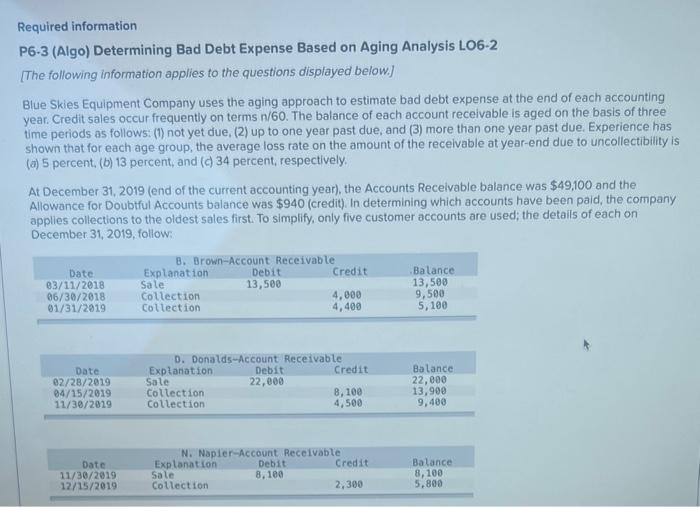

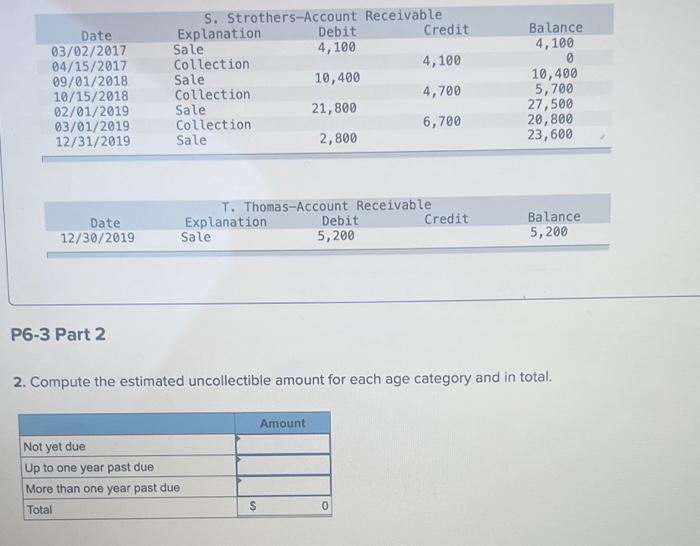

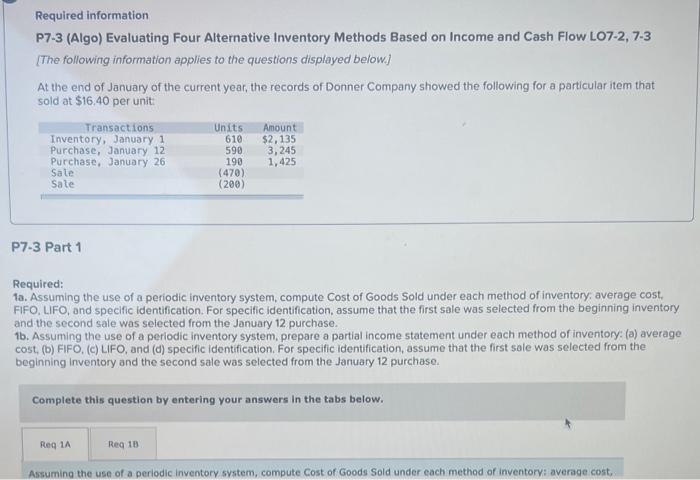

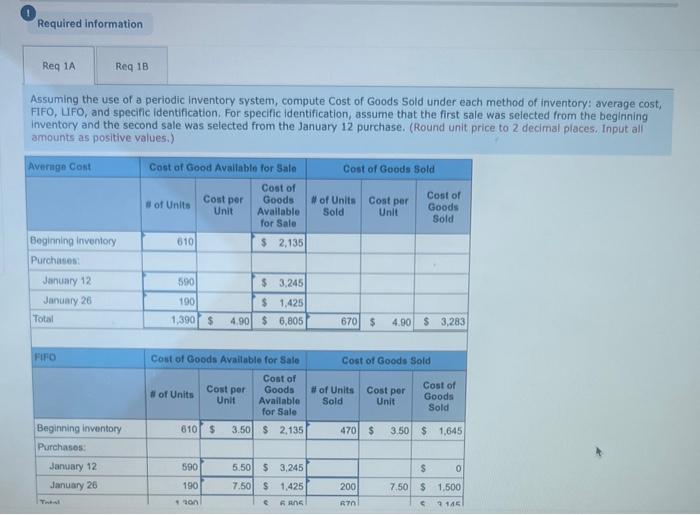

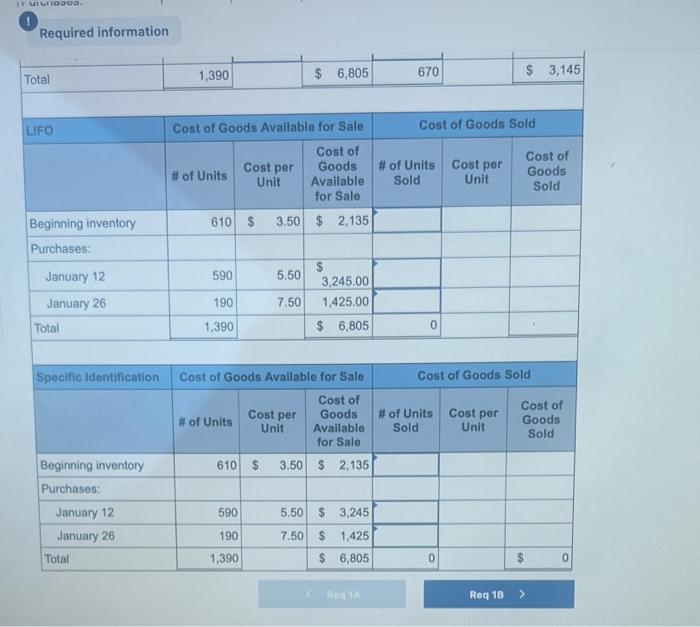

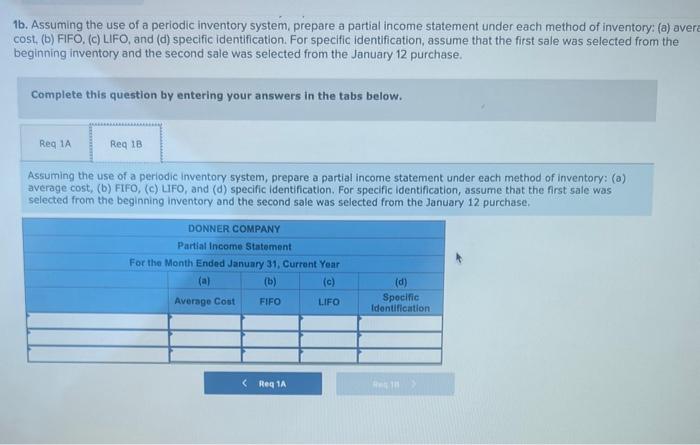

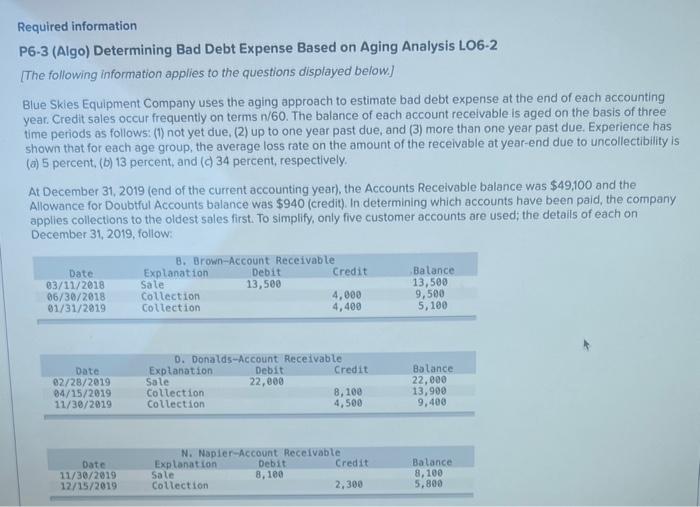

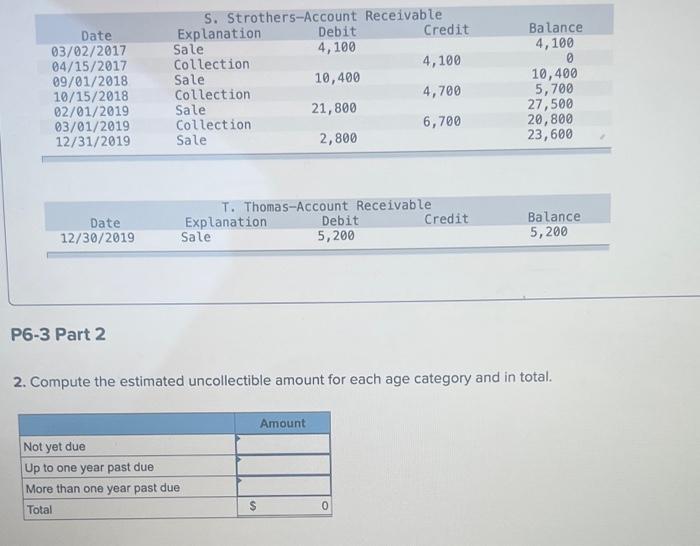

Required information P6.3 (Algo) Determining Bad Debt Expense Based on Aging Analysis LO6-2 [The following information applies to the questions displayed below.] Blue Skies Equipment Company uses the aging approach to estimate bad debt expense at the end of each accounting year. Credit sales occur frequently on terms n/60. The balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, (2) up to one year past due, and (3) more than one year past due. Experience has shown that for each age group, the average loss rate on the amount of the recelvable at year-end due to uncollectibility is (a) 5 percent, (b) 13 percent, and (c) 34 percent, respectively. At December 31, 2019 (end of the current accounting year), the Accounts Recelvable balance was $49,100 and the Allowance for Doubtful Accounts balance was $940 (credit). In determining which accounts have been paid, the company applies collections to the oldest sales first. To simplify, only five customer accounts are used; the details of each on December 31,2019 , follow: 2. Compute the estimated uncollectible amount for each age category and in total. Required information P7-3 (Algo) Evaluating Four Alternative Inventory Methods Based on Income and Cash Flow LO7-2, 7-3 [The following information applies to the questions displayed below] At the end of January of the current year, the records of Donner Company showed the following for a particular item that sold at $16.40 per unit: P7.3 Part 1 Required: 1a. Assuming the use of a periodic inventory system, compute Cost of Goods Sold under each method of inventory: average cost, FFOO. L.FO, and specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. 