Answered step by step

Verified Expert Solution

Question

1 Approved Answer

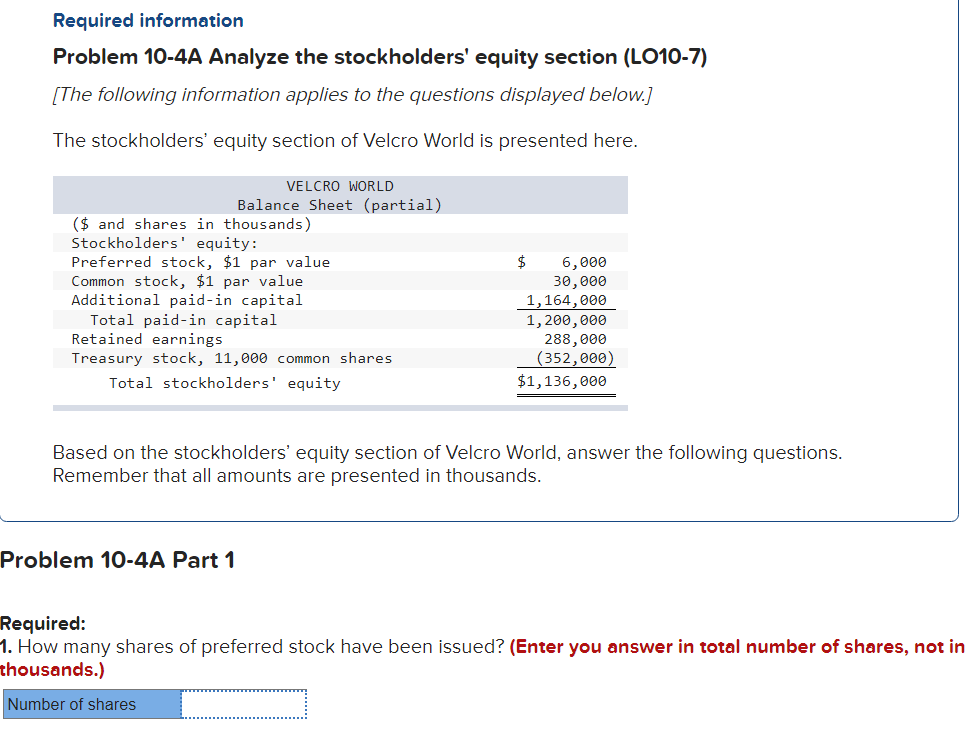

Required information Problem 10-4A Analyze the stockholders' equity section (LO10-7) [The following information applies to the questions displayed below.] The stockholders' equity section of

Required information Problem 10-4A Analyze the stockholders' equity section (LO10-7) [The following information applies to the questions displayed below.] The stockholders' equity section of Velcro World is presented here. VELCRO WORLD Balance Sheet (partial) ($ and shares in thousands) Stockholders' equity: Preferred stock, $1 par value Common stock, $1 par value Additional paid-in capital Total paid-in capital Retained earnings Treasury stock, 11,000 common shares Total stockholders' equity $ 6,000 30,000 1,164,000 1,200,000 288,000 (352,000) $1,136,000 Based on the stockholders' equity section of Velcro World, answer the following questions. Remember that all amounts are presented in thousands. Problem 10-4A Part 1 Required: 1. How many shares of preferred stock have been issued? (Enter you answer in total number of shares, not in thousands.) Number of shares 2. How many shares of common stock have been issued? (Enter you answer in total number of shares, not in thousands.) Number of shares 3. If the common shares were issued at $30 per share, at what average price per share were the preferred shares issued? Preferred shares issued price per share 4. If retained earnings at the beginning of the period was $250 million and $30 million was paid in dividends during the year, what was the net income for the year? (Enter your answer in million (i.e., 5,000,000 should be entered as 5).) Net income million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started