Answered step by step

Verified Expert Solution

Question

1 Approved Answer

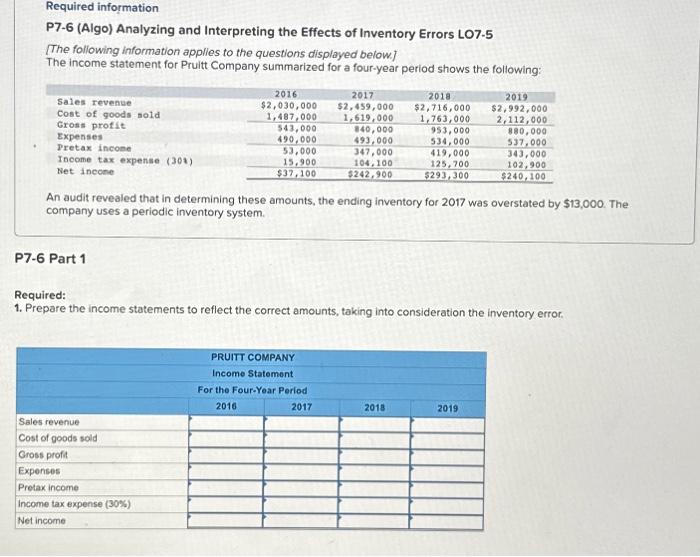

Required information P7-6 (Algo) Analyzing and Interpreting the Effects of Inventory Errors LO7-5 [The following information applies to the questions displayed below.] The income statement

Required information P7-6 (Algo) Analyzing and Interpreting the Effects of Inventory Errors LO7-5 [The following information applies to the questions displayed below.] The income statement for Pruitt Company summarized for a four-year period shows the following: Sales revenue Cost of goods sold Gross profit Expenses Pretax income Income tax expense (30%) Net income P7-6 Part 1 2016 $2,030,000 1,487,000 543,000 490,000 Sales revenue Cost of goods sold Gross profit Expenses Pretax income Income tax expense (30%) Net income 53,000 15,900 $37,100 2017 $2,459,000 1,619,000 840,000 493,000 347,000 104,100 $242,900 PRUITT COMPANY Income Statement For the Four-Year Period 2016 2017 2018 $2,716,000 1,763,000 An audit revealed that in determining these amounts, the ending inventory for 2017 was overstated by $13,000. The company uses a periodic inventory system. 953,000 534,000 419,000 125,700 $293,300 2018 Required: 1. Prepare the income statements to reflect the correct amounts, taking into consideration the inventory error. 2019 $2,992,000 2,112,000 880,000 537,000 343,000 102,900 $240,100 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started