1b. Assuming the use of a periodic inventory system, prepare a partial income statement under each method of inventory: (a) average cost, (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. Complete this question by entering your answers in the tabs below. Assuming the use of a periodic inventory system, compute Cost of Goods Sold under each method of inventory: average cost, FIFO, LFO, and specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. (Round unit price to 2 decimal places. Input all amounts as positive values,) Required information 1b. Assuming the use of a periodic inventory system, prepare a partial income statement under each method of inventory: (a) aver cost, (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. Complete this question by entering your answers in the tabs below. Assuming the use of a periodic inventory system, prepare a partial income statement under each method of inventory: (a) average cost, (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. Required information P6-3 (Algo) Determining Bad Debt Expense Based on Aging Analysis LO6-2 [The following information applies to the questions displayed below.] Blue Skies Equipment Company uses the aging approach to estimate bad debt expense at the end of each accounting year. Credit sales occur frequently on terms n/60. The balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, (2) up to one year past due, and (3) more than one year past due. Experience has shown that for each age group, the average loss rate on the amount of the reivable at year-end due to uncollectibility is (b) 5 percent, (b) 13 percent, and (c) 34 percent, respectively. At December 31, 2019 (end of the current accounting year), the Accounts Recelvable balance was $49,100 and the Allowance for Doubtful Accounts balance was $940 (credit). In determining which accounts have been paid, the company applies collections to the oldest sales first. To simplify, only