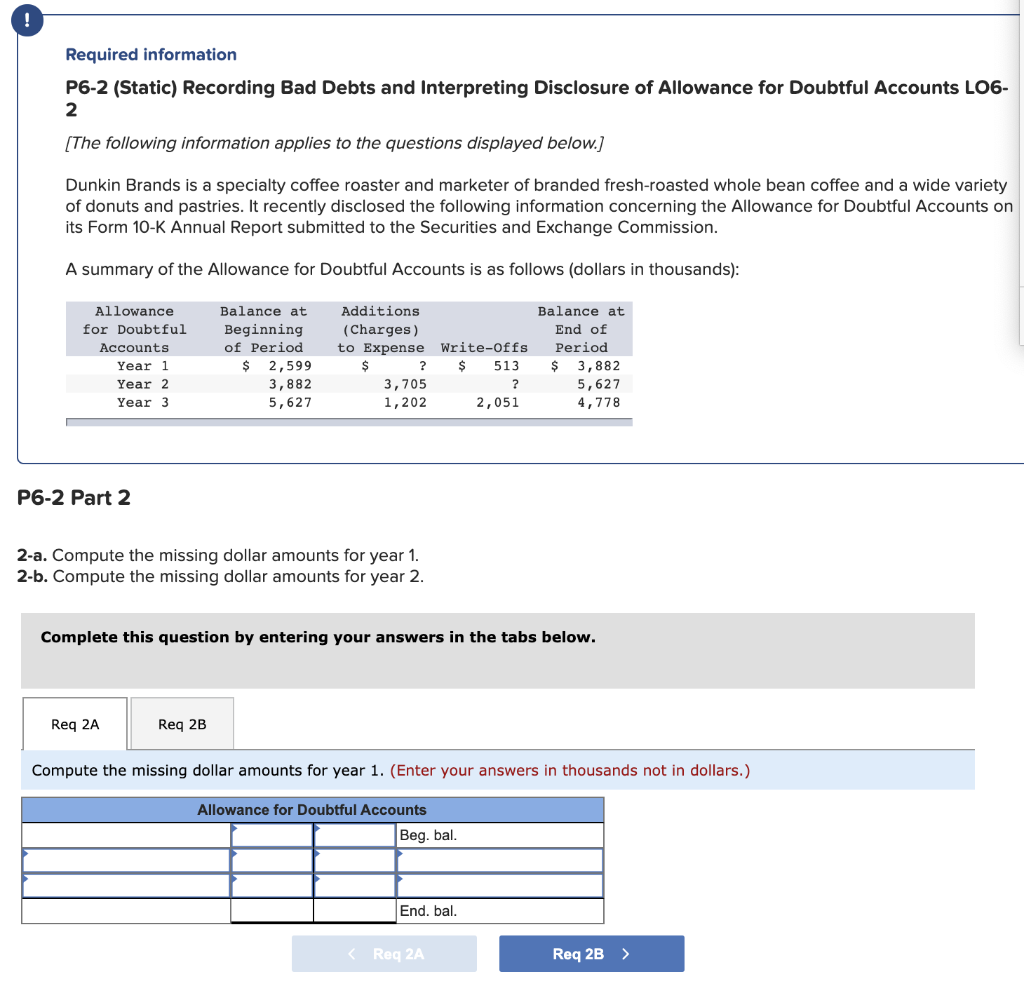

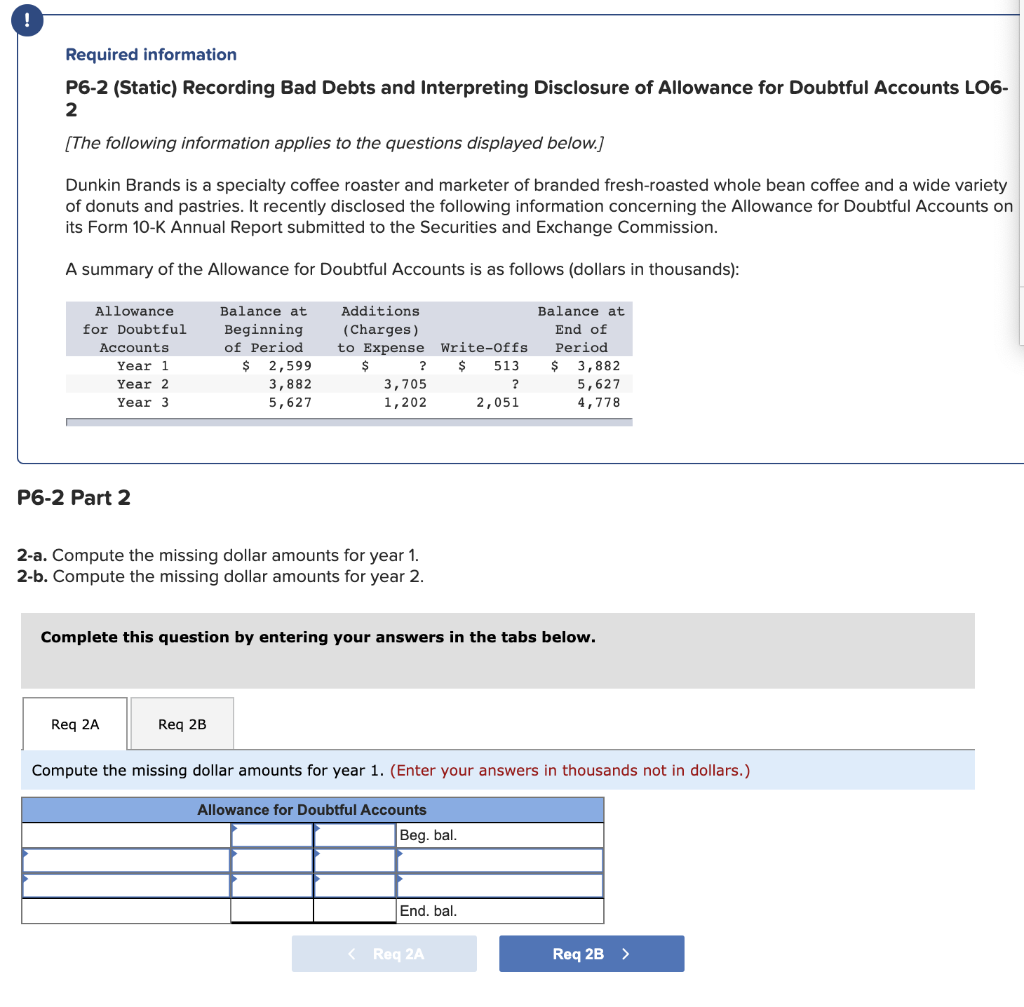

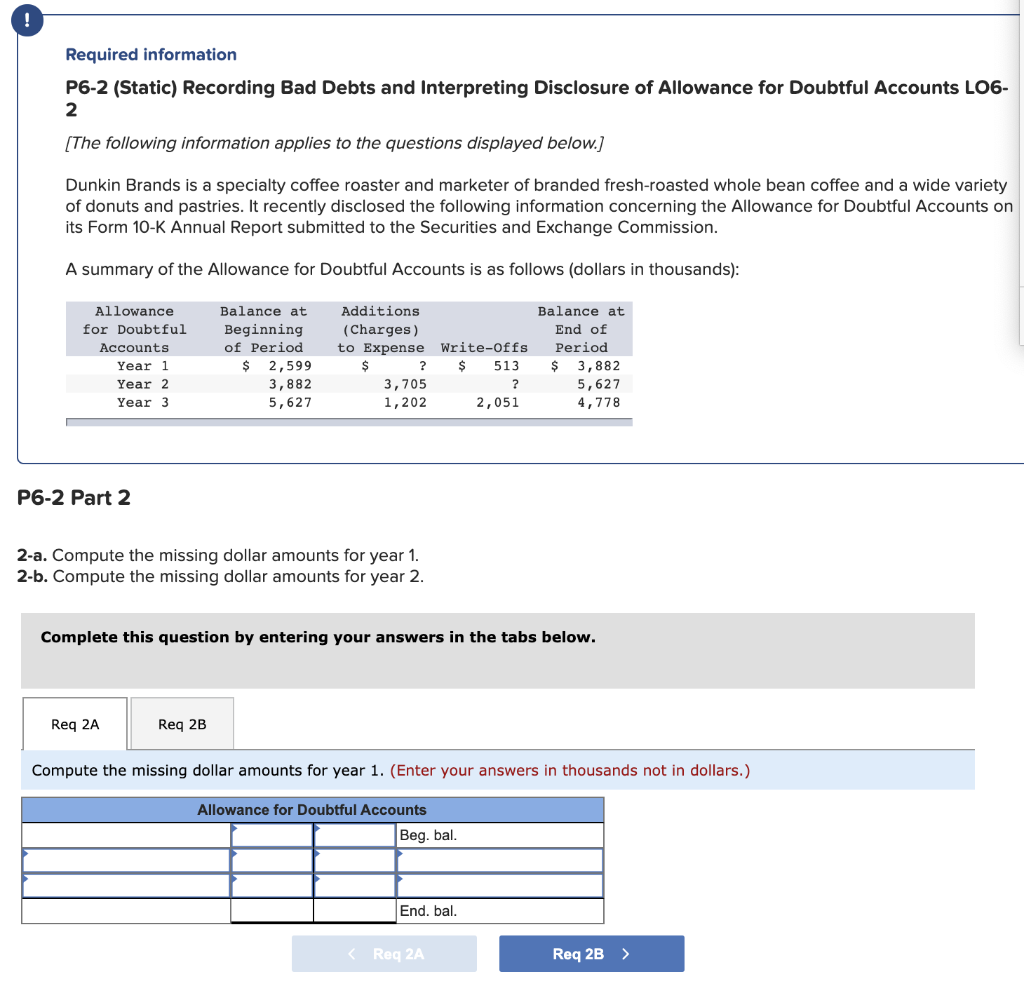

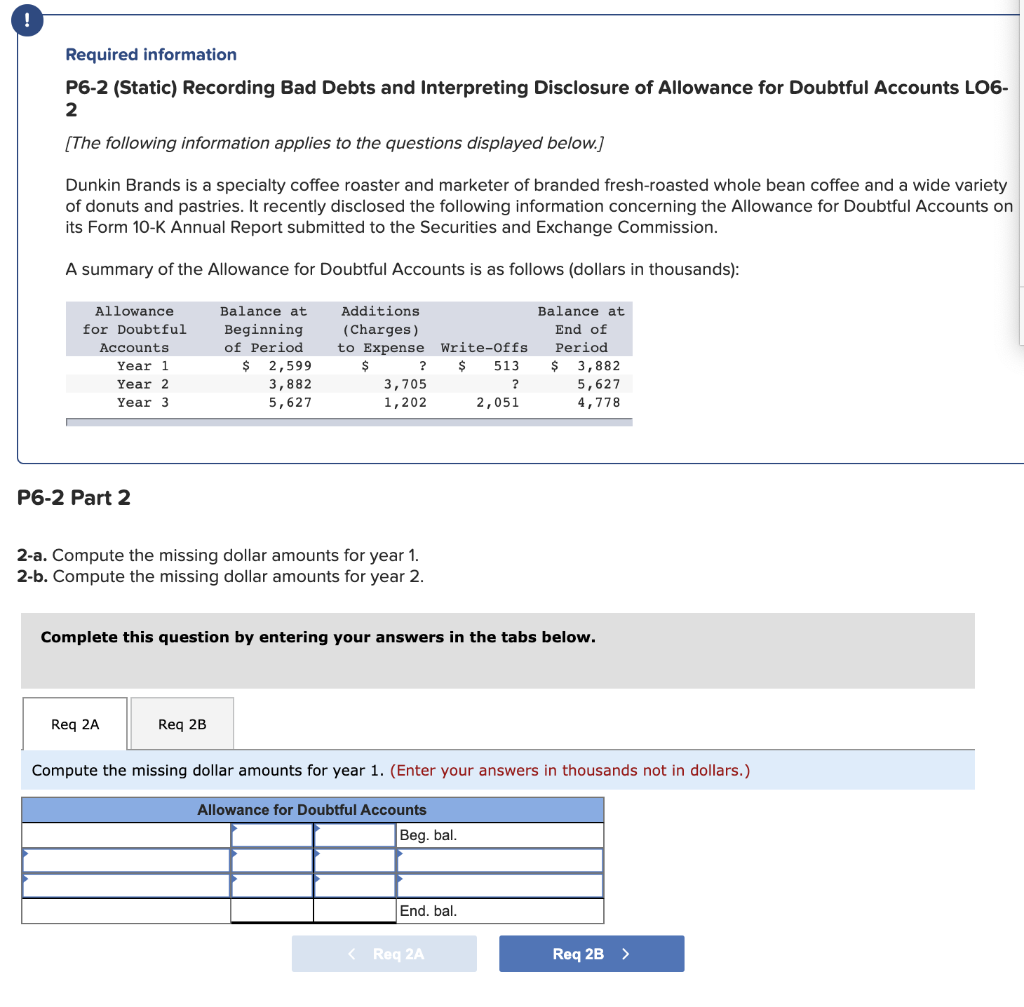

Required information P6-2 (Static) Recording Bad Debts and Interpreting Disclosure of Allowance for Doubtful Accounts LOW- 2 [The following information applies to the questions displayed below. Dunkin Brands is a specialty coffee roaster and marketer of branded fresh-roasted whole bean coffee and a wide variety of donuts and pastries. It recently disclosed the following information concerning the Allowance for Doubtful Accounts on its Form 10-K Annual