Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information PR 6-42 (Algo) Continuation of Preceding Problem; Computing Least-Squares Regression Estimates; Comparing Multiple Methods (Appendix) (LO 6-1, 6-2, 6-5, 6-6, 6-9) [The

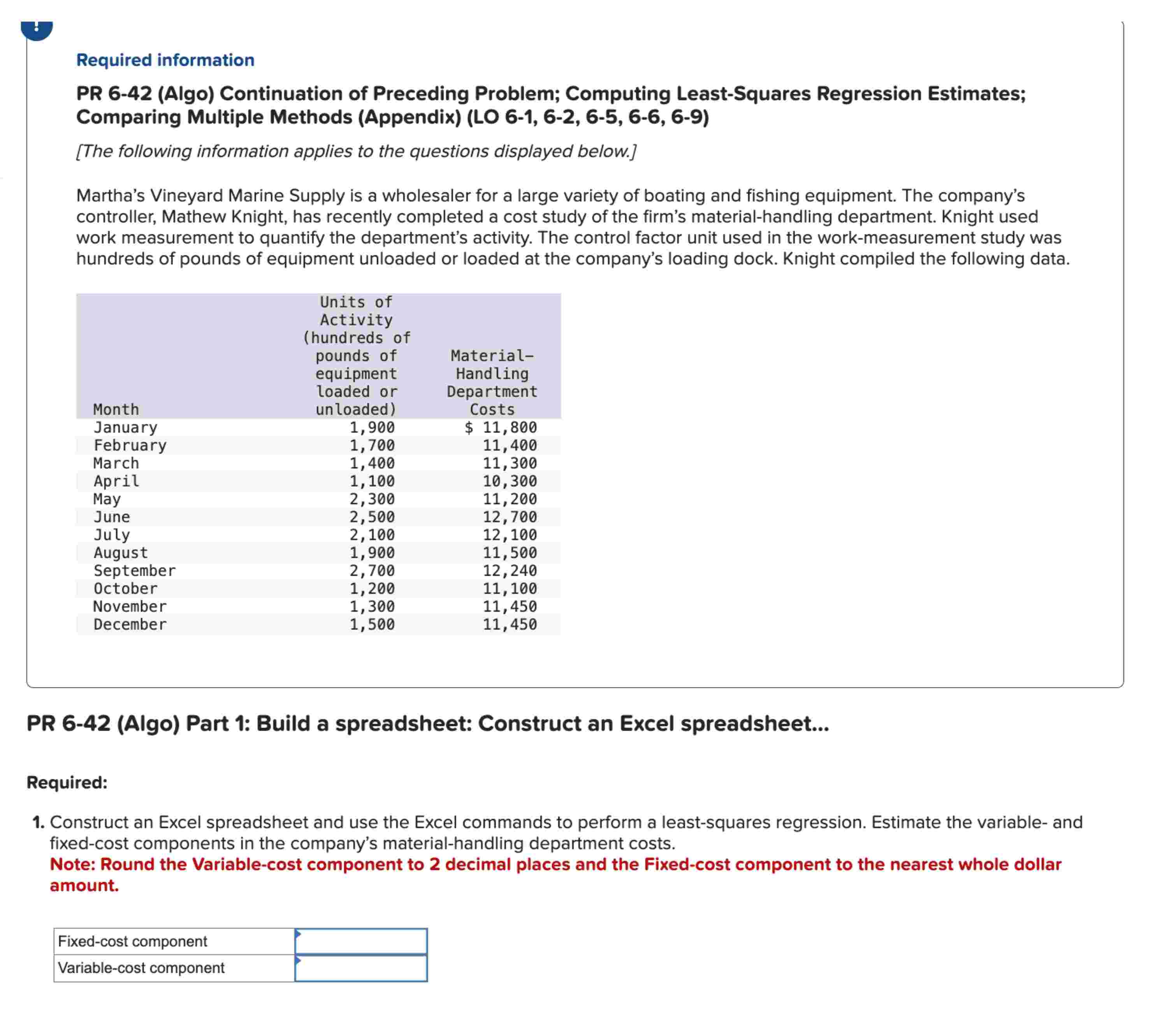

Required information PR 6-42 (Algo) Continuation of Preceding Problem; Computing Least-Squares Regression Estimates; Comparing Multiple Methods (Appendix) (LO 6-1, 6-2, 6-5, 6-6, 6-9) [The following information applies to the questions displayed below.] Martha's Vineyard Marine Supply is a wholesaler for a large variety of boating and fishing equipment. The company's controller, Mathew Knight, has recently completed a cost study of the firm's material-handling department. Knight used work measurement to quantify the department's activity. The control factor unit used in the work-measurement study was hundreds of pounds of equipment unloaded or loaded at the company's loading dock. Knight compiled the following data. Units of Activity (hundreds of pounds of Material- Month January February equipment loaded or unloaded) Handling Department Costs 1,900 $ 11,800 1,700 11,400 March 1,400 11,300 April 1,100 10,300 May 2,300 11,200 June 2,500 12,700 July 2,100 12,100 August 1,900 11,500 September 2,700 12,240 October 1,200 11,100 November 1,300 11,450 December 1,500 11,450 PR 6-42 (Algo) Part 1: Build a spreadsheet: Construct an Excel spreadsheet... Required: 1. Construct an Excel spreadsheet and use the Excel commands to perform a least-squares regression. Estimate the variable- and fixed-cost components in the company's material-handling department costs. Note: Round the Variable-cost component to 2 decimal places and the Fixed-cost component to the nearest whole dollar amount. Fixed-cost component Variable-cost component

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started