five customer accounts are used; the details of each on December 31,2019 , follow: 2. Compute the estimated uncollectible amount for each age category and in total. Required information P6.3 (Algo) Determining Bad Debt Expense Based on Aging Analysis LO6-2 [The following information applies to the questions displayed below.] Blue Skies Equipment Company uses the aging approach to estimate bad debt expense at the end of each accounting year. Credit sales occur frequently on terms n/60. The balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, (2) up to one year past due, and (3) more than one year past due. Experience has shown that for each age group, the average loss rate on the amount of the recelvable at year-end due to uncollectibility is (a) 5 percent, (b) 13 percent, and (c) 34 percent, respectively. At December 31, 2019 (end of the current accounting year), the Accounts Recelvable balance was $49,100 and the Allowance for Doubtful Accounts balance was $940 (credit). In determining which accounts have been paid, the company applies collections to the oldest sales first. To simplify, only five customer accounts are used; the details of each on December 31,2019 , follow: 2. Compute the estimated uncollectible amount for each age category and in total. Required information P7-3 (Algo) Evaluating Four Alternative Inventory Methods Based on Income and Cash Flow LO7-2, 7-3 [The following information applies to the questions displayed below] At the end of January of the current year, the records of Donner Company showed the following for a particular item that sold at $16.40 per unit: P7.3 Part 1 Required: 1a. Assuming the use of a periodic inventory system, compute Cost of Goods Sold under each method of inventory: average cost, FFOO. L.FO, and specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. 