Report submitted to the Securities and Exchange Commission. A summary of the Allowance for Doubtful Accounts is as follows (dollars in thousands): Allowance for Doubtful Accounts Year 1 Year 2 Year 3 Balance at Beginning of Period $ 2,599 3,882 5,627 Additions (Charges) to Expense Write-offs $ ? $ 513 3, 705 ? 1,202 2,051 Balance at End of Period $ 3,882 5,627 4,778 P6-2 Part 2 2-a. Compute the missing dollar amounts for year 1. 2-b. Compute the missing dollar amounts for year 2. Complete this question by entering your answers in the tabs below. Req 2A Req 2B Compute the missing dollar amounts for year 1. (Enter your answers in thousands not in dollars.) Allowance for Doubtful Accounts Beg. bal. End. bal. Required information P6-2 (Static) Recording Bad Debts and Interpreting Disclosure of Allowance for Doubtful Accounts LOW- 2 [The following information applies to the questions displayed below. Dunkin Brands is a specialty coffee roaster and marketer of branded fresh-roasted whole bean coffee and a wide variety of donuts and pastries. It recently disclosed the following information concerning the Allowance for Doubtful Accounts on its Form 10-K Annual Report submitted to the Securities and Exchange Commission. A summary of the Allowance for Doubtful Accounts is as follows (dollars in thousands): Allowance for Doubtful Accounts Year 1 Year 2 Year 3 Balance at Beginning of Period $ 2,599 3,882 5,627 Additions (Charges) to Expense Write-offs $ ? $ 513 3, 705 ? 1,202 2,051 Balance at End of Period $ 3,882 5,627 4,778 P6-2 Part 2 2-a. Compute the missing dollar amounts for year 1. 2-b. Compute the missing dollar amounts for year 2. Complete this question by entering your answers in the tabs below. Req 2A Req 2B Compute the missing dollar amounts for year 1. (Enter your answers in thousands not in dollars.) Allowance for Doubtful Accounts Beg. bal. End. bal.