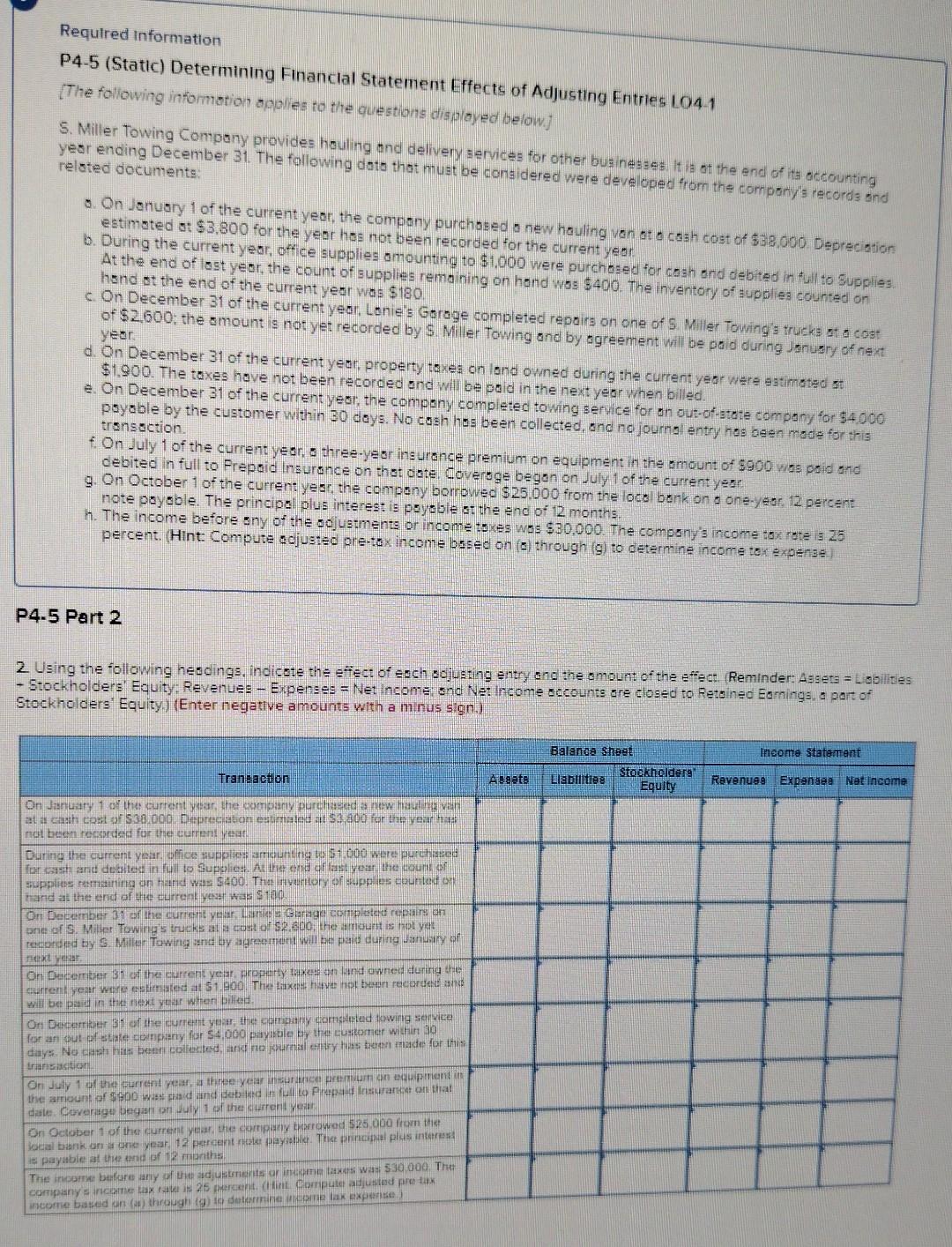

Required information P4-5 (Static) Determining Financlal Statement Effects of Adjusting Entries L04-1 [The following infomation opolies to the questions disployed below. ] 5. Miller Towing

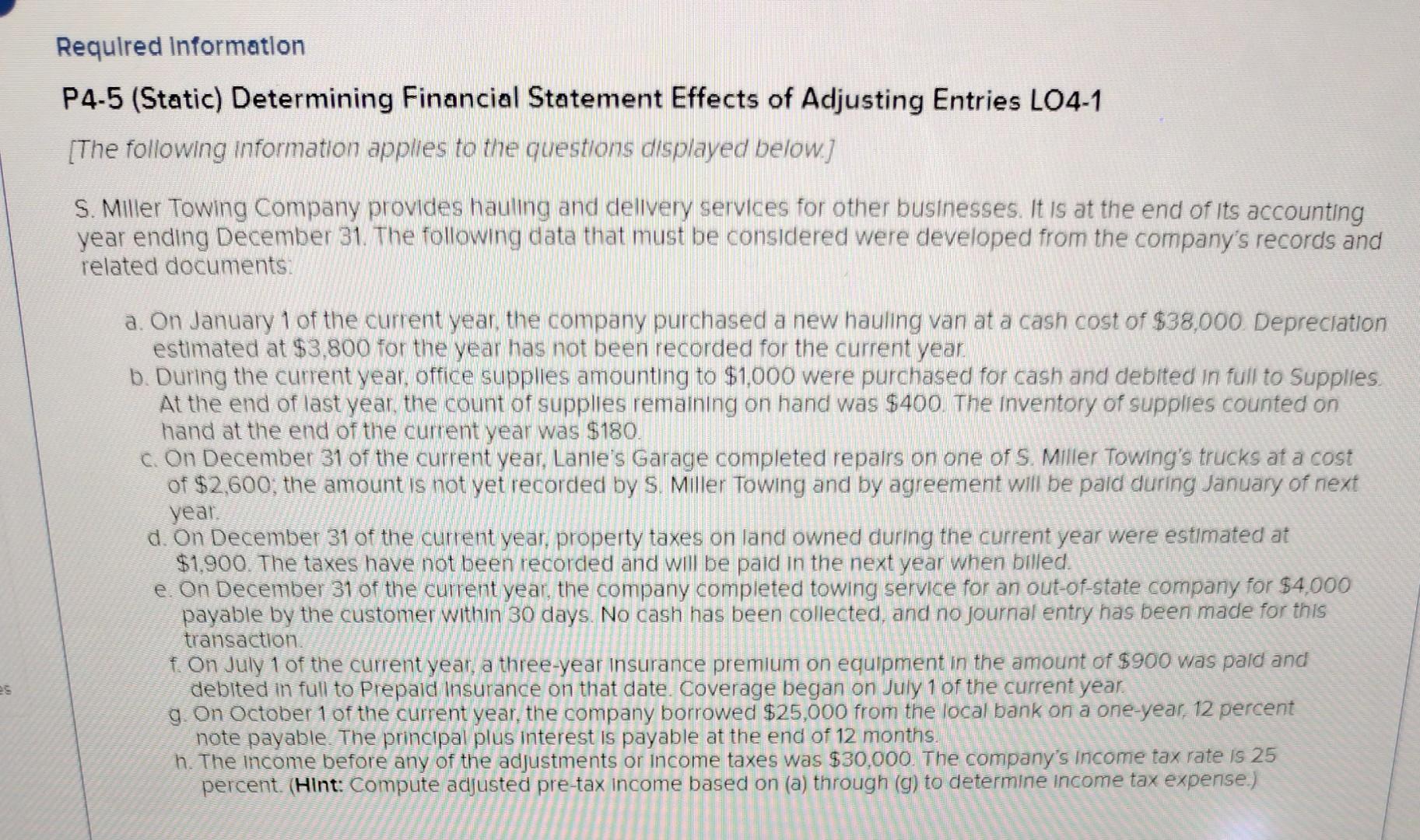

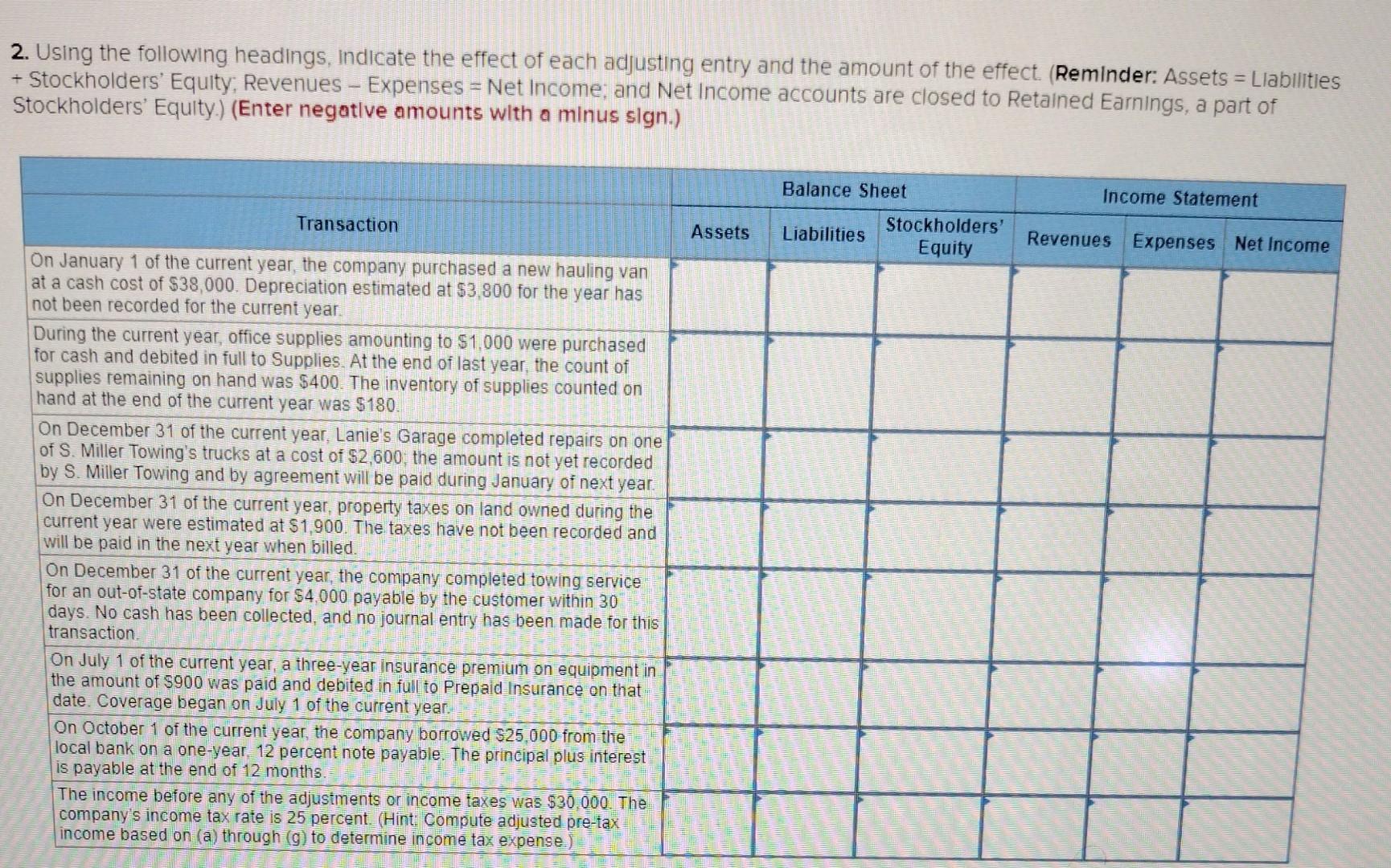

Required information P4-5 (Static) Determining Financlal Statement Effects of Adjusting Entries L04-1 [The following infomation opolies to the questions disployed below. ] 5. Miller Towing Compony provides houling and delivery services for other businesses. It ia of the end of its occounting year ending December 31. The following dote thot must be considered were developed from the compony's records snd reloted documents 0. On Jonuory 1 of the current yeor, the compony purchased a new houling von at o cssh cost of $38,000. Depreciation estimated ot $3,800 for the yeor hos not been recorbed for the current yeor: b. During the current yeor, office supplies omounting to $1,000 were purchesed for cosh ond debited in full to Supplies. hand ot the end of the current yent supplies remaining on hond wes $400. The inventory of 3upples counted on c. On December 31 of the current yeor, Lonie's Gorage completed repoirs on one of 5 . Willer Towing 3 trucks at a cost of \$2.600; the rmount is not yet recorded by 5 . Miller Towing and by ogreement will be paid during Jenusry of next d. On December 31 of the curtent yeor, property toxea on land owned during the current yeor were estimated si $1,900. The toxes hove not been recorced and will be poid in the next yeor when billed. e. On December 31 of the current yeor, the compony completec towing service for on cut-ofistate compony for 94,000 poyoble by the customer within 30 doys. No cosh hes been collected, and no joumal entry hos been mode for this tronsection. f. On July 1 of the current yeor, a three-yeor insurance premium on equipment in the omount of $900 was coid and debited in full to Frepoid insurance on thet dote. Coverege began on July t of the current yeen. 9. On October 1 of the current yesc, the compony borrowed $25.000 from the locsl benk on o one-yeor. 12 percent note poyoble. The principel plus interest is peyeble st the end of 12 months. h. The income before sny of the dojustments or income toxes was $30,000. The compsny's income tax rate is 26 percent. (Hint: Compute ocjusted pre-tax income bssed on (s) through (g) to determine income tor expense) P4. 5 Part 2 2 Using the following heodings, indicote the efect of eoch sciusting entry ond the omount of the effect. Reminder: Assets = Lobilites - Stockholders' Equity: Revenues - Expenses = Net income; and Net income sccounts ore closed to Retoheo Eamings, a port of Stockholders' Equity) (Enter negative amounts with a minus sign.) P4-5 (Static) Determining Financial Statement Effects of Adjusting Entries LO4-1 [The following information applies to the questions displayed below.] S. Miller Towing Company provides hauling and dellvery services for other businesses. It is at the end of its accounting year ending December 31. The following data that must be considered were developed from the company's records and related documents: a. On January 1 of the current year, the company purchased a new hauling van at a cash cost of $38,000 Depreciation estimated at $3,800 for the year has not been recorded for the current year. b. During the current year, office supplies amounting to $1,000 were purchased for cash and debited in full to supplies. At the end of last year, the count of supplies remaining on hand was $400. The inventory of supplies counted on hand at the end of the current year was $180. c. On December 31 of the current year, Lanle's Garage completed repalrs on one of S. Miller Towing's trucks at a cost of $2,600; the amount is not yet recorded by S. Miller Towing and by agreement will be paid during January of next year. d. On December 31 of the current year, property taxes on land owned during the current year were estimated at $1,900. The taxes have not been recorded and will be pald in the next year when billed. e. On December 31 of the current year, the company completed towing service for an out-of-state company for $4,000 payable by the customer within 30 days. No cash has been collected, and no journal entry has been made for this transaction. f. On July 1 of the current year, a three-year insurance premium on equipment in the amount of $900 was pald and debited in full to Prepald insurance on that date. Coverage began on July 1 of the current year. g. On October 1 of the current year, the company borrowed $25,000 from the local bank on a one-year, 12 percent note payable. The principal plus interest is payable at the end of 12 months. h. The income before any of the adjustments or income taxes was $30,000. The company's income tax rate is 25 percent. (Hint: Compute adjusted pre-tax income based on (a) through (g) to determine income tax expense.) 2. Using the following headings, Indicate the effect of each adjusting entry and the amount of the effect. (Reminder: Assets = Liabilitles + Stockholders' Equity; Revenues - Expenses = Net Income; and Net Income accounts are closed to Retained Earnings, a part of Stockholders' Equity.) (Enter negatlve amounts with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started