1b. Assuming the use of a periodic inventory system, prepare a partial income statement under each method of inventory: (a) average cost, (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. Complete this question by entering your answers in the tabs below. Assuming the use of a periodic inventory system, compute Cost of Goods Sold under each method of inventory: average cost, FIFO, LFO, and specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. (Round unit price to 2 decimal places. Input all amounts as positive values,) Required information 1b. Assuming the use of a periodic inventory system, prepare a partial income statement under each method of inventory: (a) aver cost, (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. Complete this question by entering your answers in the tabs below. Assuming the use of a periodic inventory system, prepare a partial income statement under each method of inventory: (a) average cost, (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. Required information P6-3 (Algo) Determining Bad Debt Expense Based on Aging Analysis LO6-2 [The following information applies to the questions displayed below.] Blue Skies Equipment Company uses the aging approach to estimate bad debt expense at the end of each accounting year. Credit sales occur frequently on terms n/60. The balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, (2) up to one year past due, and (3) more than one year past due. Experience has shown that for each age group, the average loss rate on the amount of the reivable at year-end due to uncollectibility is (b) 5 percent, (b) 13 percent, and (c) 34 percent, respectively. At December 31, 2019 (end of the current accounting year), the Accounts Recelvable balance was $49,100 and the Allowance for Doubtful Accounts balance was $940 (credit). In determining which accounts have been paid, the company applies collections to the oldest sales first. To simplify, only five customer accounts are used; the details of each on December 31,2019 , follow: 2. Compute the estimated uncollectible amount for each age category and in total