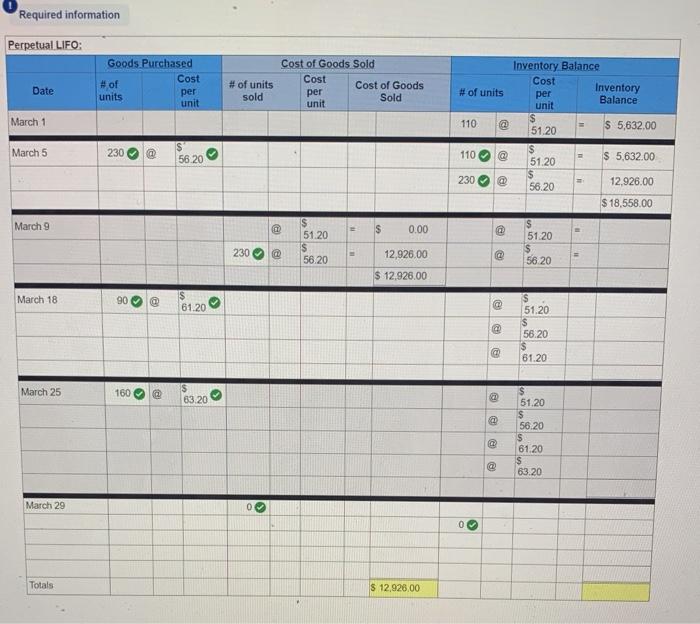

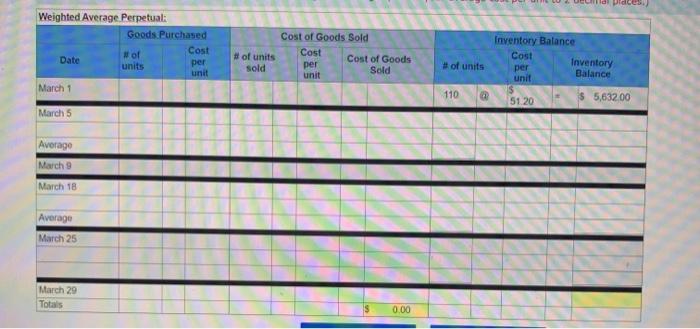

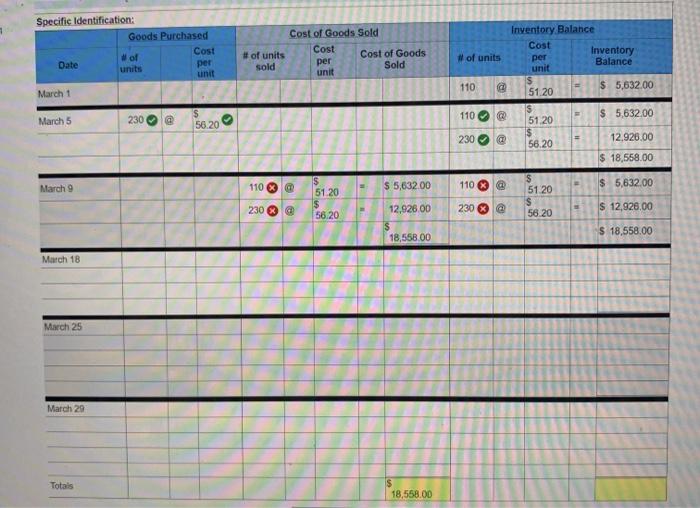

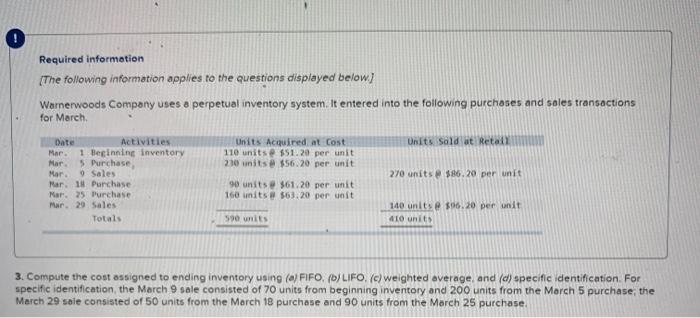

Required information Perpetual.LIFO: Goods Purchased #of Cost units per unit Cost of Goods Sold Cost Cost of Goods per Sold unit Date # of units sold # of units March 1 110 Inventory Balance Cost per Inventory unit Balance $ 51.20 $ 5,632.00 S 51.20 $ 5,632.00 $ 12,926.00 56.20 $ 18,558.00 March 5 230 110 @ @ @ 56 20 > 230 March 9 @ $ 0.00 $ 51.20 S 56.20 230 12,926.00 51.20 $ 56.20 $ 12.926.00 March 18 90 @ $ 61.20 e $ 51.20 56.20 @ 61.20 March 25 160 @ 63.20 B $ 51.20 S 56.20 $ 61.20 $ 63.20 @ @ March 29 0 0 Totals $ 12,926.00 od pieces Weighted Average Perpetual: Goods Purchased w of Cost Date units per unit March 1 #of units sold Cost of Goods Sold Cost Cost of Goods per Sold unit #of units Inventory Balance Cost Inventory per Balance unit 51 20 5,632.00 110 March 5 Average March 9 March 18 Average March 25 March 20 Totals 0.00 Specific Identification: Goods Purchased Cost #of Date per units unit Cost of Goods Sold Cost # of units Cost of Goods sold per Sold unit # of units Inventory Balance Cost Inventory per Balance unit s $ 5,632.00 51.20 110 - March 1 $ 5,632.00 230 110 S 51.20 March 5 a 56.20 230 @ 12.920.00 56.20 $ 18,558.00 March 9 110 * B $ 5,632.00 110 $ 5,632.00 51.20 $ 51.20 s 56.20 230 230 $ 12,926.00 56.20 12,926.00 S 18,558.00 18,558.00 March 18 March 25 March 20 Totals S 18,558.00 Required information (The following information applies to the questions displayed below) Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March Units Sald at Retail Date Activities Mar 1 Beginning inventory Mar Purchase Mar 9 Sales Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales Totals Units Acquired at Cost 110 units @ $51.20 per unit 210 units $56.20 per unit 90 units $61.20 per unit 160 units $63.20 per unit 270 units $86.20 per unit 140 units $96.20 per unit 410 units 590 units 3. Compute the cost assigned to ending inventory using (a) FIFO. (OLIFO. (c) weighted average, and (d) specific identification. For specific identification, the March 9 sale consisted of 70 units from beginning inventory and 200 units from the March 5 purchase, the March 29 sole consisted of 50 units from the March 18 purchase and 90 units from the March 25 purchase